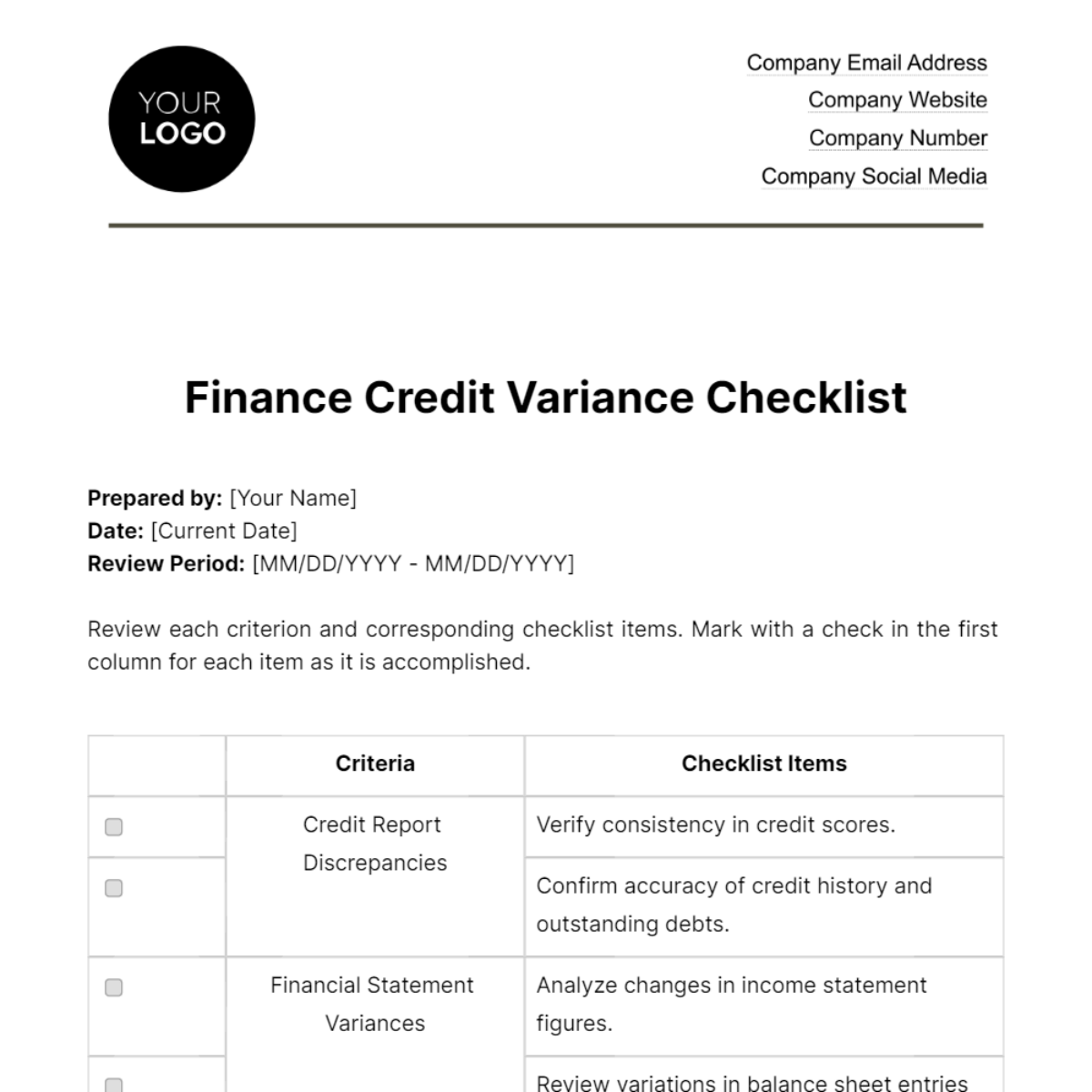

Free Finance Credit Variance Checklist

Prepared by: [Your Name]

Date: [Current Date]

Review Period: [MM/DD/YYYY - MM/DD/YYYY]

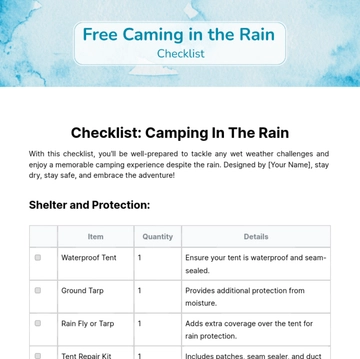

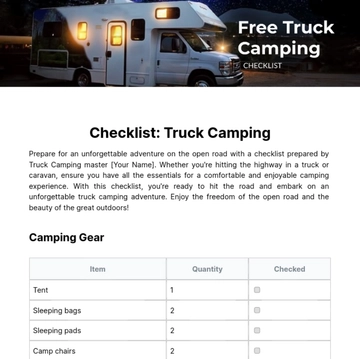

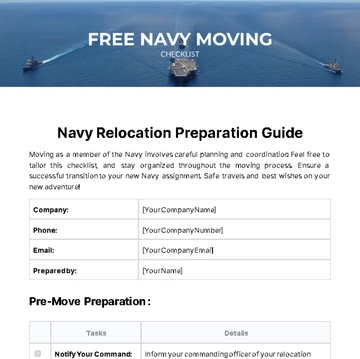

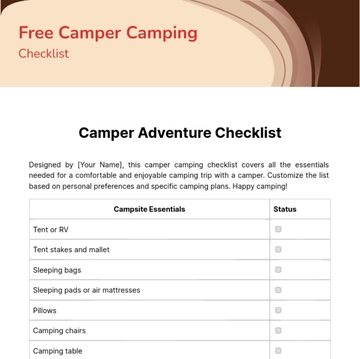

Review each criterion and corresponding checklist items. Mark with a check in the first column for each item as it is accomplished.

Criteria | Checklist Items | |

Credit Report Discrepancies | Verify consistency in credit scores. | |

Confirm accuracy of credit history and outstanding debts. | ||

Financial Statement Variances | Analyze changes in income statement figures. | |

Review variations in balance sheet entries affecting creditworthiness. | ||

Payment History Changes | Check for irregularities in payment patterns. | |

Assess any late payments or deviations from agreed-upon terms. | ||

Credit Limit Adjustments | Verify the reasons for any recent changes in credit limits. | |

Confirm that credit limits align with the financial standing of the entity. | ||

Fraud Alerts and Suspicious Activities | Investigate any flagged fraud alerts. | |

Review suspicious activities or discrepancies in credit-related data. | ||

Regulatory Compliance | Ensure adherence to local and international credit regulations. | |

Confirm compliance with internal policies and procedures related to credit practices. | ||

Customer Communication Records | Review records of customer disputes and resolutions. | |

Confirm the accuracy of information provided to customers regarding credit matters. | ||

Market Conditions | Evaluate the impact of economic conditions on credit assessments. | |

Consider industry trends and market dynamics affecting creditworthiness. |

Additional Comments/Notes

[Upon reviewing credit scores, it was found that the information is consistent, reflecting a reliable representation of credit history.] |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Optimize your credit control with our Finance Credit Variance Checklist Template from Template.net! This versatile checklist, effortlessly tailored using the AI Editor Tool, goes beyond the ordinary. Streamline your credit management processes, ensuring clarity and efficiency in assessing variances. It's a customizable and editable checklist for your convenience! Download now!

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

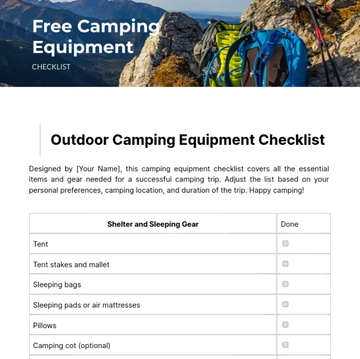

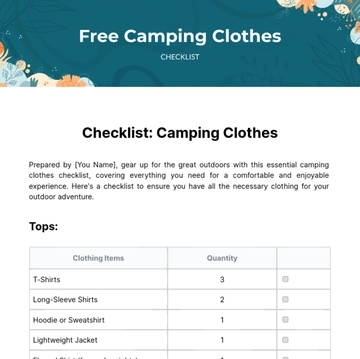

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

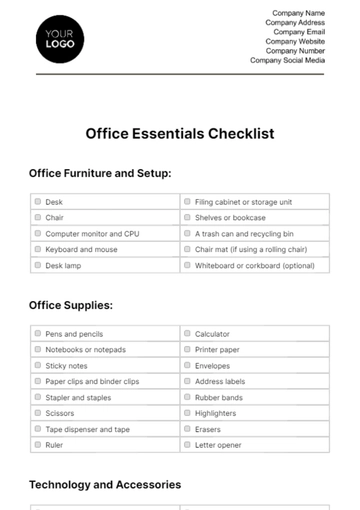

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

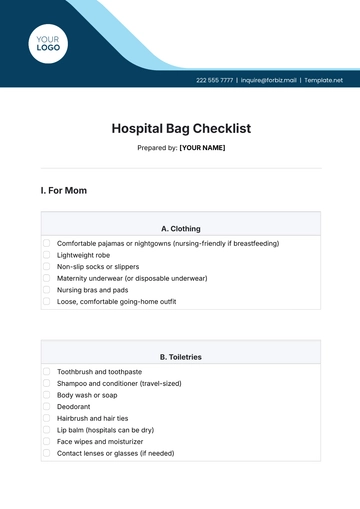

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

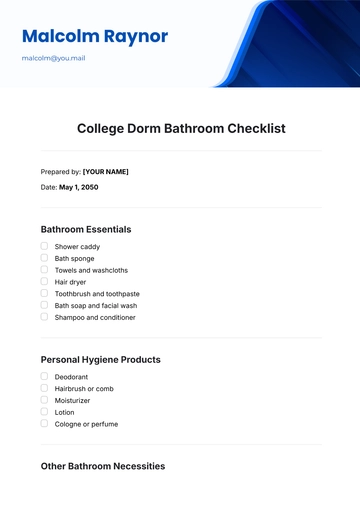

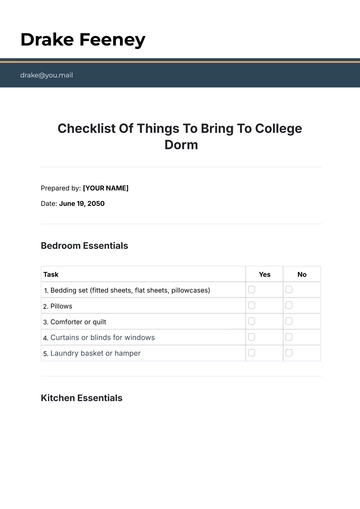

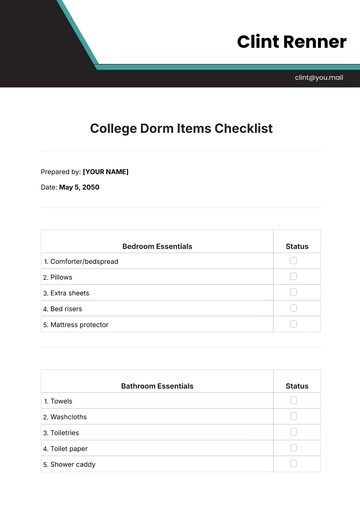

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist