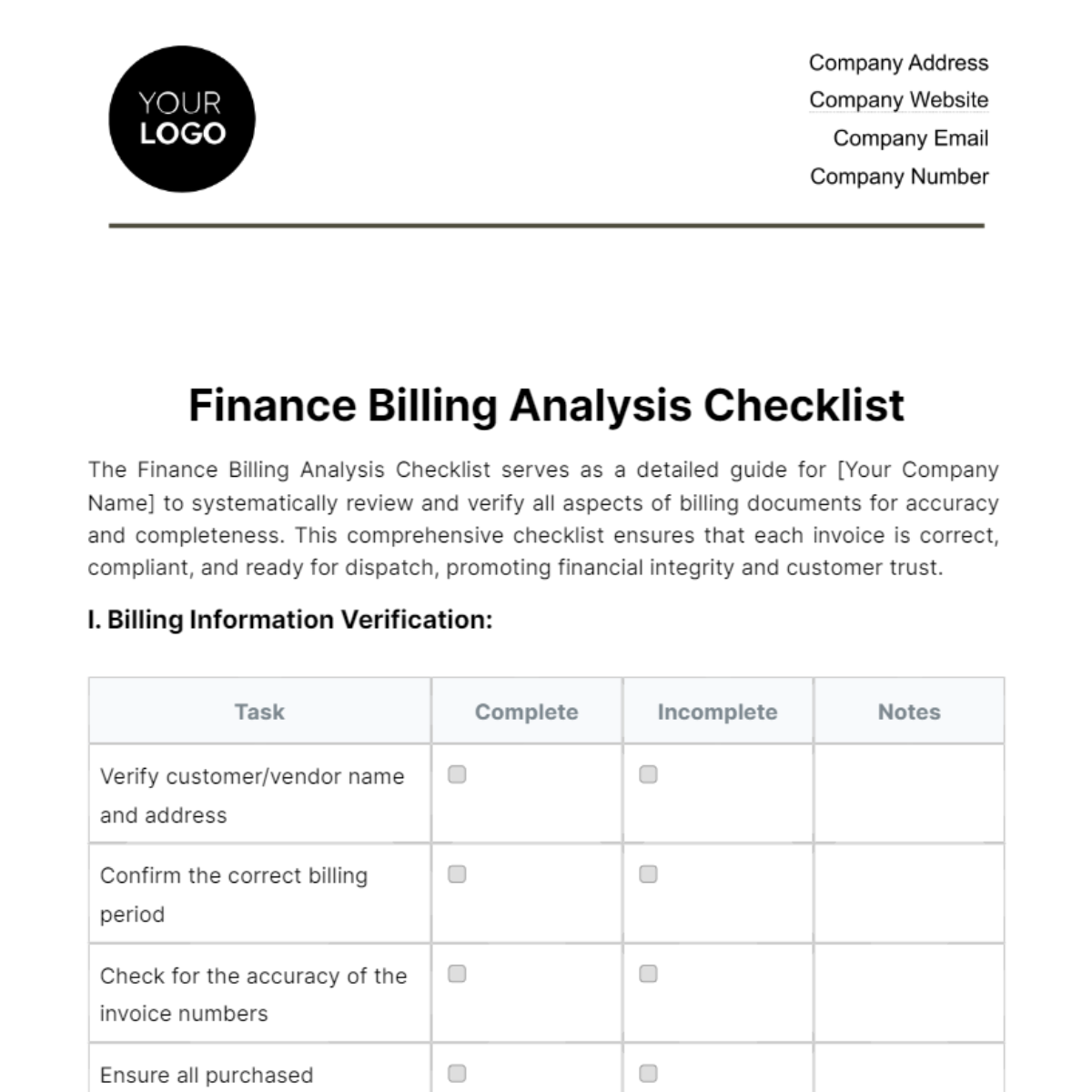

Free Finance Billing Analysis Checklist

The Finance Billing Analysis Checklist serves as a detailed guide for [Your Company Name] to systematically review and verify all aspects of billing documents for accuracy and completeness. This comprehensive checklist ensures that each invoice is correct, compliant, and ready for dispatch, promoting financial integrity and customer trust.

I. Billing Information Verification:

Task | Complete | Incomplete | Notes |

|---|---|---|---|

Verify customer/vendor name and address | |||

Confirm the correct billing period | |||

Check for the accuracy of the invoice numbers | |||

Ensure all purchased items/services are listed |

II. Pricing and Calculation Verification:

Task | Complete | Incomplete | Notes |

|---|---|---|---|

Verify unit prices against contract or standard rates | |||

Check quantities against order and delivery notes | |||

Calculate and confirm the total amount is accurate | |||

Ensure any discounts or promotions are applied correctly |

III. Terms and Conditions Verification:

Task | Complete | Incomplete | Notes |

|---|---|---|---|

Confirm payment terms (Net 30, Net 60, etc.) | |||

Verify return policy and warranty information | |||

Check for any special terms agreed upon |

IV. Tax and Compliance Review:

Task | Complete | Incomplete | Notes |

|---|---|---|---|

Ensure appropriate sales tax is applied | |||

Check for compliance with regulatory requirements | |||

Verify tax identification numbers are correct |

V. Internal Approval and Records Verification:

Task | Complete | Incomplete | Notes |

|---|---|---|---|

Ensure the invoice has been approved by the responsible person | |||

Confirm entry in the financial system and match with a purchase order | |||

Cross-check against customer/vendor statements for discrepancies |

VI. Final Review and Dispatch:

Task | Complete | Incomplete | Notes |

|---|---|---|---|

Conduct a final review of the complete invoice | |||

Ensure the invoice is sent to the correct address/method (email, mail, etc.) |

VII. Additional Notes/Comments:

Prepared By: [Your Name]

[Your Designation]

Date: [MM-DD-YYYY]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Optimize your billing processes with Template.net's Finance Billing Analysis Checklist Template. This professional resource is designed to be both editable and customizable, fitting perfectly into your company's workflow. It provides a comprehensive framework for analyzing and improving billing operations, ensuring accuracy and efficiency. This template which is editable using our Ai Editor Tool will refine your financial billing strategies effectively.

You may also like

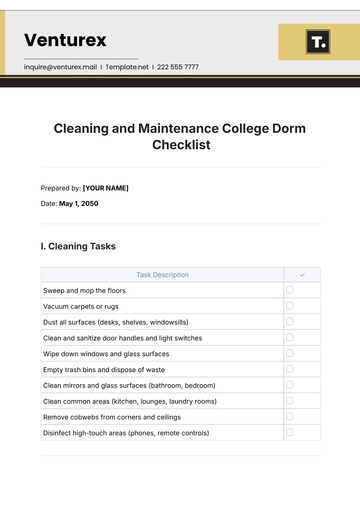

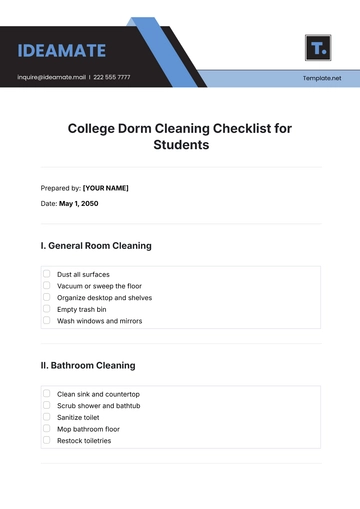

- Cleaning Checklist

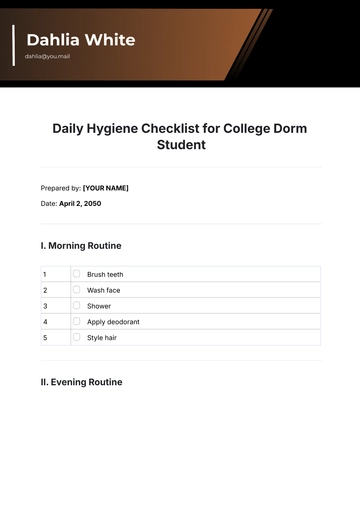

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

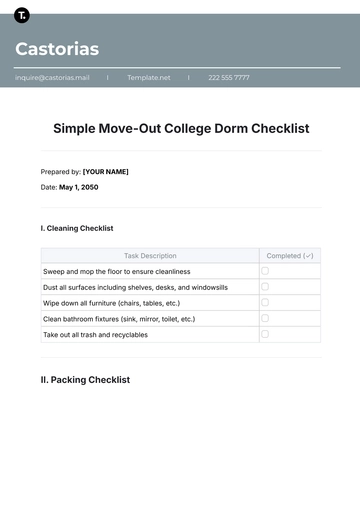

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

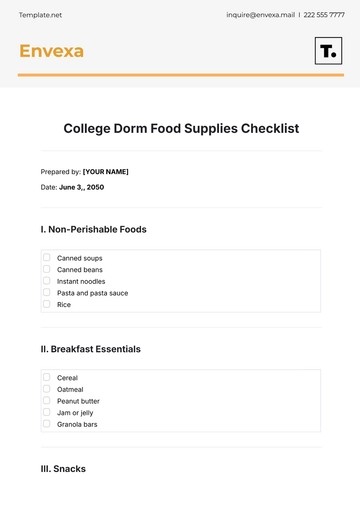

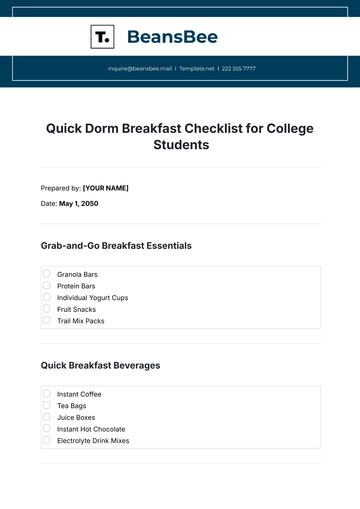

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

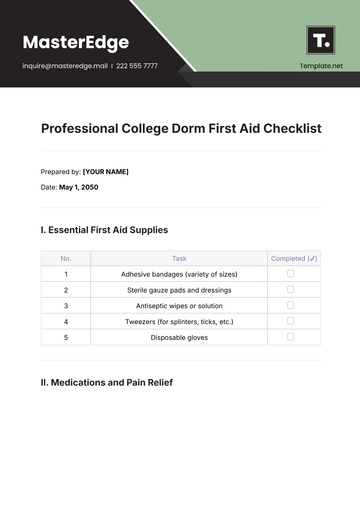

- Medical Checklist

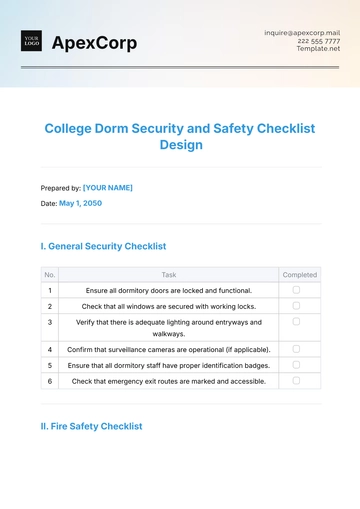

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

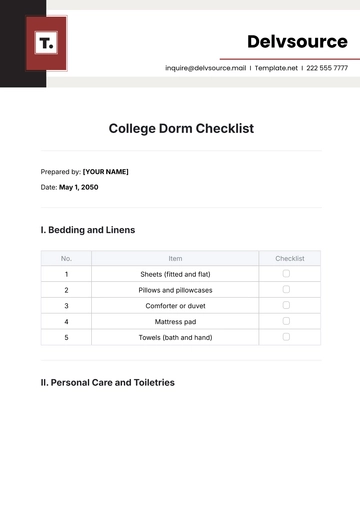

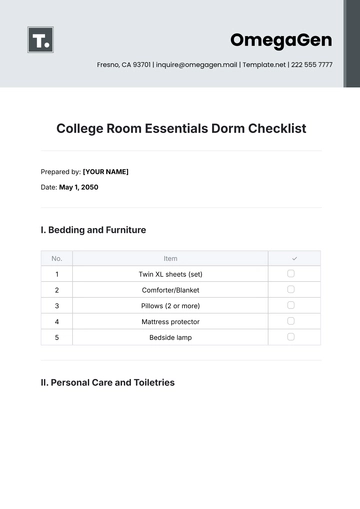

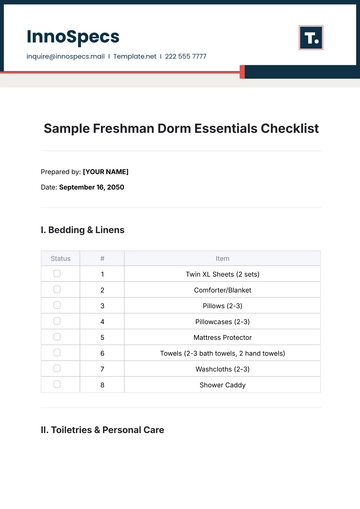

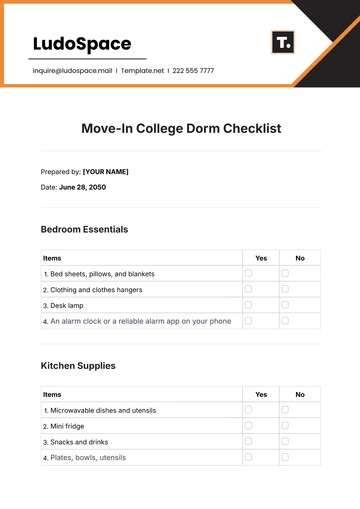

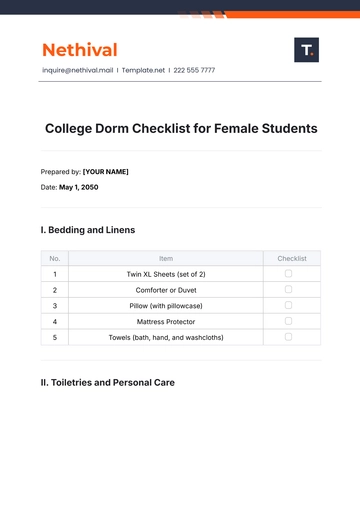

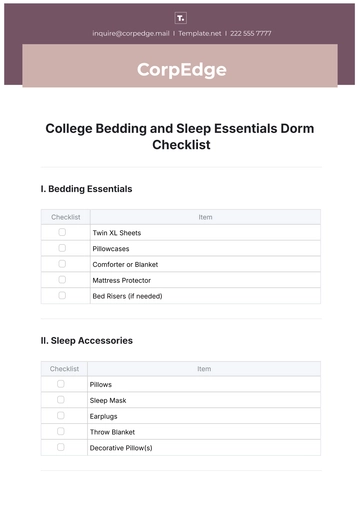

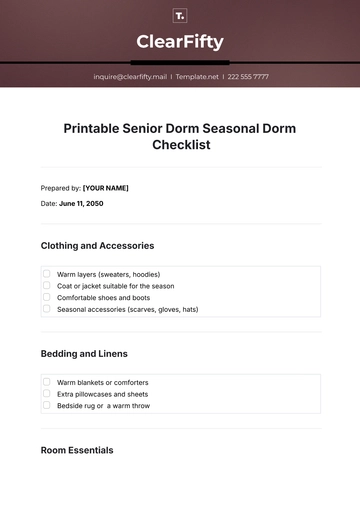

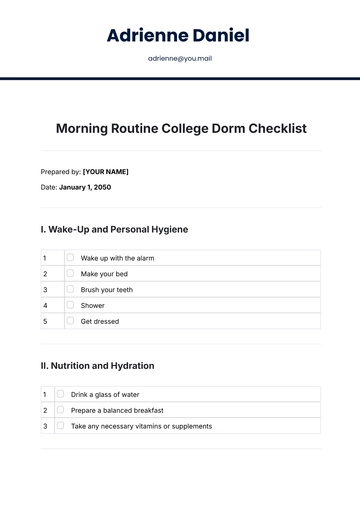

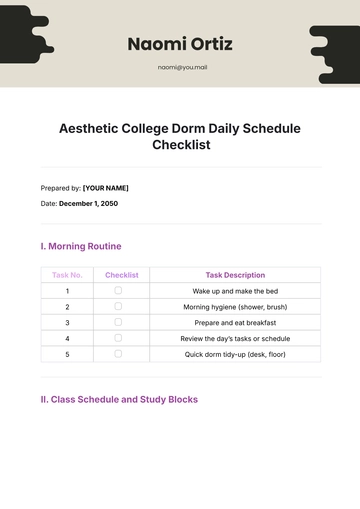

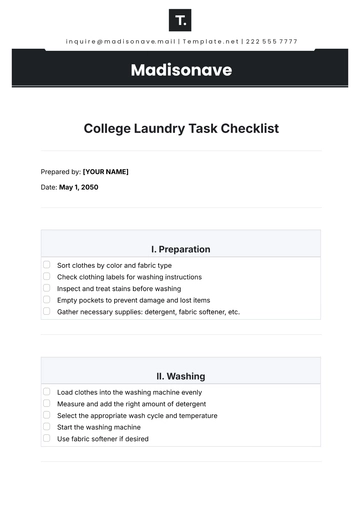

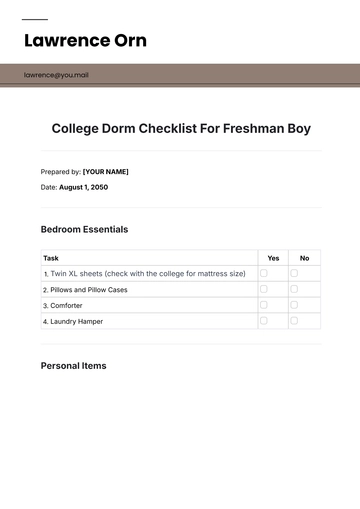

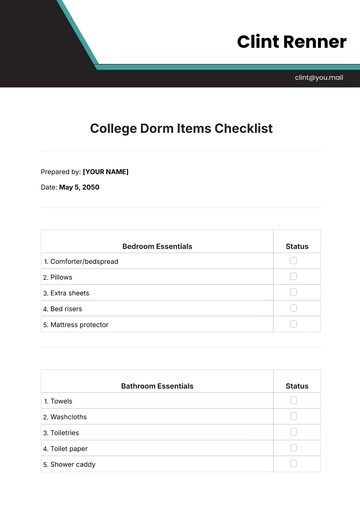

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist