Free Account Budget Audit Review

Executive Summary

This document presents the findings of the Account Budget Audit for [Your Company Name] for the fiscal year ending [Year]. It aims to assess the accuracy of budget reporting, compliance with financial policies, and the efficiency of budget allocation and spending. The review covers various departments and projects, identifying discrepancies, compliance issues, and areas for financial optimization.

Audit Scope and Methodology

The audit focused on examining budget allocations, actual expenditures, and adherence to internal and external financial regulations. A comprehensive analysis was conducted through document reviews, interviews with department heads, and financial data analysis. The goal was to ensure transparency, accuracy, and efficiency in budget management.

Departments and Projects Reviewed

Marketing

Sales

Product Development

Operations

Human Resources

IT & Infrastructure

Customer Support

Findings

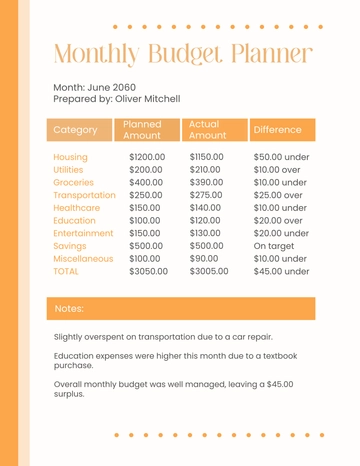

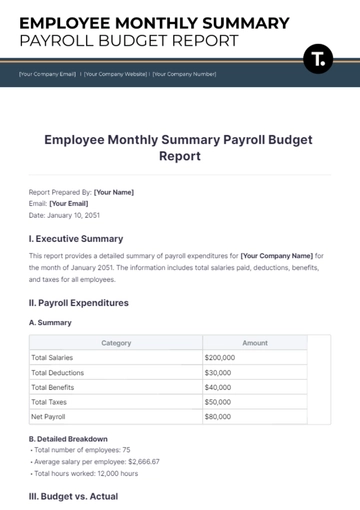

Budget Allocation and Expenditure Review

Department | Budget Allocated | Actual Expenditure | Variance | Compliance |

|---|---|---|---|---|

Marketing | $[Amount] | $[Amount] | $[Amount] | Yes/No |

Sales | $[Amount] | $[Amount] | $[Amount] | Yes/No |

Product Development | $[Amount] | $[Amount] | $[Amount] | Yes/No |

Operations | $[Amount] | $[Amount] | $[Amount] | Yes/No |

Human Resources | $[Amount] | $[Amount] | $[Amount] | Yes/No |

IT & Infrastructure | $[Amount] | $[Amount] | $[Amount] | Yes/No |

Customer Support | $[Amount] | $[Amount] | $[Amount] | Yes/No |

Total | $[Total] | $[Total] | $[Total] |

Compliance and Policy Adherence

Marketing: Found instances of non-compliant expenditures related to unauthorized vendor contracts. Recommended action: Implement stricter approval processes.

Sales: All expenditures were compliant with internal policies. However, underutilization of allocated budget suggests a need for better planning.

Product Development: Detected overspending due to lack of timely project review. Recommended action: Enhance monitoring and project management practices.

Operations: Identified minor discrepancies in reporting, though generally compliant. Recommended action: Improve documentation accuracy.

Recommendations

Strengthen Financial Controls: Enhance the approval process for expenditures and contracts to prevent unauthorized spending.

Improve Budget Planning and Forecasting: Departments showing significant variances should refine their budget forecasting methods to better align with actual needs.

Enhance Compliance Training: Conduct regular training sessions for department heads and finance staff to ensure understanding and adherence to financial policies.

Regular Audit and Review: Implement semi-annual reviews to monitor budget compliance and adjust allocations as necessary.

Conclusion

The Account Budget Audit Review for [Your Company Name] has revealed areas of strength in financial management and areas where improvements are needed. By addressing the identified discrepancies and implementing the recommended actions, the company can enhance its financial integrity, ensure compliance with policies, and optimize budget utilization for future fiscal periods.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Account Budget Audit Review Template from Template.net, a pivotal tool for rigorous financial examination. This template is fully editable and customizable, crafted to support professionals in conducting detailed budget audits with accuracy and efficiency. It provides a structured approach to financial review. The template is editable using our Ai Editor Tool for fiscal assessments and reporting.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising