Free Reporting Agent List

Company: [Your Company Name]

Date : [Date]

Overview

This list serves as a comprehensive guide illuminating the importance of Reporting Agent Lists in the tax filing process. It helps individuals and businesses alike understand how a reporting agent can simplify their tax filing process, and provides a guideline on choosing the appropriate Reporting Agent. Below are different sections capturing key aspects of a Reporting Agent, their benefits, and how to choose one, providing clear, concise, and useful information.

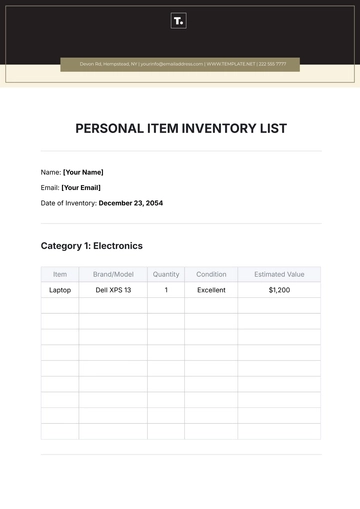

Benefits of Using a Reporting Agent

Benefit | Description |

|---|---|

Expert Guidance | Reporting agents provide expert guidance, navigating intricacies of tax regulations. |

Time Efficiency | They save you time by outsourcing your tax filing process. |

Accuracy Assurance | They ensure your filings are accurate, thus reducing the risk of errors. |

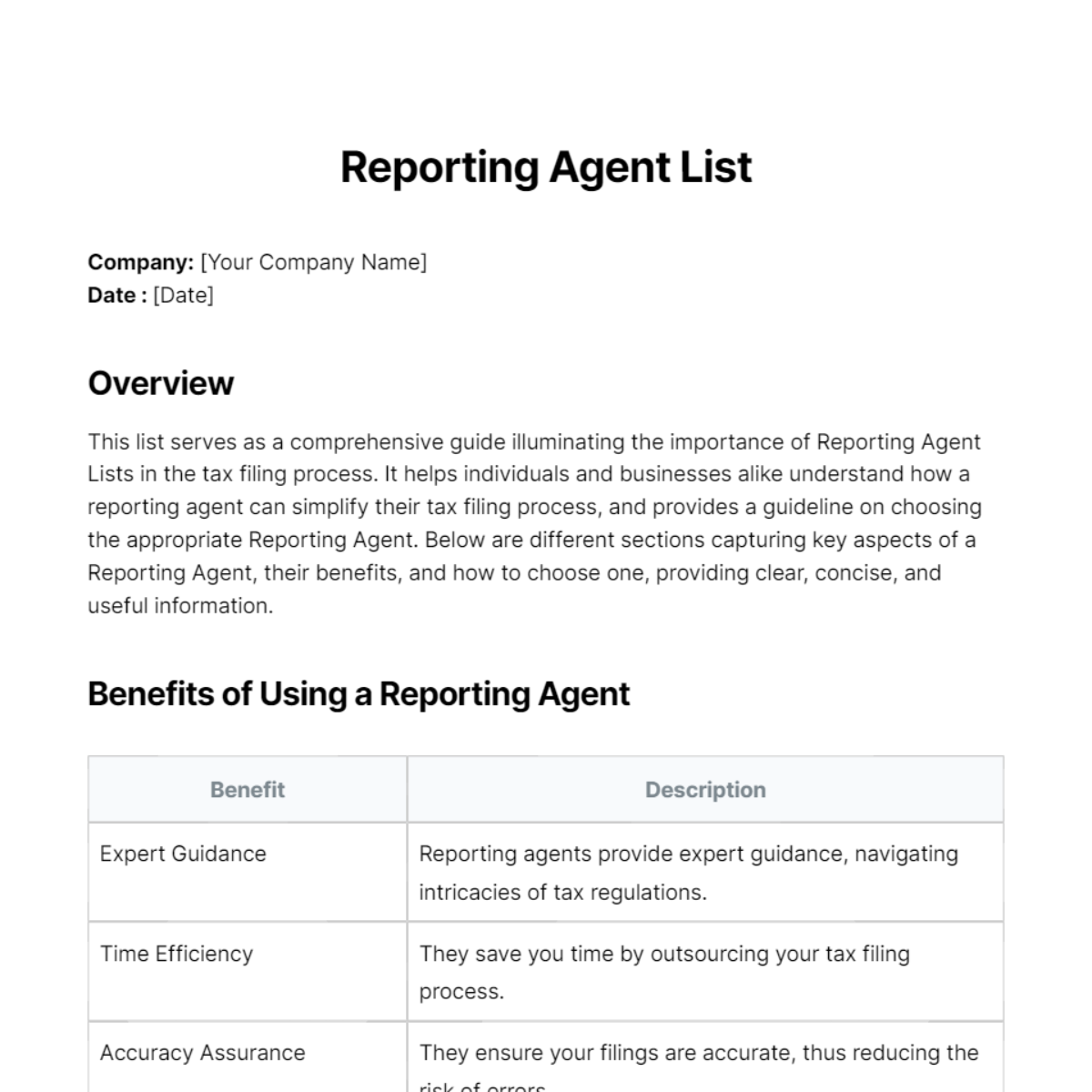

How to Choose the Right Reporting Agent

Factor | Consideration |

|---|---|

Credentials | Choose agents with relevant credentials and certifications. |

Client Reviews | Check previous client reviews. |

Cost | While considering cost, prioritize value over price. |

Notes:

Reporting Agent Lists are instrumental in choosing suitable professionals for your tax filing needs.

Ensure your chosen Reporting Agent possesses the relevant experience and qualification to effectively handle your tax matters.

Remember to review the credibility and reputation of the Reporting Agent before engaging their services.

Always prioritize value over cost when selecting a Reporting Agent. Consider their professional competency and the peace of mind their service provides by reducing the challenges and risks associated with tax filing.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing our Reporting Agent List Template, exclusively crafted for efficiency. Accessible on Template.net, this editable and customizable template streamlines your reporting process. Tailor it effortlessly with our Ai Editor Tool, ensuring a seamless experience. Elevate your reporting game with this user-friendly solution. Simplify, customize, and excel with every report.