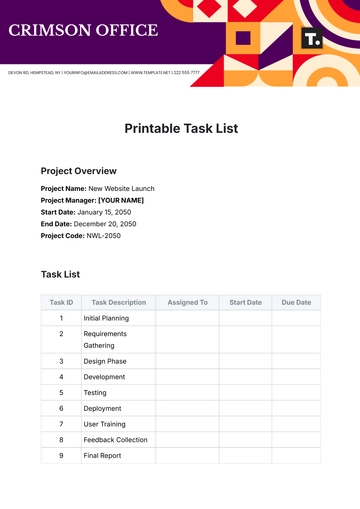

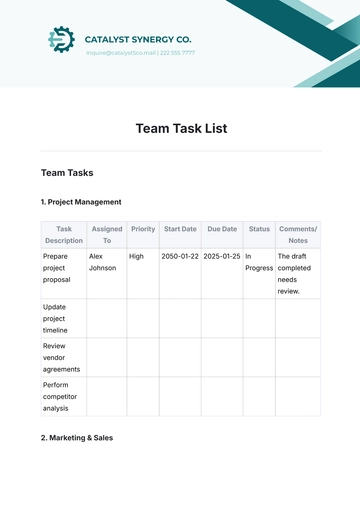

Free Due Diligence Request List

Name | Date |

[YOUR NAME] | [DATE] |

Company Name |

[YOUR COMPANY NAME] |

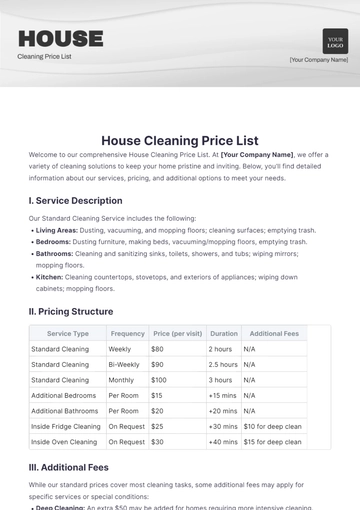

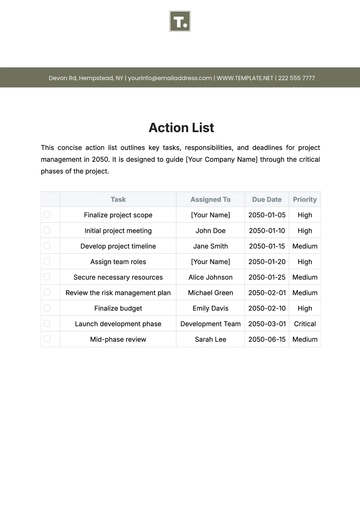

This list serves as an exhaustive checklist to assist in the process of due diligence when considering significant business decisions, such as investments, acquisitions, or partnerships. Its primary function is to guide users in gathering important financial records, legal documents, operational information, and strategic plans for thorough examination and risk assessment of the potential deal.

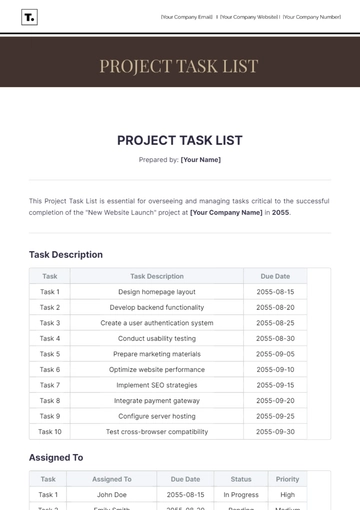

Due Diligence Request Items

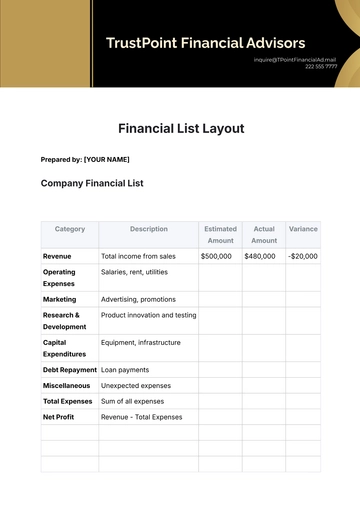

Category | Document Type | Description | Relevance |

Financial Documents | Financial Statements | Last 3-5 years of balance sheets, income statements, and cash flow statements. | Reflects the historical financial stability of the company |

Financial Documents | Tax Returns | Recent tax returns. | Verifies financial performance. |

Financial Documents | Debt Disclosure | Information on existing debts, loans, and liabilities. | Highlights financial obligations. |

Legal Documents | Incorporation Documents | Articles of Incorporation, business licenses, and permits. | Authenticates the legal status of the business. |

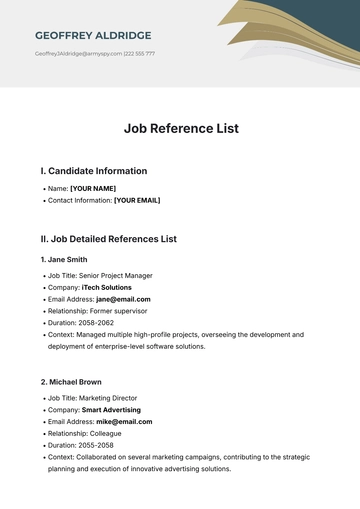

Legal Documents | Contracts and Leases | Active agreements, including customer contracts, leases, and vendor agreements. | Outlines ongoing commitments and contractual obligations. |

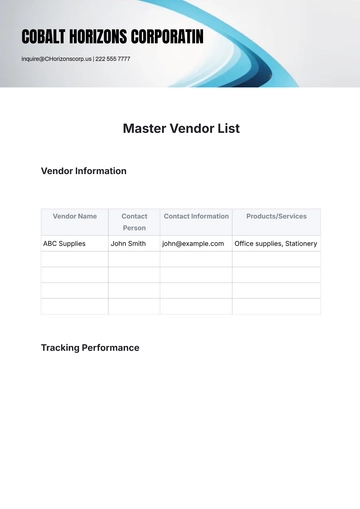

Operational Documents | Organizational Chart | A breakdown of the company’s structure and key personnel. | Provides insights into management structures and decision-making processes. |

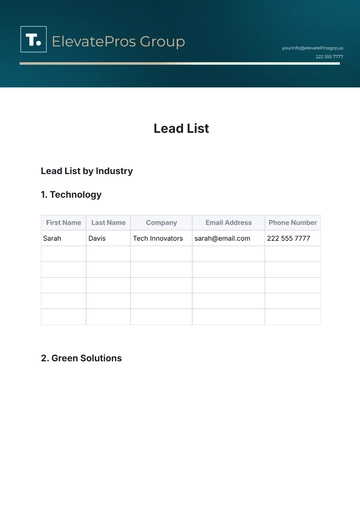

Operational Documents | Supplier and Customer Lists | Information on major suppliers and customers, including contract terms. | Assesses the reliability of supply chains and customer relationships. |

Strategic Documents | Business Plan | The company’s strategic plan for growth and development. | Offers understanding of the company's future prospects and stability. |

Strategic Documents | Market Analysis | Research on market trends, competition, and target customer segments. | Helps recognize the company's position within the industry. |

Notes | Industry-specific or deal-specific information | Specific concerns, additional requests, or unique aspects of the deal. | Ensures no unique or critical aspects of the deal are overlooked. |

Additional Reminders

Consistency and accuracy are paramount in the due diligence process.

All relevant stakeholders should be brought into the process early and should have a say in the due diligence requirements.

Due diligence is not a one-size-fits-all. The exact documents and information required may depend upon the nature and specifics of the deal.

Confidentiality should be maintained throughout the process. Boundaries should be established for what information can be shared and with whom.

Ensure to factor in the information gathered during due diligence in your decision-making process.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Welcome to the ultimate hub for Due Diligence Request List Template solutions! Unlock seamless Due Diligence processes with our meticulously crafted, editable, and customizable templates. Harness the power of our Ai Editor Tool to streamline your workflow effortlessly. Explore a range of essential templates at Template.net. Elevate your Due Diligence game today!