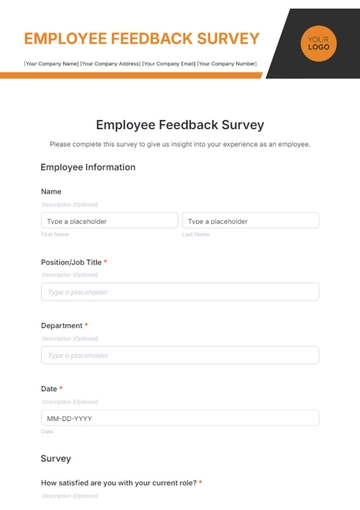

Free Operations Anti-Money Laundering Survey

Please complete this survey with detailed and accurate responses to help us assess and enhance our anti-money laundering (AML) strategies. Your insights are crucial for improving our policies and procedures. If you encounter questions that do not apply, mark them as "N/A" and provide a brief explanation if possible.

Section 1: Compliance Framework

This section aims to assess the robustness of [Your Company Name]'s anti-money laundering compliance framework, ensuring it meets regulatory standards and effectively mitigates money laundering risks.

Policies and Procedures | Does [Your Company Name] have a documented AML compliance policy and procedures? Provide scope and coverage details. |

Yes, [Your Company Name] has comprehensive AML policies covering customer due diligence, transaction monitoring, and reporting of suspicious activities. These policies are reviewed annually. | |

Regulatory Alignment | How often are AML policies reviewed and updated for regulatory alignment? |

Compliance Officer | Has a dedicated AML Compliance Officer been appointed? Provide [Name], [Job Title], [Email], and [Number]. |

Reporting Mechanisms | What mechanisms are in place for reporting suspicious activities or transactions? |

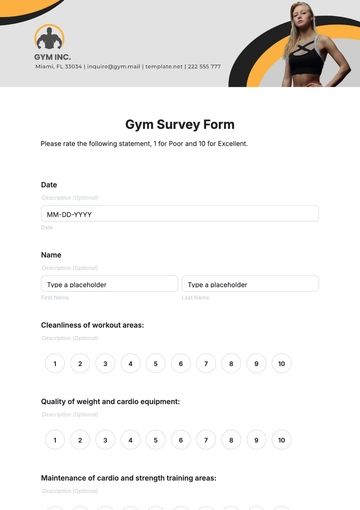

Section 2: Employee Training

This section evaluates the effectiveness and comprehensiveness of the AML training programs provided to employees of [Your Company Name], ensuring they are well-equipped to identify and report suspicious activities.

Training Programs | Describe the AML training programs provided to employees. Include frequency. |

Annual AML training sessions are mandatory for all employees, with quarterly updates provided via email. | |

Employee Assessment | How is the effectiveness of AML training assessed? Detail any tests or evaluations. |

Training Updates | How are training materials kept current with laws and practices? |

Specialized Training | Are there specialized training programs for high-risk positions? Describe. |

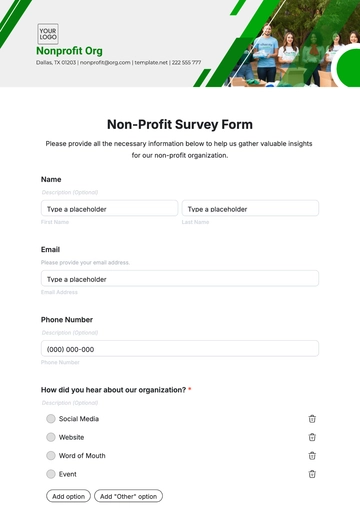

Section 3: Risk Assessment

This section gathers insights into how [Your Company Name] identifies, evaluates, and mitigates AML risks, ensuring a proactive approach to risk management.

Risk Identification | Describe the process for identifying potential AML risks. |

We conduct annual risk assessments, utilizing internal audits and industry reports to identify potential AML risks. | |

Risk Evaluation | How are identified risks evaluated and prioritized? Explain the methodology. |

Control Measures | What measures are implemented to mitigate high-priority AML risks? |

Risk Assessment Updates | Frequency of risk assessments and responsible parties. |

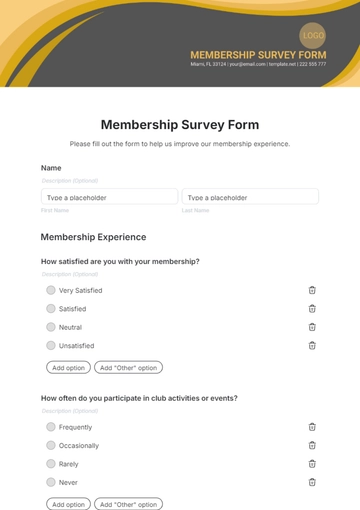

Section 4: Transaction Monitoring

This section explores the transaction monitoring systems and processes in place at [Your Company Name] to detect and investigate suspicious activities effectively.

Monitoring Systems | What systems or software are used for monitoring transactions? |

We use [Specific Software Name], an advanced AML software solution, for real-time transaction monitoring. | |

Alert Investigation | Describe the process for investigating monitoring alerts. |

Reporting Suspicious Transactions | Detail the process for handling and reporting suspicious transactions. |

Record Keeping | What are the policies for retention of AML monitoring and investigation records? |

Section 5: Customer Due Diligence (CDD)

This section assesses the customer due diligence processes employed by [Your Company Name] to verify the identity of its clients and understand the nature of their activities.

CDD Procedures | What CDD procedures are in place for new and existing customers? |

We perform standard CDD on all new customers, including identity verification and activity assessment. | |

High-Risk Customers | How are high-risk customers identified and monitored? |

Customer Information Updates | How frequently is customer information updated? |

Beneficial Ownership | What processes are in place for identifying and verifying beneficial ownership? |

Section 6: Third-Party Relationships

This section delves into the due diligence and monitoring of third-party relationships to prevent money laundering risks associated with external partnerships.

Due Diligence on Third Parties | Describe the due diligence process for third parties and partners. |

Due diligence includes reviewing the third party's AML policies, reputation checks, and ongoing monitoring. | |

Third-Party Monitoring | How are third-party relationships monitored for AML compliance? |

Reporting and Communication | Describe the reporting and communication mechanisms with third parties regarding AML matters. |

Termination Procedures | What are the procedures for terminating relationships with non-compliant third parties? |

Section 7: Technology and Innovation

This section investigates how [Your Company Name] leverages technology and innovation to enhance its AML compliance strategies and operations.

AML Technological Tools | What AML technology tools and solutions are employed by [Your Company Name]? |

We utilize [Specific Software Name] for AML compliance, which includes features for transaction monitoring, risk assessment, and reporting. | |

Innovation and AML Compliance | How does [Your Company Name] incorporate innovation into its AML compliance efforts? |

Data Security and Privacy | Describe the measures in place to ensure data security and privacy in AML operations. |

Technology Updates and Evaluation | How frequently are technological tools evaluated and updated for AML purposes? |

Section 8: Legal and Regulatory Compliance

This section confirms that [Your Company Name] adheres to the legal and regulatory framework governing anti-money laundering efforts, ensuring full compliance and preparedness for audits.

Legal Compliance | How does [Your Company Name] ensure compliance with AML laws and regulations in its operations? |

We regularly consult with legal experts to ensure our AML policies and procedures comply with current laws. | |

Regulatory Updates | Describe the process for staying updated on changes in AML legislation and regulation. |

Legal Advice and Support | What resources are available for legal advice and support on AML compliance? |

Regulatory Examinations and Audits | How does [Your Company Name] prepare for and respond to regulatory examinations and audits? |

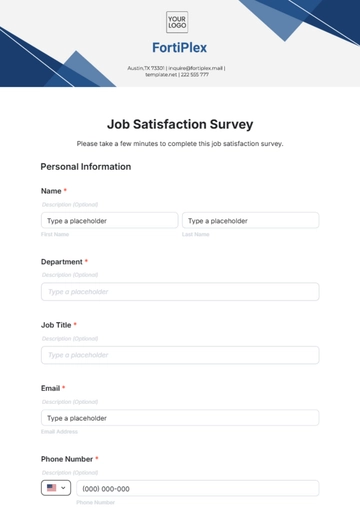

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Elevate your AML practices with Template.net's Operations Anti-Money Laundering Survey Template. It's editable, customizable and designed for ultimate user convenience, allowing you to easily input data and adjust details as required. Editable in our Ai Editor Tool for precise specifications, this template is a game-changer for your business. Don't miss out, streamline your operations today to drive the success of tomorrow.