Free Finance Budget Statement

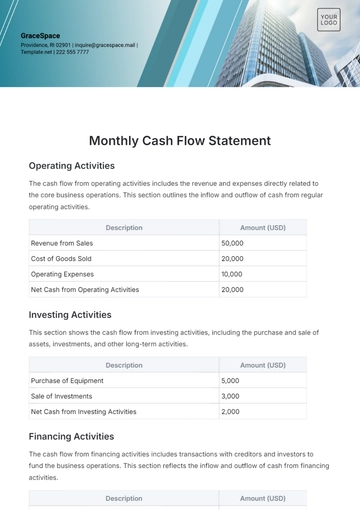

In Q3 of Fiscal Year [Year], our organization continues to focus on achieving financial sustainability and supporting strategic initiatives. The budget for this quarter reflects our commitment to prudent financial management and resource allocation.

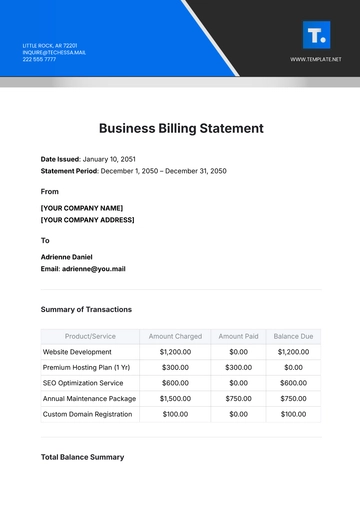

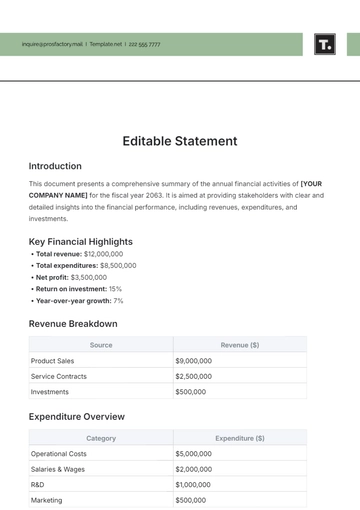

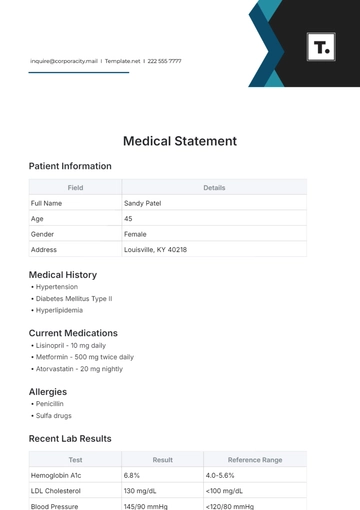

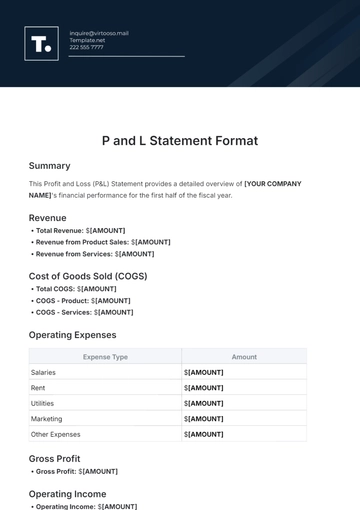

I. Revenue Projections

Revenue Source | July | August | September | Total Q3 |

Product Sales | $[0] | $[0] | $[0] | $[0] |

Service Fees | $[0] | $[0] | $[0] | $[0] |

Other Income | $[0] | $[0] | $[0] | $[0] |

Total Revenue | $[0] | $[0] | $[0] | $[0] |

II. Expenditure Projections

A. Operating Expenses

Expense Category | Jul | Aug | Sept | Total Q3 |

Personnel Costs | $[0] | $[0] | $[0] | $[0] |

Administrative Costs | $[0] | $[0] | $[0] | $[0] |

Marketing Expenses | $[0] | $[0] | $[0] | $[0] |

Total Operating Expenses | $[0] | $[0] | $[0] | $[0] |

B. Capital Expenditures

Project/Asset | Jul | Aug | Sept | Total Q3 |

[Project Name A] | $[0] | $[0] | $[0] | $[0] |

[Project Name B] | $[0] | $[0] | $[0] | $[0] |

Total Capital Expenditures | $[0] | $[0] | $[0] | $[0] |

C. Debt Service

Debt Obligation | Jul | Aug | Sept | Total Q3 |

[Loan A] | $[0] | $[0] | $[0] | $[0] |

[Loan B] | $[0] | $[0] | $[0] | $[0] |

Total Debt Service | $[0] | $[0] | $[0] | $[0] |

III. Budgetary Allocations

Department/Division | Budget Allocation |

Sales | $[0] |

Operations | $[0] |

Marketing | $[0] |

Total Budget | $[0] |

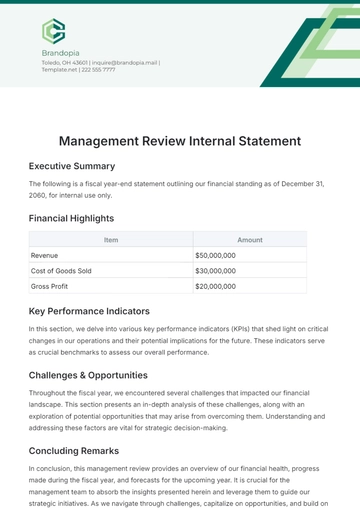

IV. Financial Ratios and Metrics

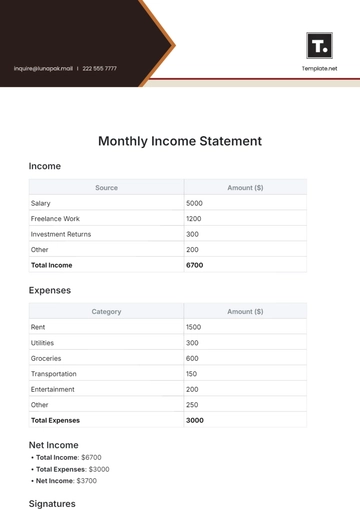

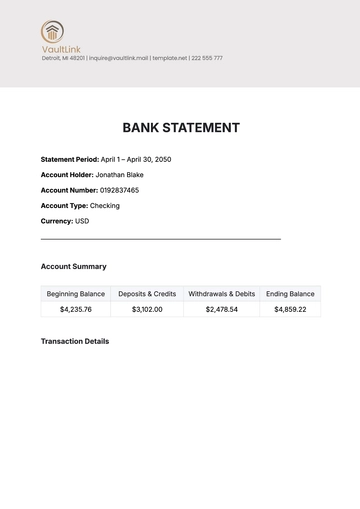

Debt-to-Equity Ratio: The Debt-to-Equity Ratio stands at a healthy 0.2, indicating a conservative approach to financing. This low ratio reflects a balanced capital structure, minimizing financial risk and demonstrating our commitment to maintaining a strong financial position.

Current Ratio: With a Current Ratio of 2.5, our organization exhibits robust liquidity. This ratio underscores our ability to meet short-term obligations comfortably, providing a financial cushion for unforeseen challenges and potential investment opportunities.

Operating Margin: The Operating Margin of 15% reflects efficient cost management and operational effectiveness. This metric indicates that for every dollar of revenue generated, we are maintaining a 15-cent profit after covering variable and fixed costs, showcasing sustainable profitability.

V. Budget Surplus/Deficit Analysis

The budget anticipates a surplus of $[0], demonstrating a sound financial position. This surplus enables us to reinvest in key initiatives, strengthen reserves, and pursue strategic opportunities. We will closely monitor actual performance against projections to identify areas for potential additional investment or cost-saving measures.

VI. Comparison with Previous Periods

Comparing Q3 FY [Year] with Q3 FY [Year] reveals a commendable [0]% increase in total revenue, attributed to successful sales strategies and market demand. Simultaneously, a [0]% decrease in operating expenses reflects ongoing efforts to optimize costs without compromising operational efficiency. This positive trend signifies the effectiveness of our financial management strategies.

VII. Conclusion and Recommendations

In conclusion, the Q3 FY [Year] Finance Budget Statement outlines a robust financial plan aligned with organizational objectives. The positive financial metrics and surplus indicate prudent fiscal management. To further enhance financial health, we recommend continuous monitoring of key performance indicators, periodic reviews of budget assumptions, and proactive measures to capitalize on emerging opportunities or address potential challenges. This adaptive approach will ensure sustained financial resilience and support long-term organizational growth.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Finance Budget Statement Template, available on Template.net. This comprehensive tool offers an editable and customizable format to create detailed budget statements effortlessly. With the Ai Editor Tool, adapt the template to suit your specific financial needs. Streamline budget reporting and analysis with this versatile solution.