Free Accounts Invoice Management Policy

I. Introduction

The importance of establishing an Accounts Invoice Management Policy cannot be overstated. It improves accuracy while protecting and streamlining our company’s financial health and operational effectiveness. This policy lays down standardized methods for processing invoices - right from receipt to payment, making sure verification, approval, and recording processes are efficient and reliable.

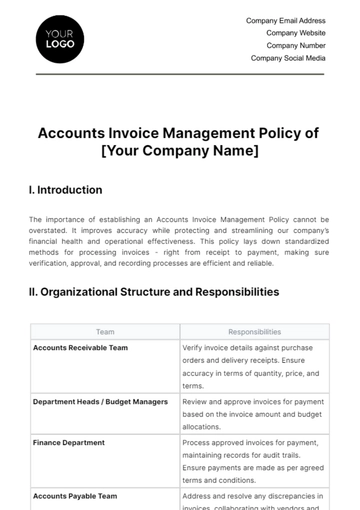

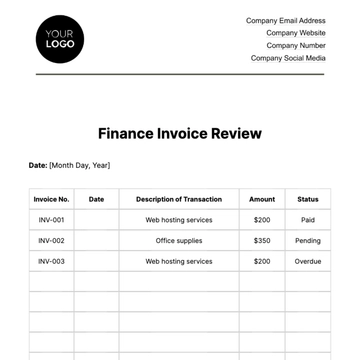

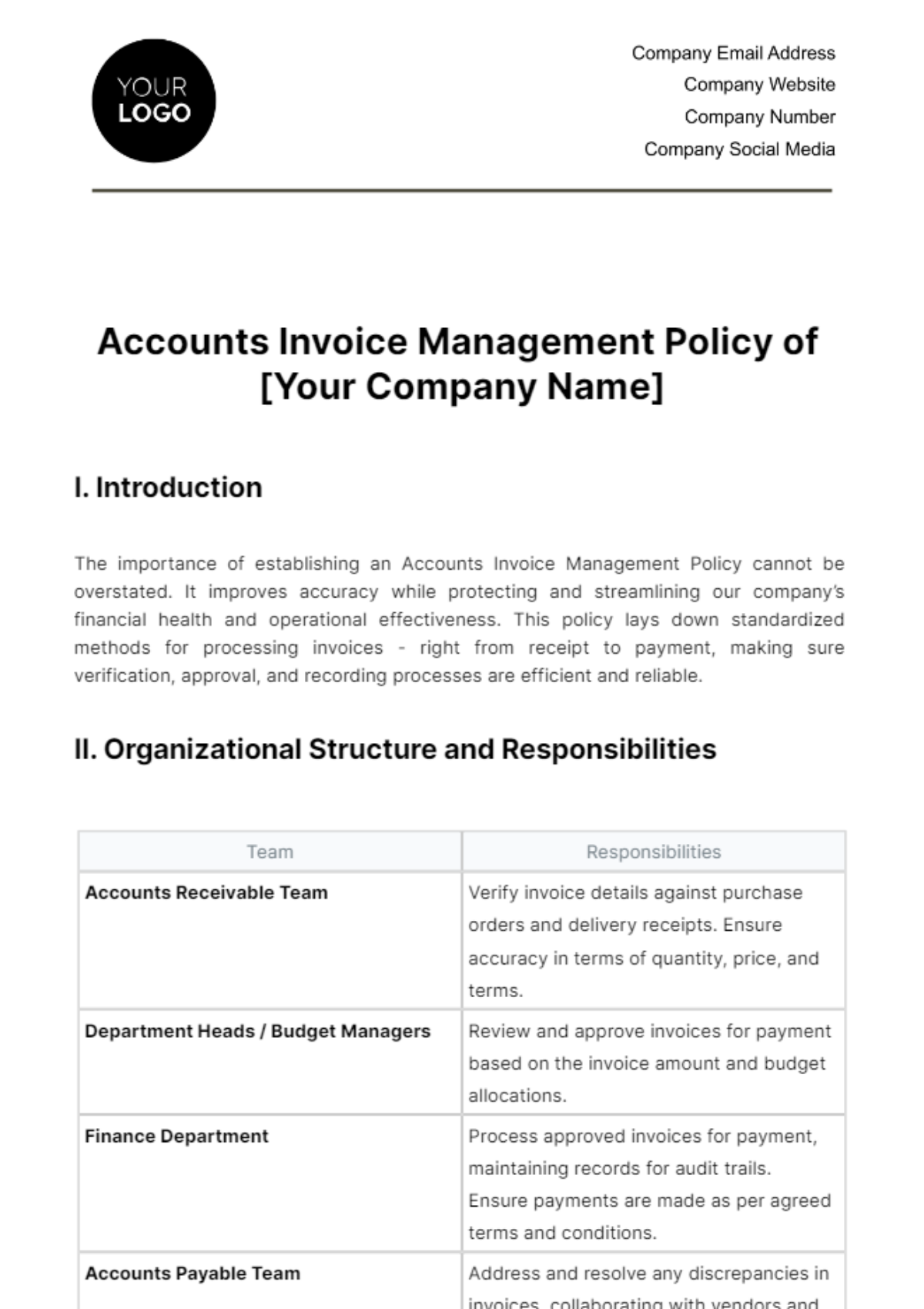

II. Organizational Structure and Responsibilities

Team | Responsibilities |

|---|---|

Accounts Receivable Team | Verify invoice details against purchase orders and delivery receipts. Ensure accuracy in terms of quantity, price, and terms. |

Department Heads / Budget Managers | Review and approve invoices for payment based on the invoice amount and budget allocations. |

Finance Department | Process approved invoices for payment, maintaining records for audit trails. Ensure payments are made as per agreed terms and conditions. |

Accounts Payable Team | Address and resolve any discrepancies in invoices, collaborating with vendors and internal departments. |

Finance Department | Maintain accurate and comprehensive records of all invoices and payments for auditing and reporting purposes. |

III. Decision-Making Process

Verify the authenticity of the invoices.

Check for discrepancies and resolve them.

Approve invoices for payment based on set criteria.

Ensure payments are made within stipulated timelines.

Maintain a record of every transaction and communication.

IV. Ethical Standards and Conduct

Maintain transparency in all dealings.

Comply with all financial and organizational regulations.

Adopt fair and respectful treatment of all vendors.

Strive for continuous improvement in accounting practices.

V. Communication and Information Management

Maintain a clear line of communication among all involved teams and departments.

Ensure the electronic storage and retrieval of all invoices and related documentation is safe and secure.

Regularly update and back up financial data.

VI. Risk Management

Identify possible financial risks and develop mitigating measures.

Create contingency plans for unforeseen circumstances impacting invoice management.

Regularly train all staff on risk management strategies.

VII. Resource Allocation and Budgeting

Resource | Allocation |

|---|---|

Financial Resources | $ [Amount] |

VIII. Conflict Resolution

Identify the source of the conflict.

Collaborate with all parties involved to understand different perspectives.

Develop a resolution plan, incorporating the viewpoints of all relevant parties.

Implement the resolution plan.

Monitor the situation to ensure the conflict does not reoccur.

In conclusion, our Accounts Invoice Management Policy aims to organize, regulate, and standardize the process for handling invoices. It strives to maintain the financial health of our company and ensure we continue to operate effectively. By adhering to this policy, we can ensure accurate record-keeping, timely payments, effective cash flow management, and overall operational success.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

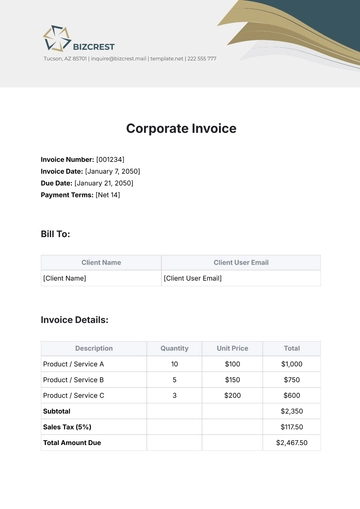

Optimize your invoicing protocol with Template.net's Accounts Invoice Management Policy. This editable, customizable template designed exclusively for precision and efficiency. Easy to tailor using our Ai Editor Tool, gain control of your accounts management effectively. Elevate your business today with our industry-standard template, making invoicing hassle-free, professional, and efficient.

You may also like

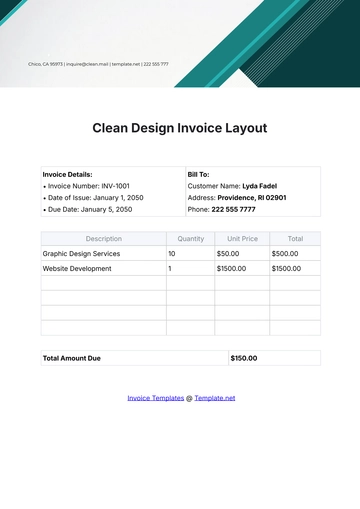

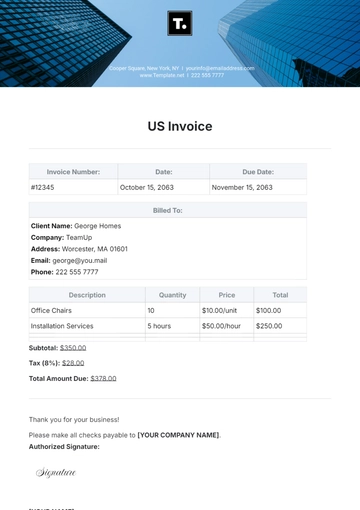

- Invoice Outline

- Creative Invoice

- Modern Invoice

- Printable Invoice

- Business Invoice

- Travel Invoice

- Rent Invoice

- Commercial Invoice

- Professional Invoice

- Restaurant Invoice

- Small Business Invoice

- Travel Agency Invoice

- Car Invoice

- Repair Invoice

- School Invoice

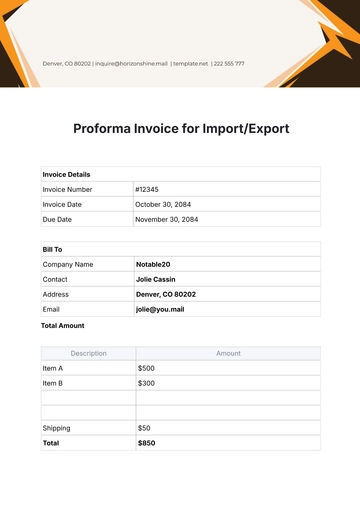

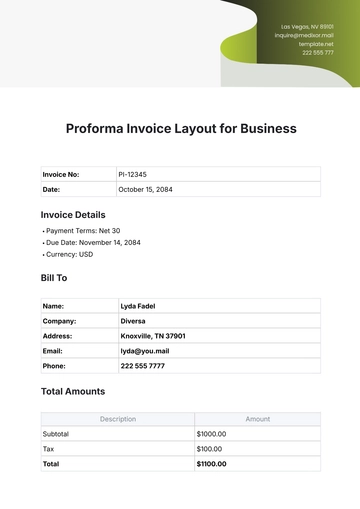

- Proforma Invoice

- Hotel Invoice

- Company Invoice

- Medical Invoice

- University Invoice

- Self Employed Invoice

- Accounting Invoice

- Real Estate Invoice

- Vehicle Invoice

- Consultant Invoice

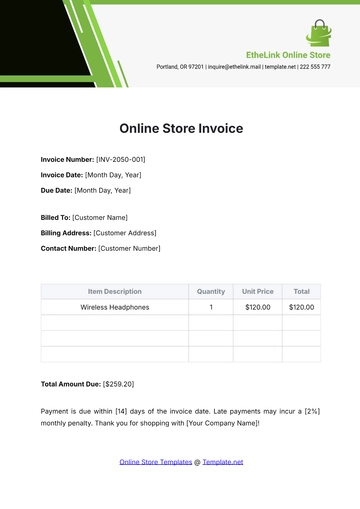

- Sales Invoice

- Startup Invoice

- Cleaning Invoice

- Agency Invoice

- Legal Invoice

- Construction Invoice

- Tax Invoice

- Bakery Invoice

- Services Invoice

- Freelancer Invoice

- Rental Invoice

- IT and Software Invoice

- Cash Invoice

- Notary Invoice

- Catering Invoice

- Auto Repair Invoice

- Automotive Invoice

- Work form Home Invoice

- Photography Invoice