Free Accounts Credit Control Memo

Date: January 25, 2084

To: All Department Heads

From: Accounts Manager

Subject: Update on Credit Control Procedures and Policies

Dear Team,

We are committed to maintaining the financial health and stability of our organization. An essential part of this commitment is effective credit control. This memo outlines the updated procedures and policies that we are implementing to ensure efficient management of our receivables and credit exposure.

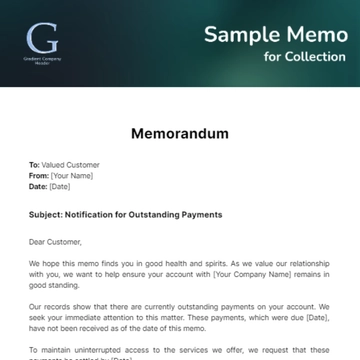

Credit Assessment: All new clients must undergo a thorough credit assessment before we extend any credit terms. This includes a review of their credit history, financial stability, and payment track record.

Credit Limits: We have revised the credit limits for different client categories. The updated limits are as follows:

Category A (High Trust): $10,000

Category B (Medium Trust): $5,000

Category C (New Clients): $2,000

Payment Terms: Standard payment terms are 30 days from the invoice date. For clients with a history of late payments, we will enforce stricter terms, including possible advance payment requirements.

Late Payment Policy: Late payments will incur a penalty of 2% per month. We will also initiate follow-up procedures after 15 days of overdue payment, which includes reminder emails and phone calls.

Account Holds: Accounts that exceed 60 days overdue will be put on hold, and no further services or goods will be supplied until the account is settled.

Debt Recovery: Unresolved debts over 90 days will be transferred to our debt collection agency for recovery.

Internal Communication: Please ensure that your teams are aware of these changes. Effective communication between departments is crucial for implementing these credit control measures.

Client Communication: Our accounts team will communicate these updates to all existing clients. New clients will receive this information as part of their onboarding process.

Your cooperation and adherence to these updated procedures are vital in minimizing credit risk and improving our cash flow. If you have any questions or need further clarification, please reach out to the Accounts Department.

Let's work together to ensure the financial sustainability of our organization.

Best Regards,

[Your Name]

Accounts Manager

CC: CEO, CFO

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Unveil the Accounts Credit Control Memo Template at Template.net, a pivotal asset for managing credit effectively. This template is superbly editable and customizable, crafted to adapt seamlessly to your credit control requirements. Fine-tune it with precision using our AI Editor tool. Ideal for maintaining robust credit management, this template is a must-have for finance professionals. Trust Template.net for top-tier financial management tools.