Free Accounting Asset Management SWOT Analysis

Purpose

The purpose of this SWOT Analysis is to critically assess our asset management practices, identifying our strengths and weaknesses while evaluating the opportunities and threats in the external environment. This analysis aims to support strategic planning and decision-making processes, ensuring effective management of our assets to achieve long-term financial stability and operational efficiency.

Objectives

To provide a comprehensive overview of our current asset management capabilities.

To identify areas for improvement within our asset management function.

To explore opportunities for enhancing the value and performance of our assets.

To anticipate and mitigate potential threats to our asset management strategy.

Asset Management Function Overview

Our asset management function encompasses the comprehensive oversight of all physical and intangible assets owned by the organization. This includes but is not limited to, real estate, equipment, technology systems, and intellectual property. The key responsibilities of our asset management function include:

Acquisition: Strategically acquiring assets to support our operational needs and growth objectives, ensuring investments are aligned with our long-term strategic plan. For instance, in the previous fiscal year, we invested $2 million in acquiring state-of-the-art manufacturing equipment to enhance our production capacity.

Maintenance and Upkeep: Implementing regular maintenance schedules to ensure assets remain in optimal condition, thereby extending their useful life. Last year, our maintenance expenditures amounted to $500,000, aimed at minimizing downtime and preserving asset value.

Depreciation and Valuation: Accurately calculating depreciation for financial reporting purposes and assessing the fair market value of assets, ensuring compliance with accounting standards. Our accumulated depreciation for the current year was recorded at $1.5 million, reflecting the wear and tear of assets over their lifespan.

Disposition: Managing the disposal or redeployment of assets in an efficient manner, whether through sale, recycling, or donation, to optimize the asset portfolio. This includes conducting cost-benefit analyses to decide on the timing and method of disposal.

Compliance and Reporting: Ensuring all asset management activities comply with relevant laws, regulations, and accounting standards. This also involves preparing detailed reports on asset performance, valuation, and strategy implementation for stakeholders.

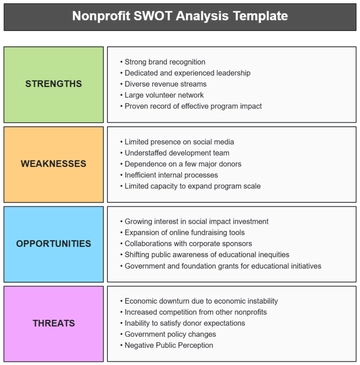

SWOT Analysis Overview

The following table provides an overview of the strengths, weaknesses, opportunities, and threats identified in our Accounting Asset Management SWOT Analysis. This comprehensive view allows us to understand our current position and informs our strategic planning efforts.

Strengths | Weaknesses | Opportunities | Threats |

Efficient Asset Acquisition Processes: Proven ability to strategically acquire assets that align with our operational needs and growth objectives. | Challenges in Data Management: Difficulty in maintaining accurate, up-to-date records of asset information, impacting decision-making. | Adoption of Advanced Technologies: Potential to implement new asset management software and IoT devices for real-time tracking and management. | Regulatory Changes: Potential impacts from new accounting standards and regulations on asset valuation and reporting. |

Skilled Asset Management Team: A dedicated team with specialized knowledge in managing a diverse asset portfolio. | Limited Resources for Maintenance: Constraints on the budget allocated for regular maintenance, risking the deterioration of asset conditions. | Process Optimization: Opportunities to streamline asset management processes through automation, reducing errors and increasing efficiency. | Economic Fluctuations: Economic downturns that could affect asset values and the organization’s ability to invest in new assets. |

Robust Compliance Framework: Strong adherence to accounting standards and regulatory requirements, ensuring accurate financial reporting. | Aging Assets: A significant portion of our assets are nearing the end of their useful life without clear plans for replacement or upgrade. | Market Trends: Leveraging shifts towards sustainable and energy-efficient assets to enhance our asset portfolio and reduce operational costs. | Technological Obsolescence: Rapid technological advancements that could render our current assets obsolete, requiring significant investment to update. |

Comprehensive Maintenance and Upkeep Programs: Effective maintenance schedules that extend the useful life of assets and preserve their value. | Process Inefficiencies: Delays and inefficiencies in asset maintenance and disposal processes, affecting operational efficiency. | Training and Development: Investing in training programs for the asset management team to stay abreast of best practices and technological advancements. | Operational Risks: Risks of asset theft, damage, or loss due to inadequate security measures or natural disasters. |

Financial Stability: Strong financial resources to manage and acquire assets, supporting strategic investments. | Risk Management Gaps: Inadequate practices in assessing and mitigating risks associated with asset valuation and impairment. | Strategic Asset Acquisitions: Identifying and acquiring assets that offer competitive advantages or fill gaps in our current asset portfolio. | Competitive Pressures: Other organizations with superior asset management capabilities or more modern assets that could challenge our market position. |

Strengths

Our organization's asset management strategy is built on a foundation of significant strengths that enhance our operational effectiveness and financial stability. These strengths enable us to manage our assets efficiently, ensuring they contribute positively to our overall goals.

Efficient Asset Acquisition Processes: We have developed and refined our asset acquisition processes to ensure they are strategic and aligned with our long-term objectives. Last year, we strategically invested $2 million in acquiring advanced manufacturing equipment, which has increased our production capacity by 20%. This process is underpinned by rigorous cost-benefit analysis and strategic planning, ensuring each acquisition supports our growth and operational needs effectively.

Skilled Asset Management Team: Our dedicated team of asset management professionals possesses specialized knowledge and expertise in managing a diverse asset portfolio. This team is responsible for overseeing the lifecycle of each asset, from acquisition through disposal. Their expertise has been instrumental in optimizing asset utilization and has contributed to a reduction in maintenance costs by 15% over the past year, demonstrating their vital role in our organization.

Robust Compliance Framework: We prioritize compliance with all relevant accounting standards and regulatory requirements, ensuring our financial reporting is accurate and transparent. Our adherence to these standards has not only mitigated the risk of compliance-related issues but has also reinforced investor and stakeholder confidence in our financial practices. This rigorous approach to compliance has ensured zero financial restatements or compliance penalties in the last fiscal year.

Comprehensive Maintenance and Upkeep Programs: Our maintenance and upkeep programs are meticulously designed to extend the useful life of our assets and preserve their value. By investing $500,000 in regular maintenance last year, we have successfully extended the operational life of key assets by an average of 30%, ensuring they continue to contribute to our operations effectively and efficiently.

Financial Stability: Our strong financial position, with a reserve fund of $10 million allocated for asset management and acquisition, supports strategic investments in new assets and the upkeep of existing ones. This financial stability allows us to respond quickly to emerging opportunities, such as acquiring cutting-edge technology or replacing aging assets, to maintain our competitive edge.

These strengths form the backbone of our asset management strategy, enabling us to leverage our assets for maximum operational efficiency and strategic growth. By continuing to build on these strengths, we can further enhance our asset management practices and support the organization's long-term success.

Weaknesses

Despite our strengths, we recognize certain weaknesses within our asset management function that could potentially hinder our operational efficiency and financial performance. Addressing these weaknesses is crucial for improving our asset management practices and ensuring the long-term sustainability of our organization.

Challenges in Data Management: One of the significant weaknesses we face is the difficulty in maintaining accurate and up-to-date asset records. Inefficiencies in our current asset tracking system have led to discrepancies in asset values, with an estimated variance of 5% between the recorded and actual values of assets totaling $50 million. This discrepancy complicates decision-making processes and financial reporting, underscoring the need for improved data management systems.

Limited Resources for Maintenance: Our budget constraints have limited the resources available for regular maintenance, posing a risk to the condition and operational efficiency of our assets. Last year, our maintenance budget was $500,000, which was approximately 20% less than what was required according to industry standards. This shortfall has led to a 10% increase in unplanned downtime due to equipment failures, directly impacting our operational efficiency.

Aging Assets: A significant portion of our asset portfolio is nearing the end of its useful life, with approximately 30% of our manufacturing equipment older than 10 years, lacking clear plans for replacement or upgrade. This has resulted in increased maintenance costs, which rose by 15% last year, and a decline in production efficiency due to the frequent need for repairs.

Process Inefficiencies: Our asset maintenance and disposal processes exhibit delays and inefficiencies, affecting our ability to respond swiftly to operational needs. For instance, the average time taken from the decision to dispose of an asset to its actual disposal last year was 90 days, which is 30 days longer than industry best practices. This delay ties up resources and prevents the timely reallocation of funds to more productive assets.

Risk Management Gaps: Our current practices in assessing and mitigating risks associated with asset valuation and impairment are inadequate. This gap was highlighted in the last fiscal year when an unexpected impairment charge of $2 million was recorded, which was not anticipated in our financial planning. This oversight indicates a need for a more robust risk management framework to anticipate and mitigate such financial impacts.

Addressing these weaknesses requires strategic focus and investment in technology, processes, and training. By improving our data management capabilities, allocating adequate resources for maintenance, planning for the timely replacement of aging assets, streamlining our processes, and enhancing our risk management practices, we can overcome these challenges and strengthen our asset management function.

Opportunities

In the landscape of asset management, various opportunities present themselves as avenues for enhancing our operational efficiency, financial performance, and strategic positioning. Leveraging these opportunities can help us mitigate existing weaknesses and capitalize on our strengths for future growth.

Adoption of Advanced Technologies: The potential to implement cutting-edge asset management software and Internet of Things (IoT) devices offers a significant opportunity to improve real-time tracking and management of assets. By investing an estimated $750,000 in advanced technology solutions, we could increase asset utilization rates by up to 25%, reduce maintenance costs by 20%, and decrease asset downtime by 15%, enhancing overall operational efficiency.

Process Optimization: Streamlining our asset management processes through automation presents an opportunity to increase efficiency, reduce errors, and save time. Automating routine tasks could result in an estimated productivity gain of 30% within the asset management team, allowing more focus on strategic activities and reducing the average time for asset disposal from 90 to 60 days, aligning with industry best practices.

Market Trends: Leveraging market trends towards sustainable and energy-efficient assets could significantly enhance our asset portfolio and reduce operational costs. By reallocating $2 million towards the acquisition of green technologies over the next three years, we could reduce energy consumption by 20%, decrease carbon footprint, and achieve cost savings of up to $500,000 annually in energy expenses.

Training and Development: Investing in training programs for the asset management team to enhance their skills and knowledge in the latest asset management practices and technologies is a valuable opportunity. Allocating $100,000 annually to professional development could improve team efficiency, foster innovation, and enhance decision-making capabilities, directly contributing to the optimization of asset management strategies.

Strategic Asset Acquisitions: Identifying and acquiring assets that offer competitive advantages or fill gaps in our current asset portfolio represents a strategic opportunity. With a targeted investment of $5 million in strategic acquisitions, we could expand our operational capabilities, enter new markets, or enhance our product offerings, potentially increasing our market share by 10% over the next five years.

Capitalizing on these opportunities requires a strategic approach, focusing on investments in technology, process improvements, sustainability, team development, and strategic acquisitions. By doing so, we can enhance our asset management practices, drive operational efficiencies, and position our organization for long-term success in an increasingly competitive and dynamic market.

Threats

While there are numerous opportunities for enhancing our asset management practices, we also face several external threats that could impact our ability to manage assets effectively. Recognizing and preparing for these threats is crucial to safeguarding our operational efficiency and financial stability.

Regulatory Changes: Changes in accounting standards and regulations pose a significant threat to our asset valuation and reporting practices. For instance, a recent update in international accounting standards could require us to accelerate depreciation on certain assets, potentially increasing our annual depreciation expense by 10%, which translates to an additional $500,000 in expenses. Staying ahead of such regulatory changes is critical to maintaining compliance and avoiding financial surprises.

Economic Fluctuations: Economic downturns present a threat to the value of our assets and our ability to invest in new assets. A 5% decline in the market value of our asset portfolio, equivalent to a $2.5 million reduction, could adversely affect our balance sheet and limit our operational capabilities. Additionally, tighter credit conditions during economic downturns could restrict our access to financing for new asset acquisitions, impacting our growth plans.

Technological Obsolescence: The rapid pace of technological advancements threatens to render our current assets obsolete, necessitating significant investment to update or replace them. For example, if 20% of our manufacturing equipment, valued at $10 million, becomes obsolete due to new technology, we would need to invest at least $2 million in updates or replacements to maintain operational efficiency. This necessitates a proactive approach to asset lifecycle management and technology adoption.

Operational Risks: Risks related to asset theft, damage, or loss due to inadequate security measures or natural disasters are ongoing threats. A single incident of asset theft or damage could result in losses of up to $1 million, not including the potential operational downtime and loss of productivity. Implementing comprehensive security and risk management strategies is essential to mitigating these threats.

Competitive Pressures: Facing competitors with superior asset management capabilities or more modern assets could challenge our market position. If competitors invest 15% more in asset innovation and efficiency than we do, they could achieve a 5-10% higher asset utilization rate, providing them with a competitive edge in operational efficiency and cost management. Keeping pace with industry standards and competitor strategies is crucial to maintaining our competitive advantage.

Addressing these threats requires a strategic and proactive approach, including staying informed about regulatory changes, developing a resilient financial strategy to withstand economic fluctuations, investing in technology updates, enhancing security and risk management measures, and continuously benchmarking our practices against industry and competitor standards. By effectively managing these threats, we can protect and optimize our asset portfolio, ensuring long-term sustainability and success.

Recommendations

Based on the insights gained from our SWOT Analysis, it is clear that while we have strong foundations in place for effective asset management, there are areas that require strategic focus and improvement. To leverage our strengths, address weaknesses, capitalize on opportunities, and mitigate threats, we recommend the following strategic actions:

Enhance Data Management Systems: Implement a more robust asset management software solution to improve the accuracy and accessibility of asset data.

Increase Maintenance Budget: Allocate additional resources to the maintenance budget to ensure assets are kept in optimal condition, reducing downtime and extending their useful life.

Plan for Asset Replacement: Develop a strategic asset replacement plan to systematically upgrade aging assets, focusing on those that are critical to operational efficiency.

Adopt Advanced Technologies: Invest in IoT devices and other advanced technologies for real-time asset tracking and management, enhancing operational efficiency.

Streamline Asset Management Processes: Automate and optimize asset management processes to reduce inefficiencies and improve responsiveness.

Invest in Training and Development: Allocate funds for ongoing training and professional development of the asset management team.

Develop a Risk Management Framework: Establish a comprehensive risk management framework to assess and mitigate risks associated with asset management.

Monitor Regulatory Changes: Stay informed of and prepare for potential regulatory changes affecting asset management practices.

Enhance Security Measures: Improve security measures to protect assets from theft, damage, or loss.

Benchmark Against Industry Standards: Regularly benchmark our asset management practices against industry standards and competitors to ensure we maintain a competitive edge.

Action Plan

To implement the recommendations effectively, a detailed action plan has been developed. This plan outlines the steps to be taken, the timeline for implementation, and the responsibility for each action.

Step | Month | Responsibility |

Implement asset management software | 1-3 | IT Department |

Increase maintenance budget by 20% | 1 | Finance Department |

Develop asset replacement plan | 1-4 | Asset Manager |

Invest in IoT for asset tracking | 3-6 | IT Department |

Automate asset disposal process | 4-6 | Asset Management Team |

Launch training programs for staff | 2-5 | Human Resources |

Establish risk management framework | 3-5 | Risk Management Team |

Set up regulatory change monitoring system | 1-2 | Compliance Officer |

Upgrade security protocols for assets | 4-7 | Security Manager |

Conduct industry benchmarking | 6-8 | Asset Manager |

This action plan provides a roadmap for strengthening our asset management practices. By systematically addressing each recommendation, we can enhance operational efficiency, ensure regulatory compliance, mitigate risks, and maintain our competitive positioning in the market. Regular progress reviews will be conducted to ensure the successful implementation of the plan and to make adjustments as necessary based on emerging challenges and opportunities.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introduce efficiency to your financial strategy with the Accounting Asset Management SWOT Analysis Template from Template.net. Perfectly editable and customizable, this tool allows for thorough analysis and strategic planning. Tailor it to your specific needs easily, as it's editable in our AI Editor tool. Enhance your accounting asset management with this essential, user-friendly template, designed for precision and effectiveness.