Free Operations Vendor Risk Assessment

I. Introduction

This assessment aims to establish a comprehensive framework for the systematic evaluation and management of potential risks associated with our vendor relationships at [Your Company Name]. Recognizing the integral role vendors play in our operations, the assessment is designed to proactively identify and mitigate risks that could impact our organizational, operational, and financial resilience. By delineating the framework for evaluating vendor risks, we lay the groundwork for informed decision-making and the implementation of strategic risk mitigation strategies. This assessment underscores our commitment to maintaining a vigilant and resilient vendor ecosystem aligned with our organizational objectives.

II. Vendor Information

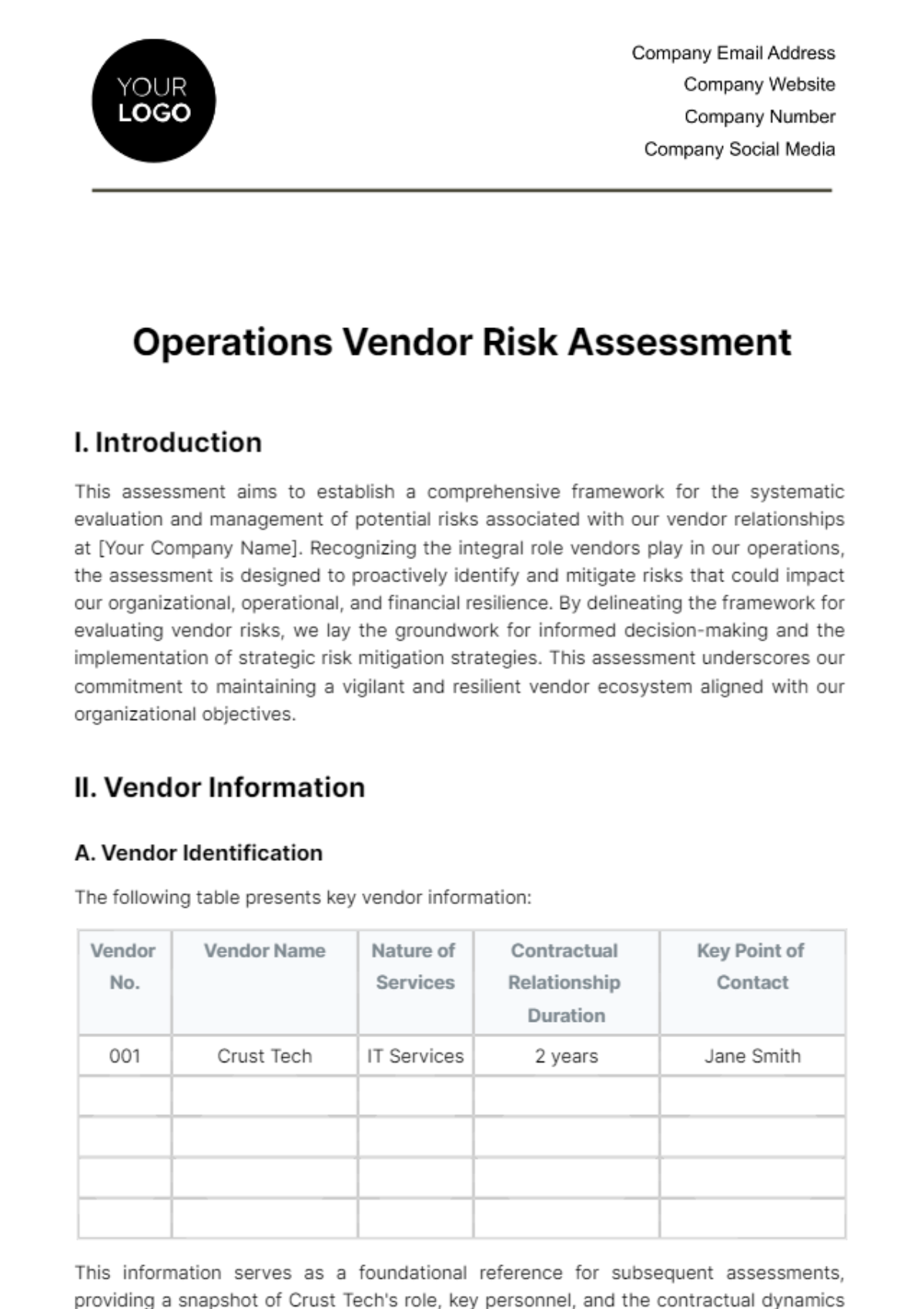

A. Vendor Identification

The following table presents key vendor information:

Vendor No. | Vendor Name | Nature of Services | Contractual Relationship Duration | Key Point of Contact |

|---|---|---|---|---|

001 | Crust Tech | IT Services | 2 years | Jane Smith |

This information serves as a foundational reference for subsequent assessments, providing a snapshot of Crust Tech's role, key personnel, and the contractual dynamics that form the basis of our engagement.

B. Service/Product Description

The following table outlines the vendor service/product description:

Vendor No. | Description of Services/ Products | Criticality to Our Operations | Key Dependencies on Vendor Deliverables |

|---|---|---|---|

1 | High | Timely delivery of software updates | IT Services for network maintenance and support |

The varied details encompass the description of services/products they provide, the criticality of these offerings to our operations, and the key dependencies we have on the deliverables. This granular exploration offers a nuanced understanding of the services/products the vendor brings to the table and their significance in the context of our operational dependencies and critical functions.

III. Vendor Risk Assessment

A. Organizational Risk

Governance Issues

Lack of transparency in ownership and governance structures may lead to conflicts of interest and decision-making challenges. Without clear lines of authority, crucial decisions may be delayed or influenced by factors not aligned with our operational objectives.

Legal and Compliance Gaps

Non-compliance with industry-specific regulations and legal requirements poses significant risks. Failure to adhere to established standards may result in legal consequences, financial penalties, and reputational damage for both the vendor and our organization.

Reputation Concerns

A negative industry reputation or a history of ethical issues may impact the vendor's reliability and trustworthiness. This can result in a lack of confidence from our stakeholders, affecting the overall perception of our organization's commitment to ethical business practices.

B. Operational Risk

Service Delivery Reliability

Inconsistencies in service delivery, failure to meet service level agreements (SLAs), or a history of subpar performance can directly impact the quality of our operations. This risk may lead to customer dissatisfaction, operational disruptions, and potential financial losses.

Business Continuity Issues

A lack of robust business continuity and disaster recovery plans increases the vulnerability to operational disruptions. This risk may result in extended downtime, affecting our ability to deliver products or services and causing reputational harm.

Dependency Risks

Overreliance on sub-vendors introduces complexities and potential vulnerabilities in the overall service/product delivery process. A failure or disruption in the operations of sub-vendors may cascade into significant challenges for our organization.

C. Financial Risk

Financial Instability

Weak financial indicators, such as liquidity issues or a history of financial distress, pose a risk to the vendor's ability to fulfill contractual obligations. Financial instability may lead to service disruptions, contract renegotiations, or, in extreme cases, the vendor's insolvency.

Non-Transparent Pricing

Lack of transparency in the pricing structure introduces uncertainties and potential financial risks. Hidden costs, unexpected fee structures, or unclear contractual terms may lead to budgetary overruns, impacting the financial health of our organization.

IV. Risk Mitigation Strategies

A. Organizational Risk Mitigation

To address the identified organizational risks, the following mitigation strategies have been identified:

Transparency Enhancement

Implement measures to enhance transparency in ownership and governance structures. This may involve contractual agreements requiring vendors to provide clear documentation of decision-making processes and organizational structures.

Contractual Compliance Assurance

Include stringent contractual clauses that enforce compliance with industry-specific regulations. Regular audits and assessments can ensure ongoing adherence, reducing the risk of legal and compliance gaps.

Reputation Management Collaboration

Collaborate with vendors to actively manage and improve their industry reputation. Establishing a joint communication strategy and monitoring mechanisms can mitigate reputation concerns and enhance trustworthiness.

B. Operational Risk Mitigation

To mitigate operational risks, the following strategies are proposed:

Performance Monitoring Framework

Implement a robust performance monitoring framework to track and assess the vendor's service delivery. Regular performance reviews, SLA adherence assessments, and customer feedback mechanisms contribute to early issue detection.

Business Continuity Planning

Collaborate with vendors to develop and regularly update comprehensive business continuity and disaster recovery plans. This proactive approach ensures operational resilience in the face of unforeseen disruptions.

Diversification of Dependencies

Mitigate dependency risks by exploring opportunities to diversify dependencies on sub-vendors. A strategic evaluation of the vendor ecosystem can identify areas where dependencies can be minimized or diversified.

C. Financial Risk Mitigation

To address financial risks, the following strategies are recommended:

Financial Health Monitoring

Establish a continuous monitoring system to assess the financial health of vendors. Regular financial reviews, credit checks, and ongoing assessments contribute to early identification of potential financial instability.

Transparent Contractual Agreements

Ensure transparency in contractual agreements, particularly regarding pricing structures. Clear and transparent contractual terms, including a comprehensive breakdown of costs, prevent unexpected financial implications.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Manage vendor risks effectively with the Operations Vendor Risk Assessment Template only on Template.net! This editable template is fully adaptable, allowing tailoring to specific vendor relationships. Utilize our customizable features for precision in assessment. Employ our AI Editor Tool to refine the assessment, ensuring alignment with your risk management practices!