Free Wage and Hour Compliance Checklist HR

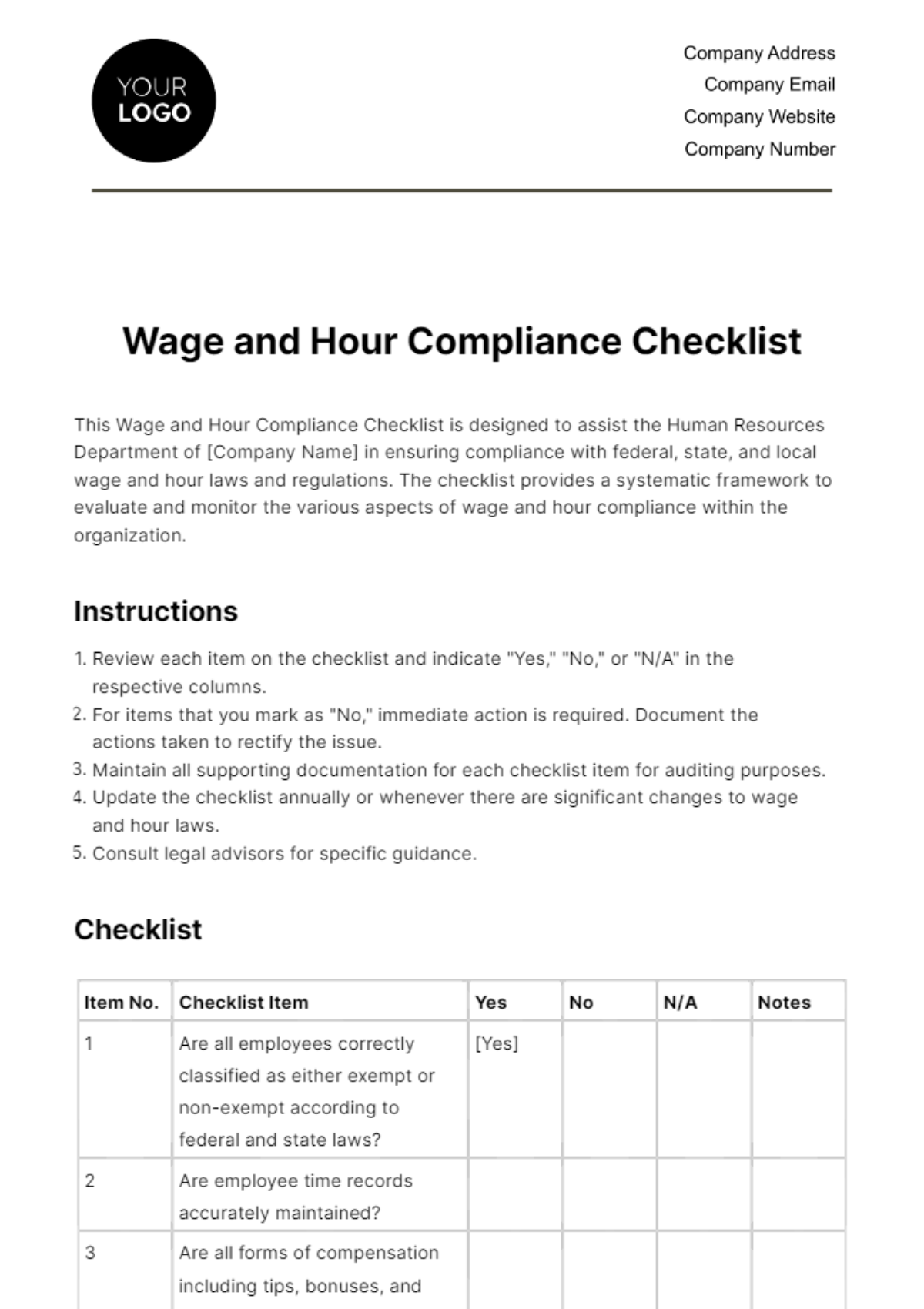

This Wage and Hour Compliance Checklist is designed to assist the Human Resources Department of [Company Name] in ensuring compliance with federal, state, and local wage and hour laws and regulations. The checklist provides a systematic framework to evaluate and monitor the various aspects of wage and hour compliance within the organization.

Instructions

Review each item on the checklist and indicate "Yes," "No," or "N/A" in the respective columns.

For items that you mark as "No," immediate action is required. Document the actions taken to rectify the issue.

Maintain all supporting documentation for each checklist item for auditing purposes.

Update the checklist annually or whenever there are significant changes to wage and hour laws.

Consult legal advisors for specific guidance.

Checklist

Item No. | Checklist Item | Yes | No | N/A | Notes |

1 | Are all employees correctly classified as either exempt or non-exempt according to federal and state laws? | [Yes] | |||

2 | Are employee time records accurately maintained? | ||||

3 | Are all forms of compensation including tips, bonuses, and commissions properly accounted for in wage calculations? | ||||

4 | Is overtime pay correctly calculated and paid for all non-exempt employees? | ||||

5 | Are meal and rest breaks provided in compliance with state and federal laws? | ||||

6 | Are payroll records retained as required by law? | ||||

7 | Are all required workplace notices and posters displayed prominently? | ||||

8 | Is there a policy in place for handling wage and hour complaints internally? | ||||

9 | Are all employees provided with accurate wage statements? | ||||

10 | Are deductions from wages made only in situations permitted by law? |

Item No. | Checklist Item | Yes | No | N/A | Notes |

11 | Is the minimum wage paid to all employees in accordance with federal, state, and local laws? | ||||

12 | Is the company in compliance with child labor laws? | ||||

13 | Are any necessary work permits or authorizations in place? | ||||

14 | Are all employees aware of the company's wage and hour policies? | ||||

15 | Are all required forms and documentation in place for independent contractors? | ||||

16 | Is paid time off (PTO) accounted for and managed correctly? | ||||

17 | Are all wage and hour records securely stored? | ||||

18 | Are there procedures in place for handling wage garnishments and other legal deductions? | ||||

19 | Are exit interviews conducted to ensure final pay is correctly calculated? | ||||

20 | Are "off-the-clock" work and volunteer time properly managed to avoid legal issues? |

Item No. | Checklist Item | Yes | No | N/A | Notes |

21 | Are remote or teleworking hours accurately tracked and recorded? | ||||

22 | Are all holiday pay policies compliant with relevant laws? | ||||

23 | Are any mandatory arbitration agreements regarding wage and hour claims compliant with applicable laws? | ||||

24 | Are pay rates and employee classifications reviewed periodically for compliance? | ||||

25 | Is there a system in place to keep up-to-date with changing wage and hour laws? |

For queries or additional information, please contact [Name] at [Contact Details].

By ensuring that each item in this checklist is reviewed and acted upon as necessary, the Human Resources Department plays a critical role in safeguarding [Company Name] against potential wage and hour compliance issues. This checklist is intended to be a proactive tool for identifying areas that may require immediate attention, thereby mitigating the risk of legal challenges, financial penalties, or damage to the company's reputation.

For any questions, concerns, or clarifications related to this checklist or wage and hour compliance matters, please reach out to the designated contact person listed in this document.

Thank you for your attention to this important aspect of our business operations.

Authorized by:

[Name, Position]

Date:

[Date]

This document is for internal use within [Company Name] and should not be considered as legal advice. It is crucial to consult with legal experts for specific guidance related to wage and hour laws that may affect your organization.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Achieve full compliance effortlessly with our Wage and Hour Compliance Checklist HR Template. This comprehensive tool is meticulously designed to guide HR professionals through every aspect of wage and hour laws, from employee classification to overtime pay. Ideal for auditing and risk mitigation, this checklist ensures you're always one step ahead of regulations.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

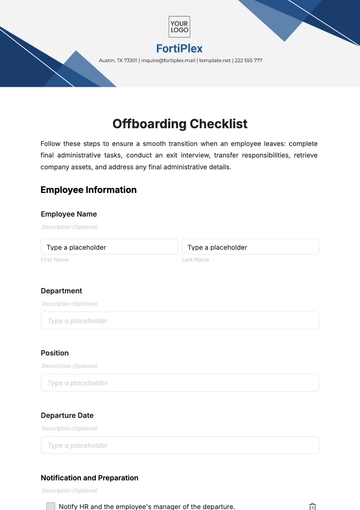

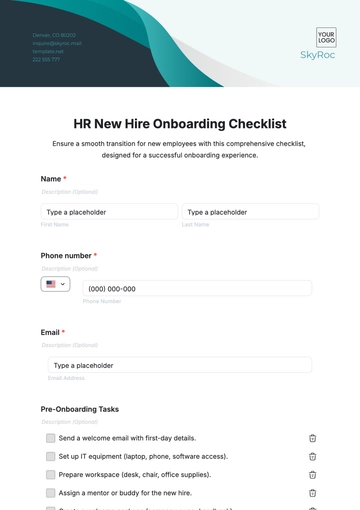

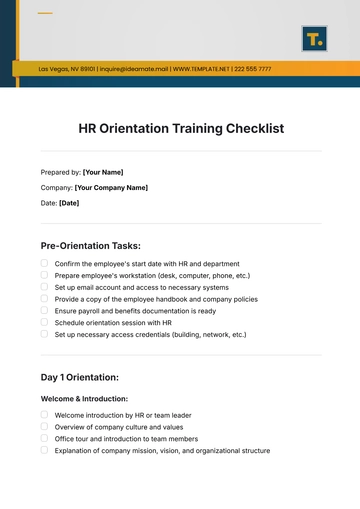

- Onboarding Checklist

- Quality Checklist

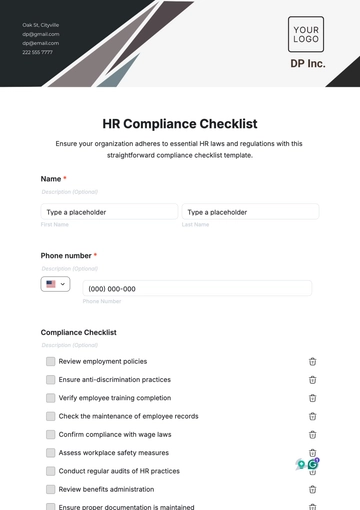

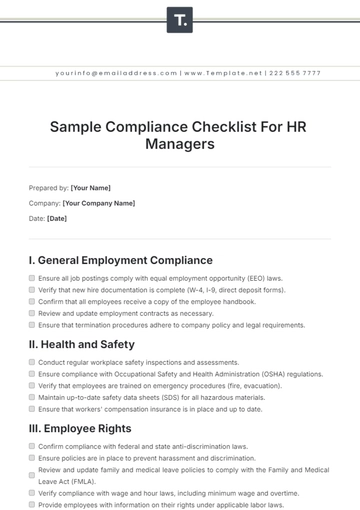

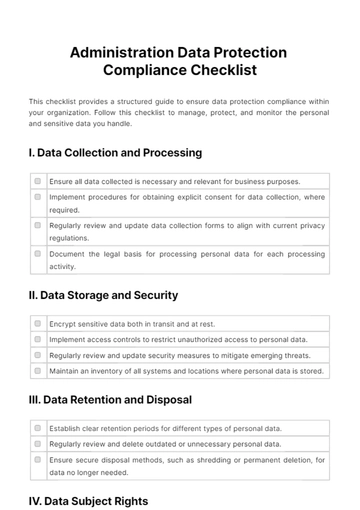

- Compliance Checklist

- Audit Checklist

- Registry Checklist

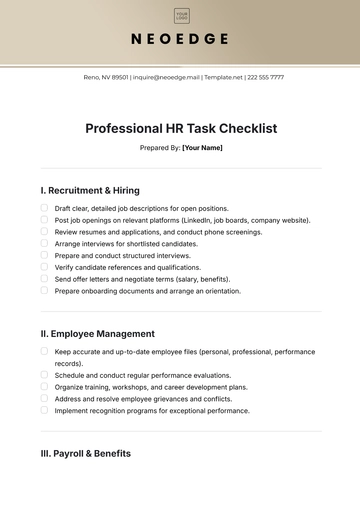

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

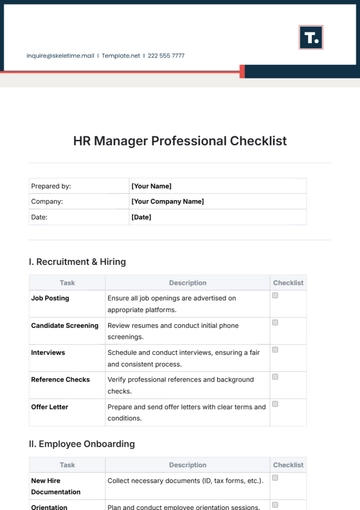

- Professional Checklist

- Hotel Checklist

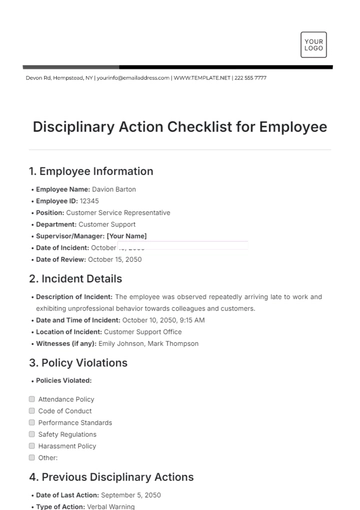

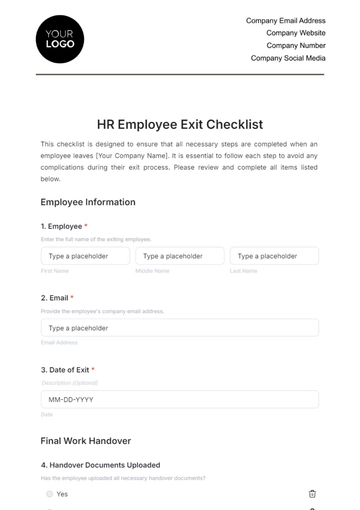

- Employee Checklist

- Moving Checklist

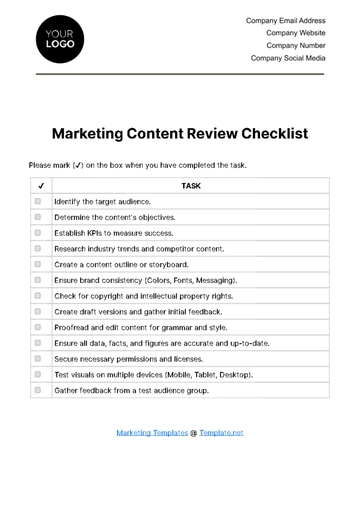

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

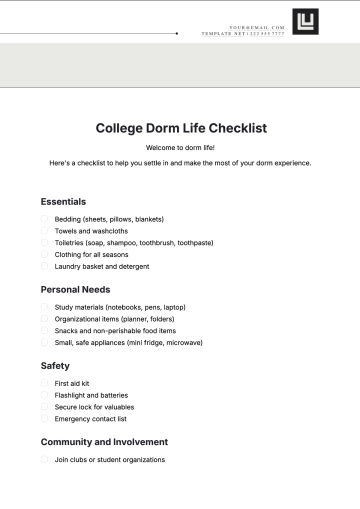

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist