Free Account Budget Sustainability Study

Executive Summary

This study was commissioned to evaluate the long-term sustainability of our organization's budget, ensuring that our financial practices support ongoing operations and the fulfillment of our strategic objectives. Through a comprehensive analysis of our financial data, projections, and risk factors, we aimed to identify strategies to maintain and improve the financial health of our account.

The methodology adopted included a review of historical financial performance, forecasting future revenues and expenditures based on current trends and assumptions, and conducting risk and scenario analyses to assess potential impacts on budget sustainability. We utilized financial data from the past five years and projected for the next decade, incorporating both internal and external economic factors.

Key findings reveal that while our current budget practices have supported stable growth, without adjustments, we could face a potential shortfall due to increasing operational costs and fluctuating revenue streams. Specifically, our analysis predicts a 5% annual increase in expenses against a more variable 2-4% increase in revenue over the next ten years.

To ensure sustainability, we recommend:

Diversifying revenue sources to reduce dependency on volatile income streams.

Implementing cost-saving measures across all departments.

Establishing a reserve fund to buffer against financial uncertainties.

Regularly reviewing and adjusting financial strategies based on market and organizational changes.

These recommendations, if implemented effectively, will strengthen our financial position and ensure our ability to support strategic objectives over the long term.

Introduction

The purpose of this Account Budget Sustainability Study is to ensure that our financial resources are managed efficiently and effectively, guaranteeing our organization's ability to operate and thrive in the long term. Recognizing the dynamic nature of our operating environment, it is essential that we periodically assess our budgetary practices to identify opportunities for improvement and address any potential vulnerabilities.

Our organization has a diverse revenue stream, including product sales, service fees, and grants, which fund an array of operations from research and development to customer service and marketing. As such, maintaining a balanced budget is critical to our mission and the continuous delivery of high-quality products and services.

The scope of this study encompasses a detailed analysis of our financial activities over the past five years, with projections extending over the next ten years. We have considered various financial parameters, including revenue growth rates, expenditure trends, capital investments, and potential economic impacts. The study is designed to provide a holistic view of our financial sustainability, taking into account both internal financial management practices and external economic factors that could affect our budget.

Methodology

To assess the sustainability of our budget, we employed a comprehensive methodology that combines historical data analysis, financial forecasting, risk assessment, and scenario planning. This multifaceted approach allowed us to evaluate our current financial health, project future trends, and identify potential risks and opportunities. Here is a detailed description of the analytical methods and assumptions used in the study.

Analytical Methods

Historical Data Analysis: We reviewed financial statements from the past five years to understand our revenue and expenditure trends. This analysis helped establish a baseline for assessing budget sustainability and identifying patterns or anomalies in our financial performance.

Financial Forecasting: Using the historical data as a foundation, we projected revenues and expenditures for the next ten years. This forecasting involved linear regression analysis for predictable income and expense categories, and more complex econometric models for volatile sources of income and unforeseen expenditures.

Risk Assessment: We conducted a thorough risk assessment to identify internal and external factors that could impact our financial sustainability. This included a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to evaluate operational efficiencies, market conditions, regulatory changes, and other relevant factors.

Scenario Planning: We developed multiple financial scenarios, including best-case, worst-case, and most likely scenarios, to understand the potential impacts of various external and internal changes on our budget. This method helped us to prepare for and mitigate potential financial challenges.

Assumptions

Several key assumptions were made during the study:

Economic growth will continue at a moderate pace, with no major recessions or booms.

Our main revenue streams will remain constant, with fluctuations within historical ranges.

Operational costs will increase at a steady rate, in line with inflation and anticipated growth.

Capital investments will be made as planned, with returns on these investments aligning with historical averages.

Sources of Data and Their Reliability

The primary sources of data for this study were our internal financial records, including income statements, balance sheets, and cash flow statements. These documents have been audited by a third-party accounting firm, ensuring their accuracy and reliability. Additionally, we consulted industry reports, economic forecasts, and regulatory filings to supplement our analysis and provide context for our projections. External data sources were selected based on their credibility and relevance to our operations and market.

The reliability of our study's conclusions is grounded in the rigorous analysis of high-quality data and the careful consideration of reasonable assumptions. However, it is important to note that all forecasts and scenarios are subject to uncertainties, and actual outcomes may vary due to factors beyond our control.

Financial Overview

The current financial state of our organization reflects a stable yet cautiously optimistic position. We have consistently increased our revenue streams year over year, though our expenditures have also risen in response to expanded operations and increased investment in research and development. Our reserves have been maintained at a healthy level, providing a buffer against unexpected financial downturns. This balance between growth, investment, and savings underscores our commitment to sustainable financial practices.

Current State of Finances

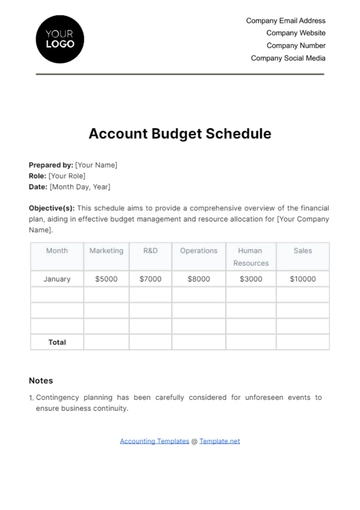

Category | Amount (in millions) |

Revenues | $150 |

Expenditures | $120 |

Reserves | $45 |

Historical Financial Performance

Year | Revenues | Expenditures | Net Income |

2079 | $100 | $80 | $20 |

2080 | $110 | $85 | $25 |

2081 | $120 | $90 | $30 |

2082 | $130 | $100 | $30 |

2083 | $150 | $120 | $30 |

Analysis

Over the past five years, our organization has demonstrated a consistent growth in revenue, averaging an annual increase of 10%. Expenditures have also grown, albeit at a slightly slower pace, reflecting our strategic investments in operations and development. Notably, our net income has remained stable, indicating effective management of our financial resources. This trend suggests a solid foundation but highlights the need for careful management of expenses to sustain our growth.

Projections of Future Revenues and Expenditures

Year | Projected Revenues | Projected Expenditures (in millions) | Projected Net Income |

2084 | $160 | $130 | $30 |

2085 | $170 | $140 | $30 |

2086 | $180 | $150 | $30 |

2087 | $190 | $160 | $30 |

2088 | $200 | $170 | $30 |

Analysis

Our projections for the next five years anticipate a continued revenue growth at an annual rate of approximately 6.25%, slightly slower than the historical trend. This conservative estimate accounts for potential market fluctuations and challenges. Expenditures are expected to increase in line with our expansion and inflationary pressures, necessitating careful financial planning to maintain our net income levels. The projections underscore the importance of identifying new revenue opportunities and implementing efficiency improvements to ensure long-term sustainability.

Risk Analysis

In assessing the sustainability of our budget, it is crucial to identify and analyze potential risks that could impact our financial health. These risks span various categories, including market dynamics, operational challenges, regulatory changes, and economic fluctuations. Understanding the likelihood and potential impact of these risks enables us to develop effective mitigation strategies, ensuring our organization's resilience and financial stability.

Risk | Likelihood | Impact | Mitigation Strategies |

Economic Downturn | Medium | High | Diversify revenue streams; build reserve funds. |

Increased Competition | High | Medium | Innovate product offerings; improve efficiency. |

Regulatory Changes | Low | High | Engage with policymakers; adapt compliance. |

Supply Chain Disruptions | Medium | Medium | Develop alternative suppliers; stock critical components. |

Technological Changes | High | High | Invest in R&D; monitor tech trends. |

Scenario Analysis

Scenario planning allows us to prepare for a range of possible futures, each with different implications for our budget. We have developed three scenarios: a best-case scenario assuming strong economic growth and successful market expansion; a worst-case scenario characterized by economic recession and increased competition; and a most likely scenario that anticipates moderate growth with manageable challenges.

Scenario | Revenue Implications | Expenditure Implications | Net Income Implications |

Best Case | Significant increase due to market expansion and new products. | Controlled increase with efficient operations. | Substantial growth in net income. |

Worst Case | Decrease due to market contraction and competition. | Increase due to higher costs and need for strategic shifts. | Reduction in net income, potentially leading to deficits. |

Most Likely | Moderate growth with steady market presence. | Gradual increase in line with inflation and strategic investments. | Stable net income with careful management. |

Analysis

In the best-case scenario, our organization leverages favorable market conditions to significantly boost revenues while maintaining efficient operations, resulting in a substantial increase in net income. This scenario would enable aggressive investment in innovation and expansion, further solidifying our market position.

The worst-case scenario presents a challenging environment where revenue declines and expenditures rise, squeezing our net income. This scenario would necessitate a rigorous review of our cost structures, potential downsizing, or redirection of resources to more profitable areas.

The most likely scenario assumes a continuation of our current trajectory with moderate revenue growth. This scenario is the most balanced and realistic, suggesting that with prudent financial management and strategic investments, we can maintain stable growth and financial health.

Recommendations for Sustainability

Based on the comprehensive analysis conducted in this study, we recommend the following strategies to ensure the long-term sustainability of our budget:

Diversify Revenue Sources: Explore new markets, develop additional product lines, and consider strategic partnerships to reduce dependency on current revenue streams and mitigate risks associated with market volatility.

Implement Cost-Saving Measures: Identify and execute opportunities to reduce operational costs without compromising quality or customer satisfaction. This includes optimizing supply chain management, automating processes where possible, and renegotiating vendor contracts.

Establish a Reserve Fund: Allocate a portion of annual net income to build and maintain a reserve fund. This fund will act as a financial buffer, enabling us to navigate unforeseen economic challenges without compromising strategic initiatives.

Regular Financial Reviews: Conduct quarterly financial reviews to monitor progress against budgetary goals and adjust strategies as necessary. This will ensure responsiveness to market changes and internal dynamics.

Invest in Technology and Innovation: Allocate resources towards research and development to stay ahead of technological advancements and market trends. This will support revenue growth and operational efficiency over the long term.

Implementation Plan

To turn these recommendations into action, we outline the following implementation plan, detailing the steps, responsible parties, and timelines for each initiative.

Action Item | Responsible Party | Timeline | Expected Outcome |

Explore new markets | Marketing & Sales Teams | Q1-Q2 2084 | Identification of 2-3 new market opportunities. |

Optimize supply chain | Operations Team | Q1-Q3 2084 | 5-10% reduction in supply chain costs. |

Establish a reserve fund | Finance Department | By end of 2084 | Reserve fund established with initial deposit. |

Conduct quarterly financial reviews | Finance Department | Quarterly (Ongoing) | Timely adjustments to financial strategy as needed. |

Invest in R&D for new products | R&D Team | Q1 2084 - | Development of 1-2 new products for market testing. |

This plan is designed to be dynamic, allowing for adjustments as we progress and as new information becomes available. Success will be measured by our ability to meet or exceed the expected outcomes associated with each action item, ultimately leading to improved financial sustainability and organizational growth. Regular progress updates will be provided to all stakeholders to ensure transparency and collective accountability.

Monitoring and Evaluation

Effective monitoring and evaluation are critical to ensuring the successful implementation of our sustainability recommendations. This process will involve setting clear indicators for success, regularly reviewing financial performance, and adjusting our strategies in response to both internal and external changes. By establishing a robust framework for monitoring and evaluation, we can ensure that our organization remains on track to achieve its financial sustainability goals.

Indicators for Success

Indicator | Description |

Revenue Growth | Annual increase in revenue from diversified sources. |

Cost Reduction | Percentage decrease in operational costs through efficiency measures. |

Reserve Fund Level | Size of the reserve fund as a percentage of annual operating expenses. |

Product Development Milestones | Progress in research and development initiatives leading to new product launches. |

Quarterly Financial Performance | Achievement of budget targets and adjustments made in response to variances. |

Frequency and Methods of Financial Review

Frequency | Method | Purpose |

Monthly | Internal Financial Statements Review | Monitor cash flow, revenue, and expenditures against budget. |

Quarterly | Performance Review Meetings | Assess progress against strategic objectives and financial indicators. |

Annually | External Audit and Strategic Planning | Validate financial performance and adjust long-term strategies. |

Conclusion

The Account Budget Sustainability Study has provided a comprehensive analysis of our financial health, identifying both strengths to build upon and areas for improvement. Through a detailed examination of our financial history, current status, and future projections, we have developed a clear understanding of the risks and scenarios that could impact our budget. Based on this understanding, we have outlined strategic recommendations and an implementation plan designed to ensure our financial sustainability.

Implementing these recommendations will require commitment, flexibility, and ongoing vigilance. By diversifying our revenue sources, optimizing costs, building a financial buffer, and continuously monitoring our financial performance, we can navigate the uncertainties of the market and secure our organization's future.

The path to financial sustainability is an ongoing journey that demands our attention and best efforts. With the strategies outlined in this study, we are well-positioned to achieve our financial goals, support our strategic objectives, and continue to thrive in a competitive and ever-changing environment.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Unlock the potential for enduring financial health with the Account Budget Sustainability Study Template from Template.net. This editable and customizable template is expertly crafted to assess and ensure the sustainability of your budgeting strategies. Tailored for modification in our AI Editor tool, it facilitates a comprehensive analysis, guiding you towards sustainable financial practices. Template.net offers this invaluable resource to aid in your pursuit of long-term budget stability and growth.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising