Free Accounting Internal Audit Risk Management Guide

As large organizations grow, financial transparency becomes ever more critical. This comprehensive guide should serve as a roadmap to navigating the complexities of internal audit risk management with an emphasis on simplicity and clarity in language.

Introduction

Internal auditing and risk management in accounting serve as crucial gears in the engine of any corporation. Sound internal auditing identifies irregularities that may result from fraud while effective risk management mitigates potential financial and operational liabilities. This guide will assist you in developing a strong groundwork for both functions, helping you ensure your company's financial health and reputation.

Getting Started

What is Internal Auditing?

Internal auditing refers to the process of an organization evaluating its operations and controls. It involves ensuring compliance with laws and regulations, safeguarding assets, reviewing financial records for accuracy, and even assessing operational efficiencies.

What is Risk Management?

Risk management in an accounting context refers to the systematic process of identifying, analyzing, and responding to financial risk faced by an organization. It involves coordinating the organization's operations to minimize risks related to currency, interest rates, credit, operations, and more.

Step-by-Step Instruction

On your journey to a streamlined internal audit and risk management strategy, these sequential instructions should offer assistance:

Step I: Risk Assessment

Identify potential risks that might affect the organization's operations or financial statements. A good risk assessment should be broad in scope to ensure all potential risks are accounted for.

Step II: Audit Plan

Create an annual audit plan. The plan should be comprehensive, prioritizing audits based on the risk assessment.

Step III: Execution

Perform the audit as planned. Make sure to keep a meticulous record of the process for future reference and improvement.

Step IV: Report

Prepare a detailed audit report to summarize findings and suggest improvements. The report should be presented to management and communicated to the relevant stakeholders.

Troubleshooting and FAQs

Why are my risk assessment results inconsistent?

This could be due to changes in the business environment, new compliance regulations, or changes in company strategy. Regular updates to your risk assessment process are advised to incorporate such changes.

What if an audit reveals significant discrepancies?

Should there be major discrepancies in an audit, appropriate corrective actions should be implemented promptly. Continuous monitoring can assure that corrective measures are working as intended.

Conclusion

Internal audit and risk assessment are essential tools to protect your company's assets, reputation, and future. To simplify your process, consider these final tips:

Stay current with accounting laws and regulations

Invest in training for you and your team

Maintain clear, open, and timely communication within your organization

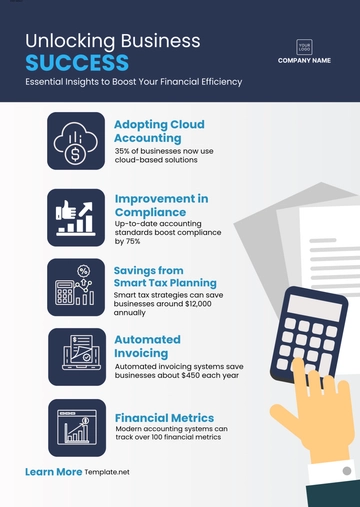

Employ technology to increase efficiency and accuracy

By using this guide, you can improve your company's financial diligence, ensure compliance, increase operational efficiency, and minimize risk – all while upholding the highest standards of fiscal integrity.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Maximize risk management effectiveness with the Accounting Internal Audit Risk Management Guide Template from Template.net. This editable and customizable guide equips you to navigate and mitigate risks effectively. Tailor it to your specific needs using our Ai Editor Tool. Enhance your internal audit process by incorporating this comprehensive template, ensuring proactive risk management in your financial operations.