Free Account Budgeting Guide

Introduction

In the fast-paced and competitive world of business, mastering financial management is indispensable. At the core of financial management lies the art of account budgeting—a vital skill that can shape the trajectory of a company's success, irrespective of its scale. Effective budgeting is not just about number-crunching; it's a strategic tool for forecasting, decision-making, and steering the company towards its long-term goals. This guide is crafted to demystify the complexities of account budgeting, presenting a user-friendly compendium filled with actionable tips, detailed instructions, and pragmatic solutions to prevalent budgeting dilemmas. Whether you're a startup navigating the initial stages of your financial journey or an established enterprise looking to refine your fiscal strategies, this guide aims to enhance your budgeting acumen, empowering you to make informed decisions that foster sustainable growth and financial stability.

Getting Started

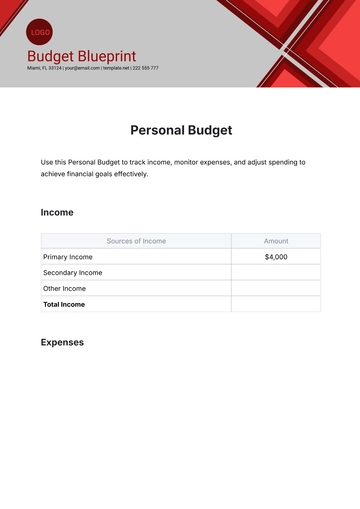

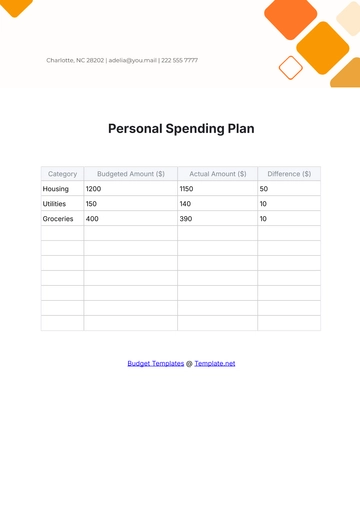

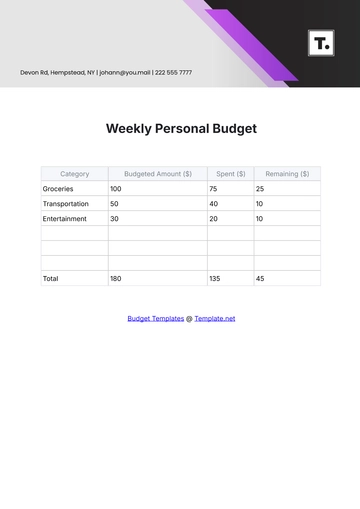

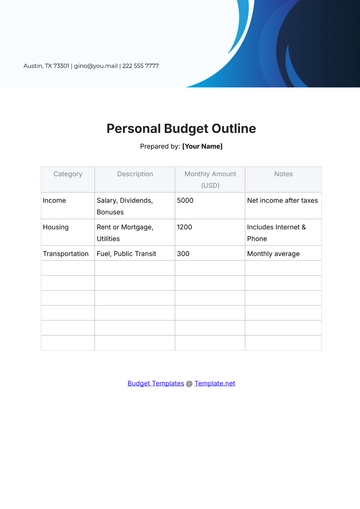

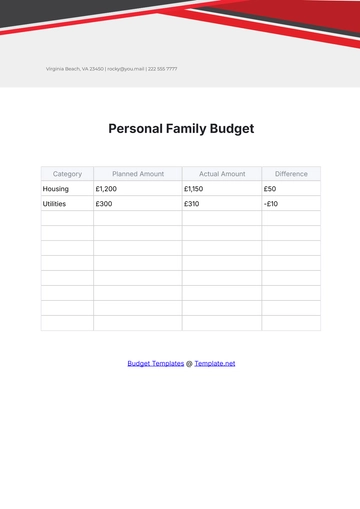

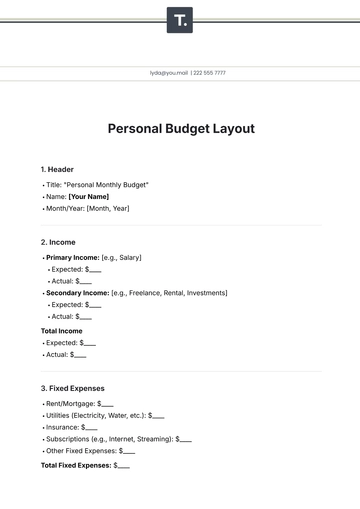

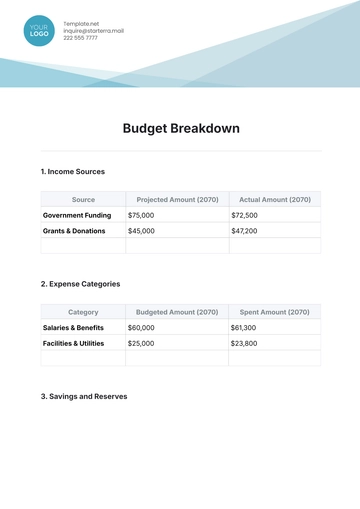

Fig 1: Business Account Budget Infographic Example

Embarking on the budgeting journey begins with a comprehensive assessment of your company's financial health. This initial phase involves a deep dive into your cash inflows and outflows—two pivotal components that paint a vivid picture of your financial landscape. Cash inflows encompass all sources of revenue, including sales, investments from shareholders, and any borrowed funds. On the flip side, cash outflows cover the spectrum of expenditures, from employee salaries and operational costs to debt repayments and capital investments. Understanding this cash flow dynamic is crucial, as it lays the groundwork for informed budgeting. By accurately gauging your financial position, you can set realistic expectations and craft a budget that not only reflects your current standing but also aligns with your future aspirations.

Step-by-Step Instruction

Identify Your Goals: Clear, measurable goals are the cornerstone of effective budgeting. Begin by outlining what you aim to achieve through your budget—be it enhancing profitability, expanding your market presence, or elevating operational efficiencies. Setting these objectives provides direction and purpose to your budgeting efforts, ensuring every financial decision propels you closer to your desired outcomes.

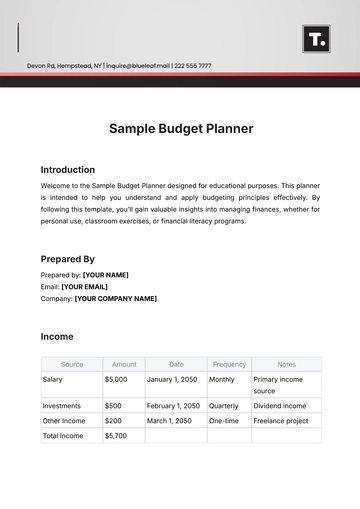

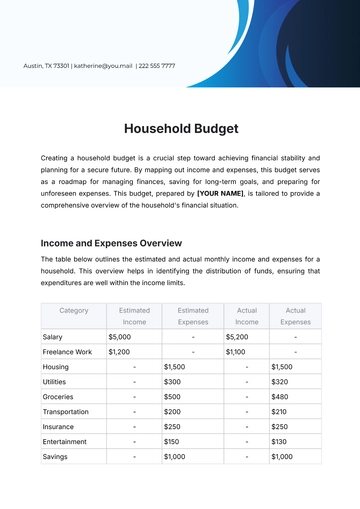

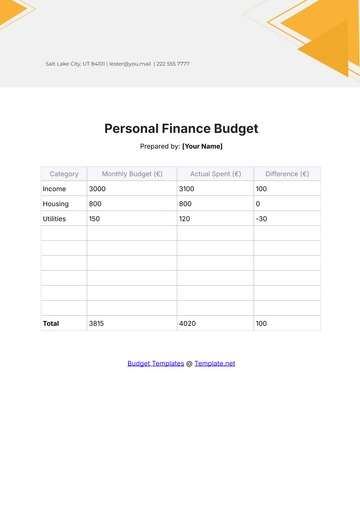

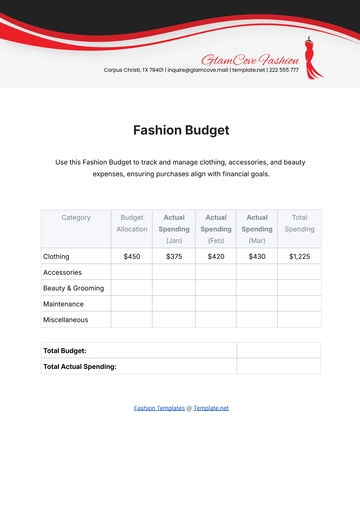

Track Your Income and Expenses: The essence of budgeting lies in the meticulous tracking of your financial transactions. This practice offers a realistic overview of your income streams and expenditure patterns, laying the foundation for a budget grounded in reality. Utilize this data to identify trends, pinpoint areas of improvement, and make informed decisions moving forward.

Create a Preliminary Budget: Armed with a clear understanding of your financial activities and goals, you're now poised to draft a preliminary budget. This initial version should merge your aspirations with the insights gleaned from your financial tracking, resulting in a budget that's both ambitious and attainable.

Refine and Finalize: Budgeting is not a set-it-and-forget-it endeavor. As market conditions fluctuate and business operations evolve, your initial budget will need adjustments. This phase involves fine-tuning your budget to accommodate unexpected changes, ensuring it remains relevant and effective. Once refined, finalize your budget, making it the definitive roadmap for your financial journey.

Implement and Monitor: The true test of a budget lies in its execution. Adherence to your budget is paramount, but equally important is the ongoing monitoring of your financial performance. Regular check-ins enable you to spot variances early, allowing for timely interventions to correct course. This proactive approach ensures your budget remains a dynamic tool, adaptable to the ever-changing landscape of your business operations.

Troubleshooting and FAQs

What should I do if my expenses consistently exceed my budget?

When your expenses surpass your budgeted amounts, it's crucial to conduct a detailed review of your financial activities. Start by identifying non-essential expenditures that can be reduced or eliminated. If the overspending is tied to essential costs, consider strategies to reallocate funds within your budget or explore avenues to boost your revenue streams. Sometimes, revisiting your budgeting assumptions for accuracy and realism can also provide insights into necessary adjustments.

How frequently should I revisit my budget?

Regular budget reviews are key to maintaining financial health. A monthly review is standard practice, offering a balanced overview of your financial progress and allowing timely adjustments. However, during periods of significant change—such as rapid business growth, market volatility, or unexpected financial challenges—it's advisable to increase the frequency of your reviews to maintain close oversight of your financial position.

What steps can I take if I find it difficult to adhere to my budget?

Difficulty in sticking to a budget is not uncommon and can often be addressed by investigating the root causes. If the issue stems from overly restrictive budgeting, reevaluating your budget to ensure it's realistic and attainable is crucial. Incorporating a contingency allowance can also provide flexibility and reduce the pressure of unforeseen expenses. Enhancing your financial discipline may involve setting up automated tracking and alerts, using budgeting tools, or seeking professional advice to build better financial habits.

How can I adjust my budget in response to unexpected financial changes?

Unexpected financial events necessitate a swift and strategic response. Begin by assessing the impact of the change on your current financial situation and long-term goals. Adjust your budget by reallocating funds, cutting back on non-critical expenses, or identifying new income sources. Regular scenario planning can also prepare you to respond more effectively to future uncertainties.

Is it beneficial to use budgeting software or tools?

Utilizing budgeting software or tools can significantly enhance your budgeting process. These tools offer features like real-time tracking, automated categorization of expenses, and customizable alerts, which help in maintaining a clear view of your financial status. They also facilitate scenario analysis and can integrate with other financial systems, providing a holistic approach to financial management.

What strategies can I employ to increase my income to better align with my budget?

Enhancing your income can involve various strategies, depending on your business model and market opportunities. Consider diversifying your product or service offerings, exploring new markets, improving sales and marketing efforts, or increasing operational efficiencies to reduce costs and boost profit margins. Strategic partnerships and investments in innovation can also open new revenue streams.

How can I ensure my budget supports my company's strategic objectives?

Aligning your budget with your company's strategic goals requires a clear understanding of your long-term vision and objectives. Ensure that your budget allocates resources to key strategic areas, such as market expansion, product development, or talent acquisition. Regular communication between financial planning and strategic planning teams is essential to maintain this alignment and adapt to evolving business priorities.

Budgeting Strategies and Conclusion

The journey to mastering account budgeting is one that demands not only a solid grasp of numbers and forecasts but also a strategic mindset, clear objectives, and unwavering discipline. This guide has been meticulously designed to arm you with the tools and knowledge necessary to refine your financial acumen, setting a firm foundation for the financial well-being and strategic growth of your company.

Budgeting is far more than a mere exercise in financial restriction; it is a vital strategy for sustainable business management. It involves a continuous cycle of planning, implementing, reviewing, and adjusting. Here are some enriched strategies and insights to help you navigate this cycle more effectively:

Foster a Culture of Financial Responsibility: Encourage a company-wide ethos where every team member appreciates the importance of financial discipline. This can be achieved through regular financial training sessions, open discussions about the company's financial goals, and incentivizing prudent financial management. When each member of your organization understands how their actions impact the company's financial health, it fosters a collective commitment to fiscal responsibility.

Adopt a Proactive Approach to Budget Management: The dynamism of the business environment necessitates a budget that can adapt to changes. Regularly monitoring your budget allows for the early detection of discrepancies between projected and actual figures, providing an opportunity to take corrective action swiftly. This proactive approach should extend beyond mere oversight; it should involve strategic adjustments to the budget in response to evolving business needs, market conditions, and unforeseen challenges.

Align Budgeting Practices with Strategic Goals: Ensure that your budgeting efforts are in harmony with your company's long-term strategic objectives. This alignment means prioritizing budget allocations to areas that drive growth, innovation, and competitive advantage. It requires a deep understanding of how different budgetary decisions can accelerate the achievement of strategic milestones, such as market expansion, product development, or customer acquisition.

Implement Integrated Financial Planning: Utilize integrated financial planning tools that link budgeting with other financial processes like forecasting, reporting, and analysis. This integration provides a comprehensive view of your financial performance, facilitating more informed decision-making and allowing for a more agile response to changes.

Encourage Cross-Departmental Collaboration: Foster an environment where departments collaborate closely in the budgeting process. This collaborative approach ensures that budgets are realistic, comprehensive, and reflective of the collective insights and expertise within your organization. It also enhances accountability and ensures that budgeting decisions support cross-functional objectives and initiatives.

Leverage Technology for Enhanced Precision and Efficiency: Embrace technological solutions that automate and streamline budgeting processes. Advanced budgeting software can offer predictive analytics, scenario modeling, and real-time financial data, empowering you to make more accurate and timely budgeting decisions.

Cultivate Financial Agility: In an ever-changing business landscape, financial agility—the ability to respond rapidly and effectively to financial challenges and opportunities—is invaluable. This involves maintaining a flexible budgeting framework that can accommodate shifts in strategy, unexpected expenses, or sudden market opportunities without compromising financial stability.

In conclusion, effective account budgeting is not a destination but a journey—a continuous process of learning, adapting, and optimizing. By incorporating these advanced strategies into your budgeting practices, you not only enhance your financial management capabilities but also position your company for sustained success and resilience in the face of change. Remember, the strongest financial plans are those that are lived by every member of the team, dynamically evolving with the business, and consistently aligned with the overarching vision and strategic goals of the company.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Template.net's Account Budgeting Guide Template is a versatile tool designed for financial professionals and businesses. With our intuitive AI editor, you can easily customize and edit this template to suit your specific needs. Streamline your budgeting process, analyze expenses, and make informed financial decisions effortlessly. Take control of your finances today with Template.net's Account Budgeting Guide Template.

You may also like

- Budget Sheet

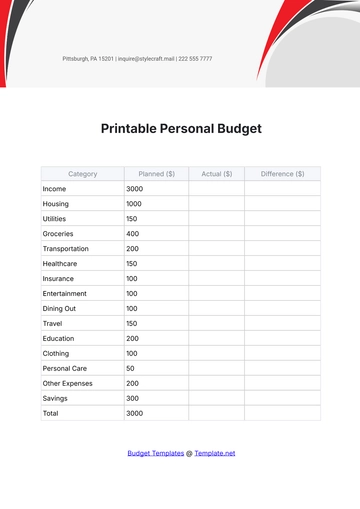

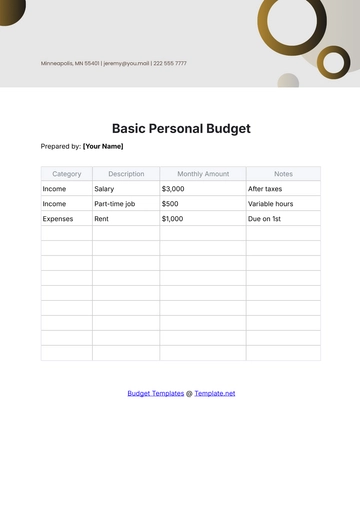

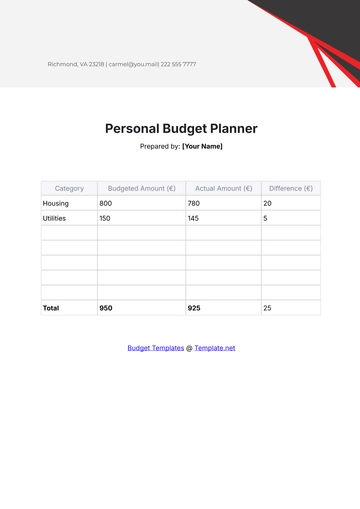

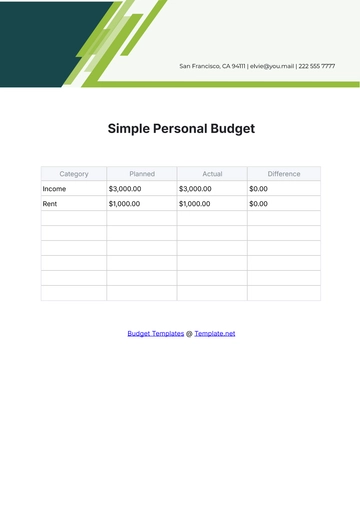

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

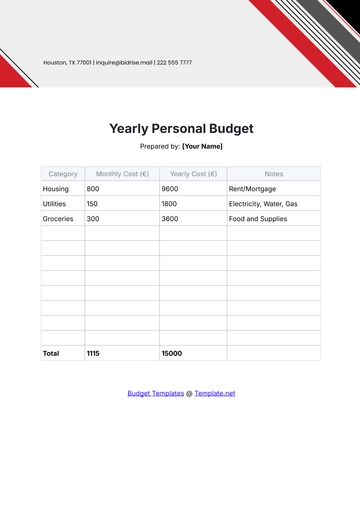

- Annual Budget

- Home Renovation Budget

- Household Budget

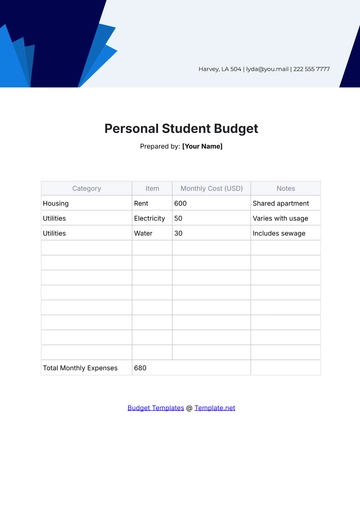

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising