Free Account Budget Transparency Report

Executive Summary

This Account Budget Transparency Report has been prepared to offer our stakeholders a clear, detailed view of our financial planning, allocation, and performance for the fiscal year 2084-2085. It underscores our commitment to transparency, accountability, and responsible financial management. By sharing this information, we aim to strengthen trust with our stakeholders and provide a basis for constructive dialogue about our financial decisions and performance.

Key Findings

Total budget for the fiscal year 2084-2085 was set at $120 million, a 5% increase from the previous year, driven primarily by enhanced operational efficiencies and revenue growth.

Revenue exceeded initial projections by 3%, reaching $124 million, attributed to diversification of income sources and improved market penetration.

Expenditures were closely managed to budget allocations, with a slight overrun of 2%, totaling $122 million, mainly due to unexpected operational costs.

The budget allocation process was refined to include more stakeholder input, leading to more targeted and effective use of resources.

Financial performance analysis indicated a solid fiscal stance, with a surplus of $2 million, which will be reinvested into strategic growth areas.

Future budgeting strategies focus on sustainability, technological investment, and expanding our market presence.

Purpose of the Transparency Report

The purpose of this Account Budget Transparency Report is to provide a comprehensive overview of our budgeting practices, financial allocations, and performance over the past fiscal year. This document is intended to demystify our financial operations and present a clear picture of how resources are being utilized to achieve our strategic objectives. Transparency in our financial reporting is a cornerstone of our organizational integrity, ensuring that all stakeholders, including employees, investors, and partners, understand our financial decisions and their implications.

Importance of Budget Transparency

Budget transparency is fundamental to fostering trust and accountability between us and our stakeholders. It ensures that our financial practices are open to scrutiny, allows for informed decision-making by stakeholders, and enhances our overall governance. By committing to transparency, we not only adhere to best practices in financial management but also reinforce our dedication to ethical standards and mutual respect in all our business dealings. Transparent budgeting processes help in identifying efficiencies, addressing any areas of concern, and aligning our financial strategies with our long-term vision for growth and sustainability.

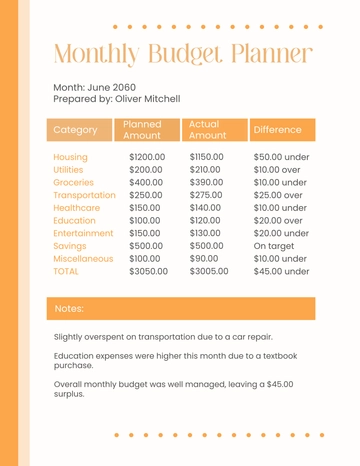

Budget Overview

For the fiscal year 2084-2085, our organization established a comprehensive budget to support our strategic objectives, enhance operational efficiency, and drive growth. The total budget was meticulously planned to align with our revenue forecasts and investment priorities, reflecting our commitment to sustainable financial management and strategic resource allocation. This overview provides a snapshot of our budgetary framework, highlighting the allocation across different categories and comparing it to the previous fiscal year to illustrate our financial planning and management efforts.

Category | 2084-2085 | 2083-2084 | % Change |

Revenue | 124,000,000 | 118,000,000 | +5.1% |

Total Expenditures | 122,000,000 | 116,000,000 | +5.2% |

Operational Costs | 70,000,000 | 68,000,000 | +2.9% |

Capital Investments | 30,000,000 | 28,000,000 | +7.1% |

R&D | 12,000,000 | 10,000,000 | +20.0% |

Marketing & Sales | 10,000,000 | 10,000,000 | 0.0% |

Net Surplus/Deficit | 2,000,000 | 2,000,000 | 0.0% |

Revenue Details

The fiscal year 2084-2085 saw a notable increase in our revenue, exceeding projections and outpacing the growth observed in the previous fiscal year. This achievement can be attributed to our diversified revenue streams and effective market expansion strategies, which have collectively bolstered our financial position.

Revenue Source | 2084-2085 | 2083-2084 | % Change |

Product Sales | 80,000,000 | 76,000,000 | +5.3% |

Service Income | 30,000,000 | 28,000,000 | +7.1% |

Licensing Fees | 8,000,000 | 7,000,000 | +14.3% |

Investment Income | 6,000,000 | 7,000,000 | -14.3% |

Analysis

The growth in product sales and service income underscores the effectiveness of our market penetration and customer engagement strategies. The increase in licensing fees reflects our successful efforts to leverage our intellectual property and partnerships. However, investment income saw a decrease, attributed to market volatility; this highlights the need for a more diversified investment strategy to mitigate such risks in the future. Overall, the positive revenue growth signifies our organization's strong market position and the successful execution of our business strategies. Moving forward, we will continue to explore new revenue opportunities while also focusing on stabilizing investment income to ensure sustained financial health and growth.

Expenditure Details

The fiscal year 2084-2085 also saw a strategic allocation of expenditures aimed at supporting our growth objectives, enhancing operational efficiencies, and investing in the future of our organization. Expenditures were carefully planned to ensure optimal use of resources across various departments and projects, contributing to our overall strategic goals. This section details our expenditure allocations, comparing them with the previous fiscal year to provide insights into our financial management strategies and investment priorities.

Expenditure Category | 2084-2085 | 2083-2084 | % Change |

Operational Costs | 70,000,000 | 68,000,000 | +2.9% |

Capital Investments | 30,000,000 | 28,000,000 | +7.1% |

Research & Development | 12,000,000 | 10,000,000 | +20.0% |

Marketing & Sales | 10,000,000 | 10,000,000 | 0.0% |

Analysis

Our commitment to research and development is evident from the 20% increase in its budget, underscoring our focus on innovation and long-term growth. Operational costs saw a modest increase, reflecting our efforts to maintain efficiency while scaling operations. The significant investment in capital projects aligns with our strategic plan to enhance infrastructure and technological capabilities, ensuring we remain competitive and agile in a rapidly evolving market. Marketing and sales expenditures remained constant, indicating a focus on optimizing current strategies to deliver value and drive revenue. This balanced approach to expenditure ensures we invest in our future while maintaining a strong operational foundation.

Budget Allocation Process

The process of budget allocation is crucial to our financial planning and strategic execution. It ensures that resources are distributed in a manner that supports our organizational objectives, drives growth, and maintains financial health. The following criteria and considerations guide our budget planning and allocation:

Strategic Alignment: Ensuring that budget allocations support our long-term strategic goals and priorities.

Return on Investment (ROI): Evaluating potential returns from investments in different areas, prioritizing those with the highest expected ROI.

Operational Efficiency: Identifying opportunities to improve efficiency and reduce costs without compromising quality or productivity.

Innovation and Growth: Allocating resources to areas with the potential for innovation, market expansion, and revenue growth.

Risk Management: Considering the risks associated with different expenditures and investments, aiming to balance potential rewards with appropriate risk levels.

Stakeholder Input: Incorporating feedback and insights from various stakeholders, including department heads, employees, and key partners, to inform budget decisions.

Market and Economic Conditions: Adapting budget allocations based on current and forecasted market conditions and economic trends to ensure resilience and flexibility.

Regulatory Compliance and Ethical Considerations: Ensuring that all budget allocations comply with relevant laws, regulations, and ethical standards.

Fiscal Responsibility and Management

Maintaining fiscal responsibility and efficient budget management is paramount to our organization's integrity and sustainability. We have implemented several measures to ensure that our financial practices not only support our current operations but also secure our future. These measures are designed to uphold our commitment to transparency, accountability, and strategic financial stewardship.

Measures Taken

Regular Financial Audits: Conducting annual external audits and quarterly internal audits to ensure accuracy and compliance with financial reporting and management practices.

Cost-Benefit Analysis for Major Expenditures: Rigorously evaluating the potential return on investment for all significant expenditures to ensure they align with our strategic goals and offer sustainable value.

Dynamic Budgeting Process: Adopting a flexible approach to budgeting that allows for adjustments in response to changing market conditions, operational needs, and strategic priorities.

Debt Management: Implementing prudent debt management strategies to maintain a healthy balance sheet and ensure long-term financial sustainability.

Reserve Funds: Establishing and maintaining reserve funds to provide financial stability and support in times of unexpected financial challenges.

Stakeholder Engagement: Involving key stakeholders in the budgeting process to gather diverse insights and foster a culture of shared financial responsibility.

Future Budgeting Strategies

Looking ahead, we are committed to refining our budgeting strategies to better support our organizational objectives, adapt to the evolving economic landscape, and capitalize on new opportunities. Our future budgeting strategies include:

Enhanced Data Analytics: Leveraging advanced data analytics to improve budget forecasting accuracy and inform strategic financial decisions.

Sustainability Focus: Integrating sustainability principles into our budgeting process to align with environmental, social, and governance (ESG) goals and commitments.

Technology Investment: Prioritizing investments in technology to drive operational efficiencies, enhance service delivery, and support innovative business models.

Diversification of Revenue Streams: Exploring new revenue opportunities to reduce reliance on traditional income sources and build financial resilience.

Strategic Partnerships: Forming strategic partnerships and collaborations to access new markets, share risks, and optimize resource utilization.

Continuous Improvement: Adopting a continuous improvement mindset to regularly review and refine budgeting practices, ensuring they remain aligned with our strategic vision and operational realities.

Conclusion

This Account Budget Transparency Report reflects our unwavering commitment to financial transparency, responsible management, and stakeholder engagement. Through diligent planning, strategic allocation, and rigorous management, we have navigated the challenges of the fiscal year 2084-2085, emerging with a solid financial foundation and a clear path forward. As we look to the future, we remain dedicated to enhancing our budgeting practices, fostering fiscal responsibility, and driving sustainable growth. We believe that by adhering to these principles, we can continue to build trust with our stakeholders, achieve our strategic objectives, and make a positive impact on the communities we serve.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Elevate your financial accountability with the Account Budget Transparency Report Template from Template.net. This editable and customizable template is designed to showcase your budgeting practices transparently. With options to be editable in our AI Editor tool, it makes communicating budget allocations and expenditures straightforward, fostering trust and clarity. Template.net provides this template to support your commitment to financial transparency, enabling stakeholders to understand and engage with your budgeting process effectively.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

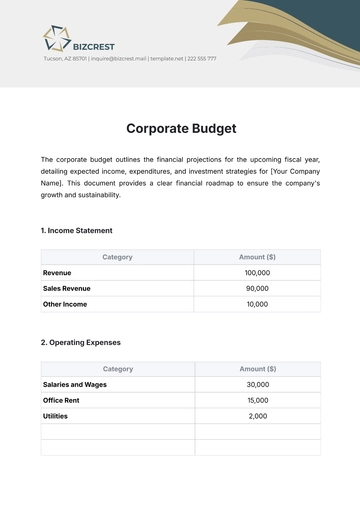

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

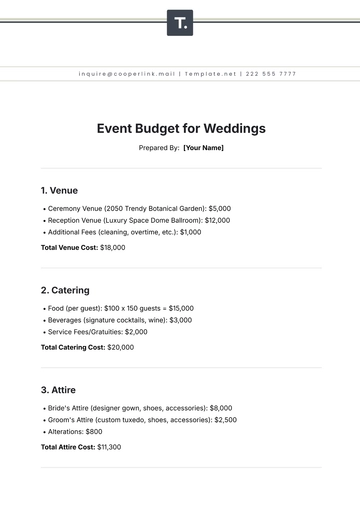

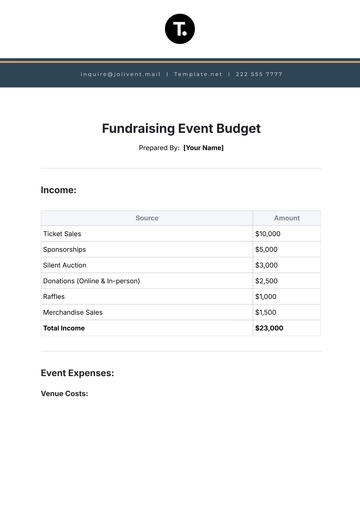

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising