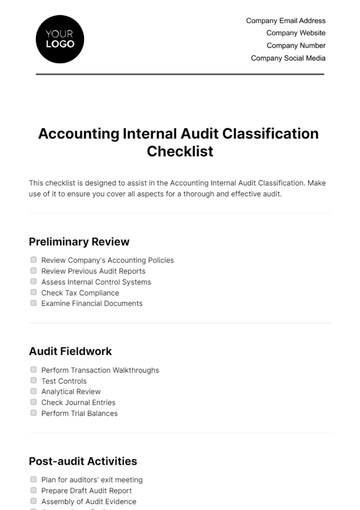

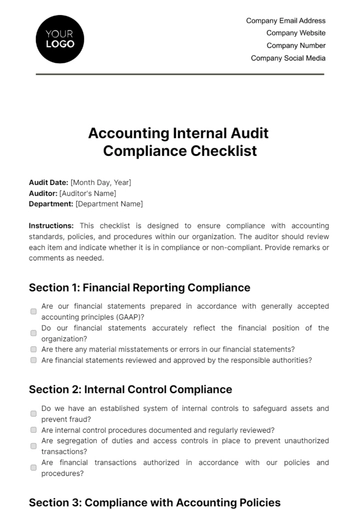

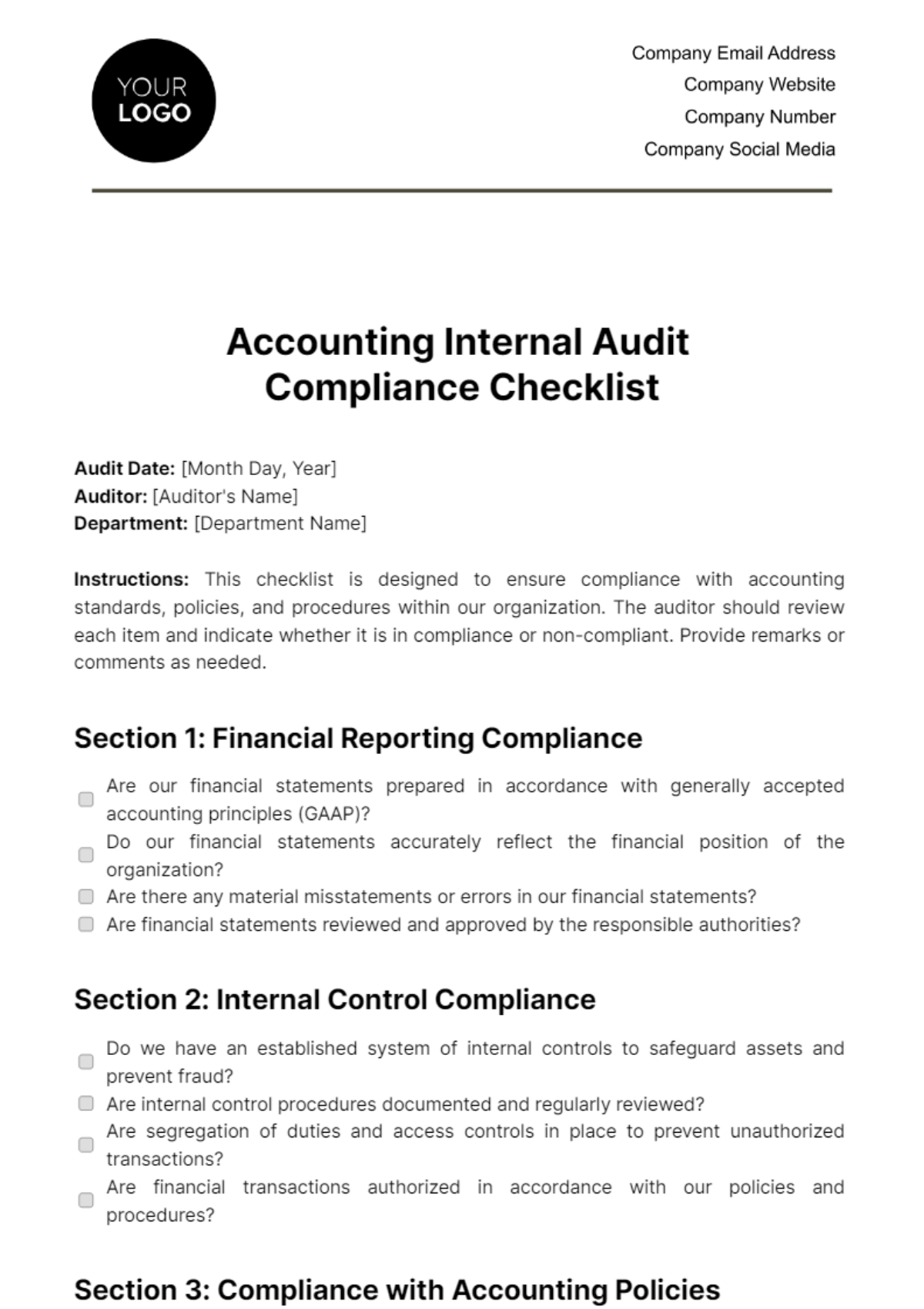

Free Accounting Internal Audit Compliance Checklist

Compliance Checklist

Audit Date: [Month Day, Year]

Auditor: [Auditor's Name]

Department: [Department Name]

Instructions: This checklist is designed to ensure compliance with accounting standards, policies, and procedures within our organization. The auditor should review each item and indicate whether it is in compliance or non-compliant. Provide remarks or comments as needed.

Section 1: Financial Reporting Compliance

Are our financial statements prepared in accordance with generally accepted accounting principles (GAAP)?

Do our financial statements accurately reflect the financial position of the organization?

Are there any material misstatements or errors in our financial statements?

Are financial statements reviewed and approved by the responsible authorities?

Section 2: Internal Control Compliance

Do we have an established system of internal controls to safeguard assets and prevent fraud?

Are internal control procedures documented and regularly reviewed?

Are segregation of duties and access controls in place to prevent unauthorized transactions?

Are financial transactions authorized in accordance with our policies and procedures?

Section 3: Compliance with Accounting Policies

Are our accounting policies and procedures up to date and in compliance with relevant regulations?

Are accounting policies consistently applied across all departments and subsidiaries?

Have there been any recent changes in accounting policies? If yes, are they properly documented?

Section 4: Tax Compliance

Are we in compliance with all applicable tax laws and regulations?

Are tax filings accurate and submitted on time?

Are tax records and documentation maintained in accordance with tax requirements?

Section 5: Regulatory Requirements

Are we in compliance with all relevant regulatory requirements related to accounting and financial reporting?

Are there any pending or ongoing regulatory investigations or issues?

Section 6: Audit and Review Compliance

Have our financial statements been audited or reviewed by external auditors, and are we in compliance with their recommendations?

Are internal audits conducted regularly, and are findings addressed promptly?

Conclusion

Based on the review conducted on [Date], we have assessed our compliance with the accounting standards, policies, and procedures outlined in this checklist. Any non-compliance issues have been identified, and corrective actions will be taken as necessary to address them.

[Auditor's Signature]

[Month Day, Year]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Explore the Accounting Internal Audit Compliance Checklist Template at Template.net, your go-to for editable and customizable professional documents. This template ensures thorough compliance checks, easily editable in our AI Editor tool. Designed for efficiency, it streamlines your audit processes, offering a comprehensive solution for audit compliance. Make your internal audits flawless and compliant with this essential tool.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

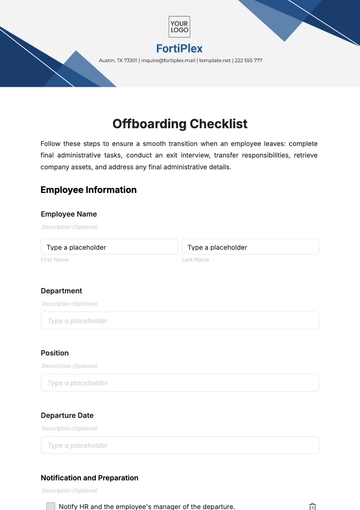

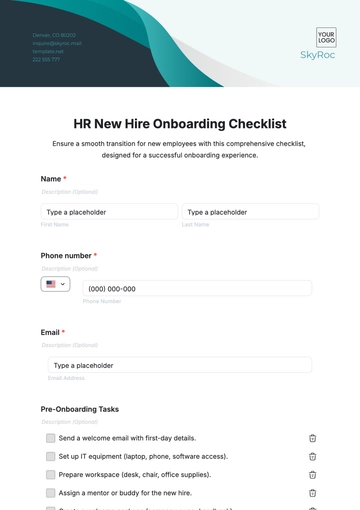

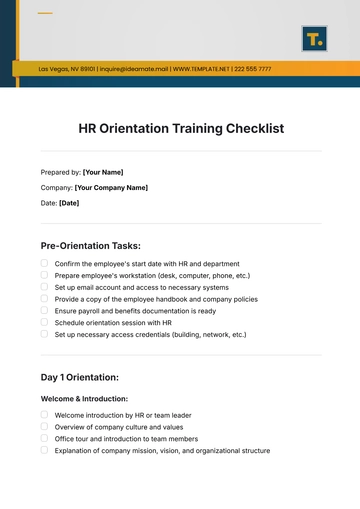

- Onboarding Checklist

- Quality Checklist

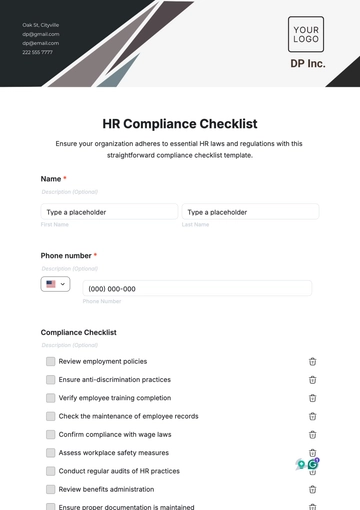

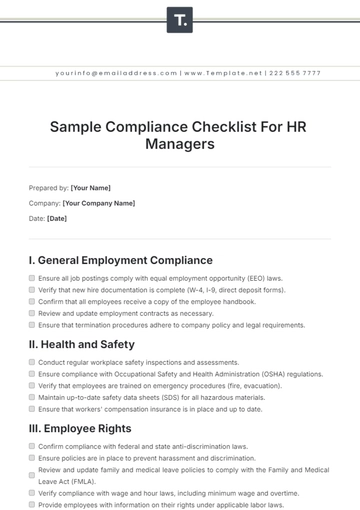

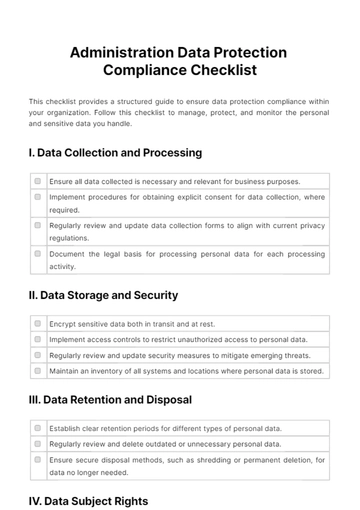

- Compliance Checklist

- Audit Checklist

- Registry Checklist

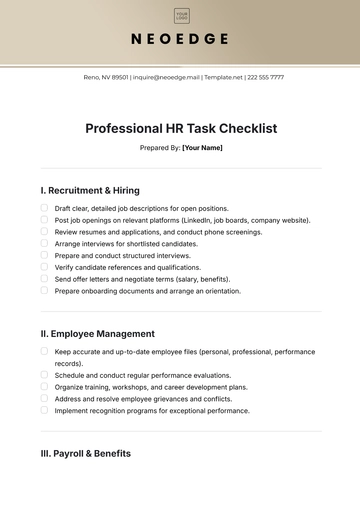

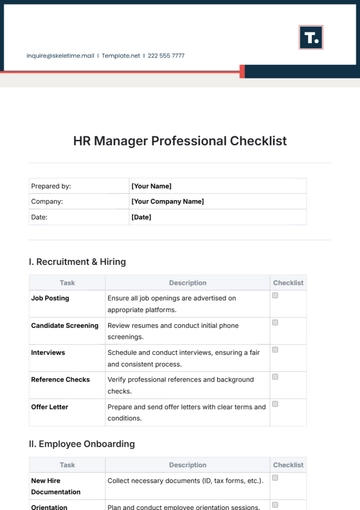

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

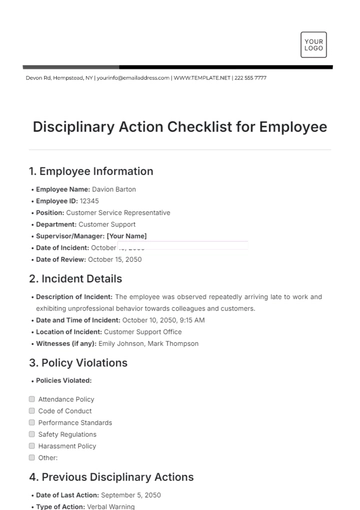

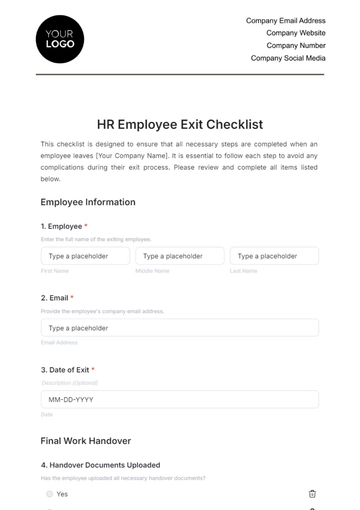

- Employee Checklist

- Moving Checklist

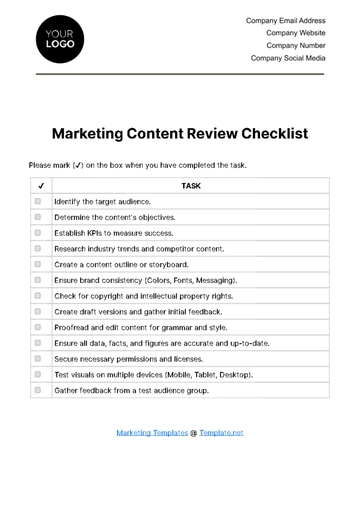

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

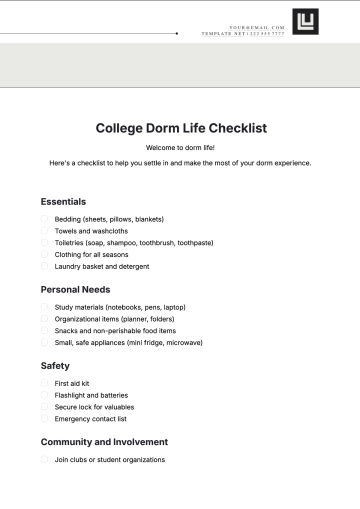

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist