Free Accounting Asset Resolution

Company: [Your Company Name]

Document Number: [Document Reference Number]

Date of Issue: [Date]

This document serves as a formal resolution concerning the management and handling of assets within [Your Company Name]. It is intended to provide authoritative guidance and legally binding decisions on various aspects of asset management.

Section 1: Introduction and Purpose

Background: This resolution addresses critical aspects of asset management, including acquisition, maintenance, valuation, and disposal.

Purpose: To ensure that all decisions and actions related to company assets are made with due diligence, comply with legal and regulatory requirements, and align with the strategic objectives of [Your Company Name].

Section 2: Asset Acquisition and Capitalization

Policy on Acquisition: Formalizes the process for acquiring new assets, including approval protocols and expenditure limits.

Capitalization Rules: Outlines the criteria for capitalizing assets, detailing the threshold values and categorization of assets as per accounting standards.

Section 3: Asset Maintenance and Utilization

Maintenance Policy: Establishes guidelines for the regular maintenance of assets to ensure their longevity and optimal performance.

Utilization Review: Mandates periodic reviews of asset utilization to ensure efficient usage and alignment with operational needs.

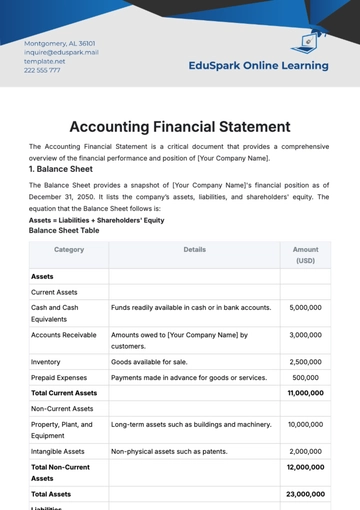

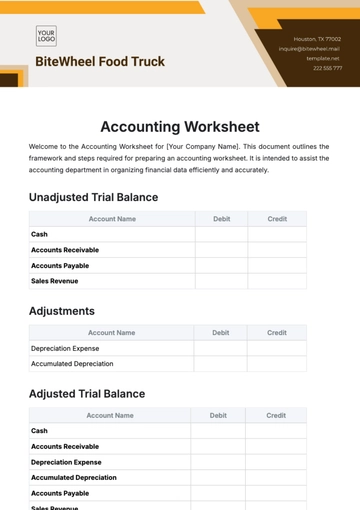

Section 4: Asset Valuation and Depreciation

Valuation Procedures: Dictates the methodologies to be used for asset valuation, ensuring they are in line with current market conditions and accounting principles.

Depreciation Policies: Defines the depreciation methods applicable to different asset categories, ensuring compliance with generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS).

Section 5: Disposal and Retirement of Assets

Disposal Process: Sets forth the procedures for asset disposal, including the criteria for determining when an asset should be retired, sold, or scrapped.

Financial Implications: Details the accounting treatment of asset disposals, including the recognition of any gains or losses in the company's financial statements.

This resolution is legally binding and is to be implemented with immediate effect. Any amendments or exceptions to this resolution must be formally approved by the authorized personnel or governing body of [Your Company Name].

Authorized Signatory:

[Your Signature]

[Your Name]

[Your Position]

[Your Company Name]

Document Approval Date: [Date]

Note: This document is intended to serve as a comprehensive guide and legal framework for asset management within [Your Company Name], ensuring consistency, compliance, and strategic alignment in all asset-related decisions and activities.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Optimize your asset resolutions with Template.net's Accounting Asset Resolution Template. This editable, customizable template, accessible in our Ai Editor Tool, offers a professional framework. Streamline your resolution process, ensuring effective management and clear communication of asset-related decisions. Embrace this essential tool for a more strategic approach to asset management.