Free Account Strategic Budget Planning Document

Executive Summary

A. [Your Company Name] Overview

[Your Company Name] is a prominent technology solutions provider, renowned for its commitment to innovation and excellence. As a market leader, we have consistently demonstrated a passion for delivering cutting-edge products and services that empower businesses to thrive in an ever-evolving digital landscape.

Mission Statement:

At [Your Company Name], our mission is to catalyze business success by providing transformative technological solutions. We strive to create value for our clients, stakeholders, and employees, fostering a culture of continuous innovation and integrity.

Vision Statement:

Our vision is to be a global trailblazer in technological advancements, setting new standards for excellence. We aim to create a world where businesses leverage technology seamlessly to achieve unparalleled success and sustainability.

Core Values:

Innovation: We foster a culture that encourages bold ideas and creative solutions.

Customer Centricity: Our clients' success is our priority, and we are dedicated to exceeding their expectations.

Integrity: We operate with transparency, honesty, and a strong commitment to ethical business practices.

Collaboration: We believe in the power of teamwork and collaboration, both internally and with our partners.

B. Budget Overview

The strategic budget for the fiscal year 2050-2051 reflects [Your Company Name]'s commitment to achieving sustainable growth, operational excellence, and financial resilience. This comprehensive budget is designed to align with the company's broader strategic objectives and position [Your Company Name] as a leader in the technology sector.

Key Highlights:

Operational Optimization: The budget allocates resources to streamline internal processes, enhance efficiency, and reduce operational costs by 10% through automation initiatives.

Revenue Growth Initiatives: With a primary focus on revenue diversification, the budget allocates [$2 million] for the research and development of two new product lines. These innovations are expected to contribute 25% to the overall revenue.

Market Expansion: To capitalize on emerging markets, [$1.5 million] is allocated for market expansion initiatives, targeting a 10% increase in market share in strategically identified regions.

Budgeting Goals and Objectives

A. Financial Goals

Revenue Growth: The primary financial goal for the fiscal year 2050-2051 is to achieve a substantial 15% increase in overall revenue, reaching [$10 million]. This growth trajectory is underpinned by a holistic approach that includes diversifying revenue streams, capturing new markets, and optimizing existing product lines.

Diversification Strategy: Allocate [$2 million] for research and development efforts to introduce two innovative product lines. This initiative aims to tap into new market segments and respond to evolving customer needs, contributing significantly to overall revenue.

Market Expansion: Invest [$1.5 million] in strategic marketing and distribution channels to expand market share in identified regions. This targeted approach aligns with our commitment to being a global technology leader and capitalizes on emerging opportunities.

Profitability Improvement: The budget sets a target net margin of 20%, reflecting [Your Company Name]'s commitment to sustainable and profitable growth. To achieve this objective, a multi-faceted strategy is outlined:

Operational Efficiency: Allocate resources ([$1.5 million]) towards operational optimization, process automation, and efficiency enhancement. This initiative aims to streamline internal workflows, reduce costs, and improve overall operational efficiency, contributing directly to increased profitability.

Cost Control Measures: Implement cost control measures across various departments, with a focus on optimizing fixed and variable costs. The budget details specific cost reduction targets for each department, contributing to an overall cost reduction of 8%.

B. Strategic Objectives

Product Innovation: [Your Company Name] recognizes the pivotal role of innovation in maintaining competitiveness. The budget allocates [$2 million] for the research and development of two new product lines. These innovations are strategically aligned with market trends, customer preferences, and the broader technology landscape, aiming to capture new market segments and bolster overall product offerings.

Timeline for Product Launch: A detailed timeline for the development and launch of each product line is provided in the project plan, ensuring a structured and timely approach to innovation.

Market Research: A portion of the budget ([$500,000]) is dedicated to in-depth market research, ensuring that the new products align with market demands and customer expectations.

Market Expansion: [Your Company Name] is poised for strategic expansion into emerging markets to seize untapped opportunities and diversify its global footprint. The budget outlines key initiatives to achieve a 10% increase in market share in these regions:

Geographical Analysis: Conduct a comprehensive analysis of potential markets, considering economic indicators, regulatory environments, and consumer behavior.

Localized Marketing Strategies: Allocate [$1 million] for localized marketing campaigns, ensuring cultural relevance and resonating with the specific needs of customers in targeted regions.

Partnerships and Alliances: Explore strategic partnerships and alliances with local businesses to facilitate market entry and establish a strong presence.

Alignment with Corporate Strategy:

These financial goals and strategic objectives are intricately connected to [Your Company Name]'s overarching corporate strategy, ensuring that the budget serves as a catalyst for sustained success and competitive advantage in the dynamic technology landscape.

Budget Assumptions

A. Economic Assumptions

GDP Growth Rate: The budget assumes a moderate GDP growth rate of 4%, reflecting the prevailing economic conditions. This assumption is grounded in a comprehensive analysis of economic indicators, expert forecasts, and historical trends.

Inflation Rate: A conservative inflation rate of 2.5% is considered in budget calculations to account for potential price increases. This factor ensures that the budget accounts for fluctuations in the cost of goods and services, safeguarding against unexpected inflationary pressures.

Exchange Rates: The assumption of stable exchange rates is based on historical performance and current market conditions. A contingency of +/- 1% is factored in to address potential fluctuations, minimizing the impact of currency exchange risks.

B. Industry and Market Assumptions

Industry Growth: The budget anticipates a robust 8% growth in the technology industry. This assumption is supported by extensive market research, industry reports, and a thorough analysis of emerging trends and technological advancements.

Demand for Sustainable Solutions: Recognizing the increasing emphasis on sustainability, a conservative estimate of a 12% increase in demand for sustainable technology solutions is assumed. This aligns with [Your Company Name]'s commitment to environmental responsibility and positions the company as a leader in eco-friendly technology solutions.

C. Internal Assumptions

Sales Forecast: A conservative sales forecast of 20% growth is considered, taking into account market trends, customer feedback, and historical sales data. This growth projection reflects [Your Company Name]'s confidence in its existing product lines and the positive impact expected from the introduction of new innovative products.

Cost of Goods Sold (COGS) Efficiency Improvement: A targeted 12% improvement in COGS efficiency is assumed, driven by process optimization, supply chain enhancements, and the adoption of cost-effective technologies. This strategic focus aims to enhance overall cost efficiency and maintain a competitive edge.

Revenue Forecast

A. Product Revenue

Product | Forecasted Revenue |

|---|---|

Product A | [$4 million] |

B. Geographical Revenue Distribution

Region | Forecasted Revenue |

|---|---|

North America | [$6 million] |

Revenue Growth Strategy:

Product Mix: The revenue forecast reflects the anticipated success of new product lines, with a balanced contribution from existing products. Continuous monitoring and adjustments will be made based on market response and customer feedback.

Geographical Expansion: The forecasted revenue distribution showcases a strategic emphasis on North America, Europe, and the Asia-Pacific region. This aligns with [Your Company Name]'s global expansion strategy, leveraging regional market dynamics and opportunities.

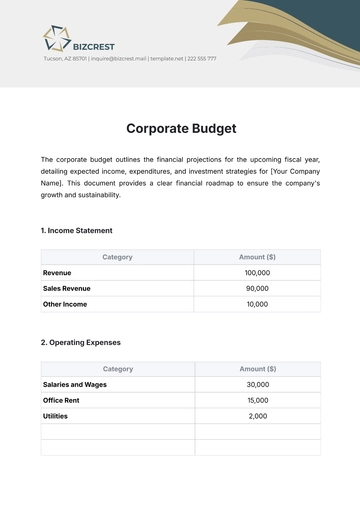

Cost Structure

A. Fixed Costs

Salaries and Benefits: The budget allocates [$3.5 million] for employee salaries and benefits. This includes planned salary increases, bonuses, and benefits to retain top talent. A comprehensive employee engagement program is also budgeted to foster a positive workplace culture.

Rent and Utilities: An allocation of [$1 million] is earmarked for office rent and utilities. This includes lease agreements, maintenance costs, and essential utilities to sustain daily operations. Proactive negotiation with landlords is part of the strategy to control fixed costs.

Technology Infrastructure: [$1.2 million] is allocated for upgrading and maintaining technology infrastructure. This includes server upgrades, software licenses, and cybersecurity measures to ensure robust IT systems. Investments in technology aim to enhance operational efficiency, cybersecurity, and overall competitiveness.

B. Variable Costs

Raw Materials: An estimated [$2 million] is allocated for raw materials. This includes the procurement of materials essential for product manufacturing. Negotiations with suppliers and bulk purchasing strategies are employed to optimize costs while ensuring a steady supply chain.

Marketing and Advertising: [$1.8 million] is allocated for marketing and advertising campaigns. This encompasses digital marketing, advertising materials, and promotional events to boost brand visibility and drive sales. A detailed marketing strategy is outlined, incorporating data-driven approaches for targeted campaigns and measurable results.

Sales Commissions: A commission pool of [$500,000] is set aside for sales representatives, incentivizing them to achieve revenue targets. The commission structure is designed to align with strategic sales objectives and customer satisfaction metrics.

C. Capital Expenditures

Equipment Upgrades: [$1.5 million] is allocated for upgrading manufacturing equipment and technology tools, enhancing operational efficiency. The focus is on adopting state-of-the-art machinery to improve production capacity and reduce downtime.

Facility Expansion: [$2 million] is budgeted for facility expansion to accommodate the growing workforce and optimize production capabilities. The expansion plan includes a timeline for construction, regulatory compliance considerations, and environmental sustainability initiatives.

Investment Allocation

A. Strategic Investments

Research and Development (R&D): [$2.5 million] is dedicated to R&D initiatives, driving product innovation and staying ahead of industry trends. Cross-functional R&D teams are established, collaborating closely with marketing and production teams to ensure holistic innovation.

Marketing Technology: An investment of [$1.2 million] is made in marketing technology tools to enhance customer engagement and optimize marketing campaigns. Implementation of customer relationship management (CRM) systems and data analytics tools is prioritized for targeted marketing strategies.

B. Return on Investment (ROI) Analysis

Product Line A: An anticipated ROI of 25% is expected within the first year, with a projected revenue contribution of [$5 million]. The marketing strategy includes product positioning, pricing optimization, and customer feedback mechanisms to ensure successful product adoption.

Market Expansion: The investment of [$1.5 million] in market expansion is expected to yield an ROI of 15%, capturing a new market share of 10%. Market research, localized marketing strategies, and partnerships with local businesses are integral components of the market expansion plan.

Strategic Rationale:

Cost Efficiency: Fixed cost allocations are based on realistic assessments of market conditions and operational requirements, ensuring financial stability while supporting growth initiatives. Continuous cost-monitoring mechanisms are in place to identify opportunities for efficiency improvements.

Investment in Innovation: The significant allocation to R&D reflects [Your Company Name]'s commitment to innovation, aiming to stay at the forefront of technological advancements. Cross-functional collaboration is emphasized to ensure a holistic and customer-centric approach to product development.

ROI Focus: Each investment is strategically chosen with a focus on achieving a positive and measurable return on investment, contributing to overall financial health. Rigorous monitoring and regular reviews are scheduled to track performance against ROI targets and make adjustments as needed.

Risk Management

A. Identified Risks

Market Fluctuations: Acknowledging the inherent volatility in markets, [$500,000] is allocated as a contingency fund to mitigate the impact of unforeseen market changes. This includes sudden shifts in demand, pricing pressures, or changes in consumer behavior.

Regulatory Changes: To address potential changes in regulations that could impact operations, [$300,000] is allocated to the legal and compliance team. This ensures proactive measures are taken to stay compliant, navigate regulatory shifts, and avoid legal repercussions.

Supply Chain Disruptions: In response to the vulnerability of global supply chains, [$800,000] is reserved to address potential disruptions. Strategies include diversifying suppliers, implementing robust risk management protocols, and establishing alternative logistics channels to maintain operational continuity.

B. Mitigation Strategies

Diversification: To counter market fluctuations, diversification strategies involve expanding product lines and entering new markets. This reduces reliance on specific products or regions, creating a more resilient business model.

Continuous Compliance Monitoring: Regular compliance audits and engagement with legal advisors ensure timely adaptation to any regulatory changes. This proactive approach mitigates legal risks and potential penalties, fostering a culture of ethical business practices.

Supply Chain Resilience: The budget allocates funds for identifying and onboarding alternative suppliers, implementing inventory buffers, and investing in technology for real-time supply chain monitoring. These measures enhance supply chain resilience and minimize the impact of disruptions.

Monitoring and Reporting

A. Key Performance Indicators (KPIs)

Revenue Growth Rate: Targeting a KPI of 15% for overall revenue growth, assessed quarterly to ensure alignment with financial goals. This KPI reflects the company's commitment to sustained financial health and expansion.

Cost-to-Revenue Ratio: Monitoring a targeted cost-to-revenue ratio of 75%, with regular assessments to identify areas for cost optimization. This KPI ensures efficient resource utilization and contributes to overall profitability.

Customer Satisfaction Index (CSI): Implementing a CSI metric to measure customer satisfaction, aiming for an increase of 10% over the fiscal year. Customer satisfaction is a critical factor in retaining and expanding the customer base.

B. Reporting Frequency

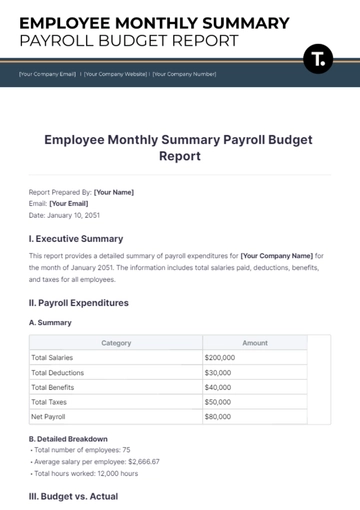

Financial Reports: Monthly financial reports will be generated, including profit and loss statements, balance sheets, and cash flow statements. These reports provide a comprehensive overview of the financial health of the company.

KPI Dashboards: Quarterly KPI dashboards will be presented, providing a comprehensive overview of performance against strategic objectives. These dashboards serve as a tool for strategic decision-making and performance evaluation.

Risk Management Updates: Bi-annual updates on risk assessments and mitigation strategies will be provided. This ensures a proactive approach to emerging challenges and allows for adjustments to risk management strategies as needed.

Strategic Monitoring:

Regular Reviews: Monthly financial reviews and quarterly strategic reviews will be conducted to assess performance against targets and adjust strategies as needed. These reviews provide a platform for continuous improvement and adaptation to dynamic market conditions.

Data-Driven Decision Making: The implementation of data analytics tools will support real-time monitoring, allowing for agile decision-making based on accurate and up-to-date information. Data-driven insights enhance strategic decision-making and enable rapid responses to market changes.

Contingency Plan

A. Emergency Fund

Operational Emergency Fund: A dedicated fund of [$1 million] is set aside to address unforeseen operational challenges, ensuring the business can swiftly respond to unexpected disruptions without compromising daily operations.

Market Downturn Reserve: [$1.5 million] is allocated to a market downturn reserve, providing a financial buffer to navigate economic downturns. This reserve is designed to sustain the business during periods of reduced demand or market instability.

B. Crisis Management Team

Formation: A crisis management team is established, comprising key executives from various departments. An annual allocation of [$200,000] is made for specialized crisis management training and team-building activities.

Communication Strategy: [$150,000] is allocated for communication strategies during crises. This includes developing communication plans, training spokespersons, and investing in communication tools to ensure transparent and timely communication with stakeholders.

Contingency Budget

A. Unforeseen Expenses

Unexpected Technology Issues: A contingency fund of [$300,000] is set aside to address unforeseen technology issues that may disrupt operations. This includes expenses related to system failures, cybersecurity incidents, or unexpected IT challenges.

Legal Contingency: [$250,000] is allocated for legal contingencies. This fund provides a financial cushion for unexpected legal issues, disputes, or regulatory challenges that may arise.

B. Strategic Opportunities Fund

Market Opportunities: An allocation of [$1.2 million] is reserved for seizing unexpected market opportunities. This fund allows [Your Company Name] to capitalize on strategic acquisitions, partnerships, or market expansion initiatives that may arise unexpectedly.

Innovation Fund: [$800,000] is dedicated to an innovation fund, providing flexibility to invest in emerging technologies or business models. This fund supports [Your Company Name]'s commitment to staying at the forefront of industry trends.

Contingency Plan Rationale:

Proactive Financial Management: The emergency fund and contingency budget are essential components of [Your Company Name]'s proactive financial management strategy. These funds provide the flexibility needed to navigate uncertainties and capitalize on unexpected opportunities.

Risk Mitigation: The crisis management team and communication strategies are integral to minimizing the impact of crises on the company's reputation and operations. These proactive measures ensure swift and effective responses to unforeseen challenges.

Strategic Flexibility: The strategic opportunities fund and innovation fund reflect [Your Company Name]'s commitment to strategic flexibility. These funds empower the company to adapt to changing market conditions, positioning it as an agile and innovative player in the industry.

Conclusion

The comprehensive account strategic budget planning document, including risk management and contingency plans, positions [Your Company Name] for sustainable growth and resilience in a dynamic business environment. The detailed allocations and strategies outlined in this document provide a roadmap for financial success, risk mitigation, and strategic adaptability. Regular monitoring and adjustments will be integral to ensuring the ongoing effectiveness of the budget and contingency plans.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Optimize your financial strategies with the Account Strategic Budget Planning Document Template from Template.net. This editable and customizable document empowers you to craft comprehensive budget plans. Utilize our Ai Editor Tool to tailor it to your specific needs, ensuring strategic alignment. Elevate your budget planning effortlessly, adapting to evolving financial landscapes. Explore the possibilities of precision and efficiency in strategic financial management with this template.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

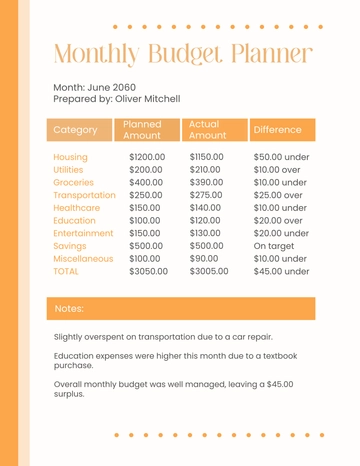

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

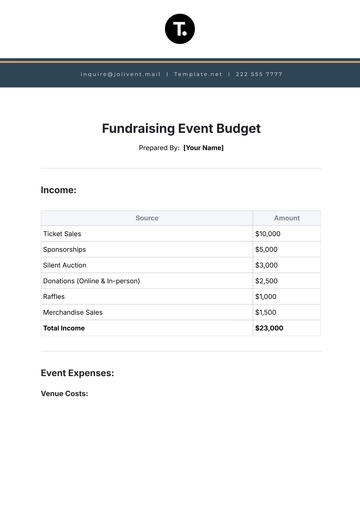

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising