Free Finance Account Reconciliation Report

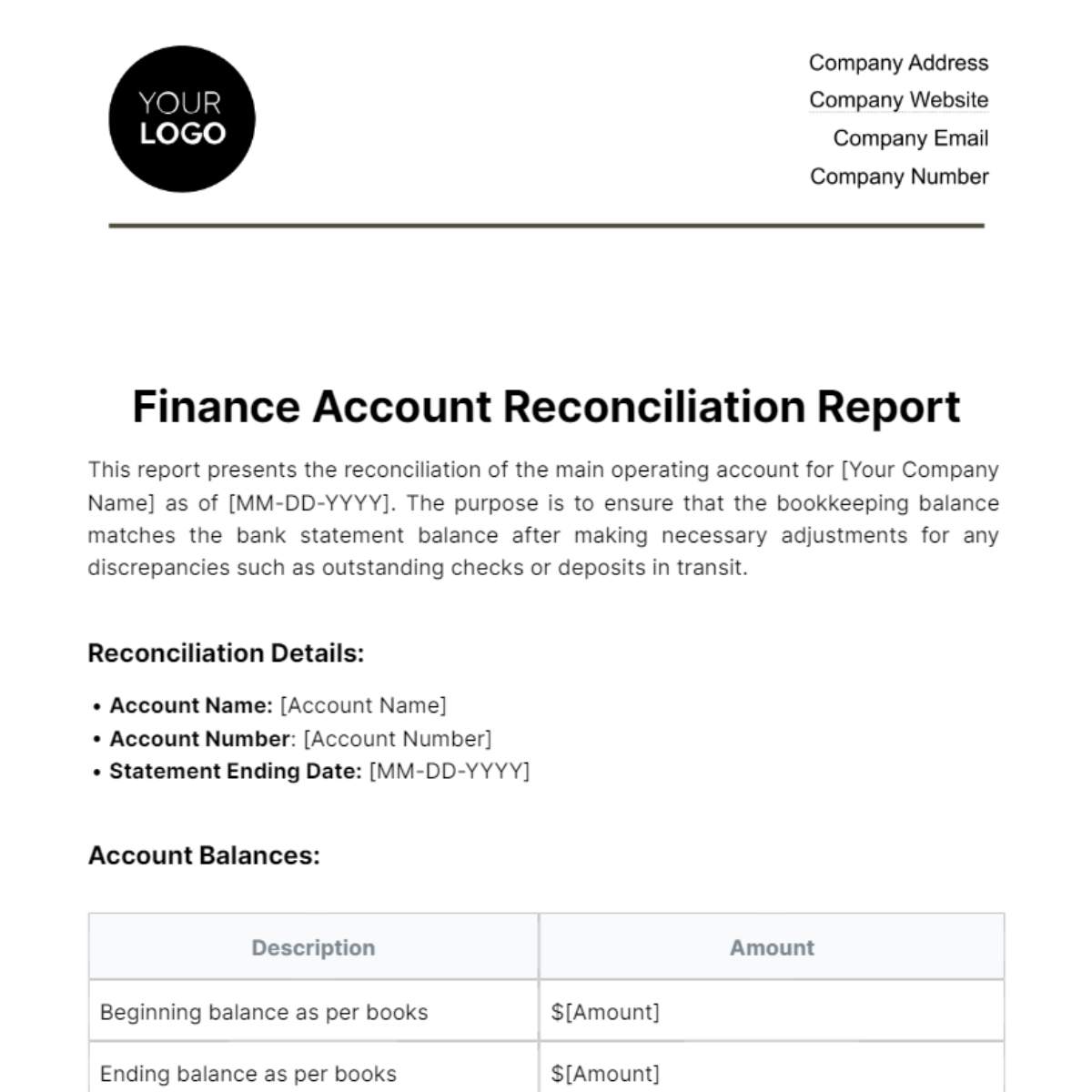

This report presents the reconciliation of the main operating account for [Your Company Name] as of [MM-DD-YYYY]. The purpose is to ensure that the bookkeeping balance matches the bank statement balance after making necessary adjustments for any discrepancies such as outstanding checks or deposits in transit.

Reconciliation Details:

Account Name: [Account Name]

Account Number: [Account Number]

Statement Ending Date: [MM-DD-YYYY]

Account Balances:

Description | Amount |

|---|---|

Beginning balance as per books | $[Amount] |

Ending balance as per books | $[Amount] |

Beginning balance as per bank | $[Amount] |

Ending balance as per bank | $[Amount] |

Adjustments:

Description | Amount | Explanation |

|---|---|---|

Outstanding Checks | $[Amount] | Checks issued but not yet cleared by the bank. |

Deposits in Transit | $[Amount] | Deposits made but not yet reflected in the bank statement. |

$[Amount] | No discrepancies were found in the bank statement. | |

$[Amount] | No discrepancies were found in the books. |

Adjusted ending balance: $[Amount]

Calculation of Adjusted Ending Balance:

The adjusted ending balance is calculated by taking the ending balance as per books and reconciling it with the outstanding checks and deposits in transit to match the ending balance as per the bank after accounting for any errors.

Supporting Documentation:

Enclosed are bank statements, detailed ledgers for the accounting period, and notes on the reconciling items such as outstanding checks and deposits in transit. These documents provide the necessary evidence and detail to support the adjustments made during the reconciliation process.

Conclusion:

Upon completion of the reconciliation process for the period ending [MM-DD-YYYY], all balances have been verified and adjusted accordingly. The account has been thoroughly reviewed and is confirmed to be accurate.

Approval and Sign-off:

Prepared by:

Name: [Your Name]

Signature:

Date: [MM-DD-YYYY]

Reviewed by:

Name: [Secondary Party’s Name]

Title: [Secondary Party’s Title]

Signature:

Date: [MM-DD-YYYY]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Maintain impeccable financial records with Template.net's Finance Account Reconciliation Report Template. This essential tool is both editable and customizable, ensuring accurate and up-to-date financial reporting. It simplifies the reconciliation process, providing a clear structure for comparing account records efficiently. Adopt this professional template and start editing using our Ai Editor Tool.

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report