Free Account Budget Summary Review

Executive Summary

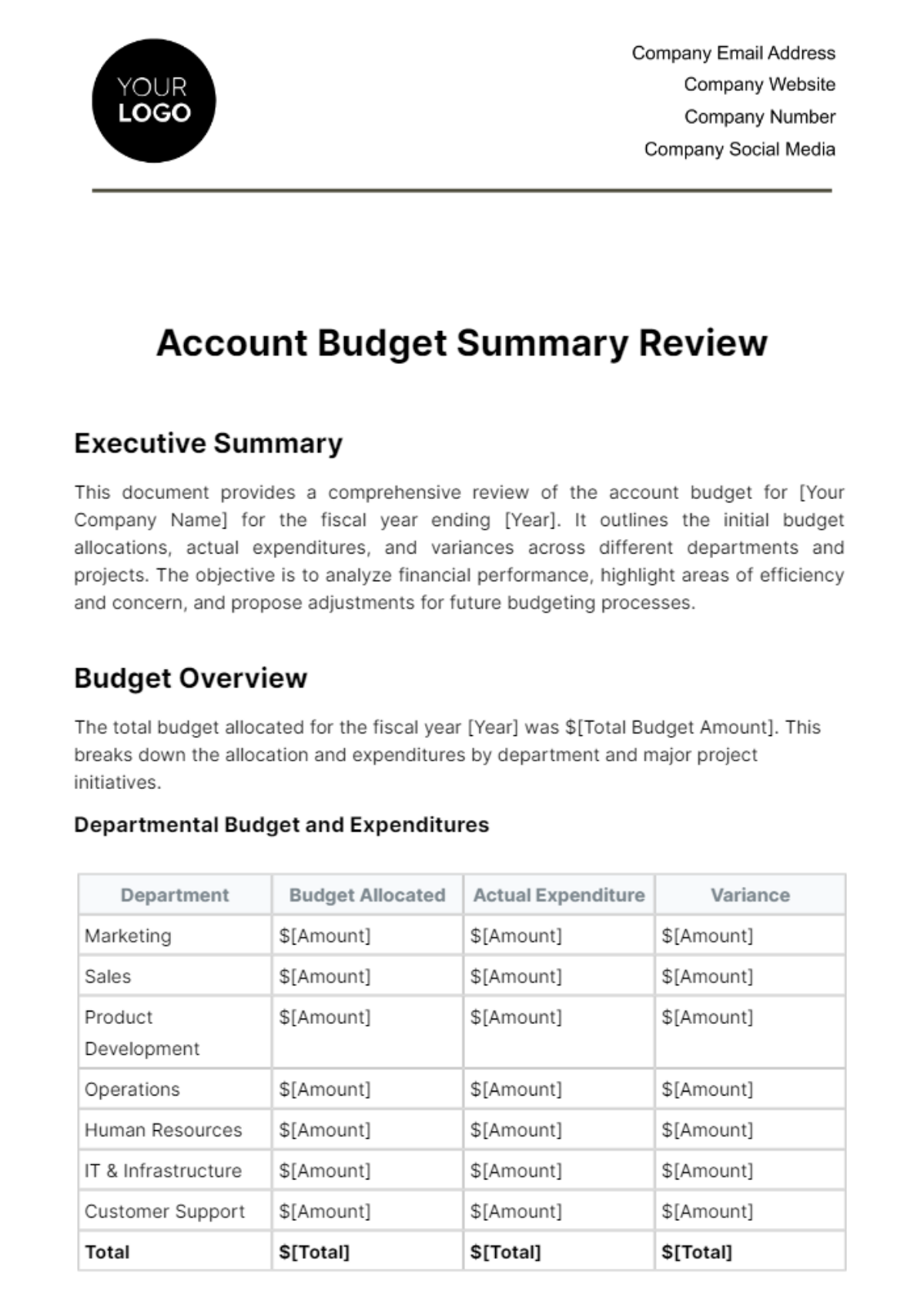

This document provides a comprehensive review of the account budget for [Your Company Name] for the fiscal year ending [Year]. It outlines the initial budget allocations, actual expenditures, and variances across different departments and projects. The objective is to analyze financial performance, highlight areas of efficiency and concern, and propose adjustments for future budgeting processes.

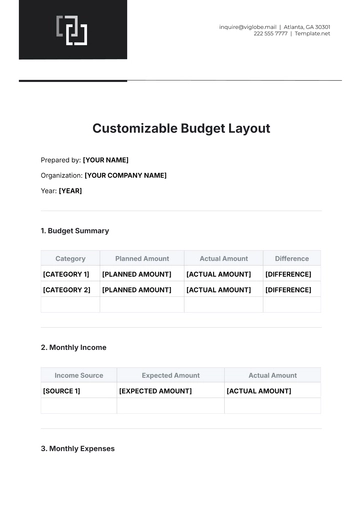

Budget Overview

The total budget allocated for the fiscal year [Year] was $[Total Budget Amount]. This breaks down the allocation and expenditures by department and major project initiatives.

Departmental Budget and Expenditures

Department | Budget Allocated | Actual Expenditure | Variance |

|---|---|---|---|

Marketing | $[Amount] | $[Amount] | $[Amount] |

Sales | $[Amount] | $[Amount] | $[Amount] |

Product Development | $[Amount] | $[Amount] | $[Amount] |

Operations | $[Amount] | $[Amount] | $[Amount] |

Human Resources | $[Amount] | $[Amount] | $[Amount] |

IT & Infrastructure | $[Amount] | $[Amount] | $[Amount] |

Customer Support | $[Amount] | $[Amount] | $[Amount] |

Total | $[Total] | $[Total] | $[Total] |

Major Project Budget and Expenditures

Project Name | Budget Allocated | Actual Expenditure | Variance |

|---|---|---|---|

[Project Name] | $[Amount] | $[Amount] | $[Amount] |

Analysis of Variances

This provides an analysis of the variances identified in the departmental and project budgets. It highlights the areas where expenditures exceeded or were under the budget, providing insights into the reasons behind these variances and suggesting corrective actions.

Key Findings:

Marketing:

The variance in marketing expenses was primarily due to an unexpected increase in digital advertising costs and a pivot to online events due to current market conditions. This shift, while necessary, led to an overrun of approximately [Percentage] above the planned budget.

Recommended action: Reallocate funds from underperforming campaigns to more cost-effective digital channels and renegotiate contracts with digital ad providers to secure better rates.

Sales:

Underutilization of the sales budget was observed due to a decrease in travel and in-person meetings, resulting in a [Percentage] underspend. The funds allocated for travel and client entertainment remained largely unused.

Recommended action: Redirect the unused budget towards enhancing virtual sales tools and training programs to boost remote sales capabilities.

Product Development:

The overage in product development costs was attributed to unforeseen expenses in licensing new technologies and delays in project timelines, resulting in a [Percentage] budget overrun.

Recommended action: Implement more rigorous project management practices to ensure timely delivery and negotiate better terms for technology licensing fees.

Recommendations for Future Budgeting

Based on the analysis of the current year's budget performance, the following recommendations are proposed to enhance future budget planning and execution:

Enhanced Forecasting: Improve budget forecasting by incorporating more dynamic market analysis and historical data trends.

Cost Management: Implement stricter cost control measures in departments with significant variances.

Resource Allocation: Reallocate resources to prioritize high-impact projects and departments demonstrating efficient budget utilization.

Regular Review: Conduct quarterly budget reviews to identify variances early and adjust allocations accordingly.

Conclusion

The account budget summary review for [Your Company Name] for the fiscal year [Year] provides a clear picture of our financial performance, highlighting areas where we excelled and identifying opportunities for improvement. By taking a proactive approach to budget management, we can ensure that our financial resources are being used effectively to support our strategic goals.

As we move forward, the insights gained from this review will be instrumental in guiding our financial planning and decision-making processes. Our commitment to fiscal responsibility, strategic investment, and continuous improvement will drive [Your Company Name] towards achieving sustained growth and success in the coming years.

Prepared By: [Your Name]

Date: [Month, Day, Year]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Account Budget Summary Review Template from Template.net, designed for precision and efficiency. Fully editable and customizable, it offers a comprehensive solution for financial analysis and planning. This professional-grade template ensures accurate budget tracking and fiscal management, making it an indispensable tool for businesses seeking optimal financial oversight. Start editing it now using our Ai Editor Tool.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising