Free Accounts Payment Protocol

TABLE OF CONTENTS

Introduction.........................................................................................................3

Accounts Payable Process Overview................................................................4

Invoice Receipt and Verification.........................................................................5

Payment Processing............................................................................................7

Records and Reporting........................................................................................8

Compliance and Audits........................................................................................9

Amendments.........................................................................................................10

Introduction

This document presents the comprehensive protocols and procedures for managing accounts payable at [Your Company Name]. The purpose of these guidelines is to establish a standardized approach for the efficient, timely, and accurate processing of all accounts payable transactions. This ensures that financial obligations to suppliers and creditors are met in accordance with contractual terms and regulatory requirements. The scope of this document covers all aspects of accounts payable, from invoice receipt to payment processing and record keeping.

Importance of Effective Accounts Payable Management

Effective accounts payable management is crucial for maintaining healthy cash flow and fostering strong supplier relationships. It plays a pivotal role in optimizing working capital and ensuring financial stability. By adhering to these protocols, [Your Company Name] aims to prevent late payments, avoid potential penalties, and capitalize on any early payment discounts. This section highlights the strategic significance of accounts payable in overall financial management and its impact on the company's profitability and reputation.

Compliance and Ethical Standards

This document also emphasizes the importance of adhering to regulatory compliance and ethical standards in all accounts payable operations. [Your Company Name] is committed to upholding the highest levels of integrity and transparency in its financial practices. This includes compliance with all relevant financial regulations, accounting standards, and internal policies. Adherence to these standards safeguards the company against legal issues and fosters trust among suppliers, stakeholders, and regulatory bodies.

Document Organization

The document is organized into several sections, each focusing on a specific aspect of accounts payable management. Each section provides detailed procedures and guidelines, ensuring a comprehensive understanding of the accounts payable process. The sections include Invoice Receipt and Verification, Payment Processing, Records and Reporting, and Compliance and Audits. This structure allows for easy navigation and reference, ensuring that relevant information is readily accessible to all staff involved in the accounts payable process.

This document will be subject to regular review and updates to reflect changes in business practices, technological advancements, and regulatory requirements. This commitment to continuous improvement ensures that the accounts payable protocols remain effective, efficient, and aligned with the best practices in the industry.

Accounts Payable Process Overview

Accounts payable at [Your Company Name] involves the systematic management of the company's short-term liabilities to its suppliers, service providers, and creditors. This function is a critical component of the company's overall financial management strategy, as it directly impacts cash flow management, working capital optimization, and maintaining strong supplier relationships. Efficient accounts payable processes ensure that the company can meet its financial obligations on time and maintain a positive credit standing in the market.

Components of the Accounts Payable Process

The accounts payable process can be broken down into several key components:

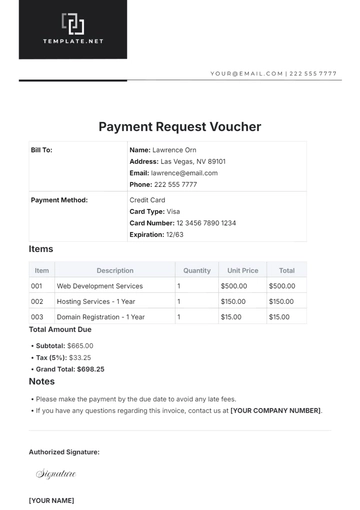

Invoice Reception: Invoices are received through designated channels, including electronic and paper formats. This initial step involves the collection and logging of invoices into the accounts payable system for further action.

Invoice Processing: Each invoice is thoroughly reviewed and processed. This involves verifying invoice details, ensuring compliance with procurement policies, and matching invoices with corresponding purchase orders and delivery receipts.

Payment Authorization: Once an invoice is validated and approved, it undergoes a payment authorization process. This includes scrutiny by the appropriate managerial levels to ensure the legitimacy and accuracy of the payment request.

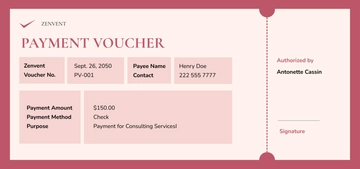

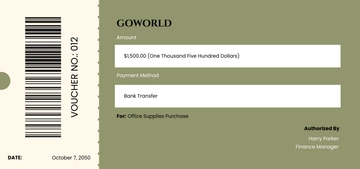

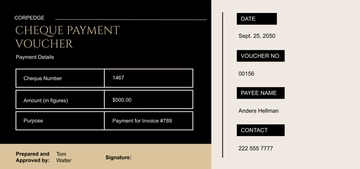

Payment Execution: Upon authorization, the payment is scheduled and executed according to the agreed terms with the supplier. Payment methods include electronic transfers, checks, or other agreed-upon means.

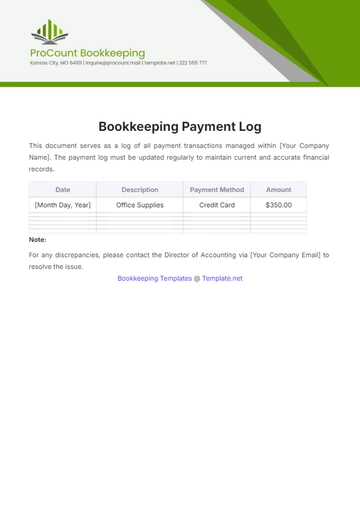

Reconciliation and Reporting: Post-payment, transactions are reconciled against financial records to ensure accuracy. Periodic reporting is conducted to provide insights into accounts payable performance, including metrics on payment efficiency, supplier payment trends, and cash flow impact.

Integration with Other Financial Systems

The accounts payable process is closely integrated with other financial systems within [Your Company Name], including procurement, budgeting, and general ledger systems. This integration is crucial for providing a comprehensive view of the company's financial commitments and spending patterns. It also facilitates accurate financial reporting and analysis, aiding in strategic financial decision-making.

Automation and Technological Tools

[Your Company Name] leverages advanced technology and automation tools in its accounts payable process. This includes the use of enterprise resource planning (ERP) systems, automated invoice processing software, and digital payment platforms. The adoption of these technologies streamlines the accounts payable process, reduces the likelihood of human error, enhances data accuracy, and improves overall efficiency.

Continuous Monitoring and Improvement

The accounts payable process is subject to continuous monitoring and performance evaluation. Key performance indicators (KPIs) are established to measure process efficiency, accuracy, and timeliness. Regular audits and reviews are conducted to identify areas for improvement, ensuring that the accounts payable function evolves in line with industry best practices and technological advancements.

Invoice Receipt and Verification

This detailed Invoice Receipt and Verification process at [Your Company Name] is designed to maintain the integrity and accuracy of the accounts payable function. It incorporates checks and balances at every stage, ensuring that only valid and verified invoices are processed for payment. This rigorous approach safeguards the company against financial discrepancies and contributes to efficient cash flow management.

Standard Procedure for Invoice Receipt

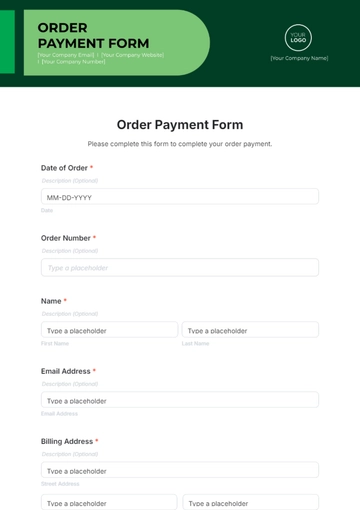

Upon receipt, every invoice directed to [Your Company Name] is immediately logged into the accounts payable system. This system acts as the central repository for all invoices and related documents. To ensure accuracy and timeliness, the following standard procedures are observed:

Electronic Receipt: Preferred method for invoice submission is electronic, via a designated email or through an online supplier portal. This method allows for quicker processing and better tracking.

Paper Invoice Handling: In cases where paper invoices are received, they are promptly scanned and digitized. The original paper copies are then filed for record-keeping, in compliance with regulatory requirements.

Initial Review: An initial review of each invoice is conducted upon receipt to verify basic information such as supplier details, invoice date, and invoice number.

Invoice Verification Process

Following the receipt and initial review, invoices undergo a comprehensive verification process. This multi-step process includes:

Purchase Order Matching: Invoices are matched against corresponding purchase orders to ensure the goods or services billed have been duly authorized and received.

Service or Goods Receipt Confirmation: Verification against delivery receipts or service completion reports is conducted to confirm that the billed goods or services have been received or rendered satisfactorily.

Accuracy Checks: Detailed checks are performed for accuracy in pricing, arithmetic calculations, and adherence to agreed terms, including discounts, taxes, and additional charges.

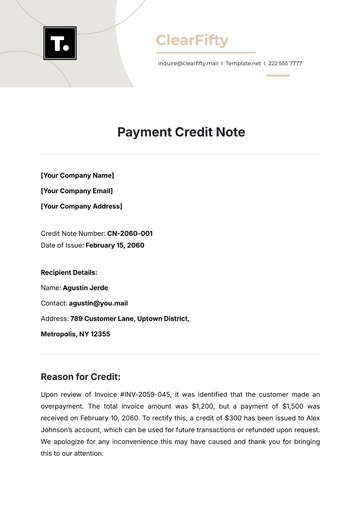

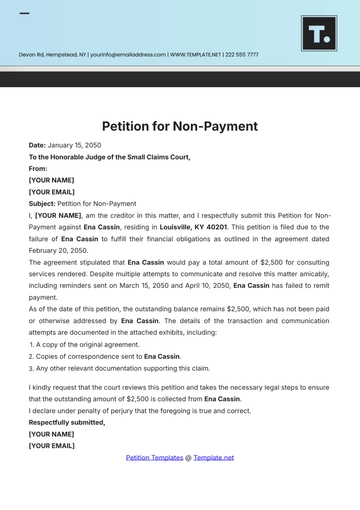

Discrepancy Resolution

In the event of discrepancies or inconsistencies in an invoice:

Supplier Contact: The supplier is contacted immediately for clarification or rectification. This may involve requesting a revised invoice or additional documentation.

Internal Consultation: Relevant departments, such as procurement or the receiving department, are consulted to resolve any disputes over quantities, quality, or service delivery.

Documentation: All communications and resolutions are fully documented for audit trails and future reference.

Approval Workflow

Post-verification, invoices are routed through a pre-defined approval workflow. This involves:

Departmental Approval: Invoices are forwarded to the respective department heads for confirmation of receipt and acceptance of goods or services.

Financial Authorization: The finance team conducts a final review for budgetary compliance and authorizes the invoice for payment.

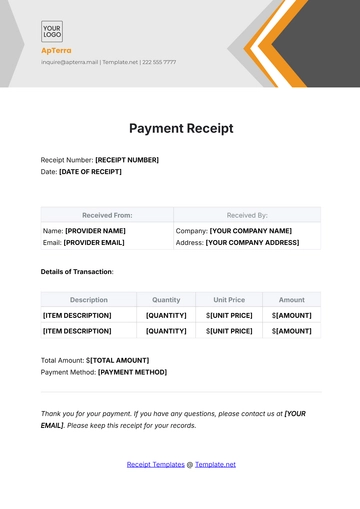

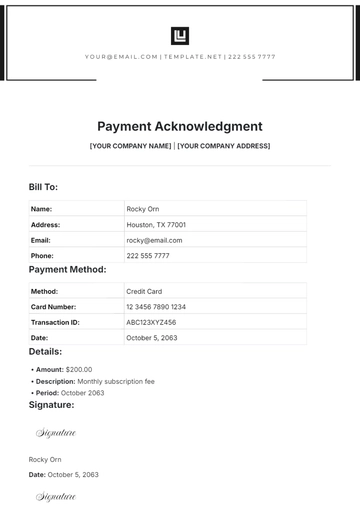

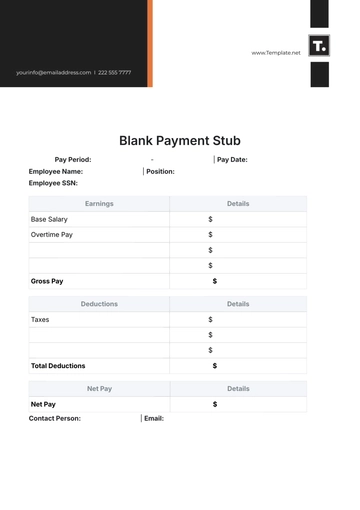

Data Entry and Record Keeping

Once approved, invoice details are entered into the financial accounting system. This includes coding each invoice to the appropriate expense category and cost center. Rigorous record-keeping is maintained, ensuring that all invoices and related documentation are stored securely for future reference and audits.

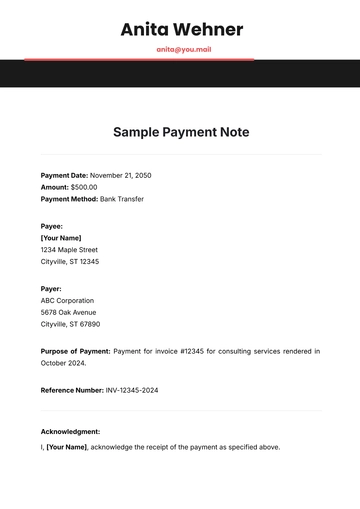

Payment Processing

These payment processing protocols at [Your Company Name] ensures a balance between efficient cash management and fulfilling our commitments to suppliers. This approach underpins our reputation for reliability and financial integrity in our business dealings.

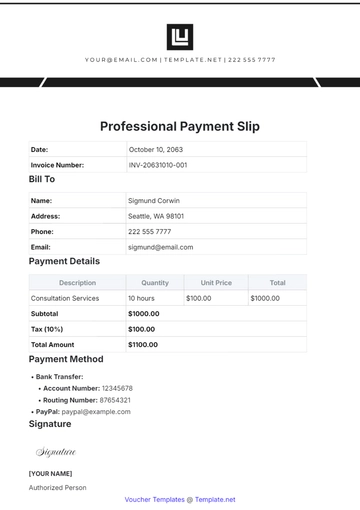

Payment Terms

Our standard payment terms are net [30 days] from the invoice date, unless alternative arrangements have been agreed upon with the supplier. This policy is designed to balance the company's cash flow requirements with the need to maintain strong supplier relationships. In certain cases, special terms such as early payment discounts or extended payment periods can be negotiated based on the supplier's policy or the nature of the business transaction.

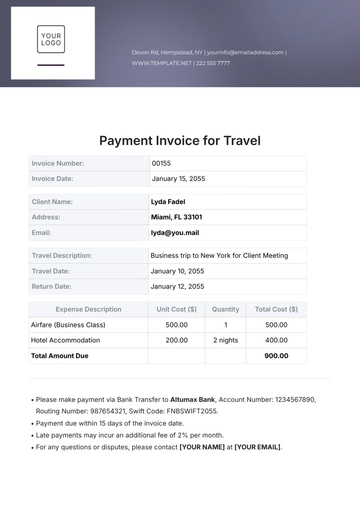

Payment Methods

We employ a variety of payment methods to accommodate different transaction requirements and preferences:

Electronic Funds Transfer (EFT): This is the primary method of payment, offering a fast, secure, and efficient means of transferring funds directly to the supplier’s bank account. EFT payments minimize processing time and are environmentally friendly as they reduce the need for paper-based transactions.

Company-Issued Checks: For suppliers who prefer traditional payment methods or in cases where EFT is not feasible, company-issued checks are provided. These checks are printed and signed following stringent security protocols to prevent fraud and ensure the integrity of transactions.

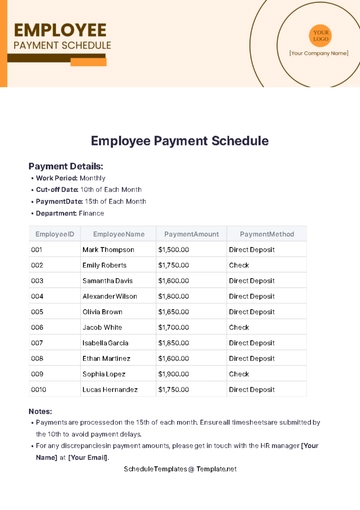

Payment Schedule

Our payment schedule is structured to ensure timely settlement of our financial obligations while managing cash flow effectively:

Bi-Weekly Processing: Payments are processed bi-weekly, with transaction dates set for the [1st and 15th of each month]. This regular schedule allows for predictable cash flow management and aids suppliers in their financial planning.

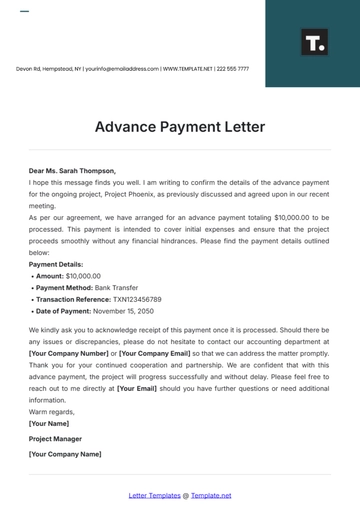

Payment Notification: Suppliers are notified in advance of the scheduled payment dates. This communication includes details of the invoices being paid and the mode of payment, providing transparency and clarity to our suppliers.

Expedited Payments: In instances where expedited payment is necessary, such as for urgent orders or to avail of early payment discounts, a special payment process is initiated. These cases are handled on an individual basis, ensuring that they meet the required criteria and receive the necessary approvals.

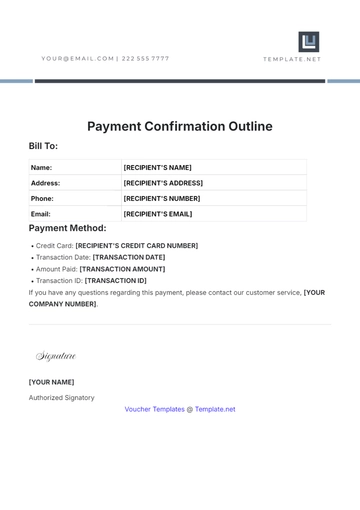

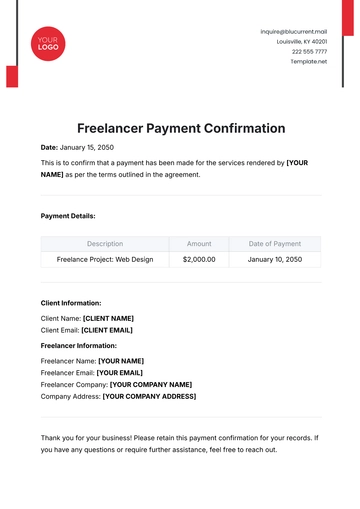

Payment Tracking and Confirmation

Each payment is meticulously tracked from initiation to completion. Suppliers receive payment confirmations along with relevant details such as payment amount, invoice numbers covered, and the expected date of fund availability. This process ensures both parties have a clear and up-to-date understanding of the payment status.

Internal Controls and Audits

Stringent internal controls are in place to oversee the payment process. This includes multiple levels of authorization for payments, regular audits of payment transactions, and reconciliation of payments with bank statements. These controls are essential for preventing errors, detecting potential fraud, and ensuring compliance with financial policies and regulatory requirements.

Records and Reporting

Through diligent record-keeping and robust reporting practices, [Your Company Name] ensures a high level of financial oversight and control. This not only aids in operational efficiency but also supports strategic financial planning and compliance with regulatory standards.

Record Keeping

Record-keeping practices are a cornerstone of our accounts payable process. Understanding the importance of accurate historical data for financial analysis, audits, and regulatory compliance, we adhere to the following protocols:

Duration of Record Retention: All invoices, payment records, and associated documentation are retained for a minimum period of [seven years]. This duration aligns with regulatory requirements and best practices for financial record-keeping.

Digital Archiving: To ensure durability and ease of access, all records are digitized and stored in a secure electronic format. This digital archiving includes scanned copies of paper invoices, digital payment records, and relevant correspondence.

Backup and Recovery: Regular backups of the accounts payable records are conducted to protect against data loss. Robust recovery procedures are in place to ensure data integrity and continuity in case of technical failures or other disruptions.

Access Control: Access to these records is strictly controlled and monitored. Only authorized personnel have access to this sensitive financial data, ensuring security and confidentiality.

Reporting

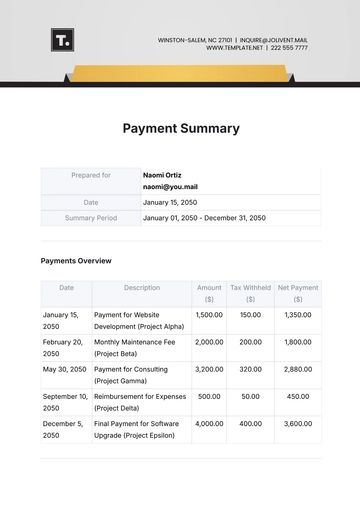

Effective reporting is critical for financial transparency and informed decision-making. Therefore, [Your Company Name] generates comprehensive monthly accounts payable reports, which include but are not limited to the following key data points:

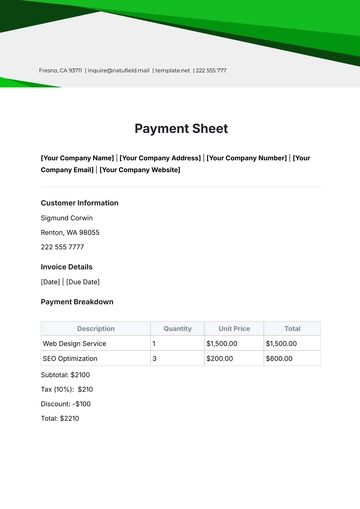

Report Item | Description |

|---|---|

Total Payable Amount | This represents the cumulative amount due to all suppliers within the reporting period. It provides insight into the company's short-term financial obligations. |

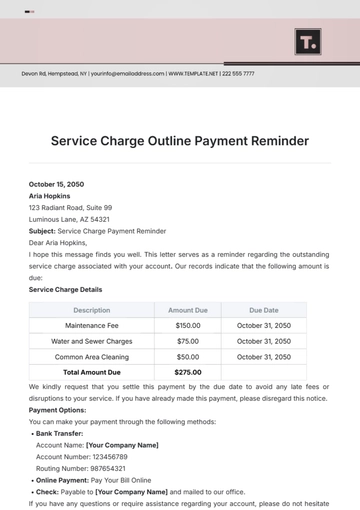

Additional elements included in our monthly reporting are:

Vendor Analysis: Breakdown of payables by vendor, highlighting major suppliers and the distribution of expenses.

Ageing Analysis: Classification of outstanding invoices by their due dates, providing visibility into overdue payments and potential cash flow impacts.

Payment Method Distribution: Analysis of payments made by different methods (EFT, checks, etc.), offering insights into operational efficiency and supplier preferences.

Discrepancy Reports: Summary of any discrepancies or issues identified during invoice processing and how they were resolved.

Reporting Tools and Distribution

The reports are generated using advanced accounting software, ensuring accuracy and efficiency. These reports are then reviewed by the finance team and distributed to relevant stakeholders, including department heads and senior management. This distribution not only fosters transparency but also aids in strategic planning and budgetary control.

Continuous Improvement in Reporting

[Your Company Name] is committed to the continuous enhancement of its reporting processes. Regular feedback is solicited from report users, and advances in reporting tools and techniques are continually evaluated to ensure our reports meet the evolving needs of the business.

Compliance and Audits

At [Your Company Name], strict adherence to compliance is a fundamental aspect of our accounts payable operations. Our commitment to compliance encompasses the following key areas:

Adherence to Accounting Standards: All processes align with Generally Accepted Accounting Principles (GAAP) and other relevant financial reporting standards. This ensures that our accounts payable practices are consistent, transparent, and accurate.

Regulatory Compliance: We diligently follow all applicable local, state, and federal regulations pertaining to financial transactions and reporting. This includes tax compliance, anti-money laundering laws, and any industry-specific financial regulations.

Internal Policies and Procedures: Our accounts payable processes are designed in accordance with internal policies and procedures that set forth guidelines for financial management, ethical conduct, and risk mitigation.

Supplier Compliance: We ensure that our suppliers also adhere to our compliance standards, including fair labor practices, environmental regulations, and ethical business practices.

Audits

Regular audits are an integral part of our financial governance. These audits serve to validate the integrity and accuracy of our accounts payable records and processes:

Internal Audits: Conducted periodically by our internal audit team, these reviews assess the effectiveness of existing accounts payable processes, identify areas for improvement, and ensure internal controls are functioning as intended.

External Audits: Independent external auditors are engaged to conduct annual audits. These provide an objective assessment of our financial practices, offer insights into industry best practices, and ensure compliance with external regulations.

Audit Reporting: Findings from both internal and external audits are documented comprehensively. Recommendations are reviewed, and actionable steps are taken to address any identified issues.

Compliance Monitoring

In addition to scheduled audits, continuous monitoring mechanisms are in place to ensure ongoing compliance. This includes regular reviews of transactional data, monitoring of compliance with payment terms, and keeping abreast of changes in financial regulations and standards.

Amendments

Our accounts payable protocol is a dynamic document that reflects the evolving nature of our business and the financial process:

Periodic Review: The protocol is subject to regular review to ensure its continued relevance and effectiveness. This review considers changes in business processes, technological advancements, and regulatory shifts.

Amendment Approval: Any amendments to the protocol are subject to approval by the senior management team and, ultimately, the Chief Financial Officer.

Communication of Amendments: Changes to the protocol are communicated in a timely manner to all relevant parties, including finance staff, other departments, and suppliers as necessary.

Document Version Control: Each amendment results in an updated version of the document, with a clear record of changes made and their effective dates. This ensures historical accuracy and accountability.

Stakeholder Engagement: Stakeholder feedback is actively sought and incorporated into the review process. This engagement ensures that the protocol remains aligned with the needs and expectations of both internal and external stakeholders.

Through these comprehensive compliance, audit, and amendment protocols, [Your Company Name] maintains the highest standards of financial integrity and accountability. This approach not only ensures compliance with current regulations and standards but also positions the company to adapt effectively to future changes in the financial environment.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Simplify your accounting tasks with Template.net's Accounts Payment Protocol Template. This editable and customizable template is designed to streamline your payment processes. It is fully editable in our AI Editor Tool to cater to your specific needs and business requirements. Enhance efficiency and maintain accuracy in managing your financial records with our versatile template.