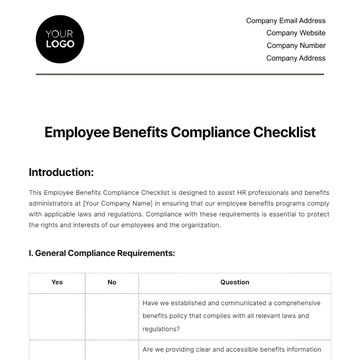

Free Employee Benefits Compliance Checklist HR

Introduction:

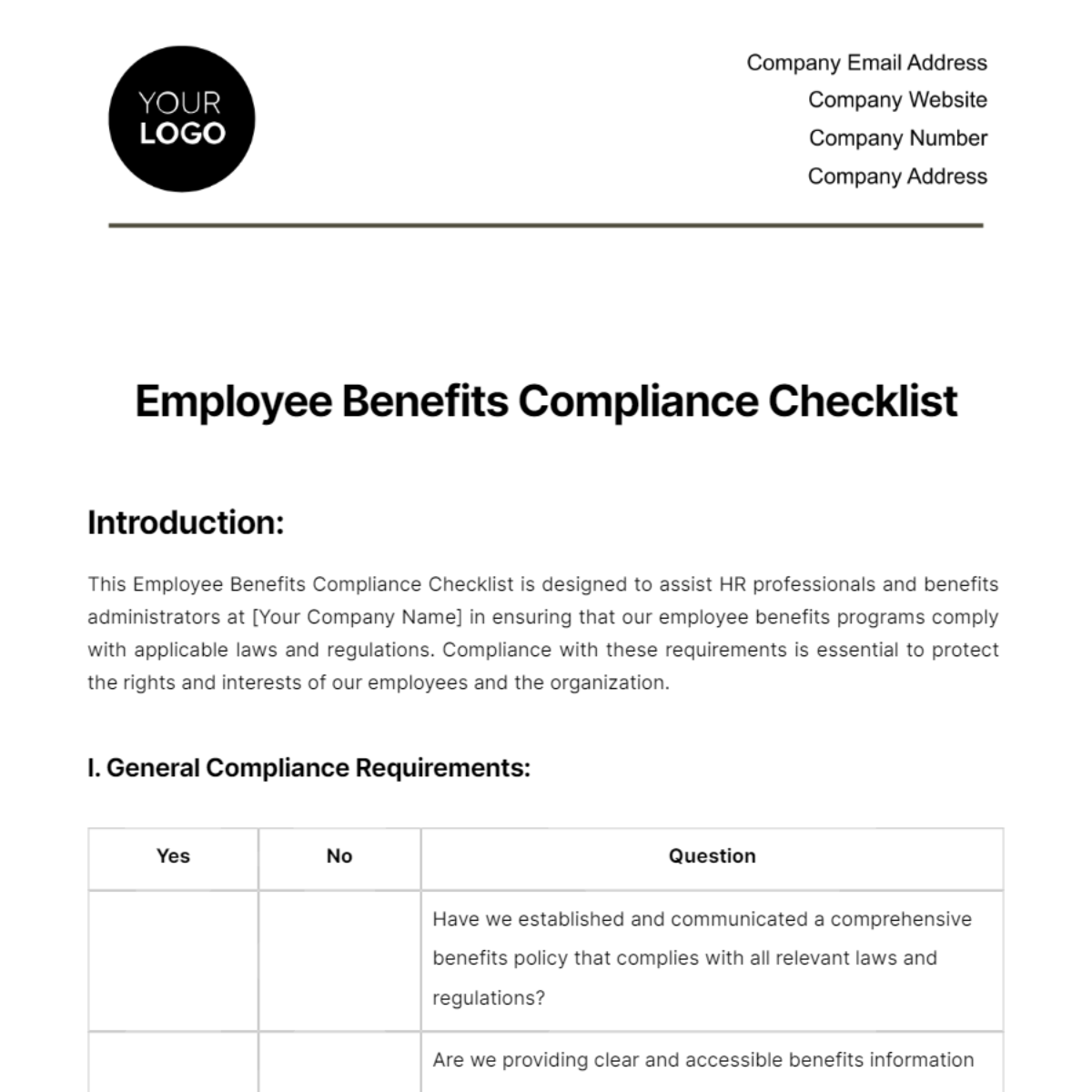

This Employee Benefits Compliance Checklist is designed to assist HR professionals and benefits administrators at [Your Company Name] in ensuring that our employee benefits programs comply with applicable laws and regulations. Compliance with these requirements is essential to protect the rights and interests of our employees and the organization.

I. General Compliance Requirements:

Yes | No | Question |

Have we established and communicated a comprehensive benefits policy that complies with all relevant laws and regulations? | ||

Are we providing clear and accessible benefits information to all employees? | ||

Do we have a system in place for regular compliance reviews and updates as laws change? |

II. Health and Welfare Benefits:

| ||

Yes | No | Question |

Are we providing health insurance coverage as required by the Affordable Care Act (ACA)? | ||

Are we offering coverage to eligible employees within the specified waiting period? | ||

Are we properly reporting health coverage information to the IRS (e.g., Forms 1094 and 1095)? | ||

| ||

Yes | No | Question |

Are we compliant with the Consolidated Omnibus Budget Reconciliation Act (COBRA) requirements for offering continued health coverage to eligible employees and their dependents? | ||

| ||

Yes | No | Question |

Are we maintaining the privacy and security of protected health information (PHI) in accordance with the Health Insurance Portability and Accountability Act (HIPAA)? | ||

| ||

Yes | No | Question |

Are we offering required health benefits such as mental health parity, maternity, and newborn care, as mandated by applicable laws? | ||

III. Retirement Benefits:

| ||

Yes | No | Question |

Are we providing eligible employees with the opportunity to participate in a retirement plan, such as a 401(k), and are we following plan-specific compliance requirements? | ||

Are we providing required notices, such as the Summary Plan Description (SPD) and Summary of Material Modifications (SMM), to plan participants? | ||

IV. Leave Benefits:

| ||

Yes | No | Question |

Are we complying with FMLA requirements, including providing eligible employees with job-protected leave for qualifying events? | ||

| ||

Yes | No | Question |

Are we adhering to state and local laws regarding paid leave, such as sick leave and parental leave, where applicable? | ||

V. Other Benefits:

| ||

Yes | No | Question |

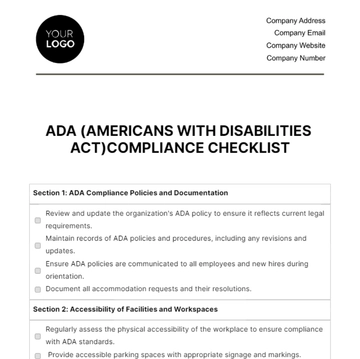

Are we providing reasonable accommodations to employees with disabilities as required by the Americans with Disabilities Act (ADA)? | ||

| ||

Yes | No | Question |

Are we complying with the Employee Retirement Income Security Act (ERISA) requirements related to employee benefits plan administration, disclosure, and reporting? | ||

VI. Recordkeeping and Reporting:

Yes | No | Question |

Are we maintaining accurate records of employee benefits enrollment, changes, and terminations? | ||

Are we properly filing and retaining records related to employee benefits for the required time periods? |

Conclusion:

Ensuring compliance with employee benefits regulations is crucial to protecting the interests of both employees and [Your Company Name]. Regularly reviewing and updating this Employee Benefits Compliance Checklist is essential to maintain our commitment to legal compliance and the well-being of our workforce.

This checklist should be reviewed periodically and updated as necessary to reflect changes in laws, regulations, and company policies.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Ensure compliance with our Employee Benefits Compliance Checklist HR Template. This comprehensive checklist covers all aspects of employee benefits, helping you navigate the complex landscape of regulations and requirements. With this customizable and downloadable template, you can confidently assess and enhance your benefits program, ensuring it meets legal standards and supports your workforce's well-being.

You may also like

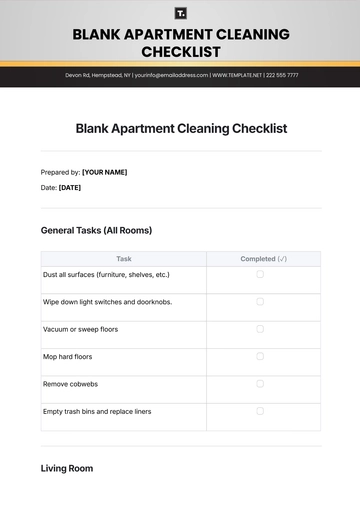

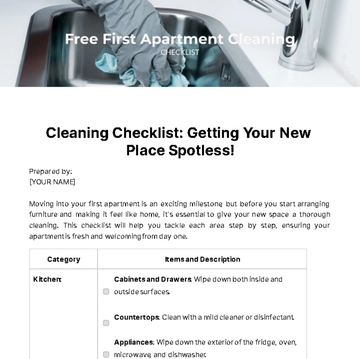

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

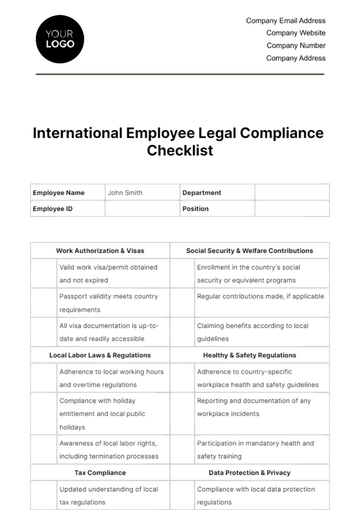

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

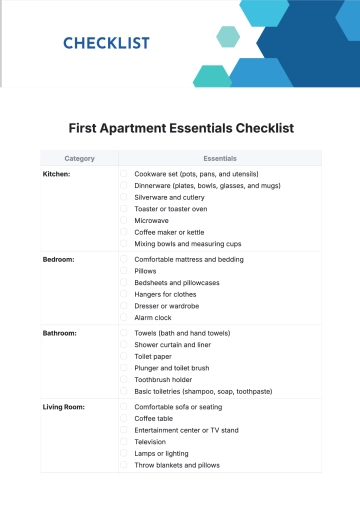

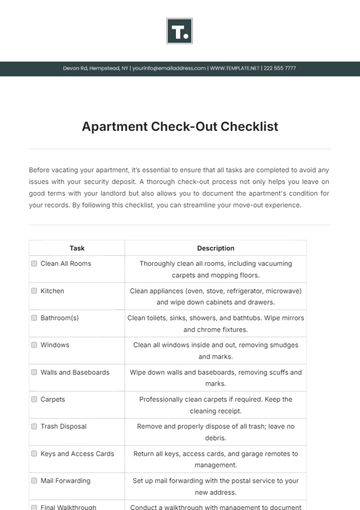

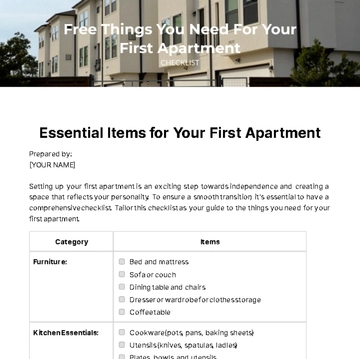

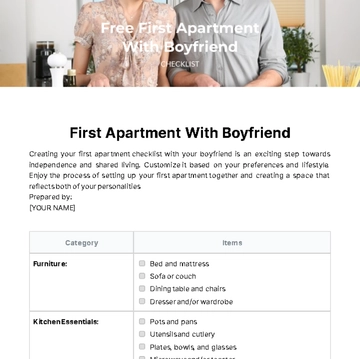

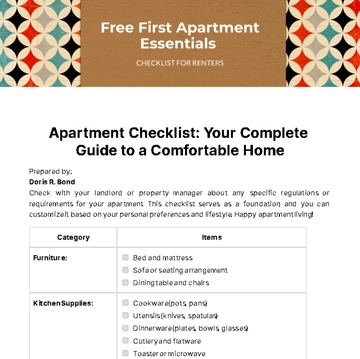

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

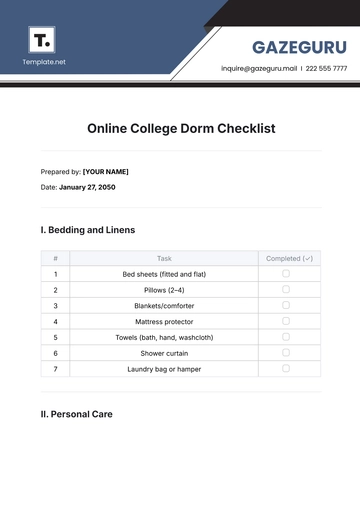

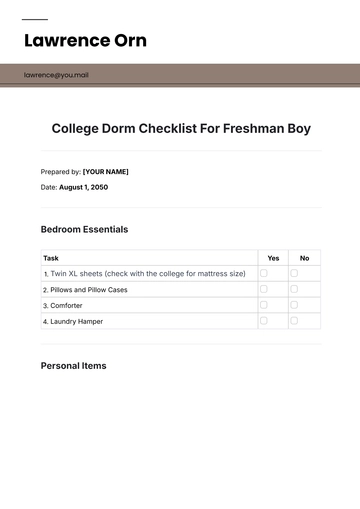

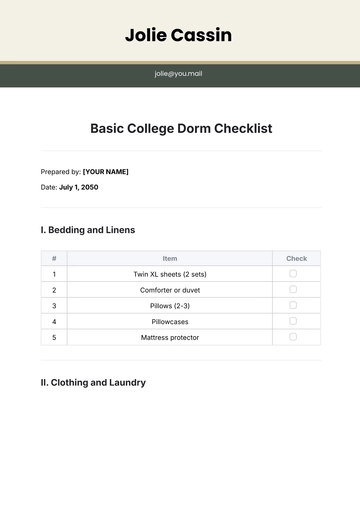

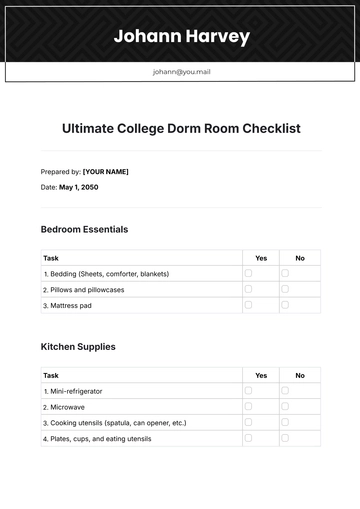

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist