Free Finance Annual Accounts Strategy Plan

Executive Summary

Purpose: The Finance Annual Accounts Strategy Plan for [Your Company Name] is a comprehensive blueprint designed to guide our financial decision-making and management throughout the fiscal year [Month Day Year]. This strategic plan is tailored to align with our overarching corporate objectives, ensuring that every financial decision supports our broader business goals.

Scope: Our strategy encompasses a broad range of financial aspects, critical for the sustenance and growth of [Your Company Name]. Key areas of focus include revenue forecasting, expense budgeting, cash flow management, and investment strategies. By addressing these areas, we aim to create a robust financial framework that not only secures our present operations but also paves the way for future expansion and success.

Objective: The primary goal of this plan is threefold: to ensure financial stability, optimize profitability, and support business growth. Financial stability is the bedrock upon which our company stands, and it is crucial to maintain a solid financial base. Optimizing profitability is not just about increasing revenue but also about efficient resource allocation and cost management. Lastly, supporting business growth encompasses investing in opportunities that align with our long-term vision, ensuring that [Your Company Name] remains competitive and innovative in our industry.

1. Company Overview

Name: [Your Company Name] is not just a name but a brand that represents quality, trust, and innovation in our industry. Our name is synonymous with excellence, reflecting our commitment to delivering the best to our clients and stakeholders.

Address: Located at [Your Company Address], our office is situated in a strategic location that offers both accessibility and visibility. This location enhances our operational efficiency and provides a conducive environment for our employees and clients.

Email: [Your Company Email] serves as a vital communication channel, ensuring we are always connected to our clients, partners, and stakeholders. This email address is monitored continuously, guaranteeing prompt and professional responses to all inquiries.

Website: Our online presence, encapsulated in [Your Company Website], is a comprehensive resource for clients and partners. It provides detailed information about our services, corporate values, and the latest updates, showcasing our commitment to transparency and open communication.

Phone: [Your Company Phone Number] is the direct line to our dedicated customer service team. This number ensures that stakeholders can reach us easily for support, inquiries, or feedback.

Social Media: [Your Social Media] channels are dynamic platforms where we engage with our audience, share insights, and build community around our brand. Through these channels, we foster relationships, provide updates, and showcase our company culture.

Primary Contact: [Your Name], reachable at [Your Personal Email] and [Your User Phone], is the primary point of contact for all matters related to this strategic plan. With a deep understanding of our company’s financial goals and strategies, [Your Name] is well-equipped to provide insights, guidance, and clarification on any aspect of this plan.

2. Financial Overview

The financial health of [Your Company Name] is the cornerstone of our business strategy and operational success. This chapter provides an in-depth analysis of our current financial position and a review of our performance in the previous fiscal year. By examining these elements, we gain valuable insights into our financial strengths, challenges, and areas for improvement. This understanding is crucial for making informed decisions and strategizing for future growth.

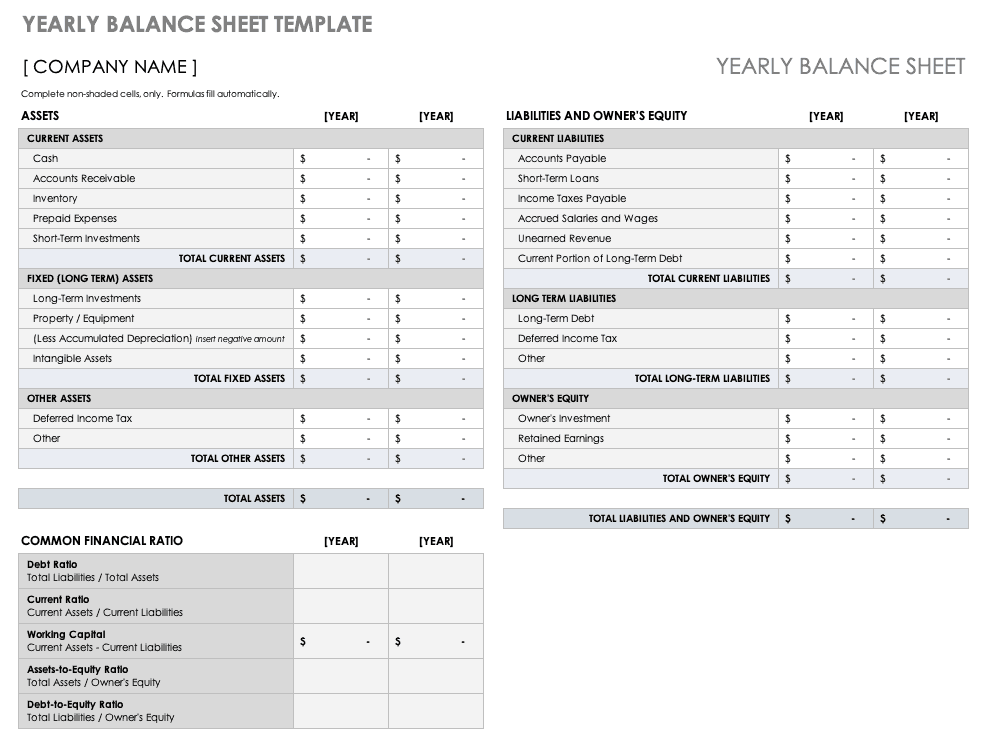

2.1 Current Financial Status

Our current financial status is a snapshot of [Your Company Name]'s economic health as of [Month Day Year]. It includes an overview of our assets, liabilities, and equity. These figures represent the tangible results of our business activities and strategic decisions.

Note: Table for Illustration Purposes Only

Note: Table for Illustration Purposes Only

3. Revenue Forecasting

Revenue forecasting is a critical component in the financial planning of [Your Company Name]. It allows us to predict future revenue and make informed decisions about investments, budget allocations, and strategic planning. In this chapter, we will outline our assumptions and methodology for projecting quarterly revenues for the upcoming fiscal year.

Assumptions

Market Growth: Assuming a steady market growth of 5% annually.

Product/Service Demand: Anticipated increase in demand due to marketing efforts.

Economic Conditions: Stable economic conditions without significant disruptions.

Forecast Methodology

We employ a combination of historical data analysis and market trend evaluation to forecast our revenues. This approach considers past performance, current market conditions, and anticipated changes in the business environment.

Projected Revenue and Growth Rate:

Quarter | Projected Revenue | Growth Rate (%) |

|---|---|---|

Q1 | $1,250,000 | 4% |

Q2 | $1,300,000 | 4.5% |

Q3 | $1,400,000 | 5% |

Q4 | $1,500,000 | 5.5% |

Note: Table for Illustration Only

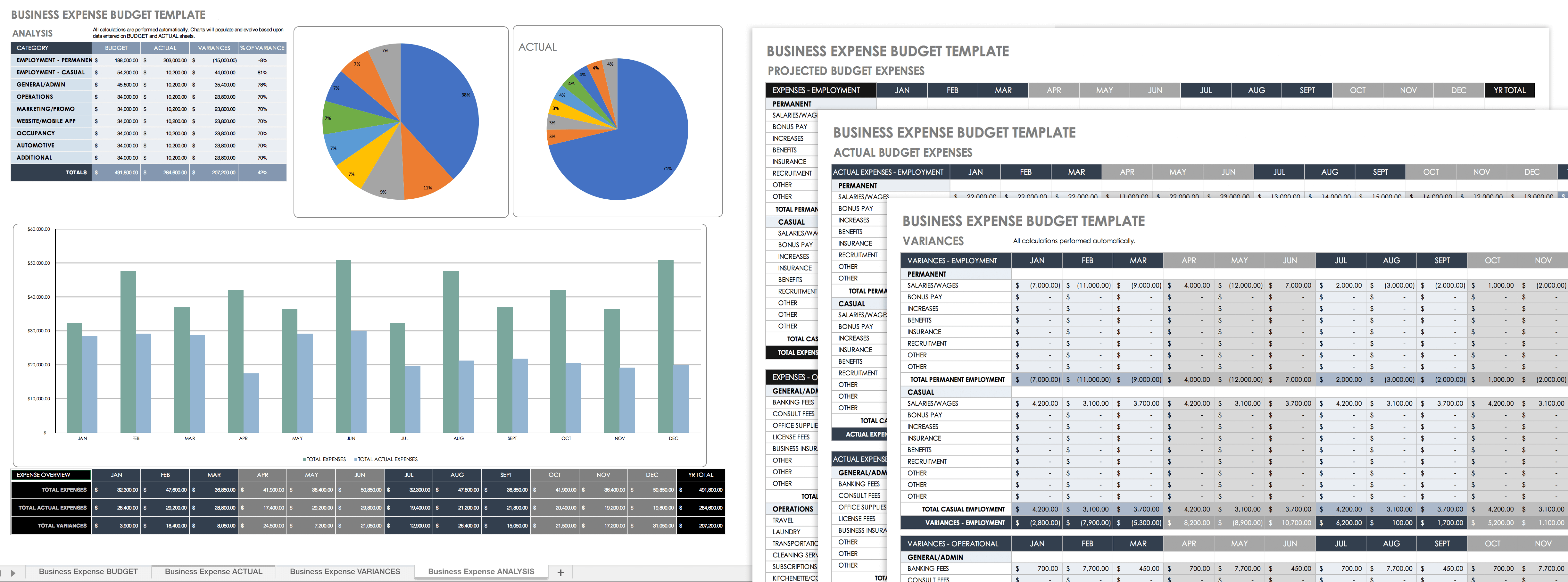

4. Expense Budgeting

Effective expense budgeting is essential for the financial health of [Your Company Name]. It involves setting budgets for different categories and implementing cost control measures. This chapter describes our budgeting principles and outlines the allocated budget for key expense categories.

Budgeting Principles

Cost-Effectiveness: Maximizing value while minimizing unnecessary expenditures.

Flexibility: Allowing for adjustments in response to unforeseen changes.

Accountability: Each department is responsible for adhering to its budget.

Cost Control Measures

Regular Review of Expenses: Monthly review meetings to monitor and adjust spending.

Supplier Negotiations: Seeking cost-effective suppliers and renegotiating contracts.

Energy Efficiency: Implementing measures to reduce utility costs.

Expense Budget by Category:

Note: Chart for Illustrative Purposes Only

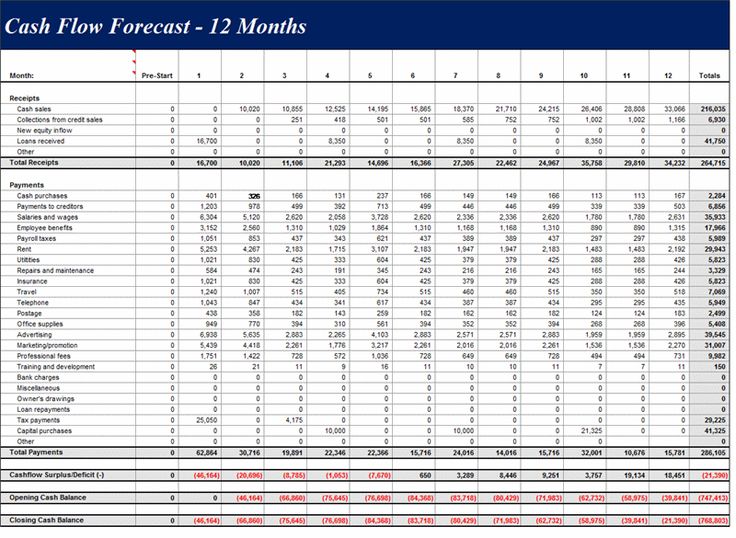

5. Cash Flow Management

Cash flow management is vital for maintaining the liquidity and financial stability of [Your Company Name]. This chapter provides our cash flow projections, detailing the expected monthly inflows and outflows, and the resulting closing balance.

Cash Flow Projections

We project cash flows based on anticipated revenue, scheduled expenses, and other financial commitments. The aim is to maintain a positive cash flow throughout the year, ensuring adequate funds for operations and growth.

Monthly Cash Flow Projections:

Note: Image for Illustrative Purposes Only

6. Investment Strategy

Investment strategy is a critical component of [Your Company Name]'s overall financial plan. It focuses on balancing the portfolio with a mix of short-term and long-term investments to achieve optimal returns while managing risk.

Short-Term Investments

Market Securities: Investment in high-grade marketable securities for quick liquidity.

Certificates of Deposit: Short-term CDs with favorable interest rates to ensure capital safety.

Treasury Bills: Government-issued treasury bills that offer secure, yet modest returns.

Long-Term Investments

Equity Shares: Investment in a diversified portfolio of equities for potential high returns.

Real Estate: Long-term investment in commercial real estate for steady rental income and capital appreciation.

Bonds and Debentures: Corporate and government bonds offering fixed interest over a longer period.

7. Risk Management

Risk management is vital in safeguarding [Your Company Name]'s assets and financial future. This chapter outlines the potential risks and the strategies to mitigate them.

Identified Risks

Market Risk: The risk of investment value changes due to market fluctuations.

Credit Risk: The risk of loss from a borrower's failure to repay a loan.

Operational Risk: Risks arising from failed internal processes and systems.

Mitigation Strategies

Diversification: Spreading investments across various assets to reduce exposure.

Credit Analysis: Rigorous credit analysis before extending credit to customers.

Process Improvement: Regular review and improvement of operational processes.

8. Compliance and Legal Considerations

Adhering to regulatory compliance and financial reporting standards is essential for [Your Company Name]'s legitimacy and reputation.

Regulatory Compliance

Tax Compliance: Adherence to federal and state tax laws.

Securities Regulations: Compliance with SEC regulations for listed companies.

Labor Laws: Following labor laws and regulations.

Financial Reporting Standards

GAAP: Adherence to Generally Accepted Accounting Principles in the U.S.

IFRS: Compliance with International Financial Reporting Standards where applicable.

9. Review and Adjustment

Regular review and adjustment of financial strategies are crucial for responding to dynamic market conditions and internal changes at [Your Company Name].

Review Frequency

Quarterly reviews of financial performance and strategy effectiveness.

Adjustment Protocols

Performance Analysis: Analyzing deviations from projected outcomes.

Strategy Refinement: Adjusting strategies based on performance analysis and market changes.

10. Conclusion

Summary of Key Strategies:

This strategy plan focuses on robust revenue forecasting, prudent expense budgeting, effective cash flow management, balanced investment strategies, comprehensive risk management, and strict adherence to compliance and legal standards.

Expected Outcomes:

Financial Stability: Stronger financial footing through effective management and strategic investments.

Growth and Profitability: Enhanced profitability and business growth through strategic planning and execution.

Risk Mitigation: Reduced exposure to financial and operational risks.

This comprehensive plan sets a clear path for [Your Company Name] to achieve its financial goals and sustain long-term success.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Unveil Template.net's Editable Finance Annual Accounts Strategy Plan Template! This versatile tool empowers businesses to optimize financial planning. Featuring customizable sections, charts, and tables using our AI editor tool, it simplifies the creation of strategic annual accounts plans. Attain financial clarity and make informed decisions with ease. Download this indispensable template now to elevate your financial strategy!

You may also like

- Finance Plan

- Construction Plan

- Sales Plan

- Development Plan

- Career Plan

- Budget Plan

- HR Plan

- Education Plan

- Transition Plan

- Work Plan

- Training Plan

- Communication Plan

- Operation Plan

- Health And Safety Plan

- Strategy Plan

- Professional Development Plan

- Advertising Plan

- Risk Management Plan

- Restaurant Plan

- School Plan

- Nursing Home Patient Care Plan

- Nursing Care Plan

- Plan Event

- Startup Plan

- Social Media Plan

- Staffing Plan

- Annual Plan

- Content Plan

- Payment Plan

- Implementation Plan

- Hotel Plan

- Workout Plan

- Accounting Plan

- Campaign Plan

- Essay Plan

- 30 60 90 Day Plan

- Research Plan

- Recruitment Plan

- 90 Day Plan

- Quarterly Plan

- Emergency Plan

- 5 Year Plan

- Gym Plan

- Personal Plan

- IT and Software Plan

- Treatment Plan

- Real Estate Plan

- Law Firm Plan

- Healthcare Plan

- Improvement Plan

- Media Plan

- 5 Year Business Plan

- Learning Plan

- Marketing Campaign Plan

- Travel Agency Plan

- Cleaning Services Plan

- Interior Design Plan

- Performance Plan

- PR Plan

- Birth Plan

- Life Plan

- SEO Plan

- Disaster Recovery Plan

- Continuity Plan

- Launch Plan

- Legal Plan

- Behavior Plan

- Performance Improvement Plan

- Salon Plan

- Security Plan

- Security Management Plan

- Employee Development Plan

- Quality Plan

- Service Improvement Plan

- Growth Plan

- Incident Response Plan

- Basketball Plan

- Emergency Action Plan

- Product Launch Plan

- Spa Plan

- Employee Training Plan

- Data Analysis Plan

- Employee Action Plan

- Territory Plan

- Audit Plan

- Classroom Plan

- Activity Plan

- Parenting Plan

- Care Plan

- Project Execution Plan

- Exercise Plan

- Internship Plan

- Software Development Plan

- Continuous Improvement Plan

- Leave Plan

- 90 Day Sales Plan

- Advertising Agency Plan

- Employee Transition Plan

- Smart Action Plan

- Workplace Safety Plan

- Behavior Change Plan

- Contingency Plan

- Continuity of Operations Plan

- Health Plan

- Quality Control Plan

- Self Plan

- Sports Development Plan

- Change Management Plan

- Ecommerce Plan

- Personal Financial Plan

- Process Improvement Plan

- 30-60-90 Day Sales Plan

- Crisis Management Plan

- Engagement Plan

- Execution Plan

- Pandemic Plan

- Quality Assurance Plan

- Service Continuity Plan

- Agile Project Plan

- Fundraising Plan

- Job Transition Plan

- Asset Maintenance Plan

- Maintenance Plan

- Software Test Plan

- Staff Training and Development Plan

- 3 Year Plan

- Brand Activation Plan

- Release Plan

- Resource Plan

- Risk Mitigation Plan

- Teacher Plan

- 30 60 90 Day Plan for New Manager

- Food Safety Plan

- Food Truck Plan

- Hiring Plan

- Quality Management Plan

- Wellness Plan

- Behavior Intervention Plan

- Bonus Plan

- Investment Plan

- Maternity Leave Plan

- Pandemic Response Plan

- Succession Planning

- Coaching Plan

- Configuration Management Plan

- Remote Work Plan

- Self Care Plan

- Teaching Plan

- 100-Day Plan

- HACCP Plan

- Student Plan

- Sustainability Plan

- 30 60 90 Day Plan for Interview

- Access Plan

- Site Specific Safety Plan