Free Annual Accounts Strategy Plan

I. Executive Summary

A. Brief Overview

Welcome to our Annual Accounts Strategy Plan for FY 2051. In the face of a dynamic market, this document outlines our commitment to strategic growth, financial stability, and operational excellence. Our focus remains on leveraging innovation, embracing sustainability, and delivering value to our stakeholders.

B. Key Highlights from the Previous Fiscal Year

In FY 2050, our financial performance exceeded expectations. We achieved a revenue of $3.2 billion, with a net profit of $500 million and a notable operating margin of 15%. Key accomplishments included the successful launch of two product lines contributing to 20% of our revenue and a 10% increase in international sales. Cost optimization initiatives resulted in a 5% improvement in operating margin.

Metric | Amount (USD) |

|---|---|

Revenue | $3.2 billion |

Net Profit | $500 million |

Operating Margin | 15% |

Cash Flow | $700 million |

C. Summary of Strategic Goals for the Upcoming Year

For FY 2051, our strategic objectives are ambitious yet attainable. We aim for a 15% revenue growth, driven by product innovation and market expansion. Operational efficiency is a key focus, with a targeted 20% reduction in operating costs. We also prioritize customer engagement through digital initiatives and plan to increase investment in sustainability practices to align with ESG goals.

D. Financial Performance Highlights

Our financial targets for FY 2051 are set with the aim of sustaining growth and ensuring financial stability. We target a revenue of $3.7 billion, a net profit of $600 million, and an operating margin of 17%. Additionally, a capital expenditure budget of $300 million is allocated to support key initiatives.

II. Organizational Overview

A. Mission and Vision Statement

Our mission is to deliver innovative solutions that empower our customers and create sustainable value for our stakeholders. As we strive to be a global leader, our vision encompasses driving positive change through excellence in products and services.

B. Business Overview

Operating in the technology sector, we specialize in software solutions catering to diverse industries such as healthcare, finance, and manufacturing. Our commitment to innovation positions us as a market leader.

C. Industry Analysis and Trends

The technology sector is experiencing a shift towards cloud-based solutions, prompting us to invest in cybersecurity. The emphasis on sustainable and socially responsible business practices aligns with our commitment to corporate responsibility. Digital transformation remains at the forefront, influencing our market competitiveness.

D. Competitive Landscape

Our competitive landscape includes major players in the technology sector. With a focus on innovation and customer-centric solutions, we remain agile and responsive to market dynamics.

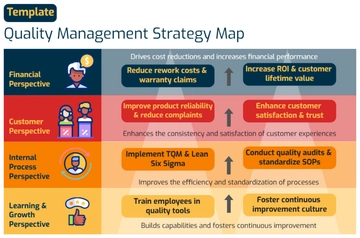

III. Strategic Objectives

A. High-Level Strategic Goals for the Year

Our high-level strategic goals for FY 2051 encompass achieving a 15% revenue growth through product innovation and market expansion. Simultaneously, we aim for a 20% reduction in operating costs to improve operational efficiency. Customer engagement and sustainability initiatives are integral components of our strategic roadmap.

B. Alignment with Long-Term Strategic Vision

The strategic goals set for FY 2051 align seamlessly with our long-term vision of becoming a market leader known for innovation, customer satisfaction, and sustainable business practices. This alignment ensures our actions today contribute to our future success.

C. Key Performance Indicators (KPIs) for Strategic Objectives

To measure our progress, we have established key performance indicators (KPIs). These include a targeted 15% revenue growth rate, a 20% reduction in operating costs, a customer satisfaction index of 90%, and an ESG performance score of 80.

KPI | Target |

|---|---|

Revenue Growth Rate | 15% |

Operating Cost Reduction Rate | 20% |

Customer Satisfaction Index | 90% |

ESG Performance Score | 80 |

D. Risks and Mitigation Strategies

Identifying potential risks is a crucial aspect of strategic planning. Economic downturn, cybersecurity threats, and supply chain disruptions are recognized risks. Mitigation strategies include diversification, cybersecurity strengthening, and establishing alternative supply chain sources.

IV. Financial Overview

A. Financial Statements from the Previous Fiscal Year

In FY 2050, our income statement reflected a revenue of $3.2 billion and a net profit of $500 million. The balance sheet showcased strong financial health, with $800 million in cash and equivalents. The cash flow statement demonstrated robust operating cash flow of $700 million.

Income Statement (FY 2050):

Metric | Amount (USD) |

|---|---|

Revenue | $3.2 billion |

Cost of Goods Sold | $1.8 billion |

Gross Profit | $1.4 billion |

Operating Expenses | $900 million |

Net Profit | $500 million |

B. Financial Performance Analysis

Comparing FY 2050 to FY 2049, we achieved a 10% increase in revenue and improved our operating margin by 2 percentage points. This analysis underscores our commitment to sustained financial growth and operational efficiency.

C. Budget Overview for the Upcoming Year

For FY 2051, our budget allocates $150 million to marketing, $200 million to research and development, $500 million to operations, $300 million to capital expenditure, and a $50 million contingency fund. This structured budget supports our strategic initiatives and ensures efficient resource allocation.

Category | Amount (USD) |

|---|---|

Marketing | $150 million |

Research & Development | $200 million |

Operations | $500 million |

Capital Expenditure | $300 million |

Contingency | $50 million |

V. Resource Allocation

A. Budget Allocation to Business Units/Departments

Our resource allocation plan designates 15% to marketing, 20% to research and development, 50% to operations, and 15% to capital expenditure. This ensures a balanced approach to support key business functions and strategic initiatives.

B. Capital Allocation for Key Projects

Critical projects for FY 2051 include allocating $150 million for new product development, $100 million for market expansion initiatives, and $50 million for IT infrastructure upgrades. These investments are strategic and align with our growth objectives.

C. Resource Efficiency Measures

To enhance resource efficiency, we are implementing digital automation across operational processes. Additionally, a comprehensive review of supply chain efficiency is underway to optimize resources and minimize costs.

VI. Investment and Funding Strategy

A. Funding Requirements for Strategic Initiatives

Strategic initiatives for FY 2051 require funding allocations as follows: $150 million for new product development, $100 million for market expansion initiatives, and $50 million for sustainability initiatives. These funding requirements are vital for achieving our set objectives.

B. Debt and Equity Considerations

Considering a mix of debt and equity financing, we aim for a debt-to-equity ratio of 0.5. This balanced approach ensures financial flexibility while optimizing capital structure for strategic initiatives.

C. Investment Decision Criteria

Investment decisions for FY 2051 will be based on expected return on investment (ROI), alignment with strategic goals, and thorough risk assessments. This criteria-driven approach ensures prudent financial decision-making.

D. Funding Sources

Exploring debt financing through bond issues and retaining earnings for internal funding are the identified funding sources for FY 2051. This diversified approach provides financial stability and flexibility.

VII. Risk Management

A. Identification of Financial Risks

Recognizing potential risks is crucial for proactive management. Identified risks for FY 2051 include economic downturn, cybersecurity threats, and supply chain disruptions. A thorough risk assessment provides the foundation for effective risk management strategies.

B. Mitigation Strategies

Mitigating economic risks involves diversifying revenue streams and prioritizing cost-effective product development. Strengthening cybersecurity measures and investing in advanced threat detection systems are key components of our risk mitigation strategy. Additionally, we are establishing alternative suppliers and maintaining strategic inventory reserves to address potential supply chain disruptions.

VIII. Compliance and Reporting

A. Compliance with Accounting Standards

Ensuring compliance with accounting standards is paramount. In FY 2051, we commit to adherence with the latest accounting standards, regularly updating our processes to reflect any changes. Our finance and accounting teams will undergo training to stay informed and compliant.

B. Regulatory Reporting Requirements

Compliance with regulatory reporting requirements is a cornerstone of our financial stewardship. We will maintain a proactive approach, staying abreast of regulatory changes, and collaborating with legal and compliance teams to ensure accurate and timely reporting.

C. Internal Controls and Auditing

Robust internal controls are fundamental to our financial integrity. Our internal audit team will conduct regular assessments, strengthening controls where necessary. External audits will be conducted by an independent audit firm to provide an additional layer of transparency and accountability.

IX. Communication and Stakeholder Engagement

A. Investor Relations Strategy

Open and transparent communication with investors is key. Our investor relations team will actively engage with shareholders, providing regular updates on financial performance, strategic initiatives, and addressing any queries promptly. Quarterly investor calls and annual shareholder meetings will be conducted to foster a sense of collaboration.

B. Communication Plan for Shareholders and Stakeholders

An effective communication plan is in place to keep all stakeholders informed. Regular newsletters, press releases, and updates on our website will provide detailed insights into our financial and strategic progress. Additionally, we will leverage social media platforms for broader reach and engagement.

C. Transparency Initiatives

To enhance transparency, we will publish an annual sustainability report outlining our ESG initiatives, environmental impact, and social responsibility efforts. This report will serve as a comprehensive guide for stakeholders, showcasing our commitment to ethical and sustainable business practices.

X. Human Capital and Talent Strategy

A. Workforce Planning

Strategic workforce planning is critical for achieving our goals. We will assess current skill sets, identify gaps, and invest in training programs to ensure our workforce is well-equipped to support our strategic objectives.

B. Compensation and Benefits Strategy

A competitive compensation and benefits strategy will be implemented to attract and retain top talent. This includes performance-based incentives, healthcare benefits, and professional development opportunities, reinforcing our commitment to employee well-being and satisfaction.

C. Training and Development Initiatives

Investing in employee development is a priority. Training programs focused on emerging technologies, leadership skills, and industry-specific knowledge will be introduced to empower our workforce and foster a culture of continuous learning.

XI. Technology and Innovation

A. Technology Investments and Initiatives

Continued investment in technology is vital for our competitiveness. We will allocate funds for research and development, focusing on emerging technologies such as artificial intelligence and data analytics. Additionally, partnerships with tech innovators will be explored to leverage external expertise.

B. Innovation Strategies

Encouraging a culture of innovation is part of our DNA. Innovation challenges, hackathons, and employee suggestion programs will be actively promoted to harness the creativity of our workforce. Successful innovations will be fast-tracked for implementation.

C. Digital Transformation Plans

Digital transformation is a key pillar of our strategy. Systems and processes will be streamlined and digitized to enhance efficiency. Cloud adoption and cybersecurity measures will be prioritized to ensure a secure and agile digital infrastructure.

XII. Environmental, Social, and Governance (ESG) Considerations

A. ESG Goals and Initiatives

ESG considerations are integral to our corporate responsibility. We have set ambitious ESG goals, including a 20% reduction in carbon emissions, community engagement programs, and diversity and inclusion initiatives. Progress will be regularly assessed and communicated.

B. Sustainability Practices

Implementing sustainable practices is central to our commitment to environmental responsibility. We will prioritize energy-efficient operations, waste reduction initiatives, and responsible sourcing. Our sustainability practices will align with global best practices and industry standards.

C. Social Responsibility Programs

Engaging with our communities is a core aspect of our social responsibility. We will actively participate in community outreach, philanthropy, and volunteer programs, contributing to social welfare and building a positive brand image.

XIII. Performance Measurement and Monitoring

A. Ongoing Monitoring of Key Metrics

Key performance indicators (KPIs) will be monitored regularly to gauge progress. Metrics such as revenue growth, customer satisfaction, and ESG performance will be tracked, and any deviations will trigger timely interventions.

B. Quarterly and Annual Performance Reviews

Quarterly and annual performance reviews will involve a comprehensive analysis of financial and strategic objectives. Performance against KPIs, budgetary adherence, and the achievement of milestones will be thoroughly evaluated to inform decision-making.

C. Adaptation and Continuous Improvement

A commitment to continuous improvement is embedded in our culture. Regular feedback loops, post-implementation reviews, and lessons learned sessions will be conducted to adapt strategies, refine processes, and foster a culture of agility and resilience.

XIV. Conclusion and Next Steps

A. Summary of Key Takeaways

Wrapping up the discussion, I would like to underline that the fiscal year 2051 emerges as a crucial phase in the lifespan of our organization. As per the details mentioned in the Annual Accounts Strategy Plan, it is clear that the roadmap laid out is comprehensive, elucidating step-by-step procedures to achieve numerous objectives. These encompass financial success and strategic growth, which are key for our organization's expansion and profitability. Moreover, the document also highlights the importance attached to implementing suitable business practices that are responsible and sustainable, reflecting our commitment to social responsibilities alongside economic growth.

B. Actionable Steps Moving Forward

For the successful implementation and execution of this plan, it is an outright imperative that a collective effort, coupled with an unwavering commitment, is demonstrated by one and all. It is critical to note that in order to facilitate this, teams from various spheres of the organization are given the adequate empowerment to undertake and execute actionable steps that perfectly align with the roles and responsibilities defined for them respectively. An environment that fosters regular and consistent patterns of communication, along with a spirit of healthy collaboration between individuals and teams, is of paramount importance. Furthermore, always keeping our strategic goals at the forefront, and letting them guide our actions, will truly be a driver for the successful attainment of our objectives.

C. Acknowledgment of Key Contributors

We wish to express our deepest and sincere gratitude to all the teams and individuals who have made substantial contributions to the development of this plan. The dedication, commitment and expertise that you have demonstrated are inarguably invaluable. It is your hard work that drives our success. With this in mind, we are eagerly looking forward to a fruitful year wherein we all will be participating and relishing our shared success.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Elevate your financial planning with the Annual Accounts Strategy Plan Template from Template.net. This editable and customizable template boasts a user-friendly interface and features an AI Editor Tool, ensuring effortless customization. Crafted for precision and ease, it's your key to aligning strategic goals seamlessly. Unlock unparalleled convenience and innovation in your annual planning process today!

You may also like

- Finance Plan

- Construction Plan

- Sales Plan

- Development Plan

- Career Plan

- Budget Plan

- HR Plan

- Education Plan

- Transition Plan

- Work Plan

- Training Plan

- Communication Plan

- Operation Plan

- Health And Safety Plan

- Strategy Plan

- Professional Development Plan

- Advertising Plan

- Risk Management Plan

- Restaurant Plan

- School Plan

- Nursing Home Patient Care Plan

- Nursing Care Plan

- Plan Event

- Startup Plan

- Social Media Plan

- Staffing Plan

- Annual Plan

- Content Plan

- Payment Plan

- Implementation Plan

- Hotel Plan

- Workout Plan

- Accounting Plan

- Campaign Plan

- Essay Plan

- 30 60 90 Day Plan

- Research Plan

- Recruitment Plan

- 90 Day Plan

- Quarterly Plan

- Emergency Plan

- 5 Year Plan

- Gym Plan

- Personal Plan

- IT and Software Plan

- Treatment Plan

- Real Estate Plan

- Law Firm Plan

- Healthcare Plan

- Improvement Plan

- Media Plan

- 5 Year Business Plan

- Learning Plan

- Marketing Campaign Plan

- Travel Agency Plan

- Cleaning Services Plan

- Interior Design Plan

- Performance Plan

- PR Plan

- Birth Plan

- Life Plan

- SEO Plan

- Disaster Recovery Plan

- Continuity Plan

- Launch Plan

- Legal Plan

- Behavior Plan

- Performance Improvement Plan

- Salon Plan

- Security Plan

- Security Management Plan

- Employee Development Plan

- Quality Plan

- Service Improvement Plan

- Growth Plan

- Incident Response Plan

- Basketball Plan

- Emergency Action Plan

- Product Launch Plan

- Spa Plan

- Employee Training Plan

- Data Analysis Plan

- Employee Action Plan

- Territory Plan

- Audit Plan

- Classroom Plan

- Activity Plan

- Parenting Plan

- Care Plan

- Project Execution Plan

- Exercise Plan

- Internship Plan

- Software Development Plan

- Continuous Improvement Plan

- Leave Plan

- 90 Day Sales Plan

- Advertising Agency Plan

- Employee Transition Plan

- Smart Action Plan

- Workplace Safety Plan

- Behavior Change Plan

- Contingency Plan

- Continuity of Operations Plan

- Health Plan

- Quality Control Plan

- Self Plan

- Sports Development Plan

- Change Management Plan

- Ecommerce Plan

- Personal Financial Plan

- Process Improvement Plan

- 30-60-90 Day Sales Plan

- Crisis Management Plan

- Engagement Plan

- Execution Plan

- Pandemic Plan

- Quality Assurance Plan

- Service Continuity Plan

- Agile Project Plan

- Fundraising Plan

- Job Transition Plan

- Asset Maintenance Plan

- Maintenance Plan

- Software Test Plan

- Staff Training and Development Plan

- 3 Year Plan

- Brand Activation Plan

- Release Plan

- Resource Plan

- Risk Mitigation Plan

- Teacher Plan

- 30 60 90 Day Plan for New Manager

- Food Safety Plan

- Food Truck Plan

- Hiring Plan

- Quality Management Plan

- Wellness Plan

- Behavior Intervention Plan

- Bonus Plan

- Investment Plan

- Maternity Leave Plan

- Pandemic Response Plan

- Succession Planning

- Coaching Plan

- Configuration Management Plan

- Remote Work Plan

- Self Care Plan

- Teaching Plan

- 100-Day Plan

- HACCP Plan

- Student Plan

- Sustainability Plan

- 30 60 90 Day Plan for Interview

- Access Plan

- Site Specific Safety Plan