Free Finance Payment Processing Checklist

The purpose of this checklist is to facilitate efficient and accurate financial payment processing within [Your Company Name]. This checklist is designed to assist you in efficiently managing your financial transactions, minimizing errors, and enhancing overall financial control. By completing specific tasks, you ensure transparency, accuracy, and reliability in your financial transactions.

Objective 1: Streamline the financial payment process

Objective 2: Minimize potential errors and financial discrepancies

Objective 3: Maintain records effectively

Objective 4: Ensure compliance with financial regulations

Subject: Finance Payment Processing

1. Invoice Processing

Check the supplier's invoice for accuracy

Enter invoice details into the accounting system

Match invoices to purchase orders and delivery notes

Approve invoices for payment

File paid invoices appropriately for future references

2. Payment Authorization

Verify the details of the payment

Check the availability of funds

Authorize payment within preset limits

Record authorized payments in the accounting system

Ensure that the payment is made on time

3. Record Maintenance and Reconciliation

Document all transactions in the general ledger

Reconcile bank statements with the general ledger

Rectify discrepancies, if any

Maintain proper receipts and documentation

Archive financial records for the specified period

4. Compliance and Financial Reporting

Check compliance with company policies and financial regulations

Prepare timely financial reports

Translate financial data into understandable management reports

Review and publish financial statements

Conduct internal audits to ensure compliance

Prepared by: [Your Name]

Date: [Month Day, Year]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Experience seamless financial transactions with Template.net’s Finance Payment Processing Checklist. This editable and customizable format ensures accuracy and oversight. Make it your own, editable in our Ai Editor Tool. Increase efficiency and establish more robust financial control today. Let us revolutionize your financial management system.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

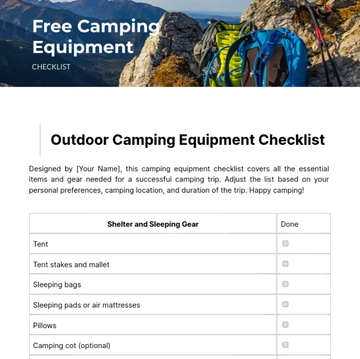

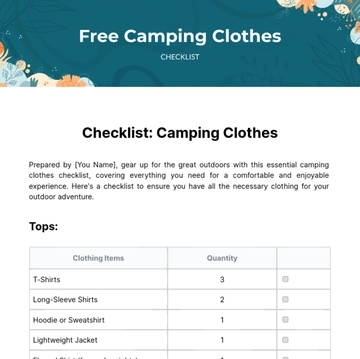

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

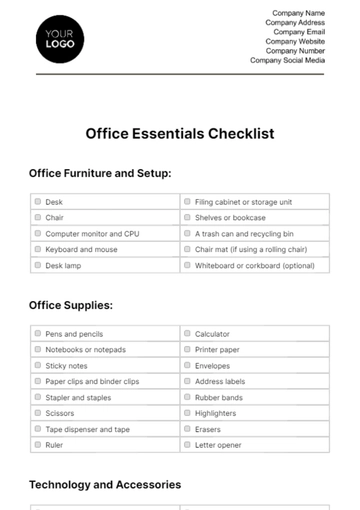

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

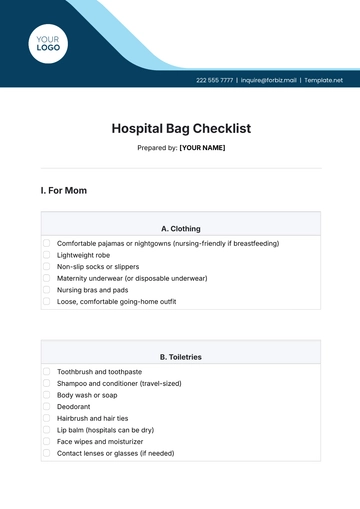

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

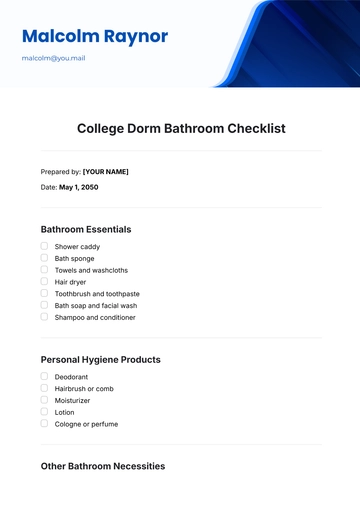

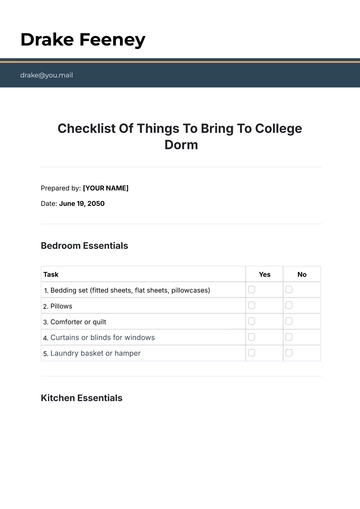

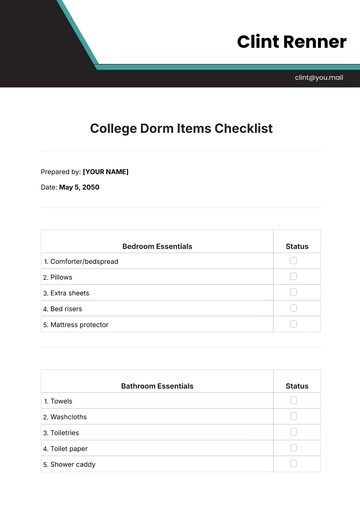

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist