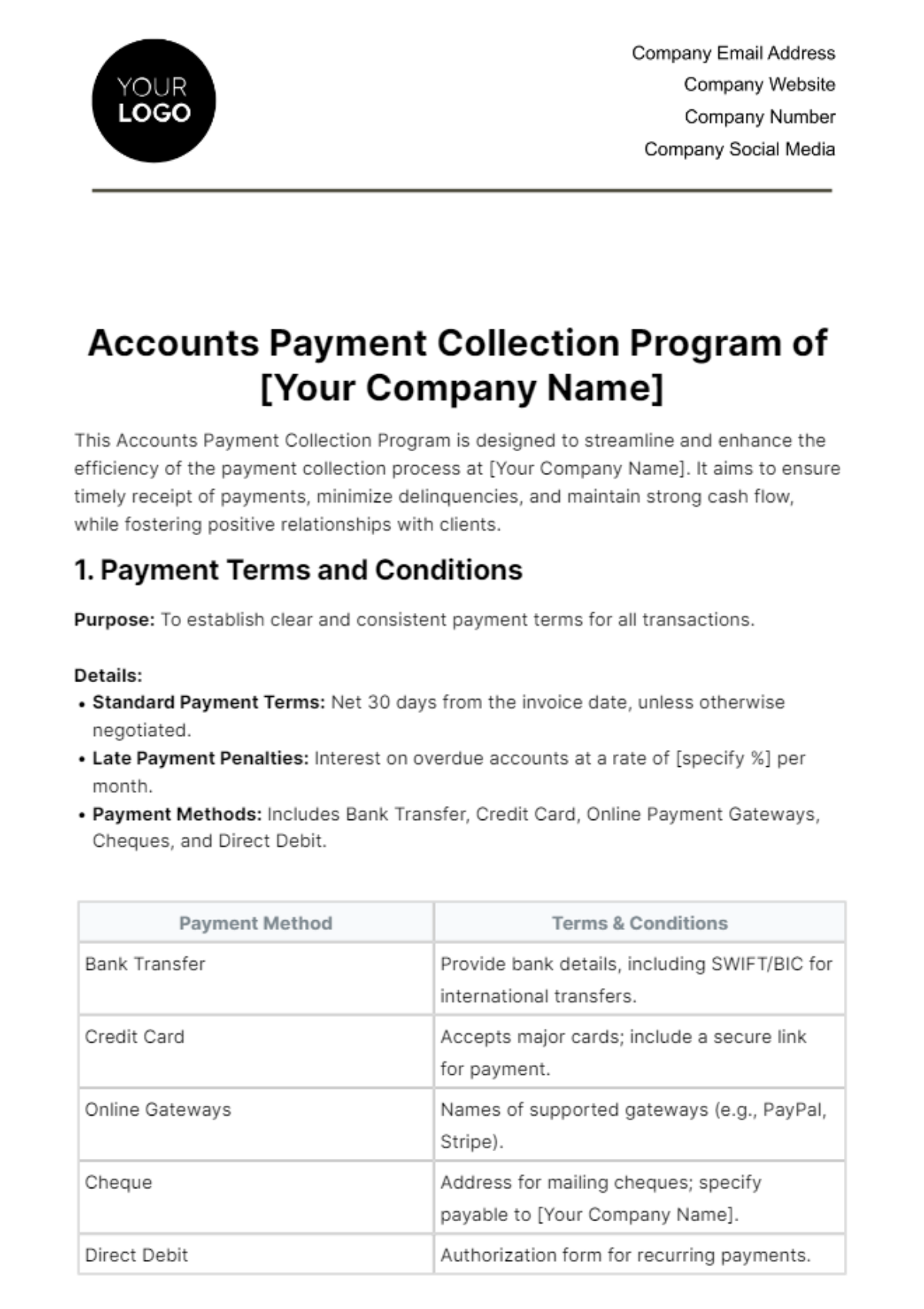

Free Accounts Payment Collection Program

This Accounts Payment Collection Program is designed to streamline and enhance the efficiency of the payment collection process at [Your Company Name]. It aims to ensure timely receipt of payments, minimize delinquencies, and maintain strong cash flow, while fostering positive relationships with clients.

1. Payment Terms and Conditions

Purpose: To establish clear and consistent payment terms for all transactions.

Details:

Standard Payment Terms: Net 30 days from the invoice date, unless otherwise negotiated.

Late Payment Penalties: Interest on overdue accounts at a rate of [specify %] per month.

Payment Methods: Includes Bank Transfer, Credit Card, Online Payment Gateways, Cheques, and Direct Debit.

Payment Method | Terms & Conditions |

|---|---|

Bank Transfer | Provide bank details, including SWIFT/BIC for international transfers. |

Credit Card | Accepts major cards; include a secure link for payment. |

Online Gateways | Names of supported gateways (e.g., PayPal, Stripe). |

Cheque | Address for mailing cheques; specify payable to [Your Company Name]. |

Direct Debit | Authorization form for recurring payments. |

2. Invoice Issuance and Distribution

Purpose: To outline the process for issuing and distributing invoices to clients.

Details:

Frequency: Invoices are issued upon completion of service or delivery of product.

Format: Digital invoices via email or client portal; paper invoices upon request.

Invoice Details: Each invoice will clearly state service/product descriptions, amounts, due date, and payment instructions.

3. Payment Monitoring and Follow-Up

Purpose: To establish a system for monitoring payments and following up on overdue accounts.

Details:

Payment Tracking System: Utilize accounting software to track payment statuses.

Reminder Schedule: Automated reminders sent 7 days, 3 days before, and on the due date. Follow-up reminders for overdue payments at 7, 14, and 30 days.

Escalation Process: Accounts overdue by 60 days will be escalated for further action.

4. Dispute Resolution and Client Communication

Purpose: To provide a mechanism for addressing payment disputes and maintaining open lines of communication.

Details:

Contact Information: Dedicated email and phone line for payment-related queries.

Dispute Resolution Process: Investigate and resolve disputes within [specify number] business days.

Client Service: Commitment to courteous and professional communication at all times.

5. Reporting and Analysis

Purpose: To conduct regular reporting and analysis for continuous improvement of the payment collection process.

Details:

Monthly Reporting: Generate reports on accounts receivable aging, payment trends, and delinquency rates.

Performance Analysis: Quarterly review of the collection process effectiveness and identification of areas for improvement.

Stakeholder Feedback: Annual survey to gather feedback from clients on the payment process.

Program Dates

Program inception: [Month Day, Year]

Payment Collection Software Training: [Month Day, Year] - [Month Day, Year]

Policy Overview and Communication Strategies: [Month Day, Year] - [Month Day, Year]

First Review: [Month Day, Year]

Conclusion

This Accounts Payment Collection Program is a comprehensive approach to managing [Your Company Name]'s receivables. It is designed to balance efficiency in collection with maintaining positive client relationships, crucial for the sustained success and financial stability of the company.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Transform your account payment collections with the Accounts Payment Collection Program from Template.net. A customizable, editable platform, designed to streamline your process. Make it uniquely yours with our Ai Editor Tool. Experience a heightened level of efficiency and accuracy like never before. Enhance your business operations today.