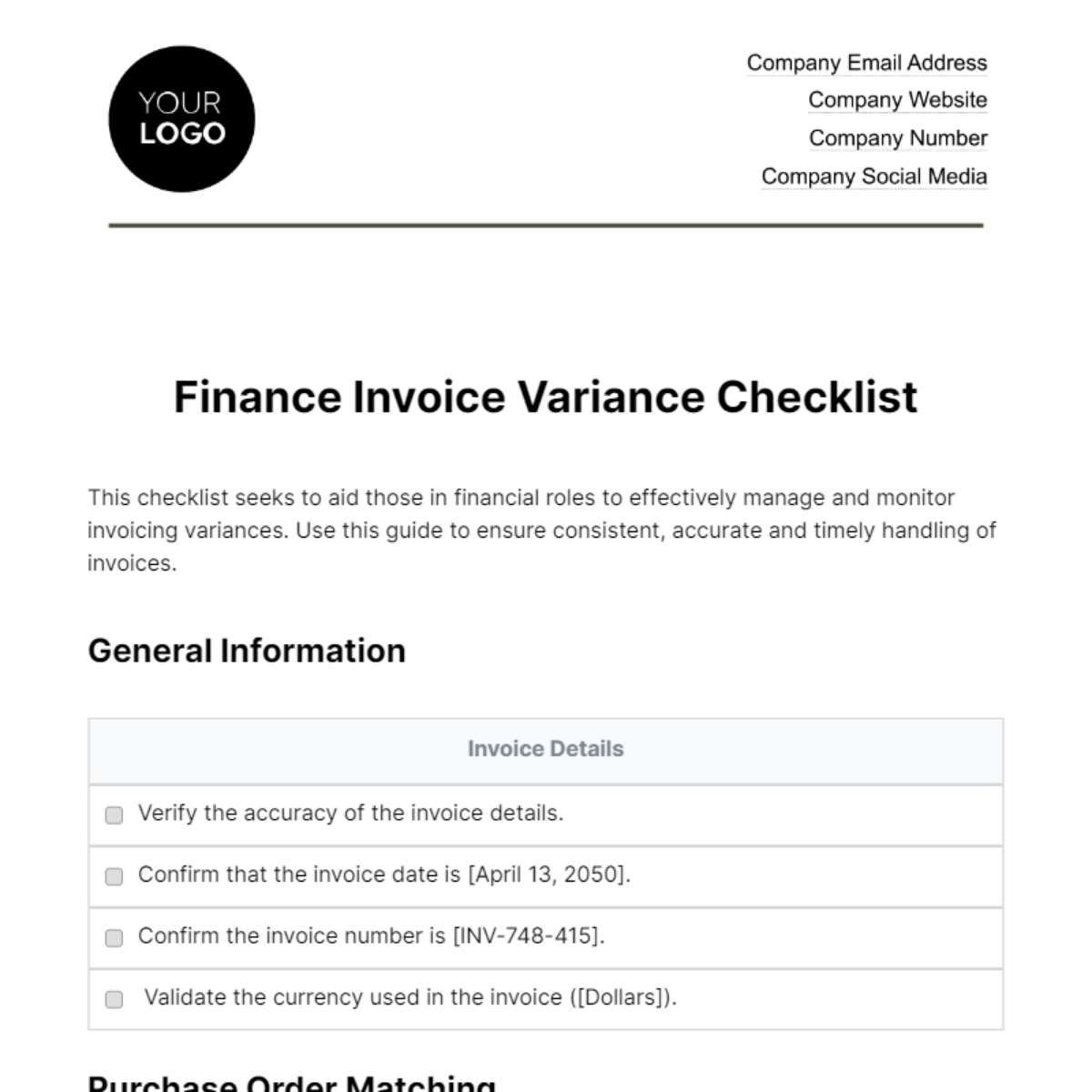

Free Finance Invoice Variance Checklist

This checklist seeks to aid those in financial roles to effectively manage and monitor invoicing variances. Use this guide to ensure consistent, accurate and timely handling of invoices.

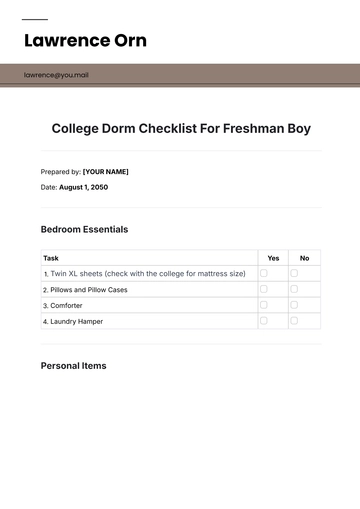

General Information

Invoice Details |

|---|

|

|

|

|

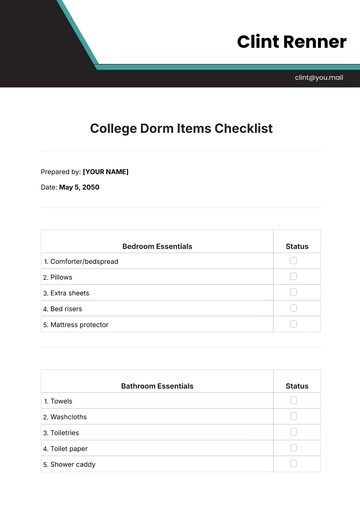

Purchase Order Matching

PO Comparison |

|---|

|

|

|

Pricing and Rates

Unit Price Check |

|---|

|

|

|

Quantity Validation

Quantity Accuracy |

|---|

|

|

Taxes and Fees

Tax Verification |

|---|

|

|

Payment Terms

Payment Due Date |

|---|

|

|

Vendor Information

Vendor Details |

|---|

|

|

Approval and Authorization

Approval Documentation |

|---|

|

|

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Effectively manage invoice variances with the Finance Invoice Variance Checklist Template on Template.net. This editable and customizable checklist simplifies the monitoring process. Tailor content effortlessly using our Ai Editor Tool, ensuring adaptability and precision. Elevate your financial workflows with this user-friendly template, offering a comprehensive approach to crafting personalized variance checklists for streamlined financial management.

You may also like

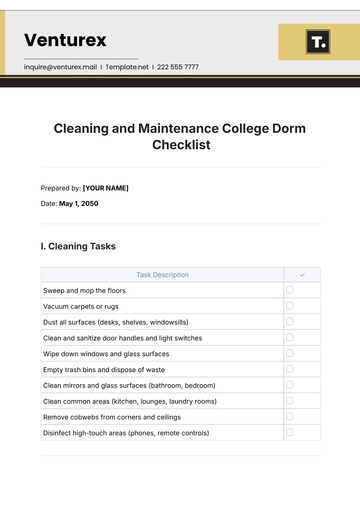

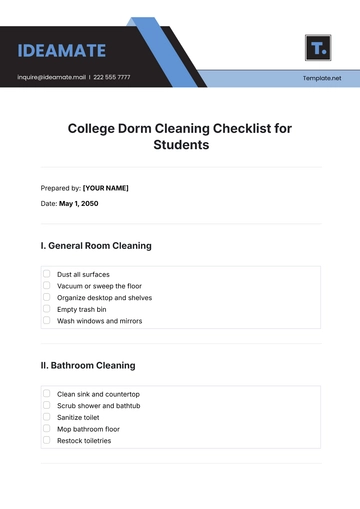

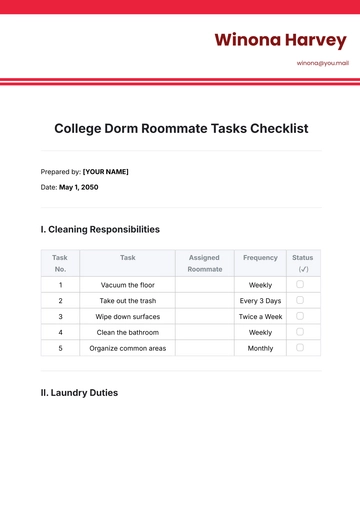

- Cleaning Checklist

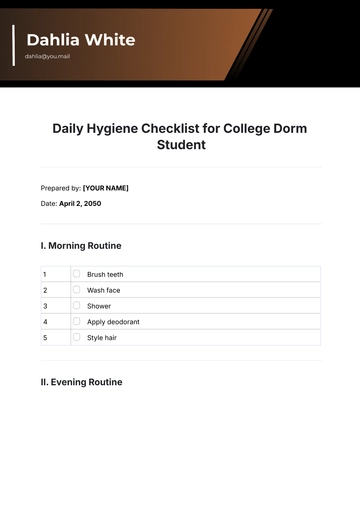

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

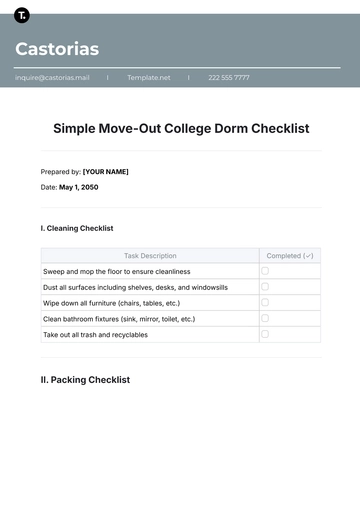

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

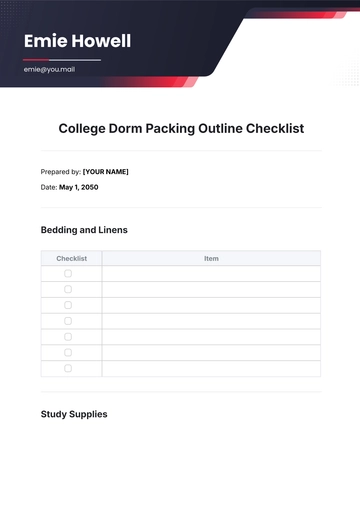

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

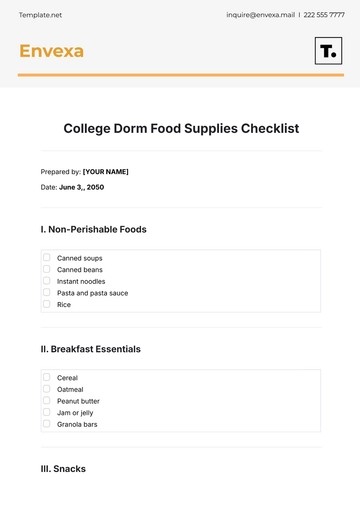

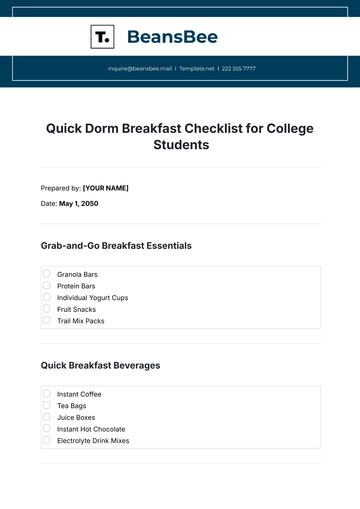

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

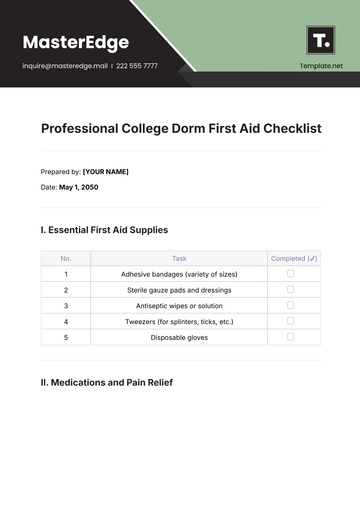

- Medical Checklist

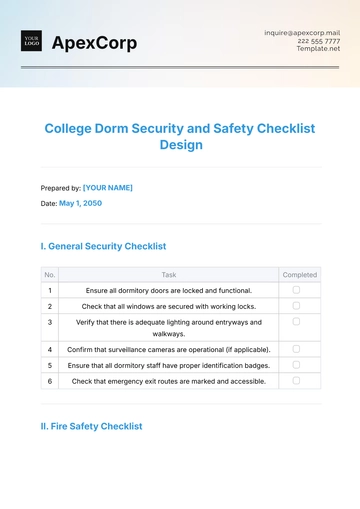

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

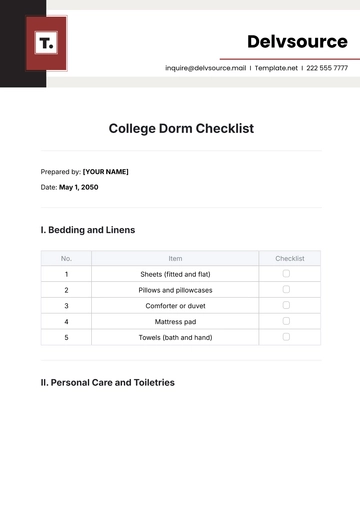

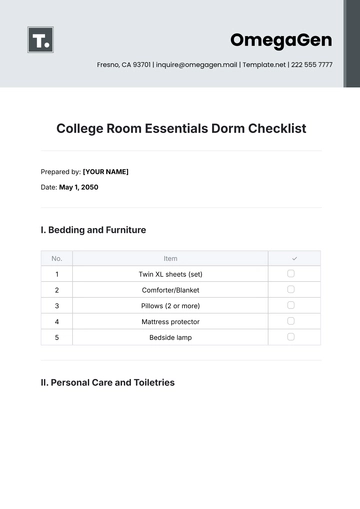

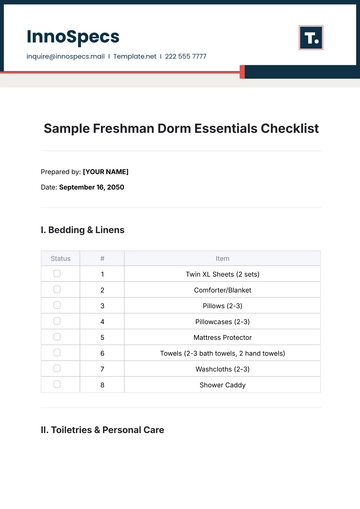

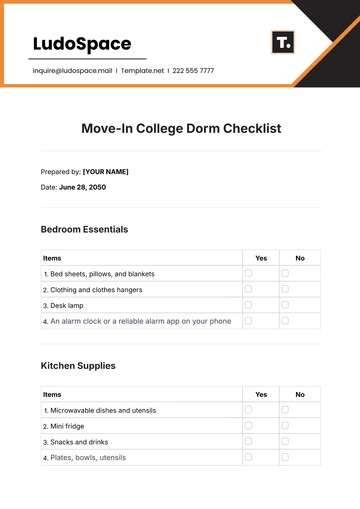

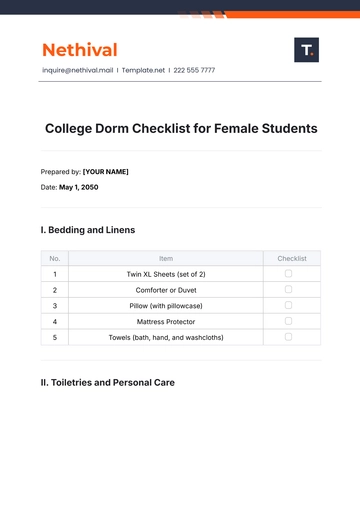

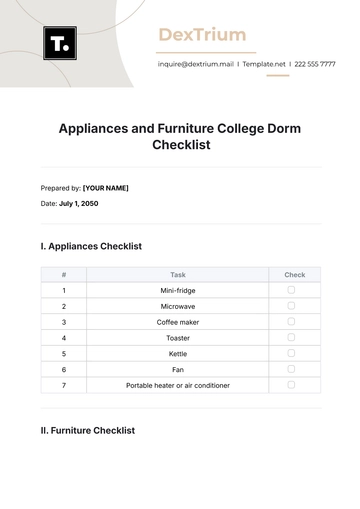

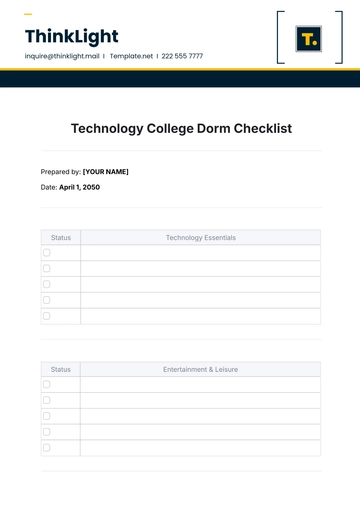

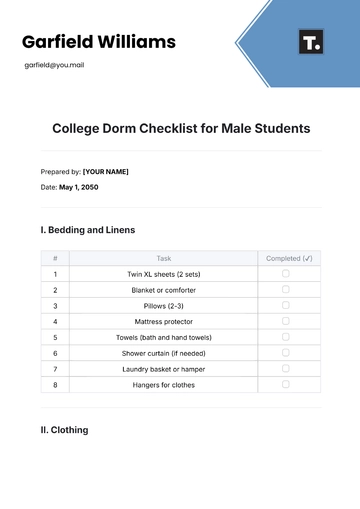

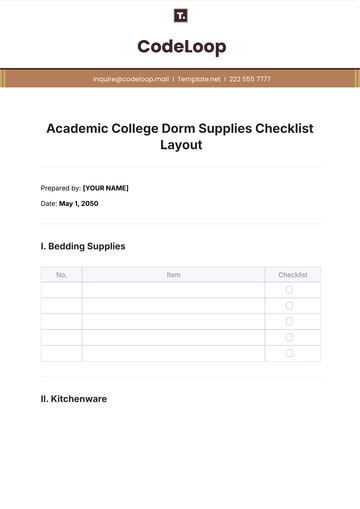

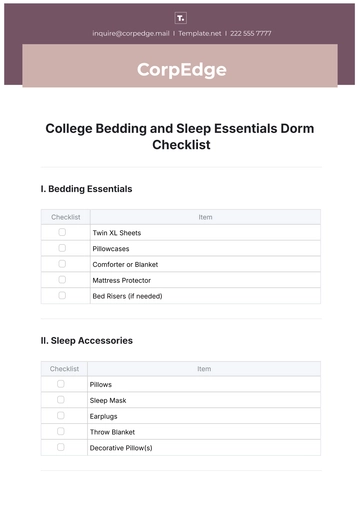

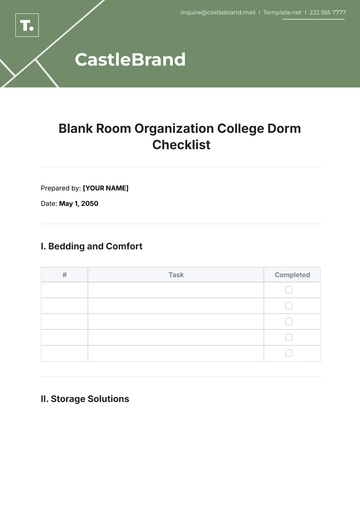

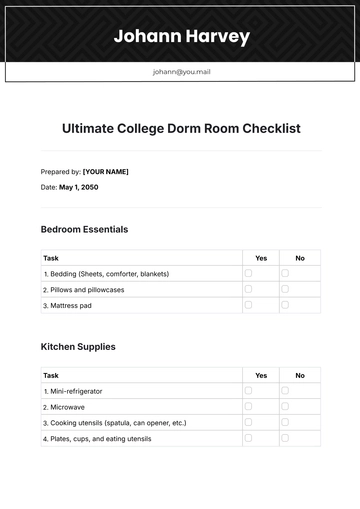

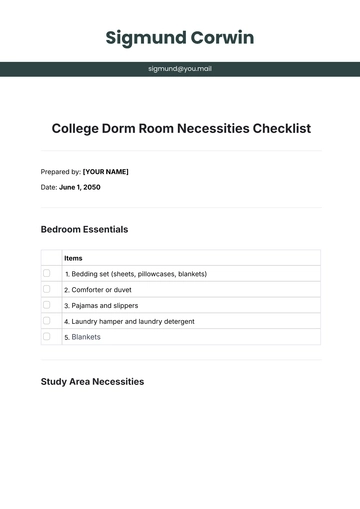

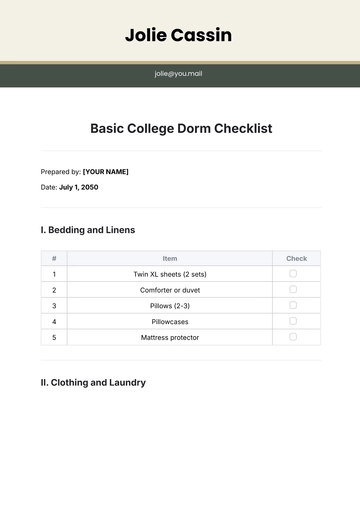

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist