Free Payroll Accounting System Restructuring Plan

Introduction

The purpose of this plan is to fundamentally revamp the existing payroll accounting system within our organization. Our primary objectives are threefold: to significantly enhance the efficiency of payroll processing, to minimize the occurrence of errors, and to guarantee the timely and precise issuance of employee paychecks. This initiative stems from a critical need to address the evolving payroll demands, driven by changes in regulatory compliance, organizational growth, and the technological landscape. By undertaking this overhaul, we aim not only to modernize our payroll system but also to align it more closely with best practices in financial management, thereby ensuring greater employee satisfaction and compliance with legal standards.

Current System Analysis

A thorough analysis of our current payroll accounting system is the foundational step in our restructuring plan. This evaluation will encompass a comprehensive review of the system's operational efficiency, its accuracy in payroll computation, and its adherence to the myriad of legal and regulatory requirements governing payroll management. We will employ a methodical approach to this analysis, utilizing both quantitative metrics (such as error rates, processing times, and system downtimes) and qualitative feedback (from user experiences and compliance audits) to paint a complete picture of the system's performance.

The analysis will be structured around several key dimensions:

Operational Efficiency: We will assess how the current system supports payroll operations, including the ease of data entry, processing speed, and the ability to handle various payroll complexities such as overtime, bonuses, and deductions.

Accuracy: This will involve examining the error rates in payroll calculations and the effectiveness of the current system in preventing, detecting, and correcting errors.

Compliance: Given the critical importance of compliance in payroll processing, we will review the system's capability to stay current with tax laws, labor regulations, and other statutory requirements, including the generation of necessary reports and documents for audit purposes.

User Experience: Feedback from the system's users, including payroll administrators, HR personnel, and employees, will be crucial in identifying usability issues and areas for improvement.

Identifying and addressing the limitations and challenges within the current system will set a clear direction for the development and implementation of the new payroll system, ensuring that it is not only more efficient and accurate but also user-friendly and compliant with legal standards.

Identifying Stakeholders

The success of the payroll system restructuring hinges significantly on the active involvement and cooperation of key stakeholders. These stakeholders encompass a diverse group of individuals and departments within the organization, each with a vested interest in the system's effectiveness and efficiency. The primary stakeholders include:

Human Resources (HR): HR plays a pivotal role in payroll management, from setting up employee records to determining benefits and deductions. Their insights will be invaluable in defining the requirements for the new system and ensuring it aligns with organizational policies and employee needs.

Finance Department: As the custodian of the company's financial processes, the Finance department's involvement is critical in ensuring the payroll system's integration with the broader financial management framework. They will provide perspectives on financial reporting, budgeting, and the management of payroll expenses.

IT Department: Given the technological nature of the payroll system, the IT department will be instrumental in assessing the technical requirements, ensuring data security, and supporting the system's integration with other organizational systems.

Employees: As the end recipients of the payroll, employees have a direct stake in the system's accuracy and reliability. Their feedback can provide valuable insights into the user experience, including the clarity of pay stubs and the ease of accessing payroll information.

Legal and Compliance Teams: These teams will ensure that the payroll system complies with all relevant laws, regulations, and industry standards, thereby safeguarding the organization against legal and financial risks.

Engaging these stakeholders from the outset through regular consultations, feedback sessions, and involvement in the decision-making process will be key to ensuring that the new system meets the diverse needs and expectations of all parties involved. This collaborative approach will not only facilitate smoother implementation and transition but will also foster a sense of ownership and acceptance among the various stakeholders, thereby enhancing the overall success of the project.

Detailing New System Requirements

The foundation of a successful payroll system overhaul lies in meticulously defining the requirements for the new system. These requirements must encapsulate a broad spectrum of functionalities to ensure comprehensive payroll management, from basic processing to complex compliance reporting. The following delineates the core requirements and features essential for the new payroll accounting system:

Adaptability to Various Salary Structures: The system must accommodate diverse salary configurations, including hourly wages, salaries, commissions, bonuses, and other forms of compensation, ensuring accurate and efficient processing of each pay type.

Comprehensive Benefits Management: It should seamlessly handle various employee benefits such as health insurance, retirement contributions, and leave balances, integrating these elements into the payroll calculations while adhering to applicable regulations.

Advanced Tax Handling: The system must be equipped to calculate, withhold, and report all necessary taxes at federal, state, and local levels, automatically updating to reflect changes in tax laws and ensuring compliance with all tax obligations.

Deductions and Garnishments Processing: Capabilities to manage deductions such as union dues, loan repayments, and garnishments, ensuring they are accurately processed in accordance with legal requirements.

Governmental and Compliance Reporting: The software should facilitate the generation of required reports for governmental agencies, including year-end tax documents, without necessitating manual compilation, thus streamlining compliance processes.

Employee Self-Service Portal: An intuitive portal where employees can access their pay stubs, tax documents, benefits information, and submit time-off requests, enhancing transparency and reducing administrative workload.

Integration Capabilities: The new system should integrate seamlessly with existing HR, finance, and time tracking systems to ensure a unified and efficient workflow across departments.

Data Security and Privacy: Robust security measures to protect sensitive payroll and personal employee information, in compliance with data protection regulations such as GDPR or CCPA, as applicable.

Scalability: The system must be capable of scaling up to accommodate organizational growth, including adding new employees, handling increased transaction volumes, and expanding into new jurisdictions or countries as needed.

User-Friendly Interface: A clear and intuitive interface for administrators and users, reducing the learning curve and minimizing the risk of errors in payroll processing.

Reliable Customer Support and Training: Access to comprehensive training materials and a responsive customer support team to assist with system implementation, troubleshooting, and ongoing queries.

Software Selection

Selecting the right payroll software is a critical decision that requires a thorough evaluation of available options against the company's specific needs. The selection process will involve several key steps:

Market Research: Conduct an extensive review of the payroll software market to identify potential systems that meet the outlined requirements.

Feature Comparison: Compare the functionalities of different software options, focusing on the ability to meet the detailed system requirements, especially those features identified as critical to the company's payroll processes.

Cost Analysis: Evaluate the pricing models of each software option, considering not only the initial costs but also ongoing expenses such as subscription fees, per-employee costs, and any additional charges for updates or additional features.

Scalability and Flexibility: Assess each system's scalability to ensure it can grow with the company and its flexibility to adapt to changing payroll regulations and company policies.

Customer Support and Service Levels: Review the level of customer support provided, including availability, response times, and the quality of assistance offered, as well as the availability of training resources and materials.

Peer Reviews and References: Seek feedback from other organizations that have implemented the payroll systems under consideration to gain insights into their real-world application, challenges, and benefits.

Demonstrations and Trials: Request demonstrations and, where possible, trial periods from vendors to test the software's functionality, user-friendliness, and compatibility with existing systems.

Vendor Negotiation and Contracting

Upon selecting a suitable payroll software, the next crucial step is to enter into negotiations with the vendor. This phase is not just about negotiating the best price but also about ensuring the agreement covers all essential aspects of the partnership, including:

Pricing and Payment Terms: Negotiate favorable terms that align with the company's budget and payment capabilities. Discuss possibilities for discounts based on long-term commitments or the number of users.

Data Migration Support: Ensure the vendor provides comprehensive support for migrating data from the old system to the new one, minimizing disruptions and data integrity issues.

Training and Onboarding: Secure commitments for in-depth training for the payroll team and other system users, ensuring a smooth transition and effective use of the new system from day one.

Ongoing Support and Updates: Clarify terms related to ongoing technical support, system updates, and upgrades to ensure the system remains current and supported throughout its use.

Service Level Agreements (SLAs): Establish clear SLAs covering system uptime, support response times, and resolution timelines for issues, safeguarding against potential disruptions to payroll processing.

Compliance and Security: Confirm that the software and the vendor's practices comply with relevant data protection and privacy laws, and that appropriate measures are in place to secure sensitive payroll and personal data.

Termination Clauses: Understand the terms under which either party can terminate the agreement and any associated costs or obligations, ensuring flexibility and protection for the company.

By meticulously addressing these aspects during the negotiation and contracting phase, the company can establish a strong foundation for a successful and beneficial partnership with the payroll software vendor, ensuring the new system meets current and future payroll needs.

System Integration and Migration

The transition to the new payroll system is a critical phase that involves meticulous planning and execution to ensure a seamless migration of data and integration with existing business systems. This process is divided into several key steps to maintain the integrity of payroll data and minimize operational disruptions.

Pre-Migration Planning: This initial step involves a comprehensive audit of the current payroll data to identify and cleanse any redundant, outdated, or incorrect information. It's also crucial to map out how existing data fields correspond to those in the new system to ensure compatibility.

Data Backup: Prior to migration, a complete backup of all payroll data is essential to prevent any potential loss of information. This backup serves as a safeguard against unforeseen issues that may arise during the migration process.

Migration Testing: A pilot migration with a subset of payroll data should be conducted to test the migration process. This test run helps identify any challenges in data compatibility or integrity and allows for the adjustment of migration strategies before the full-scale transfer.

Full-Scale Migration: Upon successful testing, the full-scale migration can commence. This should be scheduled during a period of low payroll activity to minimize impact on operations. Rigorous monitoring and support should be provided throughout this process to address any issues promptly.

Post-Migration Audit: After the migration, a thorough audit of the data in the new system is necessary to confirm its accuracy and completeness. This involves comparing a set of payroll records from the new system against the old system to ensure consistency.

System Integration: The new payroll system needs to be integrated with other business systems, such as HR management and financial accounting software. This integration ensures that data flows seamlessly between systems, enhancing efficiency and reducing the need for manual data entry.

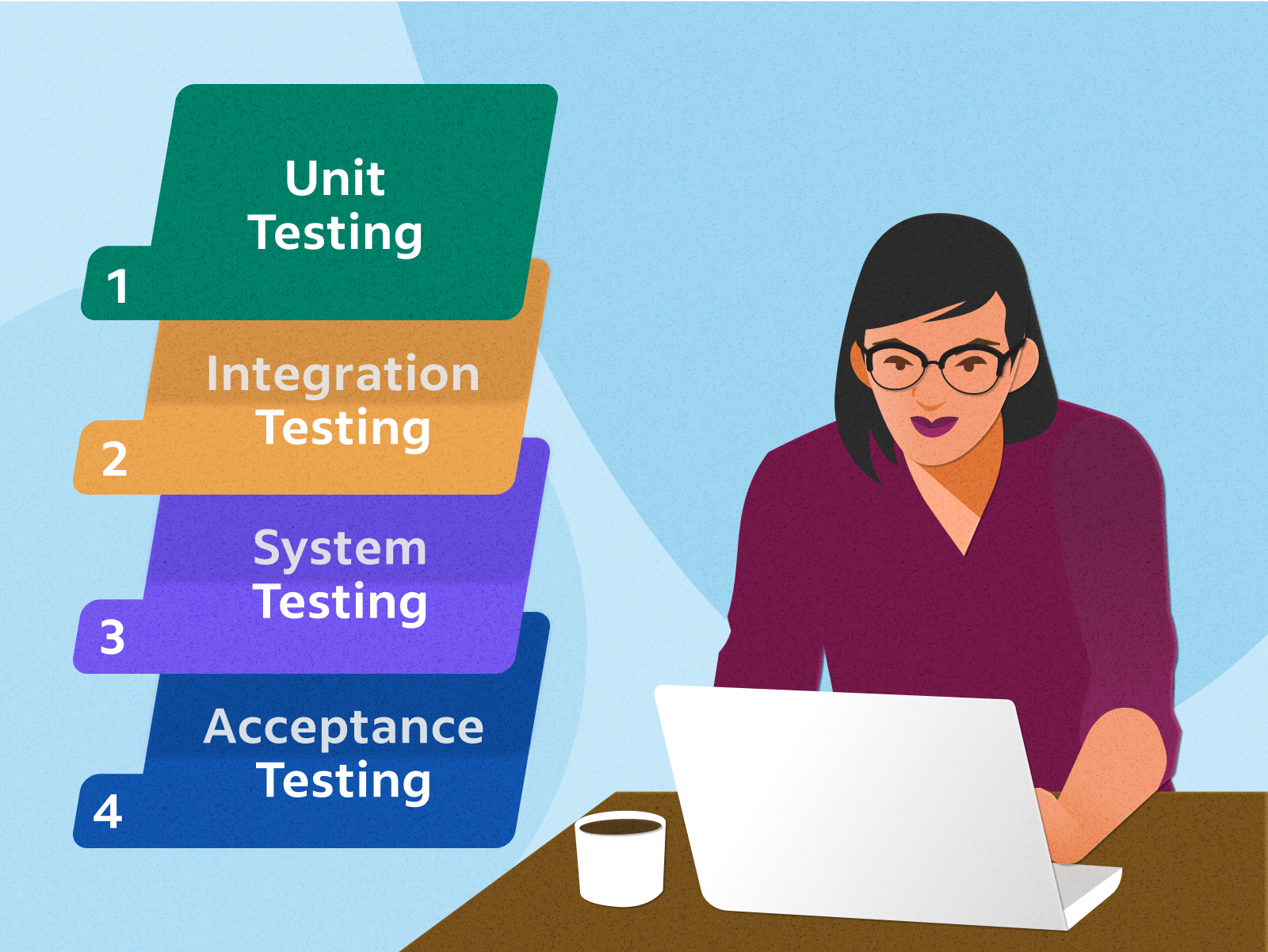

Testing and Validation

Ensuring the reliability and functionality of the new payroll system through rigorous testing and validation is crucial before it goes live. This phase is designed to identify and address any issues, ensuring the system operates as intended under various scenarios.

Functional Testing: This step involves verifying that all features of the payroll system work as expected. It includes testing salary calculations, deductions, benefits processing, tax computations, and report generation to ensure they align with specified requirements.

Integration Testing: Tests are conducted to ensure the new payroll system integrates smoothly with other business systems. This includes checking data exchanges, workflows, and triggers between the payroll system and HR, finance, and timekeeping systems.

Compliance Testing: Given the critical importance of compliance in payroll processing, the system must be tested against current tax laws and employment regulations. This testing ensures that the system accurately calculates taxes and complies with reporting requirements.

User Acceptance Testing (UAT): This involves end-users testing the system in a controlled environment to validate the user experience and functionality from the user's perspective. Feedback from this testing is crucial for making user-centric improvements.

Load Testing: The system is tested under varying loads to ensure it can handle peak processing demands, such as during end-of-month payroll runs or year-end reporting, without performance degradation.

Security and Privacy Testing: Tests are conducted to ensure that the payroll system securely handles and stores sensitive employee data, protecting against unauthorized access and data breaches.

Fig 1: Testing and Validation Flowchart Example

Training

Comprehensive training is essential to ensure that all users, from payroll administrators to management and employees, can effectively utilize the new payroll system. This training should be multifaceted to address the diverse needs of the users.

Administrator Training: Payroll administrators should receive in-depth training on all aspects of the payroll system, including setting up payroll runs, configuring benefits and deductions, handling taxes, and generating reports. This training should also cover troubleshooting common issues and understanding the system's security features.

Employee Training: Employees should be familiarized with the self-service portal, where they can view their pay stubs, manage their personal information, and understand their benefits and deductions. This can be achieved through online tutorials, quick reference guides, and FAQ sections.

Management Training: Managers and other key personnel should be trained on accessing payroll reports, approving timesheets, and understanding payroll costs as they relate to budgeting and financial planning.

Compliance Training: Given the legal implications of payroll processing, it's crucial to include training on relevant labor laws, tax regulations, and compliance requirements to ensure that the team is aware of the legal framework governing payroll.

Review and Feedback

After the implementation of the new payroll system, an ongoing review and feedback mechanism should be established to monitor the system's performance and collect user feedback.

Initial Review: Shortly after implementation, an initial review should be conducted to assess the transition process, identify any immediate issues, and gauge user satisfaction. This review should involve discussions with key stakeholders and end-users to gather insights and feedback.

Feedback Mechanism: Establish a structured process for collecting ongoing feedback from users, which can be facilitated through surveys, suggestion boxes, or regular meetings. This feedback is crucial for identifying areas for improvement and enhancing user satisfaction.

Performance Analysis: Regularly analyze the system's performance against the initial objectives, such as improved efficiency, accuracy, and compliance. This involves tracking metrics such as error rates, processing times, and user satisfaction levels.

Continuous Improvement: Use the insights gained from reviews and feedback to implement continuous improvements to the system. This may involve software updates, additional training sessions, or process adjustments to address any identified issues or inefficiencies.

Long-term Review: Conduct annual or bi-annual reviews to assess the long-term impact of the new system on payroll operations and organizational objectives. This review should consider changes in regulatory requirements, organizational growth, and technological advancements to ensure the payroll system remains effective and compliant.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Template.net's Payroll Accounting System Restructuring Plan Template is a game-changer for businesses. This comprehensive, easily editable, and customizable template, enhanced with our AI editor tool, simplifies the process of reimagining your payroll system. Streamline operations, improve efficiency, and ensure compliance effortlessly. Achieve financial success with this template – your key to a smarter payroll strategy.

You may also like

- Finance Plan

- Construction Plan

- Sales Plan

- Development Plan

- Career Plan

- Budget Plan

- HR Plan

- Education Plan

- Transition Plan

- Work Plan

- Training Plan

- Communication Plan

- Operation Plan

- Health And Safety Plan

- Strategy Plan

- Professional Development Plan

- Advertising Plan

- Risk Management Plan

- Restaurant Plan

- School Plan

- Nursing Home Patient Care Plan

- Nursing Care Plan

- Plan Event

- Startup Plan

- Social Media Plan

- Staffing Plan

- Annual Plan

- Content Plan

- Payment Plan

- Implementation Plan

- Hotel Plan

- Workout Plan

- Accounting Plan

- Campaign Plan

- Essay Plan

- 30 60 90 Day Plan

- Research Plan

- Recruitment Plan

- 90 Day Plan

- Quarterly Plan

- Emergency Plan

- 5 Year Plan

- Gym Plan

- Personal Plan

- IT and Software Plan

- Treatment Plan

- Real Estate Plan

- Law Firm Plan

- Healthcare Plan

- Improvement Plan

- Media Plan

- 5 Year Business Plan

- Learning Plan

- Marketing Campaign Plan

- Travel Agency Plan

- Cleaning Services Plan

- Interior Design Plan

- Performance Plan

- PR Plan

- Birth Plan

- Life Plan

- SEO Plan

- Disaster Recovery Plan

- Continuity Plan

- Launch Plan

- Legal Plan

- Behavior Plan

- Performance Improvement Plan

- Salon Plan

- Security Plan

- Security Management Plan

- Employee Development Plan

- Quality Plan

- Service Improvement Plan

- Growth Plan

- Incident Response Plan

- Basketball Plan

- Emergency Action Plan

- Product Launch Plan

- Spa Plan

- Employee Training Plan

- Data Analysis Plan

- Employee Action Plan

- Territory Plan

- Audit Plan

- Classroom Plan

- Activity Plan

- Parenting Plan

- Care Plan

- Project Execution Plan

- Exercise Plan

- Internship Plan

- Software Development Plan

- Continuous Improvement Plan

- Leave Plan

- 90 Day Sales Plan

- Advertising Agency Plan

- Employee Transition Plan

- Smart Action Plan

- Workplace Safety Plan

- Behavior Change Plan

- Contingency Plan

- Continuity of Operations Plan

- Health Plan

- Quality Control Plan

- Self Plan

- Sports Development Plan

- Change Management Plan

- Ecommerce Plan

- Personal Financial Plan

- Process Improvement Plan

- 30-60-90 Day Sales Plan

- Crisis Management Plan

- Engagement Plan

- Execution Plan

- Pandemic Plan

- Quality Assurance Plan

- Service Continuity Plan

- Agile Project Plan

- Fundraising Plan

- Job Transition Plan

- Asset Maintenance Plan

- Maintenance Plan

- Software Test Plan

- Staff Training and Development Plan

- 3 Year Plan

- Brand Activation Plan

- Release Plan

- Resource Plan

- Risk Mitigation Plan

- Teacher Plan

- 30 60 90 Day Plan for New Manager

- Food Safety Plan

- Food Truck Plan

- Hiring Plan

- Quality Management Plan

- Wellness Plan

- Behavior Intervention Plan

- Bonus Plan

- Investment Plan

- Maternity Leave Plan

- Pandemic Response Plan

- Succession Planning

- Coaching Plan

- Configuration Management Plan

- Remote Work Plan

- Self Care Plan

- Teaching Plan

- 100-Day Plan

- HACCP Plan

- Student Plan

- Sustainability Plan

- 30 60 90 Day Plan for Interview

- Access Plan

- Site Specific Safety Plan