Free Accounts Invoice Management Guide

Introduction

Welcome to our comprehensive Accounts Invoice Management Guide. This guide is designed to be a valuable resource for all staff involved in the handling, processing, and management of invoices within our organization. Effective invoice management is crucial to the financial health and operational efficiency of our company, ensuring that we maintain positive cash flow and strong supplier relationships.

Purpose of the Guide

The primary purpose of this guide is to provide clear, detailed instructions and best practices for managing invoices. It serves as a standard reference for all procedures related to invoice processing, from the receipt of an invoice to its final payment. By adhering to the guidelines outlined here, we aim to achieve greater accuracy, efficiency, and compliance in our invoice management processes.

Importance of Efficient Invoice Management

Efficient invoice management is essential for maintaining our organization's financial stability and reputation. Timely and accurate processing of invoices impacts several key areas:

Cash Flow Management: Ensures that we have a clear understanding of our financial obligations and can plan our expenditures accordingly.

Supplier Relationships: Prompt payment and effective communication with suppliers strengthen our professional relationships and can lead to better terms and discounts.

Compliance and Reporting: Adherence to legal and financial standards in invoice processing is critical to avoid penalties and to ensure accurate financial reporting.

Scope of the Guide

This guide covers a comprehensive range of topics related to invoice management:

Detailed procedures for receiving, verifying, and processing invoices.

Guidelines for the approval and payment of invoices.

Best practices for record-keeping, data entry, and use of invoice management software.

Strategies for effective communication with suppliers and handling disputes.

Compliance requirements and preparations for audits.

By following the guidelines and procedures outlined in this document, our team will be equipped to handle invoices efficiently and effectively, contributing to the overall success and financial health of our organization.

I. Understanding Invoices

Invoices are fundamental documents in business transactions, serving as a formal request for payment and a critical component of effective financial management. Understanding the nature, types, and legalities of invoices is essential for everyone involved in invoice processing.

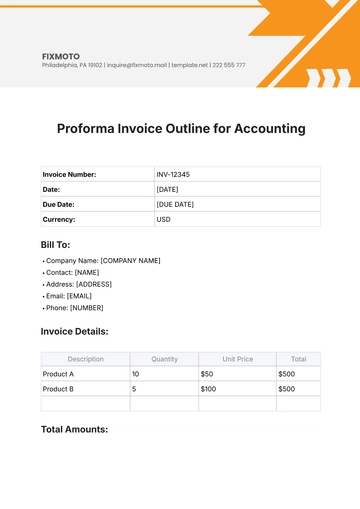

A. Definition and Types of Invoices

An invoice is a document issued by a seller to a buyer, outlining the goods or services provided, and requesting payment. There are several types of invoices, each serving different purposes:

Standard Invoice: A general invoice typically used in various business transactions.

Commercial Invoice: Used for foreign trade, detailing the value of goods for customs.

Proforma Invoice: An estimated invoice sent before goods or services are delivered.

Credit Invoice: Issued when a refund or credit is provided to the buyer.

Debit Invoice: Indicates an increase in the amount due, often due to a price adjustment.

Timesheet Invoice: Used for billing hours worked, commonly in services and consultancy.

Recurring Invoice: Sent on a regular basis for ongoing services (e.g., subscriptions).

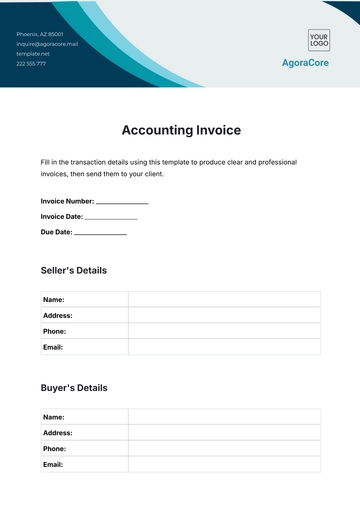

B. Key Components of an Invoice

An effective invoice should include several key components to ensure clarity and legal compliance:

Invoice Number: A unique identifier for the invoice.

Date of Issue: The date when the invoice is generated.

Seller’s Details: Name, address, and contact information of the seller.

Buyer’s Details: Name, address, and contact information of the buyer.

Description of Goods/Services: Detailed list of products or services provided.

Quantities and Unit Prices: The amount of each item and the price per unit.

Total Amount Due: The total price payable, including taxes and discounts.

Payment Terms: Instructions for payment, such as due date and payment methods.

Tax Information: Relevant tax details, if applicable.

C. Legal Requirements and Standards for Invoices

Invoices must comply with certain legal requirements and standards to be valid:

Legality: Must be a legal document in accordance with local business laws.

Tax Compliance: Must include necessary tax information as per the local tax regulations.

Accuracy: Should accurately represent the transaction and adhere to agreed terms.

Record Keeping: Must be retained for a specific period as required by law for auditing and tax purposes.

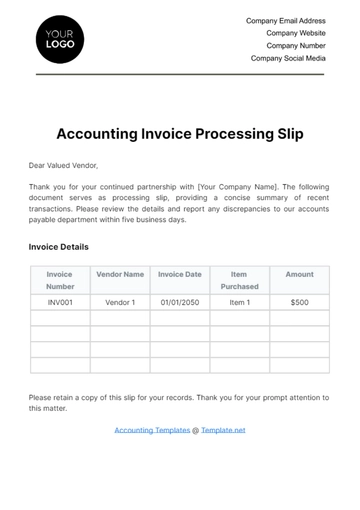

II. Invoice Processing Workflow

The invoice processing workflow is a systematic approach to handling invoices from the moment they are received until payment is processed. This workflow is crucial for maintaining financial accuracy, ensuring timely payments, and upholding strong vendor relationships. It involves several stages, each requiring specific actions and checks to ensure that all invoices are handled consistently and efficiently.

A. Steps from Receiving an Invoice to Payment Processing

Invoice Receipt: Receiving the invoice via mail or electronically.

Invoice Verification: Checking the invoice details against purchase orders and delivery receipts for accuracy.

Data Entry: Recording the invoice details in our financial system.

Invoice Approval: Reviewing and approving the invoice for payment, based on delegated authority levels.

Payment Scheduling: Setting up the payment in line with our cash flow and the invoice terms.

Payment Execution: Making the payment to the vendor through the chosen method (e.g., bank transfer, check).

Record Updating: Updating our financial records to reflect the payment.

Archiving: Filing the invoice and associated documents for future reference and audits.

B. Roles and Responsibilities in the Invoice Processing Team

Role | Responsibilities |

Accounts Payable Clerk | Receives and verifies invoices. Prepares invoices for approval. |

Accounts Payable Manager | Oversees the entire invoice process. Approves invoices within their authority level. Manages the payment schedule. |

Financial Controller | Reviews and approves high-value invoices. Ensures compliance with financial policies. Oversees cash flow management related to payables. |

Auditor/Internal Reviewer | Periodically audits the invoice process. Ensures adherence to internal controls and compliance. Identifies areas for process improvement. |

IT Support Specialist | Maintains and troubleshoots financial software. Ensures the security and integrity of invoice data. Assists in implementing technology solutions for efficiency. |

III. Receiving and Verifying Invoices

The initial stages in our invoice management process involve the receipt and verification of invoices. This phase is critical as it sets the foundation for accurate and efficient invoice processing, ensuring that all payments are justified, correct, and made in a timely manner.

A. Procedures for Receiving Invoices

Centralized Reception: All invoices are received through a central point, either via a dedicated email address or physical mail, to ensure no invoice is overlooked.

Immediate Acknowledgment: On receipt, immediately acknowledge the invoice to the sender, confirming its receipt.

Preliminary Check: Conduct a preliminary check for basic details such as vendor name, date, and invoice number.

Document Scanning and Filing: Scan paper invoices and file them electronically for easy access and processing.

Data Entry: Enter the invoice details into our accounting system for tracking and processing.

B. Handling Discrepancies and Errors

Error Identification: Quickly identify any discrepancies or errors in the invoice compared to purchase orders or delivery notes.

Vendor Communication: Promptly contact the vendor to clarify or rectify any discrepancies or errors.

Documentation: Document all communications and corrections for audit trails and future reference.

Approval Hold: Place the invoice on hold for approval until all discrepancies are resolved.

Update Records: Once resolved, update the records and proceed with the approval process.

IV. Invoice Approval Process

The approval process is a critical step in ensuring that all invoices are valid, accurate, and align with our budgetary constraints. It involves several checks and balances to prevent errors and fraud.

A. Steps in the Approval Process

Review by Accounts Payable: Initial review of the invoice for completeness and compliance with company policies.

Departmental Verification: Verification by the relevant department to confirm receipt of goods or services.

Budget Check: Ensuring the expense aligns with the department's budget.

Final Approval: Final review and approval by authorized personnel, usually in the finance department.

B. Delegation of Authority and Approval Limits

Role | Approval Limit | Scope of Authority |

Accounts Payable Clerk | Up to $1,000 | Approve routine, low-value invoices. |

Department Manager | Up to $10,000 | Approve department-specific invoices. |

Accounts Payable Manager | Up to $50,000 | Approve all invoices within limit, oversee invoice processing. |

Financial Controller | Above $50,000 | Approve high-value invoices, oversee budget compliance. |

V. Data Entry and Record Keeping

Accurate data entry and meticulous record keeping are pivotal in the invoice management process. These practices ensure that all financial transactions are recorded correctly, facilitating effective tracking, reporting, and compliance with legal and regulatory requirements.

A. Best Practices for Data Entry

Consistency in Data Entry: Standardize the format and fields for entering invoice data into our system to maintain consistency and accuracy.

Double-Check Mechanism: Implement a procedure where a second person reviews the data entry for errors or discrepancies.

Regular Data Backup: Ensure regular backups of the invoice data to prevent loss due to system failures or other unforeseen events.

B. Retention Periods for Different Types of Documents

Document Type | Retention Period |

Invoices | 7 years |

Purchase Orders | 7 years |

Delivery Notes/Receipts | 7 years |

Payment Records | 7 years |

Tax-Related Documents | 10 years |

Legal Correspondence | Indefinite |

VI. Invoice Payment Procedures

Effective invoice payment procedures are essential for maintaining good vendor relationships and proper financial management. These procedures are designed to ensure timely and accurate payments in accordance with our contractual obligations.

A. Payment Terms and Conditions

Typically, payments are processed within 30 days of the invoice date. Late payments may incur interest or penalties as per the terms agreed upon with the vendor. In case of disputes, payments may be withheld until the issue is resolved.

B. Methods of Payment

Payment Method | Description |

Bank Transfer | Direct transfer of funds from our bank account to the vendor's account. |

Check | Issuing a business check payable to the vendor. |

Online Payment Systems | Utilizing online payment platforms for faster processing. |

Credit Card | Payment through company credit cards for smaller expenses. |

C. Policies on Early Payment Discounts and Late Payment Penalties

We encourage taking advantage of early payment discounts offered by vendors to optimize costs. Late payments can result in penalties or interest charges as specified in the vendor’s terms. Avoiding such penalties is a priority, and we strive to adhere strictly to payment deadlines.

VII. Dealing with Suppliers

Effective communication and relationship management with suppliers are crucial aspects of the invoice management process. Proper handling of supplier interactions not only fosters strong business relationships but also ensures smooth transactional processes and timely resolution of any issues that may arise.

Communication Guidelines

Prompt and Clear Communication: Respond to supplier inquiries and communications in a timely and clear manner to maintain good relationships and trust.

Dispute Resolution Process: Have a clear and fair process for handling disputes, ensuring that any disagreements are resolved quickly and amicably.

Regular Updates: Keep suppliers informed about the status of their invoices and payments, especially if there are any delays or issues.

Feedback Channels: Establish channels through which suppliers can provide feedback or suggestions on the invoicing process.

Maintaining Professionalism: Always maintain a professional and courteous demeanor in all interactions with suppliers.

VIII. Monitoring and Reporting

Regular monitoring and reporting are vital for assessing the effectiveness of the invoice management process. Key Performance Indicators (KPIs) help in measuring performance against set targets, enabling us to identify areas for improvement and take corrective actions.

Key Performance Indicators (KPIs)

KPI | Target Metric |

Invoice Processing Time | Reduce average processing time to under 5 days |

Error Rate in Invoicing | Maintain an error rate of less than 2% |

On-Time Payment Rate | Achieve a 95% on-time payment rate |

Supplier Satisfaction Level | Maintain a supplier satisfaction score of 85% or higher |

Cost Savings from Early Payments | Achieve cost savings of 3% from early payment discounts |

Dispute Resolution Time | Resolve any disputes within 10 business days |

IX. Auditing and Compliance

Maintaining a robust auditing and compliance framework is essential to ensure the integrity and efficiency of our invoice management process. Regular audits help in identifying discrepancies, improving processes, and ensuring adherence to legal and regulatory standards.

Audit Process

Internal Audits: Conduct periodic internal audits to review and verify the accuracy and completeness of invoice records.

External Audits: Engage external auditors annually to assess our compliance with financial regulations and reporting standards.

Compliance Checks: Regularly review procedures to ensure they align with current laws and industry best practices.

Process Evaluation: Evaluate the effectiveness of the invoice management process during audits, identifying areas for improvement.

Reporting Findings: Document and report audit findings to management, along with recommendations for corrective actions.

X. Training and Development

Continuous training and development are crucial for ensuring that our team is equipped with the necessary skills and knowledge to effectively manage invoices. Regular training programs keep our staff updated on best practices, new technologies, and regulatory changes.

Training Programs

Program | Duration | Audience |

Basic Invoice Processing | 2 Days | New Accounts Payable Staff |

Advanced Invoice Management | 1 Week | Experienced Accounts Payable Staff |

Compliance and Legal Standards | 3 Days | All Staff involved in Invoice Processing |

Software and Technology Training | 1 Week | IT Support and Accounts Payable Staff |

Soft Skills Development (Communication, Negotiation) | 2 Days | Customer Service and Accounts Payable Staff |

XI. Continuous Improvement

Our approach to invoice management is not static; it's a continuous journey towards improvement. We regularly review our processes and systems to identify inefficiencies, bottlenecks, and areas for technological upgrades. Feedback from staff, suppliers, and auditors plays a crucial role in this process. Implementing changes based on this feedback and the latest industry trends ensures that our invoice management system remains efficient, compliant, and aligned with our organizational goals. This commitment to continuous improvement is fundamental to maintaining our competitiveness and operational excellence.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Accounts Invoice Management Guide Template from Template.net, your solution for mastering invoice processes. This template is impressively editable and customizable, allowing you to create a guide that fits your specific invoicing requirements. Modify it with precision using our AI Editor tool. Ideal for streamlined and effective invoice management. Choose Template.net for unparalleled financial organization tools.

You may also like

- Invoice Outline

- Creative Invoice

- Modern Invoice

- Printable Invoice

- Business Invoice

- Travel Invoice

- Rent Invoice

- Commercial Invoice

- Professional Invoice

- Restaurant Invoice

- Small Business Invoice

- Travel Agency Invoice

- Car Invoice

- Repair Invoice

- School Invoice

- Proforma Invoice

- Hotel Invoice

- Company Invoice

- Medical Invoice

- University Invoice

- Self Employed Invoice

- Accounting Invoice

- Real Estate Invoice

- Vehicle Invoice

- Consultant Invoice

- Sales Invoice

- Startup Invoice

- Cleaning Invoice

- Agency Invoice

- Legal Invoice

- Construction Invoice

- Tax Invoice

- Bakery Invoice

- Services Invoice

- Freelancer Invoice

- Rental Invoice

- IT and Software Invoice

- Cash Invoice

- Notary Invoice

- Catering Invoice

- Auto Repair Invoice

- Automotive Invoice

- Work form Home Invoice

- Photography Invoice