Free Accounting Guide

Introduction

Welcome to our comprehensive Accounting Guide, designed to provide both novices and seasoned practitioners with a clear and practical understanding of accounting principles and practices. This guide serves as a valuable resource, offering insights into the fundamental aspects of accounting, from basic concepts and terms to the intricacies of financial reporting and tax compliance. Whether you're a small business owner, an aspiring accountant, or a professional looking to refresh your knowledge, this guide aims to equip you with the essential tools and understanding needed to navigate the world of accounting effectively. Our goal is to present these concepts in an accessible manner, enabling you to apply them confidently in various business scenarios.

A. Basic Accounting Principles

Accounting is grounded in a set of fundamental principles that form the backbone of all financial practices. Understanding these principles is essential for accurate and consistent financial reporting.

Double-Entry System: Every financial transaction has equal and opposite effects in at least two different accounts. This system ensures the accounting equation (Assets = Liabilities + Equity) remains balanced.

Accrual Basis of Accounting: Revenues and expenses are recorded when they are earned or incurred, regardless of when the cash is actually received or paid. This principle provides a more accurate picture of a company's financial position.

Consistency Principle: Accounting methods should be applied consistently from one period to the next. This consistency allows for meaningful comparison of financial data over time.

Prudence Principle: Revenues and profits are only recognized when they are assured, while expenses are accounted for as soon as they are foreseen. This principle prevents the overstatement of financial health.

Going Concern Principle: Assumes that a business will continue to operate indefinitely, which justifies the deferral of certain expenses and the spreading of asset costs over their useful life.

Matching Principle: Expenses should be matched with revenues in the period in which the revenue was earned, providing a more accurate representation of profitability.

Materiality Principle: Financial reporting should focus on information that could influence the decision-making of its users, allowing insignificant details to be disregarded.

Objectivity Principle: Financial reporting should be based on objective evidence, ensuring that financial statements are free from bias and subjectivity.

B. Key Accounting Terms and Definitions

Accounting encompasses a wide range of terms and definitions that are crucial for understanding and effectively navigating the financial landscape. Below is a list of key accounting terms, each integral to grasping the complexities of financial recording and reporting:

Assets: Resources owned by a company, expected to bring future economic benefits.

Liabilities: Financial obligations or debts owed by a company to external parties.

Equity: The residual interest in the assets of a company after deducting liabilities.

Revenue: Income generated from normal business operations.

Expenses: Costs incurred in the process of generating revenue.

Debit: An entry on the left side of an account, indicating increases in assets and expenses, or decreases in liabilities, equity, and revenue.

Credit: An entry on the right side of an account, indicating increases in liabilities, equity, and revenue, or decreases in assets and expenses.

General Ledger: A complete record of all financial transactions over the life of a company.

Journal Entry: The method by which transactions are recorded in the accounting system.

Trial Balance: A report that lists the balances of all ledgers and accounts to check the arithmetic accuracy of the ledger postings.

C. Accounting Process and Cycle

The accounting process and cycle encompass a series of steps to collect, process, and communicate financial information. Here is an overview of the key stages in the accounting cycle, each integral to maintaining accurate and comprehensive financial records:

Identify Transactions: Record financial transactions as they occur, ensuring each has a financial impact on the company.

Record Transactions in a Journal: Document transactions chronologically in the accounting journal, detailing amounts, accounts affected, and dates.

Post to the General Ledger: Transfer the information from the journal to the general ledger, where transactions are classified by account.

Prepare an Unadjusted Trial Balance: Compile a report listing all the accounts and their balances to check the accuracy of postings.

Make Adjusting Entries: Adjust journal entries at the end of an accounting period to account for accrued and deferred items.

Prepare an Adjusted Trial Balance: Update the trial balance after posting the adjusting entries to ensure it remains in balance.

Prepare Financial Statements: Compile the income statement, balance sheet, and cash flow statement using information from the adjusted trial balance.

Close the Books: Close temporary accounts and transfer their balances to permanent accounts to prepare for the next accounting period.

Prepare a Post-Closing Trial Balance: Ensure all temporary accounts have been closed and the ledger is ready for the next period.

D. Bookkeeping Fundamentals

Bookkeeping is the foundational practice in accounting, involving the systematic recording and organizing of financial transactions. Effective bookkeeping is essential for accurate financial reporting and analysis, compliance with tax laws, and informed decision-making. Below are key bookkeeping practices, each vital to maintaining the financial integrity of a business:

Recording Transactions: Every financial transaction, regardless of size, must be recorded in the accounting journal with the date, amount, and a brief description. This record forms the basis for all further accounting processes.

Maintaining Ledgers: After recording transactions in the journal, they are categorized and posted to respective ledger accounts. The ledger provides a detailed and organized view of each account's activity over a period.

Reconciling Bank Statements: Regularly comparing the company’s bank statements with its own records to identify and rectify any discrepancies. This ensures that the company’s records are accurate and up-to-date.

Managing Accounts Receivable and Payable: Keeping track of what is owed to the business and what the business owes to others. Timely management of these accounts is crucial for maintaining cash flow.

Preparing Trial Balances: A trial balance is prepared periodically to test the mathematical accuracy of the bookkeeping entries. It lists all the ledger account balances at a particular point in time.

E. Financial Statements and Reporting

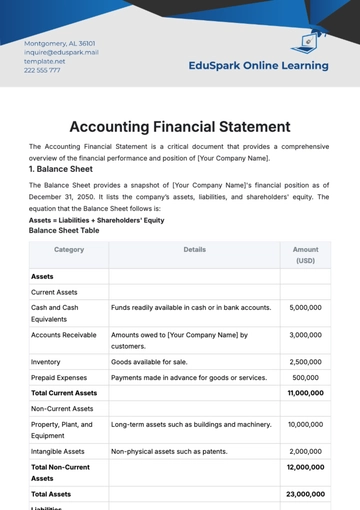

Financial statements are key outputs of the accounting process, providing critical insights into the financial health and performance of a business. They are essential tools for stakeholders, including investors, managers, and regulatory bodies.

Financial Statement | Preparation | Interpretation | Usage |

Income Statement | Summarizes revenues and expenses to show the company's profitability over a specific period. | Used to assess the company's operational efficiency and profitability. | Frequently used by investors and creditors to gauge the company's financial performance. |

Balance Sheet | Lists the company's assets, liabilities, and equity at a specific point in time, providing a snapshot of its financial position. | Reveals the company’s financial stability and capital structure. | Essential for financial analysis, including liquidity and solvency assessments. |

Cash Flow Statement | Shows the inflows and outflows of cash, highlighting the company's ability to generate cash to fund operations and investments. | Used to understand the company’s cash generation and spending patterns. | Important for assessing the company’s liquidity and long-term viability. |

F. Managing Accounts Receivable and Payable

Effective management of accounts receivable and payable is crucial for maintaining healthy cash flow and financial stability in a business. Accounts receivable represents the money owed to the company by its customers for goods or services delivered but not yet paid for. In contrast, accounts payable represents the money that the company owes to its suppliers or creditors for goods or services received. Balancing these two accounts is key to ensuring that the business has enough cash on hand to meet its obligations.

Accounts Receivable Management Strategies

Prompt Invoicing: Issue invoices immediately after goods or services are delivered to ensure timely payments.

Clear Payment Terms: Establish and communicate clear payment terms with customers, including due dates and late payment penalties.

Regular Follow-ups: Monitor outstanding invoices and follow up with customers regularly to remind them of pending payments.

Offer Payment Incentives: Encourage early payments by offering discounts or favorable terms for prompt payment.

Credit Checks: Conduct credit checks on new customers to assess their creditworthiness and set appropriate credit limits.

Accounts Payable Management Strategies

Timely Payments: Pay suppliers on time to maintain good relationships and possibly qualify for discounts.

Leverage Payment Terms: Take advantage of the full payment terms offered by suppliers without incurring late fees.

Prioritize Payments: Prioritize payments based on cash flow needs, importance of the supplier, and potential discounts or penalties.

Negotiate Better Terms: Regularly review and negotiate payment terms with suppliers to improve cash flow.

Automate Processes: Use accounting software to automate accounts payable processes for efficiency and accuracy.

G. Payroll Accounting

Payroll accounting is a critical component of a company’s financial operations, involving the process of calculating, managing, and recording employee salaries, wages, bonuses, and deductions. It encompasses compliance with various tax and employment laws, ensuring accurate and timely payments to employees, and maintaining detailed payroll records. Proper payroll accounting is crucial for both financial accuracy and legal compliance.

Calculating Gross Pay: Determine the total pay due to each employee before deductions, based on their salary or hourly wage rates, including any overtime, bonuses, or commissions.

Deducting Taxes and Other Withholdings: Calculate and deduct appropriate taxes (federal, state, local) and other withholdings like Social Security, Medicare, and retirement contributions from each employee's gross pay.

Issuing Paychecks and Direct Deposits: After calculating net pay (gross pay minus deductions), issue paychecks or direct deposits to employees on the scheduled pay date.

Recording Payroll Expenses: Record payroll transactions in the general ledger, reflecting them as expenses and liabilities.

Preparing Payroll Reports: Generate payroll reports for internal use and compliance, and prepare necessary documents for tax filings.

H. Tax Considerations and Compliance

Navigating tax laws is a complex yet essential aspect of accounting. Understanding and complying with these laws is crucial for any business operation.

U.S. Tax Law | Compliance Measures | Filing Requirement |

Federal Income Tax | Withhold appropriate federal taxes from employee wages based on IRS guidelines. | File annually using forms like Form 1040 or 1120. |

State and Local Income Taxes | Comply with state and local tax rates and regulations for withholding. | File based on state and local deadlines and forms. |

FICA (Social Security and Medicare) | Withhold Social Security and Medicare taxes from employee wages and match the amounts as an employer. | Report using Form W-2 and Form 941. |

Federal Unemployment Tax (FUTA) | Pay FUTA tax, which is solely an employer's responsibility, not withheld from employees. | Report annually using Form 940. |

State Unemployment Taxes (SUTA) | Pay state unemployment taxes, adhering to individual state requirements. | Varies by state, often reported quarterly. |

I. Internal Controls and Fraud Prevention

Internal controls are essential mechanisms within an organization's accounting processes, designed to safeguard assets, ensure financial reporting accuracy, and prevent fraud. These controls involve policies, procedures, and checks that help in detecting and mitigating the risk of errors or fraudulent activities. Implementing strong internal controls is not just a protective measure; it's a fundamental aspect of sound financial management. The following are our guidelines for internal controls and fraud prevention:

Segregation of Duties: Divide responsibilities among different individuals to reduce the risk of error or inappropriate actions.

Regular Reconciliations: Routinely reconcile bank statements with internal records to catch and correct discrepancies.

Authorization Controls: Implement authorization procedures for significant transactions to ensure validity and accuracy.

Employee Training: Educate employees about fraud risks and the importance of internal controls.

Audits and Reviews: Conduct regular internal and external audits to independently examine financial and operational procedures.

Secure Documentation: Safeguard financial documents and records to prevent unauthorized access and tampering.

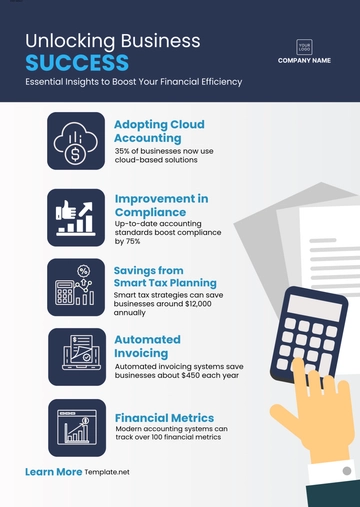

J. Use of Accounting Software

Accounting software plays a pivotal role in modern financial management, automating complex processes and ensuring accuracy and efficiency. The right software can streamline accounting tasks, provide real-time financial insights, and enhance overall financial control.

Accounting Software | Benefits | Best Used For |

QuickBooks | User-friendly, comprehensive financial management features. | Small to medium-sized businesses. |

Xero | Strong cloud-based features, accessible from anywhere. | Businesses requiring remote access. |

FreshBooks | Simple invoicing and time tracking, ideal for freelancers. | Freelancers and small service-based businesses. |

Sage 50cloud | Robust inventory and project management features. | Businesses with complex inventory needs. |

Zoho Books | Affordable, with excellent automation and integration options. | Small businesses and startups. |

K. Case Studies

Real-world case studies provide valuable insights into how accounting principles are applied in various business scenarios. They offer a practical perspective on the challenges faced by businesses and the strategies used to address them. Below are three case studies that illustrate the application of key accounting principles in different contexts.

Case Study 1: Retail Business Expansion

A rapidly growing retail business decided to open new stores across the country. To finance this expansion, it needed a clear picture of its financial health. By applying the accrual basis of accounting, the company was able to recognize revenue at the point of sale, even if payments were received later. This provided an accurate representation of sales during their peak season, which was crucial for securing a loan for expansion. The matching principle also helped in appropriately allocating expenses to the same period as the revenues they helped generate, giving a true picture of profitability.

Case Study 2: Manufacturing Company's Equipment Purchase

A manufacturing company purchased new equipment to increase its production capacity. The cost of the equipment was significant, and instead of expensing the entire cost in the year of purchase, the company used the principle of depreciation. This allowed the cost to be spread over the useful life of the equipment, reflecting its usage and benefit over several years. This application of the matching principle ensured that the company's financial statements accurately reflected the long-term investment and its impact on profitability.

Case Study 3: Service Company Managing Cash Flow

A service-based company faced challenges in managing cash flow due to irregular payment patterns from clients. By implementing stringent accounts receivable management practices, including prompt invoicing and regular follow-ups, the company improved its cash collection. Additionally, the company used cash flow statements to monitor the inflows and outflows of cash, enabling them to make informed decisions about expenses, investments, and potential borrowing needs.

Conclusion

The journey through the world of accounting, from its basic principles and terminologies to the complexities of financial reporting and fraud prevention, underscores the indispensable role of accounting in the business landscape. This guide has endeavored to provide a comprehensive overview of the various facets of accounting, equipped with practical insights and real-world applications. Whether you are a budding accountant, a seasoned professional, or a business owner, understanding these principles and practices is crucial for navigating the financial challenges of the modern business environment. The case studies illustrate the practical application of these principles, highlighting the importance of sound accounting in decision-making and strategic planning. As the financial world continues to evolve, so too must our understanding and application of accounting principles, ensuring that we remain equipped to meet the challenges and opportunities that lie ahead.

References and Further Reading

Warren, C.S., Reeve, J.M., & Duchac, J. (2020). Accounting. Cengage Learning.

Kimmel, P.D., Weygandt, J.J., & Kieso, D.E. (2019). Financial Accounting: Tools for Business Decision Making. Wiley.

Horngren, C.T., Sundem, G.L., Elliott, J.A., & Philbrick, D.R. (2018). Introduction to Financial Accounting. Pearson.

AICPA (American Institute of Certified Public Accountants). (2021). Accounting and Auditing Publications.

Bragg, S.M. (2020). Accounting Best Practices. Wiley.

Alexander, D., Britton, A., & Jorissen, A. (2019). International Financial Reporting and Analysis. Cengage Learning EMEA.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Empower your financial knowledge with the Accounting Guide Template from Template.net. This resource, meticulously designed for clarity and comprehensibility, is both editable and customizable. Adapt it effortlessly to your specific instructional needs using our AI Editor tool. Template.net is your go-to for creating detailed, user-friendly accounting guides that educate and inform effectively.