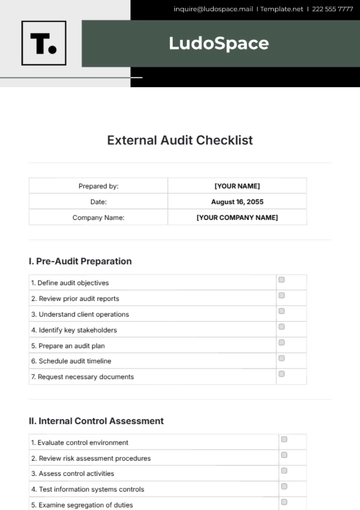

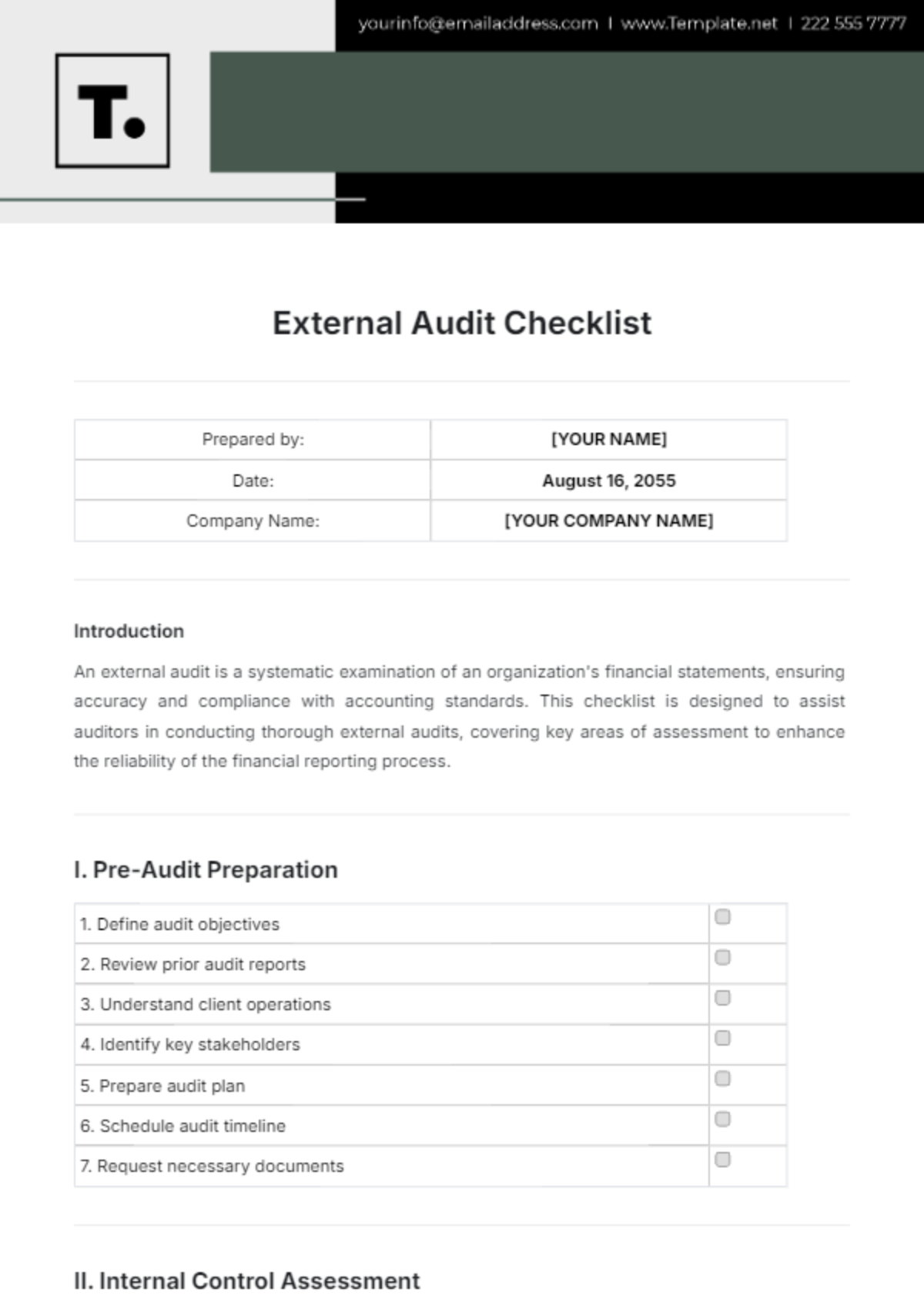

Free External Audit Checklist

Prepared by: | [YOUR NAME] |

Date: | August 16, 2055 |

Company Name: | [YOUR COMPANY NAME] |

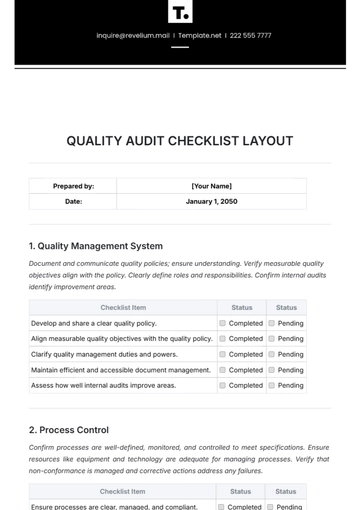

I. Pre-Audit Preparation

1. Define audit objectives | |

2. Review prior audit reports | |

3. Understand client operations | |

4. Identify key stakeholders | |

5. Prepare an audit plan | |

6. Schedule audit timeline | |

7. Request necessary documents |

II. Internal Control Assessment

1. Evaluate control environment | |

2. Review risk assessment procedures | |

3. Assess control activities | |

4. Test information systems controls | |

5. Examine segregation of duties | |

6. Analyze documentation processes |

III. Financial Statement Review

1. Examine income statement | |

2. Review balance sheet | |

3. Analyze cash flow statement | |

4. Verify account balances | |

5. Confirm revenue recognition policies | |

6. Evaluate expense classifications |

IV. Compliance Checks

1. Review compliance with regulations | |

2. Check adherence to internal policies | |

3. Assess tax compliance | |

4. Examine contracts for compliance | |

5. Verify licensing requirements |

V. Reporting and Recommendations

1. Compile audit findings | |

2. Prepare audit report | |

3. Present findings to stakeholders | |

4. Discuss recommendations | |

5. Follow up on implementation of recommendations |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Experience unparalleled convenience with our External Audit Checklist Template available on Template.net. This editable and customizable checklist guarantees a smooth audit process, providing accuracy and efficiency. Utilize our Ai Editor Tool to modify the checklist according to your specific requirements, streamlining the auditing experience. Elevate and optimize your auditing processes today!

You may also like

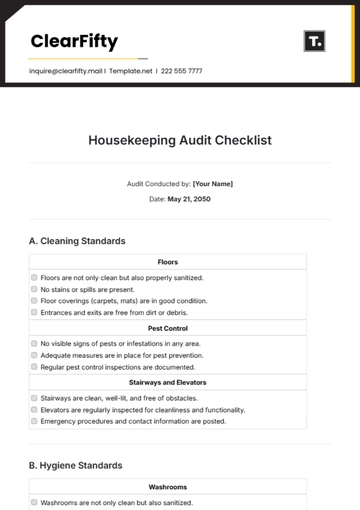

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

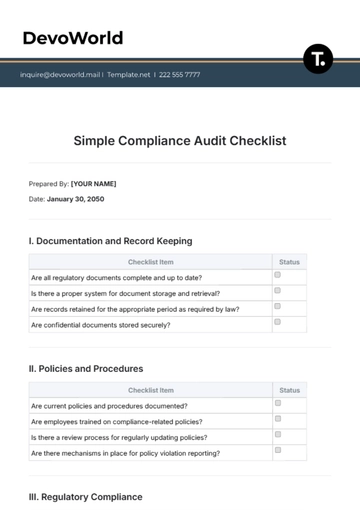

- Compliance Checklist

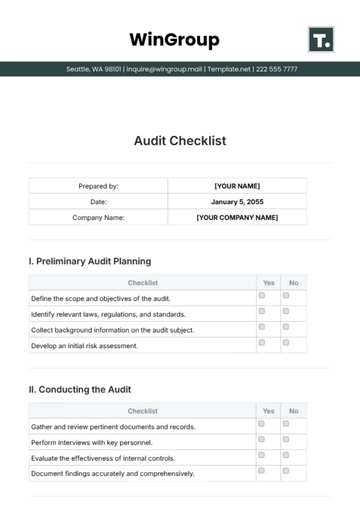

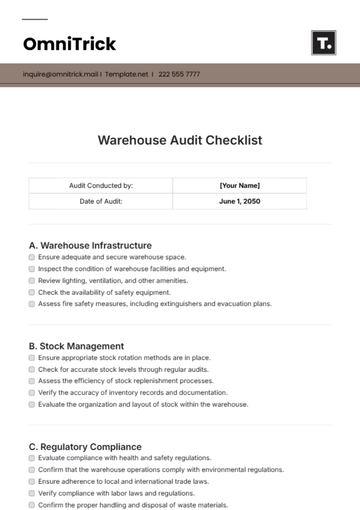

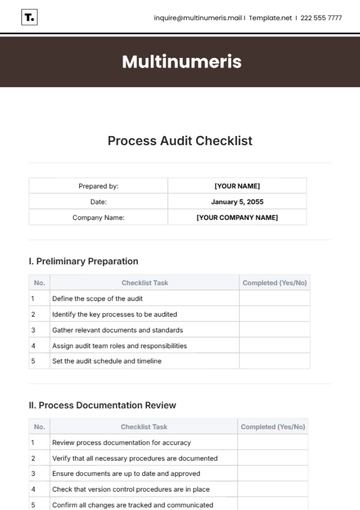

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

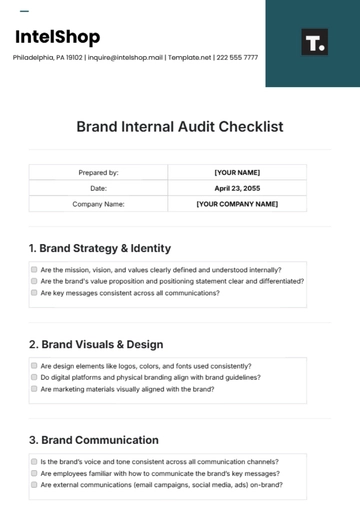

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

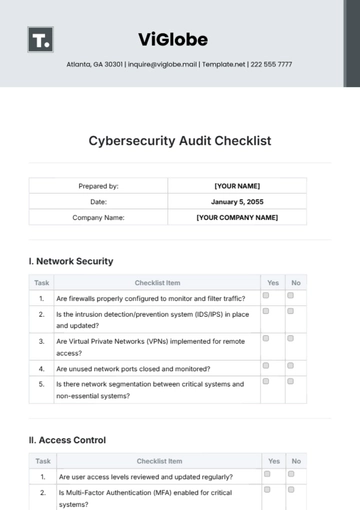

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist