Free Mortgage Contract

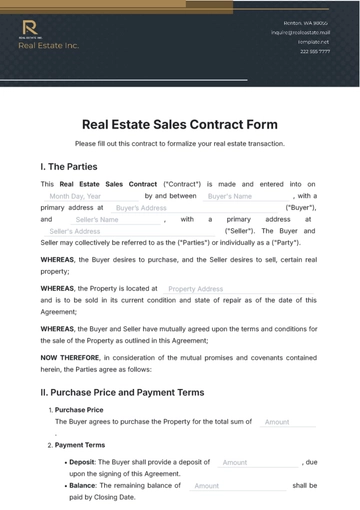

This Mortgage Contract ("Contract") is entered into on [DATE] between [BORROWER'S FULL LEGAL NAME], hereinafter referred to as the "Borrower," residing at [BORROWER'S ADDRESS], and [LENDER'S FULL LEGAL NAME], hereinafter referred to as the "Lender," located at [LENDER'S ADDRESS].

1. Loan Details

The Borrower agrees to borrow from the Lender the principal amount of [PRINCIPAL AMOUNT] USD (the "Loan") with an interest rate of [INTEREST RATE]%, compounded [COMPOUNDING FREQUENCY], to be repaid over a term of [LOAN TERM] years. The Borrower acknowledges and agrees to pay any applicable fees or charges associated with the Loan as outlined in this Contract.

1.1 Principal Amount and Interest Rate:

The Lender agrees to provide a principal loan amount of [Principal Amount] to the Borrower at an annual interest rate of [Interest Rate]%.

1.2 Loan Term and Compounding Frequency:

The loan term shall be [Loan Term] years, with interest compounded [Compounding Frequency] (monthly/annually/etc.).

1.3 Fees:

The Borrower shall be responsible for payment of origination fees, closing costs, and any other applicable charges as detailed in Schedule A attached hereto.

Attached Schedule:

Schedule A, This indicates that detailed information regarding any applicable fees or charges associated with the mortgage loan will be provided in an attached schedule labeled Schedule A. This allows for a more comprehensive understanding of the financial obligations of the borrower beyond what is explicitly stated in the main body of the contract.

2. Property Description and Collateral

The property being mortgaged is described as [PROPERTY ADDRESS], with legal description [LEGAL DESCRIPTION]. The Borrower hereby pledges and mortgages said property as collateral to secure repayment of the Loan. In the event of default, the Lender shall have the right to initiate foreclosure proceedings and sell the property to satisfy the debt.

2.1.1 Description of Property:

The property being mortgaged is located at [Property Address] and is legally described as [Legal Description].

2.1.2 Collateral:

The Borrower hereby pledges the aforementioned property as collateral to secure the repayment of the loan under this Contract. In the event of default, the Lender shall have the right to initiate foreclosure proceedings as outlined in Section 2.

2.1.3 Late Fees and Grace Period:

In the event of default, the Borrower shall be subject to late fees of [Late Fee Amount] for each payment not made within [Grace Period] days of its due date. The mention of late fees and grace periods for curing defaults falls under this subsection.

2.1.4 Foreclosure Proceedings:

Upon default, the Lender may initiate foreclosure proceedings under applicable laws and regulations, and the Borrower shall be liable for all costs and expenses incurred in connection therewith. This subsection addresses the lender's rights and procedures in the event of default by the borrower, including the initiation of foreclosure proceedings.

3. Terms and Conditions

The Borrower agrees to abide by the terms and conditions outlined in this Contract, including but not limited to making timely payments, maintaining insurance on the property, and notifying the Lender of any changes in circumstances that may affect the Loan. The Lender reserves the right to enforce the terms of this Contract and pursue remedies available under law in the event of default.

4. Repayment Schedule

The Borrower shall repay the Loan in [NUMBER OF PAYMENTS] equal installments of [AMOUNT OF EACH PAYMENT] USD each, due on the [DUE DATE] of each month/year, commencing on [COMMENCEMENT DATE]. The Borrower may prepay the Loan in whole or in part at any time without penalty.

Installment Details:

The Borrower shall repay the loan in [Number of Payments] equal installments of [Amount] each, commencing on [Date of First Payment] and continuing on the [Frequency] thereafter until the loan is fully repaid.

Prepayment Options:

The Borrower may prepay the outstanding balance of the loan, in whole or in part, at any time without penalty.

5. Interest Rate and Fees

The interest rate on the Loan shall be fixed at [INTEREST RATE]%, with [ORIGINATION FEES/CLOSING COSTS] payable at closing. The Borrower shall be responsible for any additional fees or charges incurred during the term of the Loan, including but not limited to property taxes, insurance premiums, and maintenance costs.

6. Default and Remedies

In the event of default, the Borrower shall be liable for any late fees incurred and shall cure the default within [GRACE PERIOD] days of receiving notice from the Lender. If the default is not cured within the specified period, the Lender may accelerate the Loan and initiate foreclosure proceedings under applicable law.

7. Governing Law and Jurisdiction

This Contract shall be governed by and construed under the laws of [STATE/COUNTRY], without regard to its conflict of law principles. Any disputes arising out of or relating to this Contract shall be resolved exclusively in the courts of [JURISDICTION].

IN WITNESS WHEREOF, the undersigned parties, the Borrower and the Lender, have executed this Mortgage Contract as of the date first above written. The Borrower acknowledges receipt of the principal loan amount and agrees to abide by the terms and conditions outlined herein. The Lender confirms the provision of the loan and affirms its commitment to adhere to the agreed-upon terms, including the specified interest rate and repayment schedule

[Borrower's Name]

[Date Signed]

[Lender's Name]

[Date Signed]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Template.net's Mortgage Contract Template ensures clarity and legal compliance in mortgage agreements. Covering loan terms, interest rates, repayment schedules, and collateral details, our template streamlines the contracting process. Download now to establish secure mortgage agreements, safeguarding the interests of all parties. Simplify your real estate transactions and enhance contract accuracy with this comprehensive and professionally crafted Mortgage Contract Template.

You may also like

- Rental Contract

- Contractor Contract

- Contract Agreement

- One Page Contract

- School Contract

- Social Media Contract

- Service Contract

- Business Contract

- Restaurant Contract

- Marketing Contract

- Real Estate Contract

- IT Contract

- Cleaning Contract

- Property Contract

- Supplier Contract

- Partnership Contract

- Food Business Contract

- Construction Contract

- Employment Contract

- Investment Contract

- Project Contract

- Payment Contract

- Student Contract

- Travel Agency Contract

- Startup Contract

- Annual Maintenance Contract

- Employee Contract

- Gym Contract

- Event Planning Contract

- Personal Contract

- Nursing Home Contract

- Law Firm Contract

- Work from Home Contract

- Software Development Contract

- Maintenance Contract

- Music Contract

- Amendment Contract

- Band Contract

- DJ Contract

- University Contract

- Salon Contract

- Renovation Contract

- Photography Contract

- Lawn Care Contract