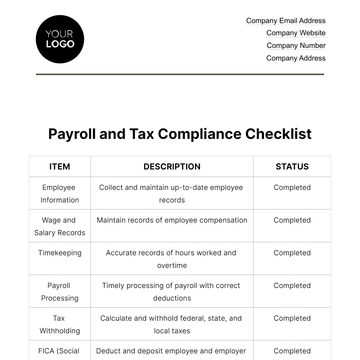

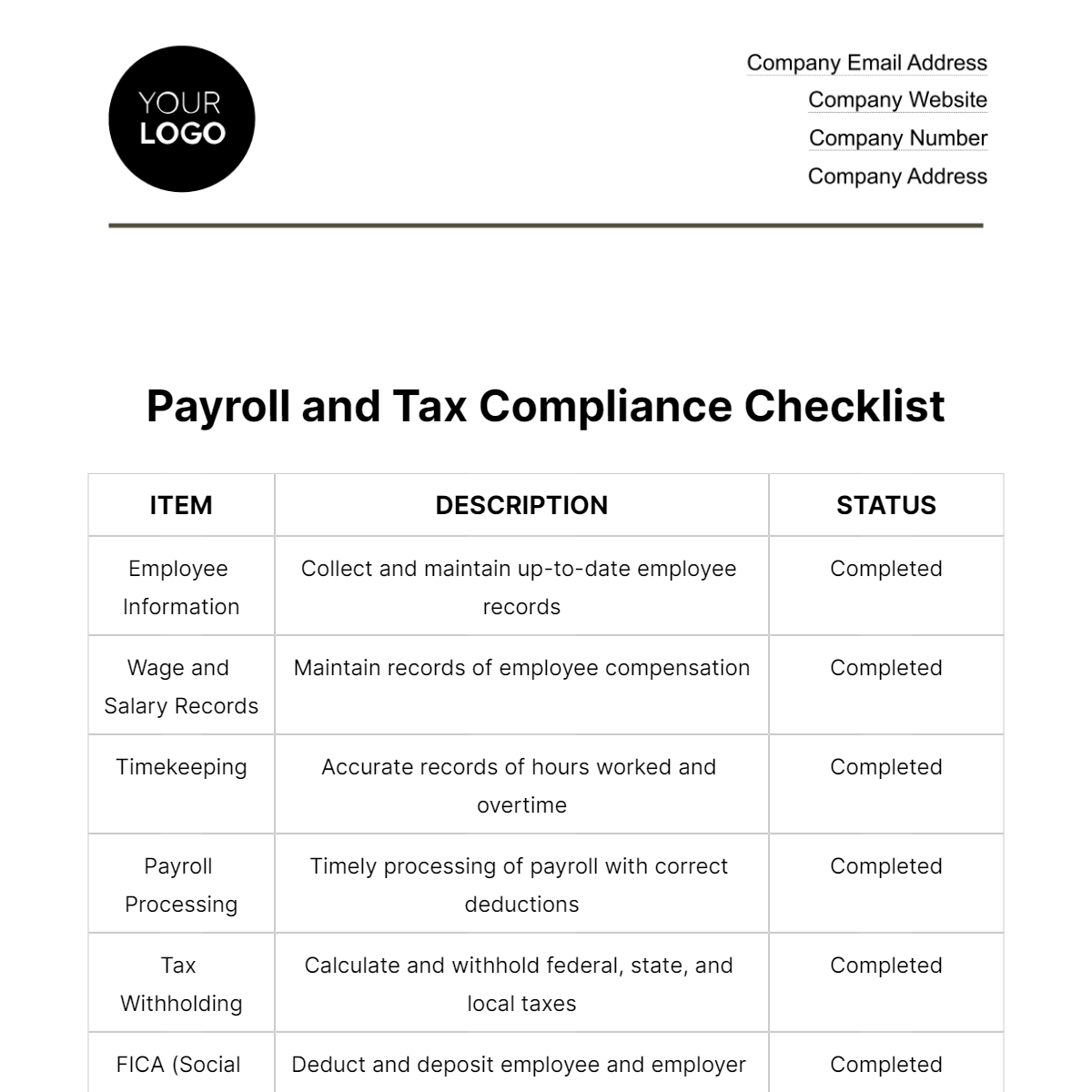

Free Payroll and Tax Compliance Checklist HR

ITEM | DESCRIPTION | STATUS |

Employee Information | Collect and maintain up-to-date employee records | Completed |

Wage and Salary Records | Maintain records of employee compensation | Completed |

Timekeeping | Accurate records of hours worked and overtime | Completed |

Payroll Processing | Timely processing of payroll with correct deductions | Completed |

Tax Withholding | Calculate and withhold federal, state, and local taxes | Completed |

FICA (Social Security) | Deduct and deposit employee and employer contributions | Completed |

Medicare | Deduct and deposit employee and employer contributions | Completed |

State Income Tax | Deduct and deposit state income taxes | Completed |

Local Income Tax | Deduct and deposit local income taxes | Completed |

Federal Tax Deposits | Ensure accurate and timely federal tax deposits | Completed |

Payroll Deductions | Handle voluntary deductions (e.g., benefits, 401(k)) | Completed |

Garnishments | Comply with court-ordered garnishments | Completed |

Payroll Reports | Generate and retain payroll reports for record-keeping | Completed |

W-2 Forms | Distribute W-2 forms to employees by January 31st | Completed |

1099 Forms | Issue 1099 forms to independent contractors | Completed |

Unemployment Insurance | Pay state unemployment insurance contributions | Completed |

Workers' Compensation | Maintain workers' compensation insurance coverage | Completed |

Record Retention | Comply with record retention requirements | Completed |

Compliance Audits | Prepare for and cooperate in tax audits | Completed |

Updates and Changes | Stay current with tax laws and make necessary changes | In Progress |

Employee Communication | Educate employees on tax-related matters | In Progress |

Documentation | Keep detailed payroll records for at least 3 years | Completed |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Navigate the complex world of payroll and taxes effortlessly with our Payroll and Tax Compliance Checklist HR Template. Ensure accurate payments and compliance with this comprehensive checklist. This template simplifies the process, minimizing errors and helping you meet your financial obligations flawlessly.

You may also like

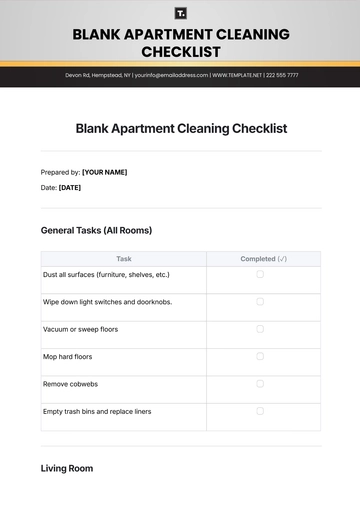

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

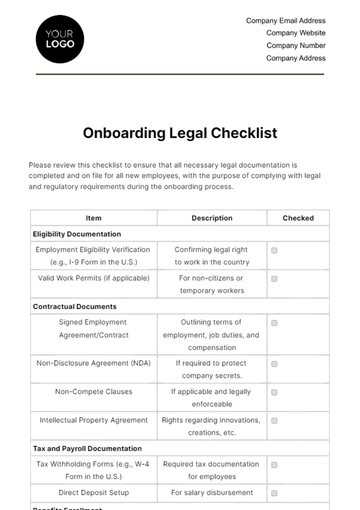

- Onboarding Checklist

- Quality Checklist

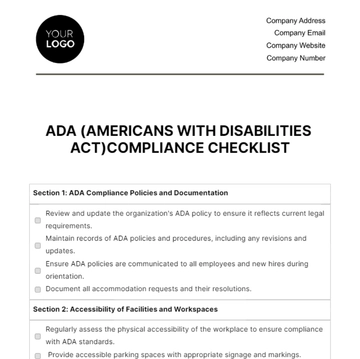

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

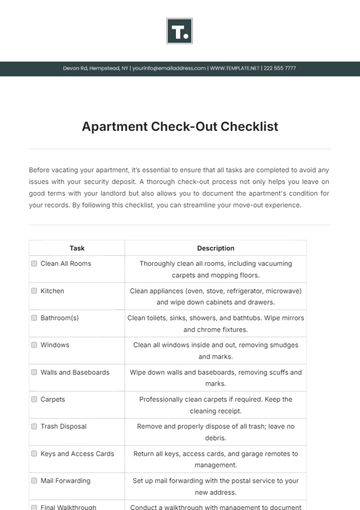

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

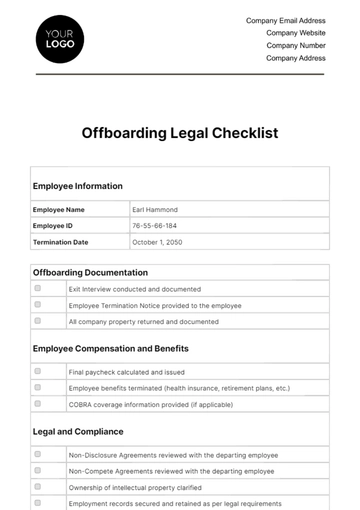

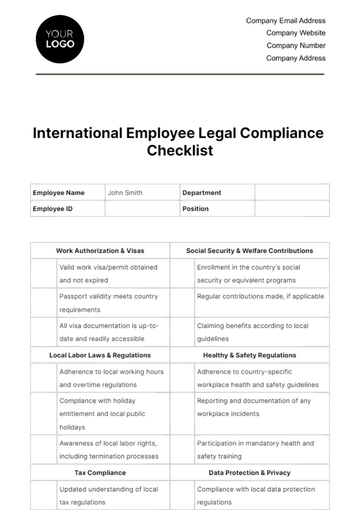

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

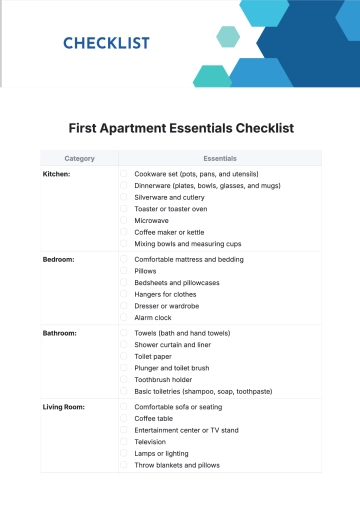

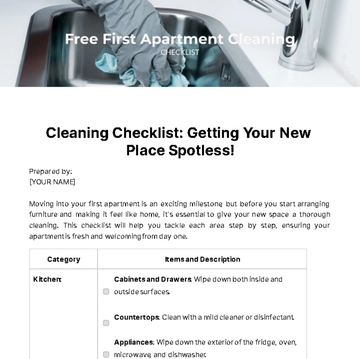

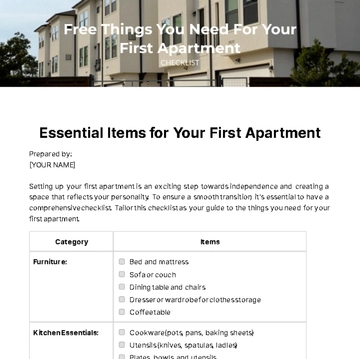

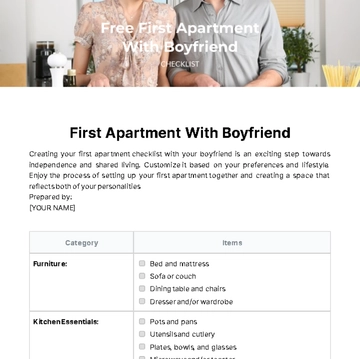

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

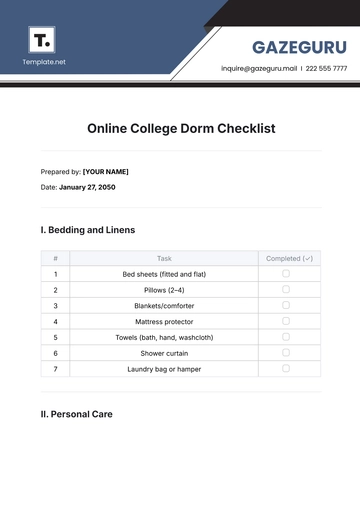

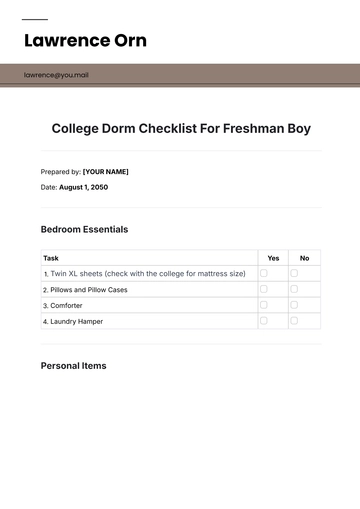

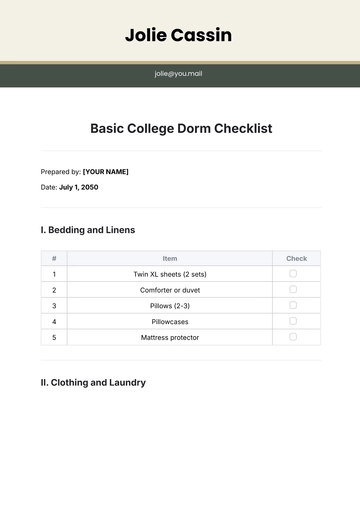

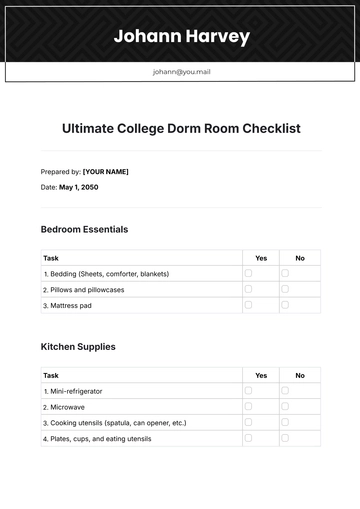

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist