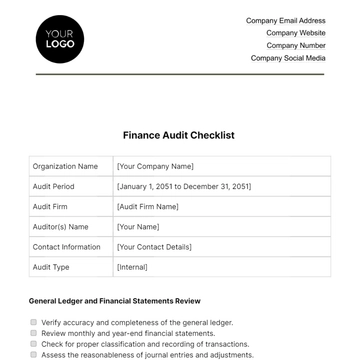

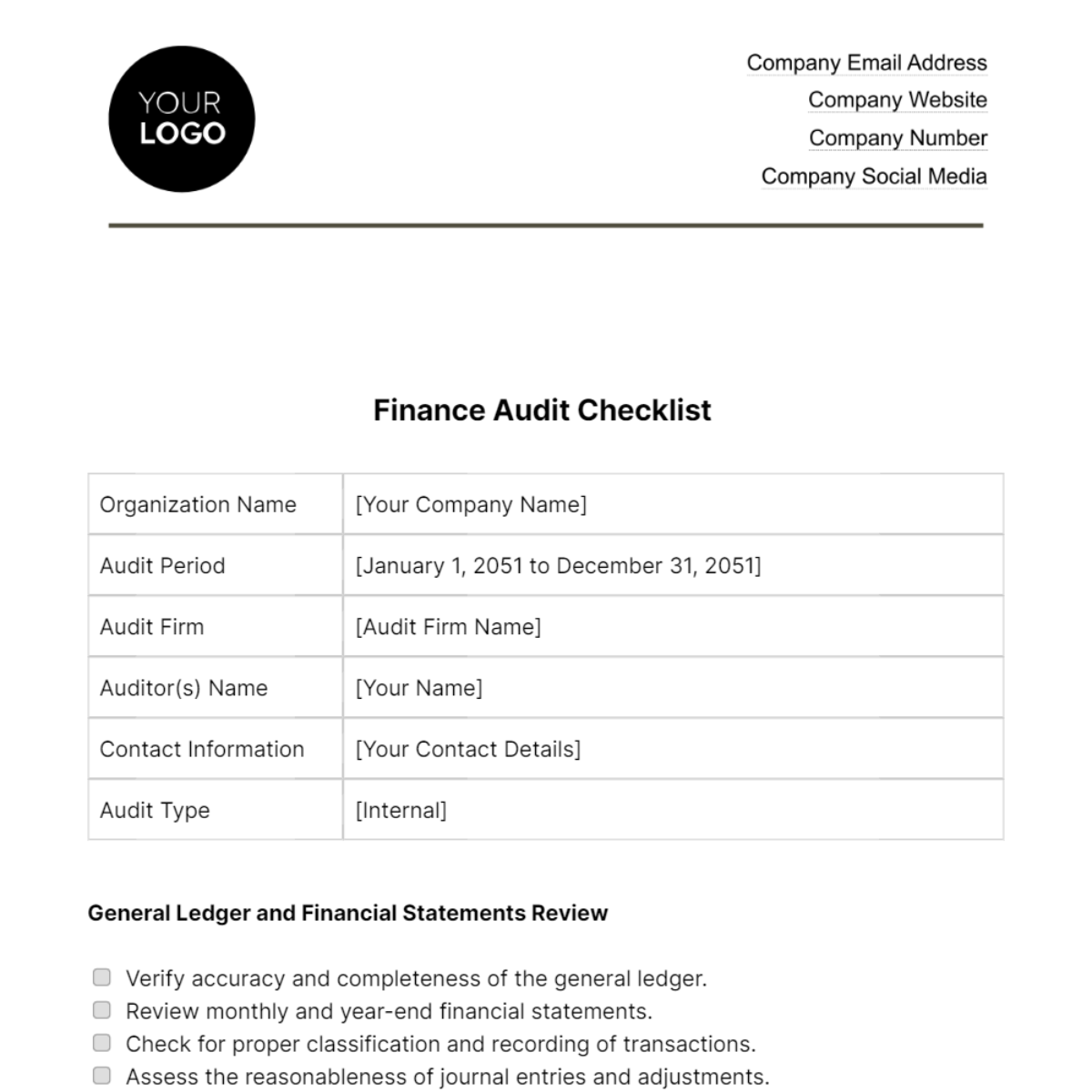

Free Finance Audit Checklist

Organization Name | [Your Company Name] |

Audit Period | [January 1, 2051 to December 31, 2051] |

Audit Firm | [Audit Firm Name] |

Auditor(s) Name | [Your Name] |

Contact Information | [Your Contact Details] |

Audit Type | [Internal] |

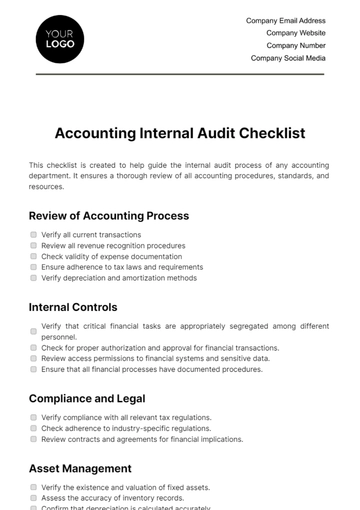

General Ledger and Financial Statements Review

Verify accuracy and completeness of the general ledger.

Review monthly and year-end financial statements.

Check for proper classification and recording of transactions.

Assess the reasonableness of journal entries and adjustments.

Cash and Bank Reconciliations

Ensure all bank accounts are reconciled monthly.

Review reconciliation statements for any long-standing unreconciled items.

Inspect cash handling procedures and petty cash management.

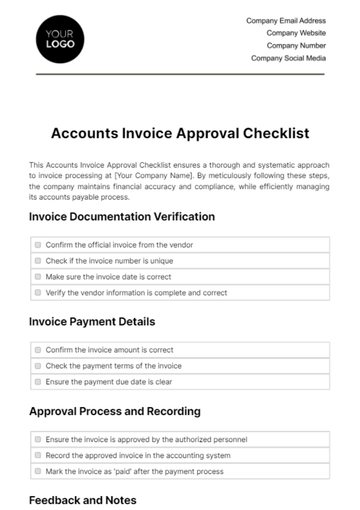

Accounts Receivable and Payable

Verify aging analysis of accounts receivable and payable.

Assess adequacy of allowance for doubtful accounts.

Review procedures for invoice processing and payment.

Confirm proper authorization for expenditures.

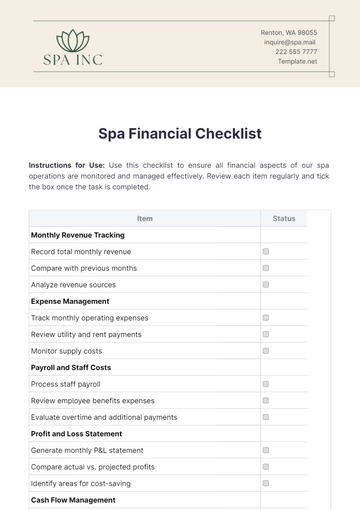

Payroll and Employee Benefits

Examine payroll records for accuracy and compliance with wage laws.

Review employee benefits disbursement and record-keeping.

Inspect adherence to tax withholding and reporting requirements.

Fixed Assets and Depreciation

Audit physical existence and condition of fixed assets.

Review depreciation methods and calculations.

Ensure proper documentation for acquisitions and disposals.

Inventory Management

Conduct physical inventory counts and compare with records.

Evaluate adequacy of inventory valuation methods.

Inspect inventory storage and security measures.

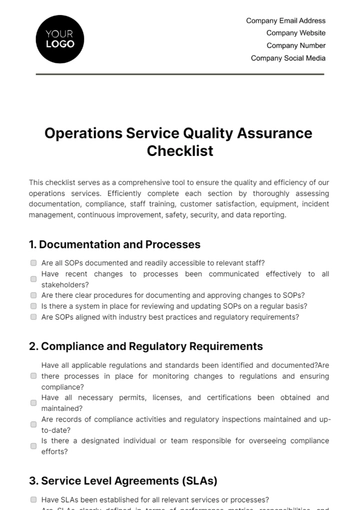

Internal Control Systems

Review internal control procedures for financial reporting.

Assess risk management and fraud prevention measures.

Examine authorization and approval processes.

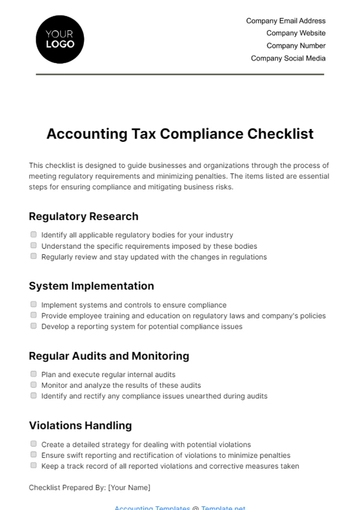

Compliance with Laws and Regulations

Verify compliance with relevant financial regulations.

Review filings and reports submitted to regulatory authorities.

Inspect adherence to contractual obligations and agreements.

Taxation

Review tax returns and payments for accuracy.

Inspect compliance with tax laws and reporting requirements.

Evaluate documentation supporting tax calculations.

IT Systems and Data Security

Assess security of financial data and IT systems.

Review backup and recovery procedures for financial data.

Examine controls over access to financial systems and data.

Conclusion and Recommendations

Summarize audit findings and any identified issues.

Provide recommendations for improvement and corrective actions.

Author: Your Name

Company: Your Company Name

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your audit preparations with the Finance Audit Checklist Template from Template.net. Editable and customizable, this checklist organizes essential audit tasks and considerations. A valuable tool for audit teams, it ensures comprehensive coverage of financial areas, promoting thorough examination and compliance with auditing standards and organizational policies.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

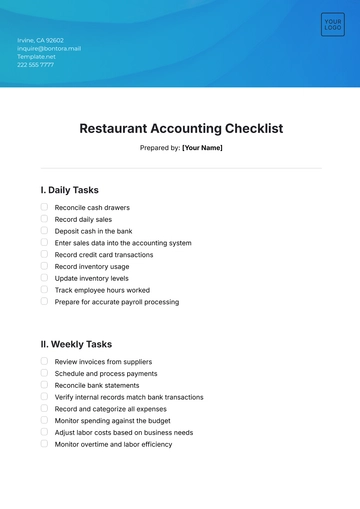

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist