Free Payroll Accounting Review

I. Introduction

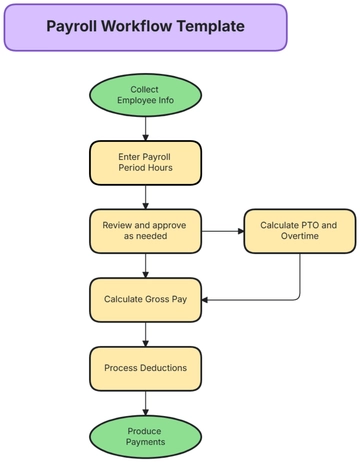

This report aims to illustrate the robustness and accuracy of the payroll systems at [Your Company Name]. The review results showed that we have incorporated rigorous protocols and checks to guarantee payroll disbursement precision and seamless compliance with payroll tax obligations. Our deftly managed data and in-depth verification mechanisms contribute to a remarkably low error rate in payroll disbursement. Precision-fueled payments in terms of salary, compensation, and deductions underscore our unfaltering commitment to fairness and transparency. Notably, efficient payroll tax management serves as a testament to our strict adherence to legal norms. By protecting the company from tax penalties and audits, we uphold our employees' trust in our legal stewardship, which in turn fosters a reliable work atmosphere. As such, our efforts not only reflect the acumen of our accounting team but also echo our dedication to our esteemed workforce.

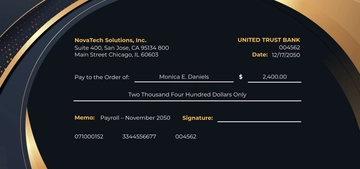

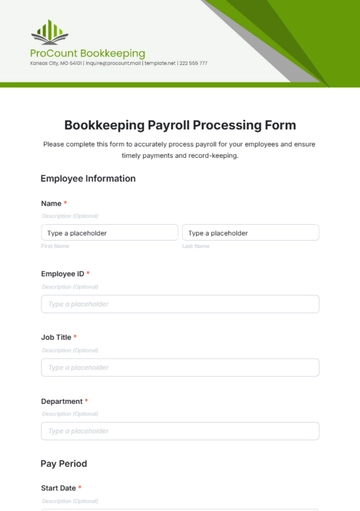

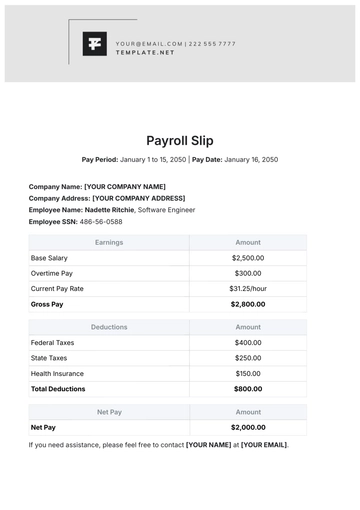

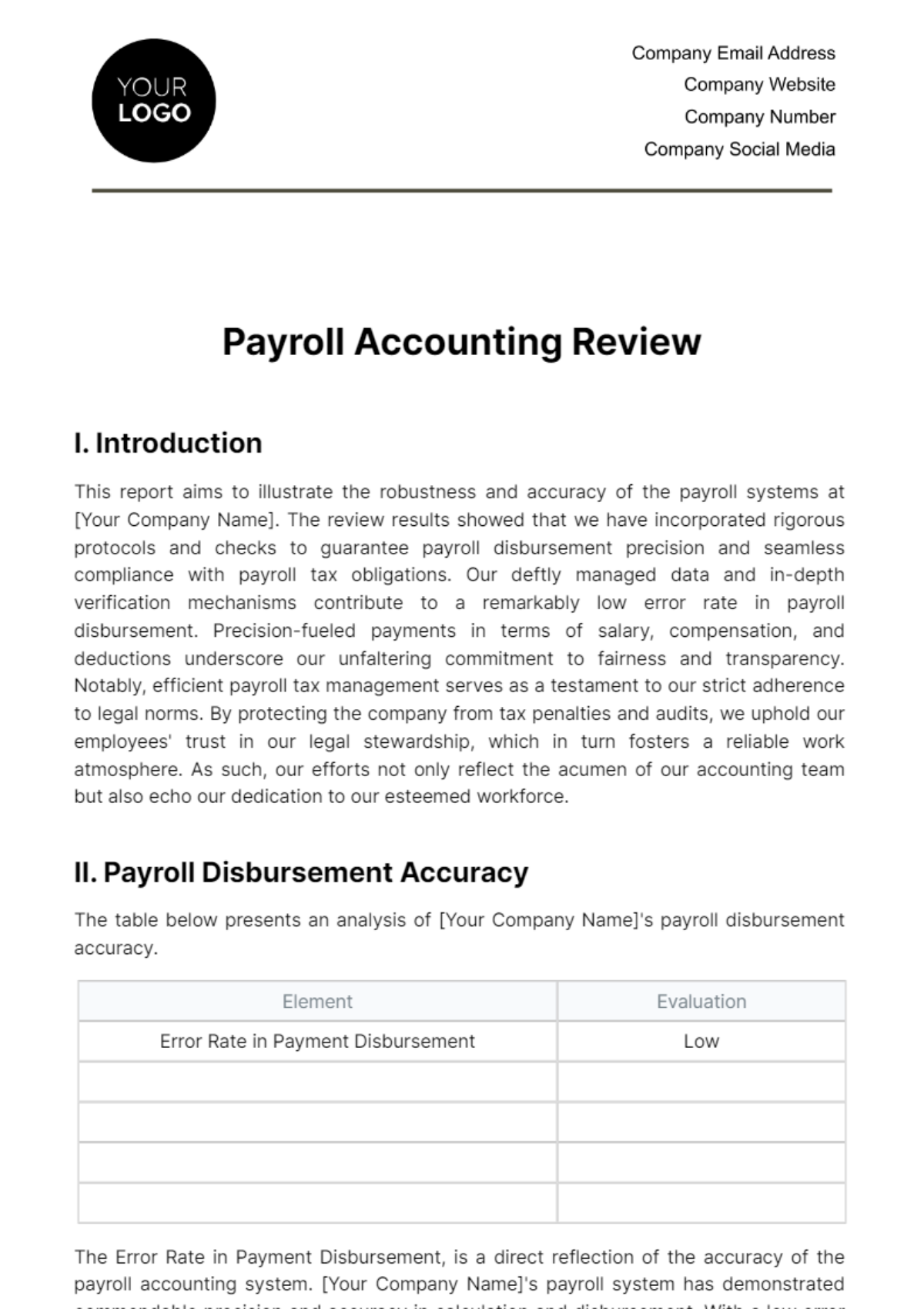

II. Payroll Disbursement Accuracy

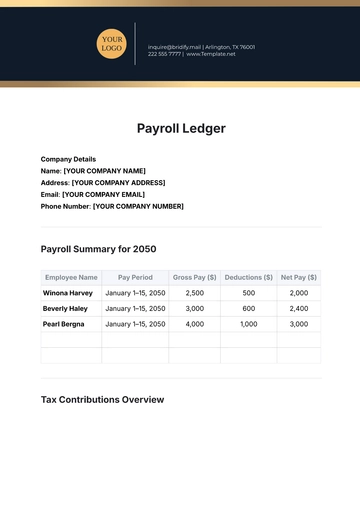

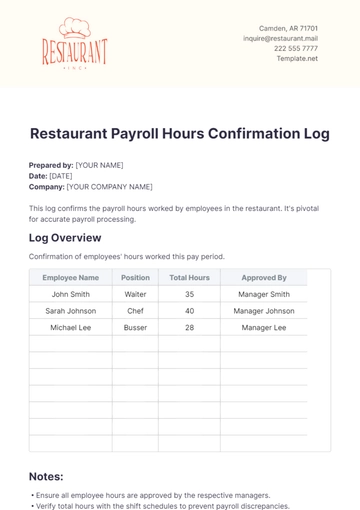

The table below presents an analysis of [Your Company Name]'s payroll disbursement accuracy.

Element | Evaluation |

|---|---|

Error Rate in Payment Disbursement | Low |

The Error Rate in Payment Disbursement, is a direct reflection of the accuracy of the payroll accounting system. [Your Company Name]'s payroll system has demonstrated commendable precision and accuracy in calculation and disbursement. With a low error rate, it points to meticulousness in data management, computation, and a solid verification system in place. The system demonstrates a high capacity in recognizing and appropriately applying salary packages, compensations, deductions, and actual net pay that employees receive. This is important in the assurance of trust and transparency that a company extends to its employees. An accurate payroll system minimizes potential financial discrepancies, eliminates legal implications, and ensures a healthy, trustworthy work environment. It validates not just the competence of the accounting department but also rightly underpins the company's commitment to its workforce.

III. Payroll Tax Compliance

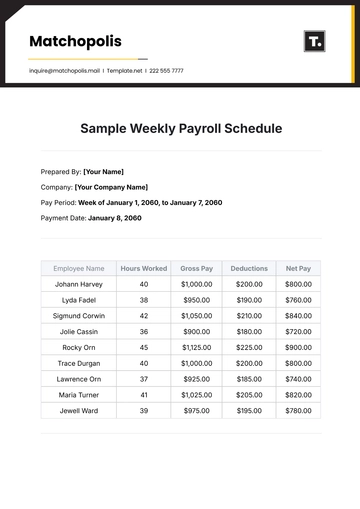

The detail in the table below offers an insight on [Your Company Name]'s compliance with payroll tax obligations:

Element | Evaluation |

|---|---|

Fulfillment of Tax Obligations | Excellent |

Managing tax compliance is one of the fundamental aspects of a well-functioning payroll accounting system. It not only protects the company from potential tax penalties and audits but also reassures the employees of the firm's legal compliance. This fosters trust and motivates the workforce, contributing to a healthier work environment overall. An area where [Your Company Name]'s payroll system particularly shines is in its fulfillment of tax obligations. With an Excellent rating, one can glean its rigor in abiding by the legal tax laws and regulations. This encompasses accurate deductions from paychecks, timely remittance of payroll taxes to authorities, and preparation of precise tax forms - all of which the system efficiently handles.

IV. Conclusion

In conclusion, the review of our payroll accounting system at [Your Company Name] reveals a system of remarkable precision and compliance. With a commendably low error rate in payroll disbursement, we have asserted our meticulousness and commitment to fairness and transparency. Our robust protocols and checks for accuracy intensify our employees' trust and amplify a reliable work culture. Furthermore, our efficient management of payroll tax obligations safeguards the company from tax discrepancies and legally validates our operations. These findings underline the competence of our accounting team and exhibit our unwavering dedication to our valued workforce, thus strengthening our reputation as a reliable and trustworthy employer.

Reviewed by [YOUR NAME]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Scrutinize payroll processes with our Payroll Accounting Review Template, a customizable tool found on Template.net! This versatile and editable template allows seamless customization using our AI Editor Tool. Tailor the review process to your specific payroll requirements, optimizing your overall payroll management with efficiency and precision! Grab it right away!