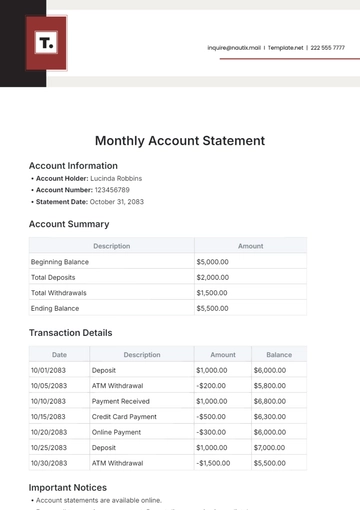

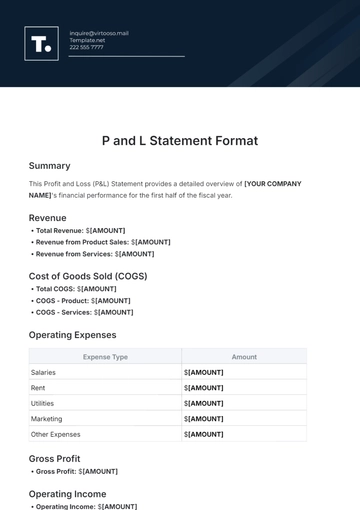

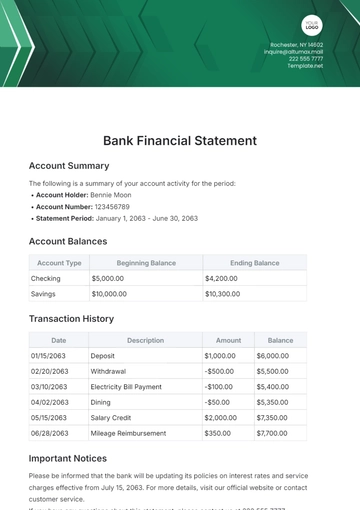

Free Payroll Accounting Statement

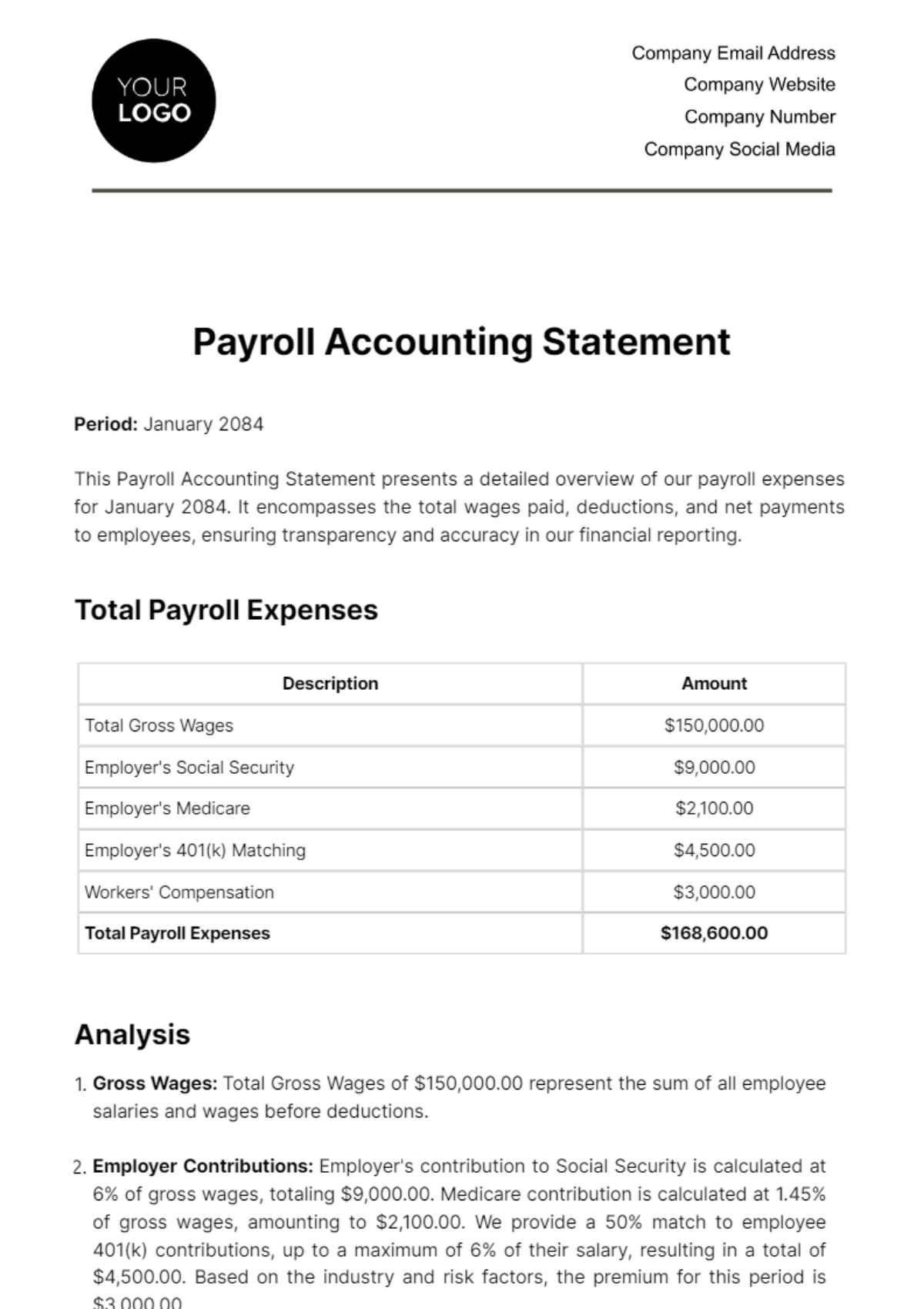

Period: January 2084

This Payroll Accounting Statement presents a detailed overview of our payroll expenses for January 2084. It encompasses the total wages paid, deductions, and net payments to employees, ensuring transparency and accuracy in our financial reporting.

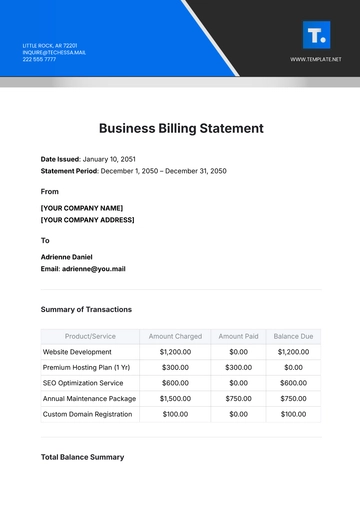

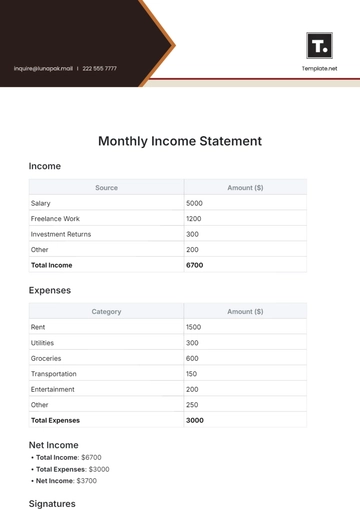

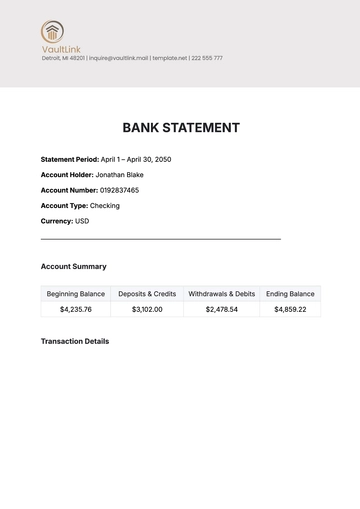

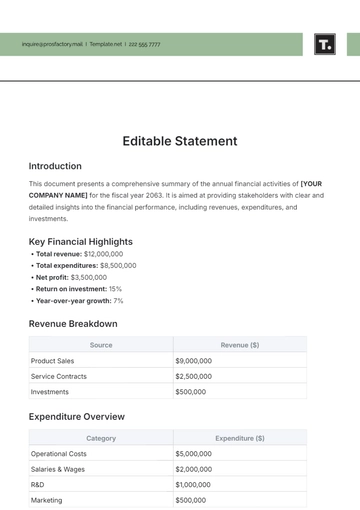

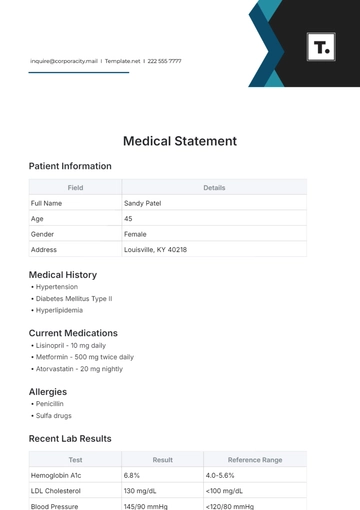

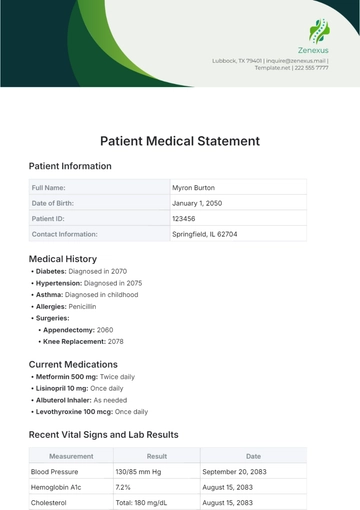

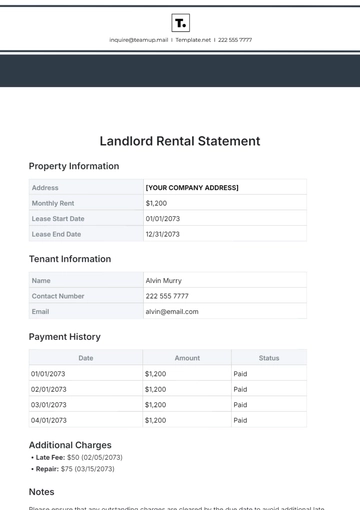

Total Payroll Expenses

Description | Amount |

Total Gross Wages | $150,000.00 |

Employer's Social Security | $9,000.00 |

Employer's Medicare | $2,100.00 |

Employer's 401(k) Matching | $4,500.00 |

Workers' Compensation | $3,000.00 |

Total Payroll Expenses | $168,600.00 |

Analysis

Gross Wages: Total Gross Wages of $150,000.00 represent the sum of all employee salaries and wages before deductions.

Employer Contributions: Employer's contribution to Social Security is calculated at 6% of gross wages, totaling $9,000.00. Medicare contribution is calculated at 1.45% of gross wages, amounting to $2,100.00. We provide a 50% match to employee 401(k) contributions, up to a maximum of 6% of their salary, resulting in a total of $4,500.00. Based on the industry and risk factors, the premium for this period is $3,000.00.

Net Payroll Expense: After accounting for all expenses, the net payroll expense for the period is $168,600.00. This figure represents a significant part of our operational costs and is essential for budgeting and financial planning.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the Payroll Accounting Statement Template from Template.net, a game-changer in payroll management. This template is both editable and customizable, tailored to meet the unique requirements of your business. Enhanced for use with our AI Editor tool, it simplifies complex payroll calculations, ensuring accuracy and compliance. Opt for Template.net for effortless and precise payroll accounting documentation.