Free Operations Risk Management Policy

I. Introduction

At [Your Company Name], we recognize the imperative role of a robust Operations Risk Management Policy in sustaining efficient operations and elevating our service delivery. This sets the stage for comprehensive insights, ensuring a thorough understanding of the policy's overarching purpose and its cascading impact on our organizational resilience.

A. Policy Rationale

The rationale behind this management policy is rooted in our commitment to proactively identify, assess, and mitigate potential risks inherent in our operations. By establishing a clear framework and structured approach, we aim to foster a culture of risk awareness, ensuring that all stakeholders understand their role in safeguarding the integrity and continuity of our operations.

B. Strategic Alignment

This policy aligns strategically with [Your Company Name]'s broader organizational goals. By acknowledging and addressing operational risks, we bolster our ability to achieve sustained growth, enhance service quality, and fortify our position as a responsible and resilient entity within our industry.

C. Scope and Applicability

Scope: This policy's scope extends across all facets of [Your Company Name]'s operations, encompassing processes, personnel, technology, and external factors that may impact our functioning.

Applicability: All employees, from the executive level to front-line staff, are bound by this policy. Contractors, partners, and other entities engaging in operations with [Your Company Name] are expected to align with these risk management principles.

D. Policy Objectives

The objectives of this policy are:

Mitigation of Potential Risks: The primary objective is to systematically mitigate potential risks, safeguarding our operations from disruptions and ensuring business continuity.

Establishment of a Risk-Aware Culture: Foster a culture of risk awareness and responsibility among all employees, encouraging proactive identification and reporting of potential risks.

Enhancement of Decision-Making: Enable informed decision-making by integrating risk evaluation into our strategic and operational processes.

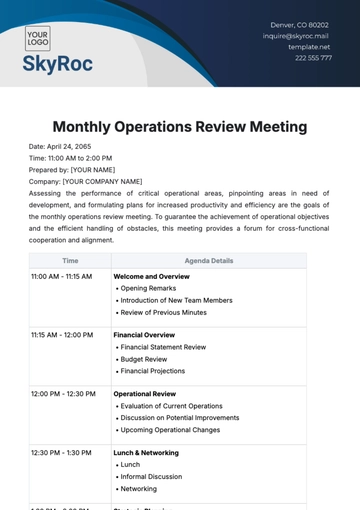

II. Organizational Structure and Responsibilities

The table below outlines the roles and responsibilities integral to the implementation of our policy:

Position/Role | Responsibilities |

|---|---|

CEO | Oversee risk management process, strategic decision making |

Risk Management Officer | Implement risk management strategies, procedures, assess risks |

Employees | Participate in training, adhere to risk management policies |

In our organizational context, the CEO assumes a crucial role as the overseer of the risk management process. Their responsibility extends beyond strategic decision-making; it encompasses setting the tone for a risk-aware culture and ensuring that risk considerations are integrated into overarching business strategies.

The Risk Management Officer serves as the frontline executor, translating strategic risk objectives into tangible actions. They play a vital role in implementing risk management strategies and procedures while conducting ongoing risk assessments to proactively identify potential threats.

The employees, collectively forming the backbone of daily operations, are vital participants in the risk management process. Their engagement in training programs ensures a collective understanding of risk management principles, fostering a culture where each individual is not just aware of potential risks but actively contributes to mitigating them.

This delineation of roles establishes a collaborative approach, where risk management becomes an embedded aspect of our organizational culture. The strategic oversight of the CEO, operational execution by the Risk Management Officer, and active participation of every employee collectively contribute to a resilient and risk-aware organizational environment.

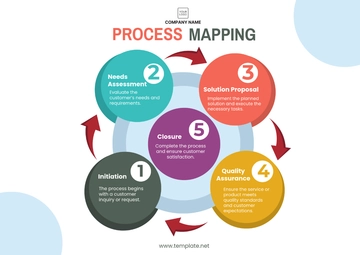

III. Decision Making Process

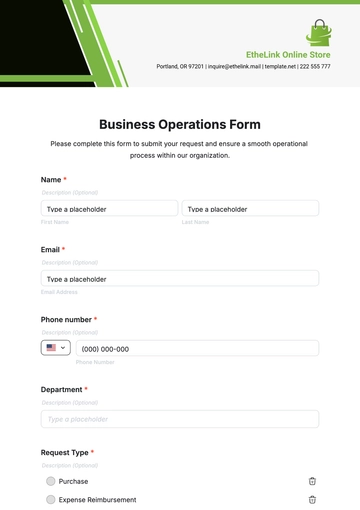

The Decision-Making Process within our Operations Risk Management Policy serves as a dynamic framework, guiding our stakeholders through a systematic approach to evaluate, decide, and implement actions in the face of potential risks.

A. Evaluation of Potential Risks and Benefits

In navigating the complexities of decision-making, our stakeholders are tasked with a comprehensive evaluation of potential risks and benefits associated with each option. This involves a nuanced analysis, considering both short-term gains and long-term consequences. By fostering a proactive identification of risks at this initial stage, we empower our decision-makers to make well-informed choices.

B. Choosing an Alternative Decision

Once potential risks and benefits are thoroughly evaluated, stakeholders proceed to choose an alternative decision that best aligns with our organizational objectives and risk tolerance. This step involves a careful balance between risk mitigation strategies and the pursuit of opportunities. By fostering a culture of adaptability and forward-thinking, we position ourselves to navigate challenges while maximizing potential rewards.

C. Implementation of the Decision

The chosen decision is then implemented with precision and efficiency. This phase emphasizes the importance of clear communication, coordinated execution, and a commitment to the principles outlined in our risk management policy. Through a seamless integration of risk considerations into the implementation process, we reinforce our dedication to operational resilience.

D. Review of Outcomes and Consequences

Post-implementation, our stakeholders engage in a thorough review of outcomes and consequences. This retrospective analysis provides valuable insights into the effectiveness of the chosen decision, allowing us to refine our approach based on real-world outcomes. Continuous learning from both successes and challenges is integral to our adaptive risk management culture.

IV. Ethical Standards and Conduct

A. Adherence to Laws and Regulations

Compliance as a Pillar: Adhering to all applicable laws and regulations is non-negotiable. It serves as a foundational pillar of our ethical framework, ensuring that our operations remain within legal bounds.

Continuous Monitoring: We commit to continuous monitoring and updates to align our practices with any changes in laws or regulations, ensuring ongoing compliance and legal resilience.

B. Maintenance of High Levels of Integrity and Honesty

Integral Components: Integrity and honesty are integral components of our organizational character. Every decision, action, and interaction is guided by these principles, fostering trust among stakeholders.

Cultivating Trust: The maintenance of high levels of integrity and honesty not only fulfills ethical obligations but also actively contributes to the cultivation of trust among employees, clients, and partners.

C. Respect for Rights and Dignity

Dignity as a Priority: We affirm our commitment to respecting the rights and dignity of every individual associated with [Your Company Name], recognizing diversity, and fostering an inclusive and supportive environment.

Inclusive Decision-Making: This commitment extends to our decision-making processes, ensuring that all perspectives are considered, and decisions are made with a genuine understanding of their impact on individuals.

D. Support and Fostering of Ethical Decision-Making

Ethical Decision-Making Culture: We actively support and foster a culture of ethical decision-making at every level of our organization. This includes providing resources, training, and guidance to empower employees to make ethical choices.

Accountability Mechanisms: Accountability is woven into the fabric of our ethical framework. Mechanisms are in place to ensure that individuals are held accountable for their decisions and actions, reinforcing the importance of ethical conduct.

V. Communication and Information Management

A. Establishing Clear Lines of Communication

Transparency as a Core Value: Transparent communication is a core value that underpins our risk management strategy. Clear lines of communication are established to facilitate the seamless flow of information throughout the organization.

Accessibility of Information: We prioritize making information accessible to relevant stakeholders, ensuring that everyone is well-informed about potential risks, risk mitigation strategies, and other pertinent information.

B. Maintaining Confidentiality of Sensitive Information

Safeguarding Sensitive Data: Confidentiality is paramount, especially when dealing with sensitive information. Robust measures are in place to safeguard this information, limiting access to authorized personnel only.

Secure Information Transmission: Whether internal or external, information transmission occurs through secure methods, minimizing the risk of unauthorized access or data breaches.

C. Timely and Transparent Communication During Emergencies

Proactive Communication Protocols: In times of emergencies, timely and transparent communication is prioritized. Well-defined protocols ensure that relevant information is disseminated promptly to mitigate the impact of unforeseen events.

Accurate and Transparent Reporting: Accurate reporting of incidents, risks, and their potential impact is crucial. Transparent communication during emergencies builds trust among stakeholders and allows for a collective and coordinated response.

D. Periodic Communication Training and Drills

Training for Effective Communication: Employees undergo periodic training to enhance their communication skills, especially in conveying risk-related information. This ensures that the organization is well-prepared for effective communication in various scenarios.

Drills to Test Communication Plans: Regular drills are conducted to test the efficacy of communication plans during simulated risk scenarios. This proactive approach allows for refinement and improvement based on practical insights gained from these exercises.

VI. Risk Assessment and Mitigation

A. Identifying Potential Risks

Proactive Identification: The organization fosters a culture of proactive risk identification. Employees at all levels are encouraged to identify and report potential risks associated with their respective roles and operational domains.

Regular Risk Assessment Sessions: Regular risk assessment sessions are conducted, bringing together relevant stakeholders to systematically identify and evaluate potential risks across various operational aspects.

B. Assessing Severity and Likelihood of Risks

Holistic Assessment Criteria: Risks are assessed based on a holistic set of criteria, considering both their severity and likelihood. This ensures a nuanced understanding of the potential impact and probability of occurrence.

Quantitative and Qualitative Measures: Both quantitative and qualitative measures are employed in the risk assessment process, providing a comprehensive view that aids in prioritizing and addressing risks based on their magnitude and potential consequences.

C. Developing Strategies to Mitigate Identified Risks

Tailored Mitigation Strategies: Once risks are identified and assessed, customized mitigation strategies are developed. These strategies are tailored to the specific nature of each risk, considering its unique characteristics.

Collaborative Strategy Development: The development of mitigation strategies is a collaborative effort, involving key stakeholders to garner diverse perspectives and ensure a well-rounded approach to risk mitigation.

D. Monitoring and Review of Implemented Risk Management Strategies

Continuous Monitoring: Implemented risk management strategies are subject to continuous monitoring. This proactive approach ensures that the strategies remain effective in the face of evolving operational dynamics.

Periodic Review Sessions: Periodic review sessions are conducted to assess the ongoing relevance and effectiveness of implemented strategies. Any necessary adjustments are made to enhance their efficacy based on evolving risk scenarios.

VII. Conclusion

In conclusion, this Operations Risk Management Policy serves as a guide for all employees within [Your Company Name]. Our goal is to mitigate operational risks, maintain high standards of ethical conduct, make informed decisions, and foster healthy communication lines for the safety and productivity of our operations and everyone involved. We reaffirm our commitment to allocating resources judiciously and resolving conflicts efficiently to build a safer, stronger, and more resilient organization.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Mitigate risks effectively with the Operations Risk Management Policy Template only here at Template.net! This comprehensive policy template is fully editable and customizable, allowing tailoring to your organizational context. Employ our AI Editor Tool strategically, ensuring a well-crafted and customized risk management approach that aligns perfectly with your operational goals!