Free Accounting Asset Review

Prepared by [Your Name]

This comprehensive Accounting Asset Review provides a deep dive into the state, assessment, functionality, and management of [Your Company Name]'s assets, delivering crucial insights for strategic decision-making and financial planning.

Asset Valuation

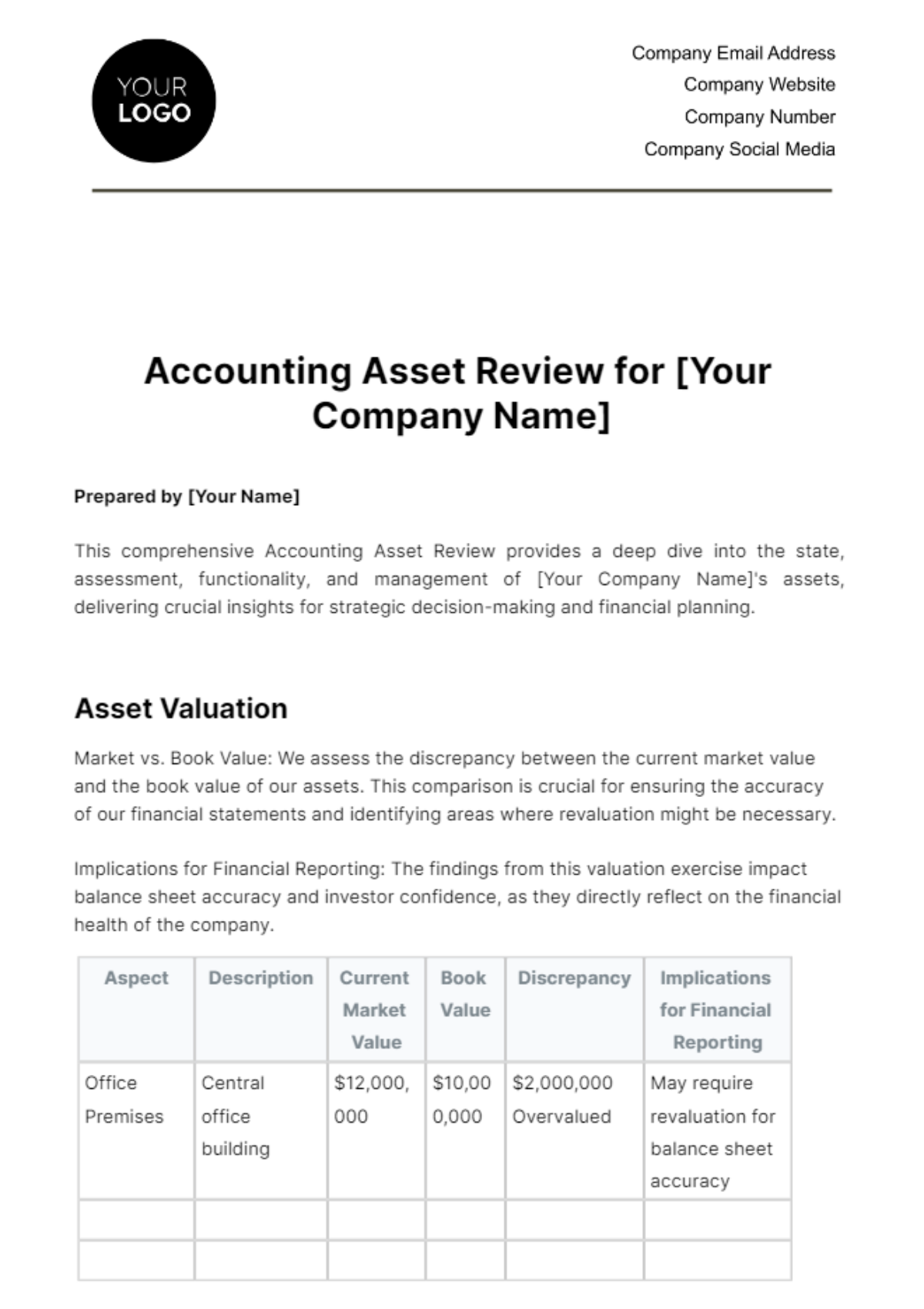

Market vs. Book Value: We assess the discrepancy between the current market value and the book value of our assets. This comparison is crucial for ensuring the accuracy of our financial statements and identifying areas where revaluation might be necessary.

Implications for Financial Reporting: The findings from this valuation exercise impact balance sheet accuracy and investor confidence, as they directly reflect on the financial health of the company.

Aspect | Description | Current Market Value | Book Value | Discrepancy | Implications for Financial Reporting |

|---|---|---|---|---|---|

Office Premises | Central office building | $12,000,000 | $10,000,000 | $2,000,000 Overvalued | May require revaluation for balance sheet accuracy |

Depreciation Analysis

Methods and Timetables: We evaluate the appropriateness of the depreciation methods (straight-line, declining balance, etc.) and schedules applied to each asset. Ensuring these are in line with GAAP or IFRS is essential for accurate financial reporting and tax compliance.

Impact on Financial Performance: This analysis impacts how assets and their depreciation are reflected in profit and loss statements, influencing overall financial performance metrics.

Asset | Method | Useful Life | Annual Depreciation | Total Accumulated Depreciation | Impact on Financial Performance |

|---|---|---|---|---|---|

Office Premises | Straight-Line | 30 Years | $333,333 | $3,333,330 | Consistent expense, impacts net income annually |

Asset Performance and Utilization

Usage Review: The usage patterns of each asset are analyzed to determine how effectively they contribute to organizational goals. Underutilized or overburdened assets are identified for strategic reallocation or replacement.

Optimization Strategies: Based on this analysis, strategies are developed to optimize asset usage, enhancing overall operational efficiency and reducing unnecessary expenditures.

Asset | Usage Pattern | Optimization Strategy | Expected Outcome |

|---|---|---|---|

Office Premises | Regular use, low wear | Maintenance scheduling | Prolonged life, consistent utility |

Risk Management and Compliance

Risk Assessment: We scrutinize the assets for potential risks, particularly obsolescence. This includes evaluating how quickly assets may become outdated or less functional due to technological advancements.

Compliance Check: Ensuring that asset management practices comply with legal and accounting standards is vital for mitigating legal and financial risks.

Risk Factor | Assessment | Compliance Check | Mitigation Strategy |

|---|---|---|---|

Obsolescence | High for Technology | Meets current standards | Plan for regular technology updates |

Asset Maintenance and Upkeep

Maintenance Review: The effectiveness of current maintenance strategies for physical assets is examined. This includes assessing whether these strategies prolong asset life and maintain performance levels.

Strategic Upkeep Planning: Based on this review, recommendations are made for improving or modifying maintenance plans to optimize asset longevity and functionality.

Asset | Current Maintenance Strategy | Effectiveness | Recommended Changes |

|---|---|---|---|

Office Premises | Biannual check-ups | Highly Effective | Continue current plan |

Asset Lifecycle Management

Lifecycle Analysis: Each asset's lifecycle stage is analyzed to assist in making informed decisions about repairs, upgrades, or disposals. This helps in maximizing the value derived from each asset throughout its usable life.

Strategic Disposal Planning: Insights from this analysis guide strategic planning regarding when to retire assets, thereby optimizing the asset portfolio and reducing unnecessary holding costs.

Asset | Current Lifecycle Stage | Decision Points | Strategic Disposal Planning |

|---|---|---|---|

Office Premises | Mid-life | Renovation vs. Relocation | Long-term retention, potential future sale |

Employee Performance Review

This section is designed to assess how employee actions and decisions impact the management, valuation, and overall performance of the company's assets. This section provides crucial insights into the human element influencing asset efficiency and effectiveness.

Employee Name | Role | Performance Metrics | Asset Management Impact | Rating | Improvement Areas |

|---|---|---|---|---|---|

[Name] | [Job Title] | Accuracy in Asset Valuation, Compliance with Standards, Timely Reporting | High impact on accurate asset valuation and compliance | Excellent | Enhance technology adaptation skills |

By integrating subjective impressions and objective observations in this Accounting Asset Review, it aims to illustrate a compelling narrative that not only enhances but also embodies the unique identity of the brand.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Template.net presents the Accounting Asset Review Template, a customizable and editable solution for thorough asset evaluations. Ensure comprehensive and detailed asset reviews, enhancing your asset management with a professional and organized approach. This template is your key to meticulous asset oversight. Elevate your asset management strategy with this template.