Free Account Tax Planning for Budgeting

Understanding the Company Profile

It's important to begin the tax planning process by acquiring a comprehensive understanding of the company's profile. This includes its industry, size, employee structure, and its overall financial health. Also, gather information on the company's previous fiscal years, tax history, and its various sources of income.

Company Name: [Insert Company Name]

Contact Details: [Insert Contact Details]

Persons' Names: [Insert Names]

Date: [Insert Date]

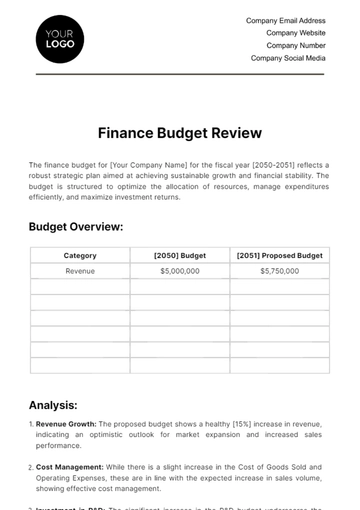

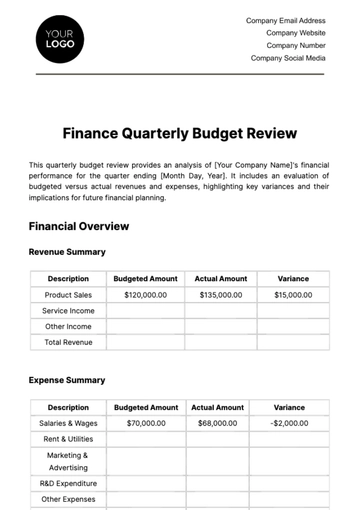

Estimating Potential Revenue and Expenses

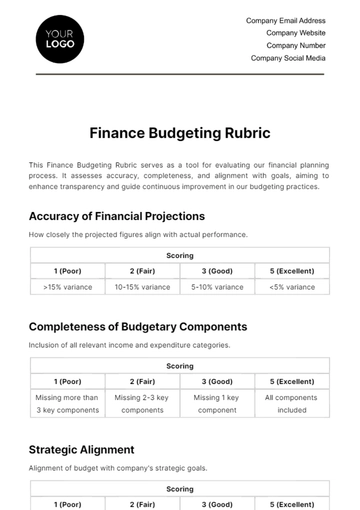

Knowing the projected revenue and expenses for the year will aid in creating a more effective tax plan. Accurate estimations will allow us to strategize and explore tax benefits available for particular levels of income and expenditures.

Identifying the Various Taxes to Pay

Once we have a firm understanding of the company's operations, we need to identify the array of taxes to pay. This could include corporate taxes, employment taxes, state and local taxes, and potentially international taxes for businesses operating beyond local borders.

Exploring Available Tax Deductions and Credits

Familiarizing ourselves with available tax deductions and credits is a useful step in reducing the company's tax liability. By doing so, we can effectively plan for potential savings in the tax season.

Utilizing Capital Gains and Losses

As a part of tax planning, examining the capital gains and losses is essential. Understanding capital gains tax rates and the tax implications of potential losses can have a direct and significant impact on the company's overall tax liability.

Implementing Tax-Efficient Investment Strategies

Planning for tax should also involve the review of the company's investment portfolio. It's key to identify whether these investments are tax-efficient or if there are adjustments to be made.

Understanding Compliance Regulations

Every company must ensure that their tax planning meets all compliance regulations set by their respective taxation authorities. Breaching these rules would result in penalties that may affect the company's financial health.

Planning for Long-term Tax Implications

Achieving the short-term goal of minimizing the current tax liabilities is crucial. However, understanding the long-term tax implications is also vital for the sustainable growth and profitability of the company.

Seeking Professional Tax Advisory

Companies should consider hiring professional tax advisors to aid in their tax planning process. They can provide much-needed expertise and advanced tax strategies to not only meet the regulatory requirements but also to improve profitability through tax savings.

Reviewing and Updating the Plan

Finally, any tax plan should not remain static. As business landscapes and tax laws evolve, the tax planning process should also undergo regular reviews and updates to ensure its effectiveness.

Company Name: [Insert Company Name]

Contact Details: [Insert Contact Details]

Persons' Names: [Insert Names]

Date: [Month Day, Year]

This comprehensive Account Tax Planning for Budgeting Plan is a crucial tool for [Insert Company Name] to manage its financial responsibilities effectively. By following these steps and continuously monitoring the tax plan, the company can not only minimize its tax liability but also ensure long-term financial success and compliance with tax regulations.

For any questions or assistance in implementing this plan, please contact:

[Insert Contact Details]

We are here to support [Insert Company Name] in achieving its financial goals and ensuring tax efficiency.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Template.net offers an Account Tax Planning for Budgeting Template, designed to streamline financial management. This editable and customizable template, paired with our AI editor tool, simplifies tax planning. Seamlessly organize budgets, track expenses, and optimize fiscal strategies. Achieve financial success effortlessly with Template.net's versatile solution. Stay ahead of your financial game today!

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising