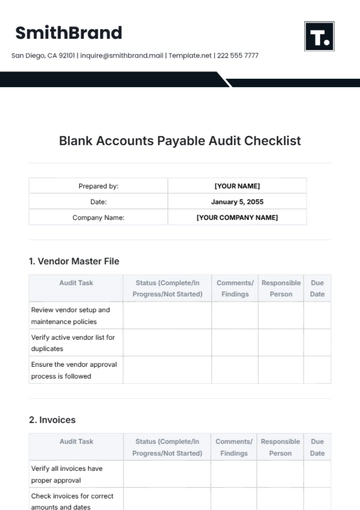

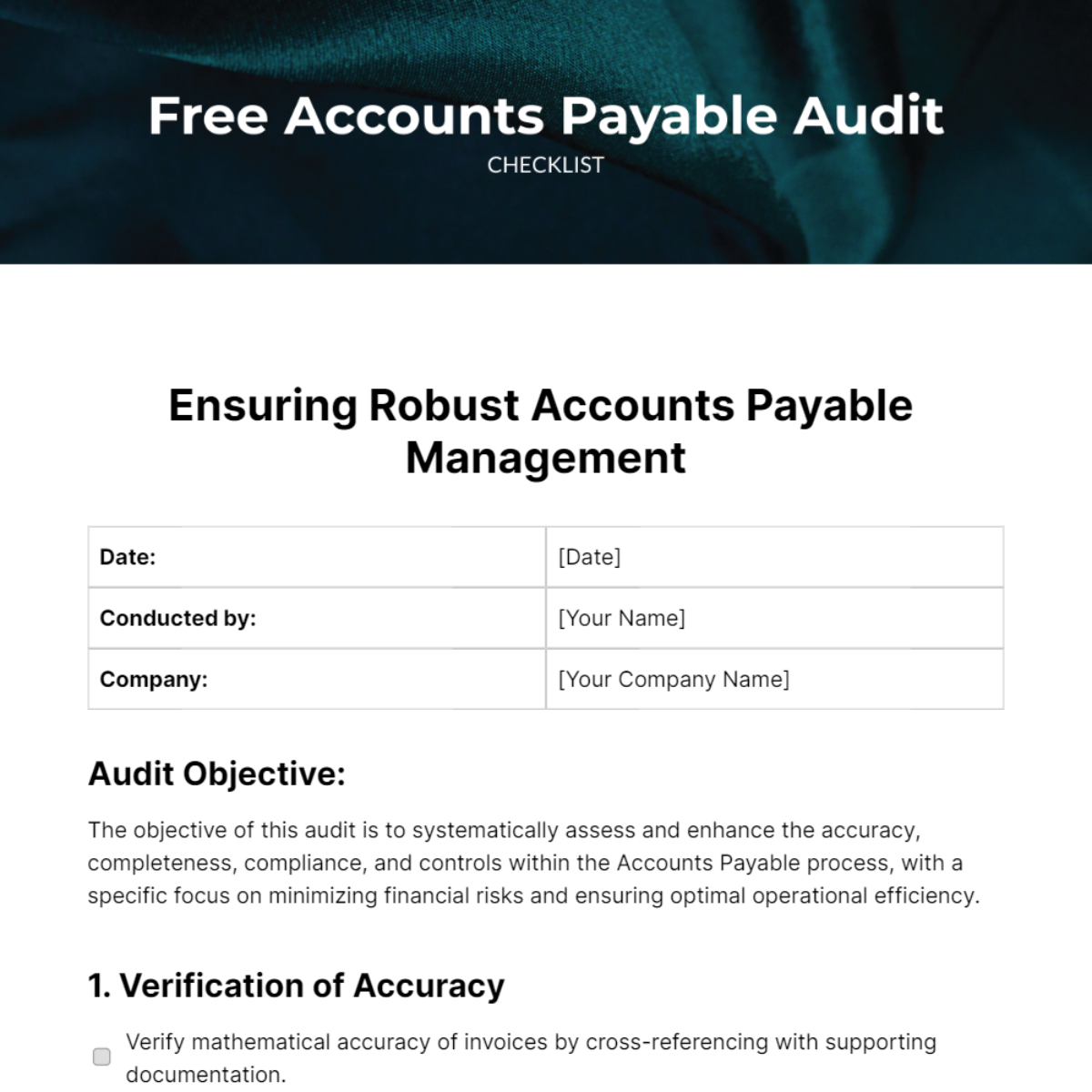

Free Accounts Payable Audit Checklist

Date: | [Date] |

Conducted by: | [Your Name] |

Company: | [Your Company Name] |

Audit Objective:

The objective of this audit is to systematically assess and enhance the accuracy, completeness, compliance, and controls within the Accounts Payable process, with a specific focus on minimizing financial risks and ensuring optimal operational efficiency.

1. Verification of Accuracy

Verify mathematical accuracy of invoices by cross-referencing with supporting documentation.

Confirm legitimacy of suppliers through thorough vetting processes.

Review and confirm the correctness of account coding for each transaction.

2. Assessment of Completeness

Ensure systematic recording of all received invoices.

Confirm accurate and comprehensive recording of all payments made.

Conduct a meticulous review of the reconciliation between the accounts payable ledger and the general ledger.

3. Review of Compliance

Verify strict adherence to established Accounts Payable policies and procedures.

Ensure compliance with relevant tax regulations governing payment transactions.

Confirm adherence to contractual terms and agreements with suppliers.

4. Effectiveness of Controls

Thoroughly review internal control procedures implemented in the Accounts Payable process.

Evaluate the segregation of duties within the Accounts Payable department for enhanced internal control.

Assess the effectiveness of controls in place for payment processing, focusing on accuracy and security.

5. Minimization of Financial Risks

Identify and address potential fraudulent activities through comprehensive scrutiny.

Assess the risk associated with overpayments or duplicate payments, implementing preventive measures.

Evaluate the potential financial impact of late payment penalties, if applicable, and devise strategies for mitigation.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Accounts Payable Audit Checklist Template, a meticulously crafted tool exclusively available on Template.net. This dynamic, editable, and customizable checklist ensures precision in financial audits, offering unparalleled convenience. Seamlessly edit in our AI Editor Tool for a tailored approach to safeguarding your financial processes. Elevate your audits with ease!

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

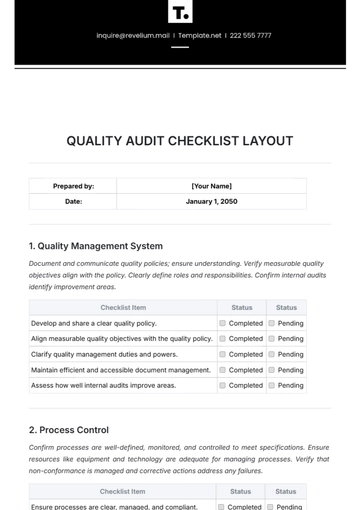

- Quality Checklist

- Compliance Checklist

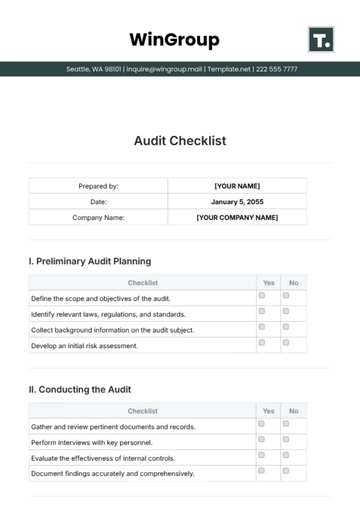

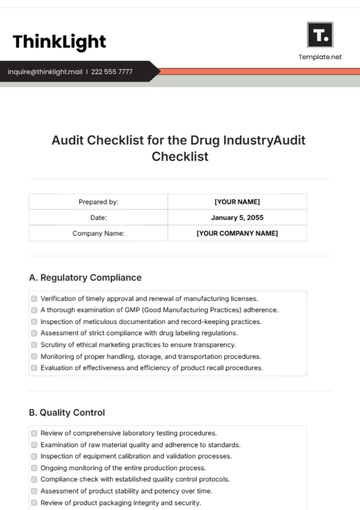

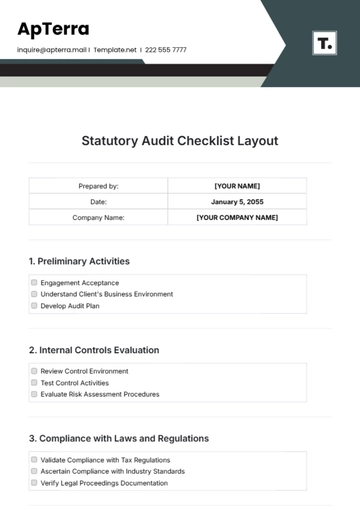

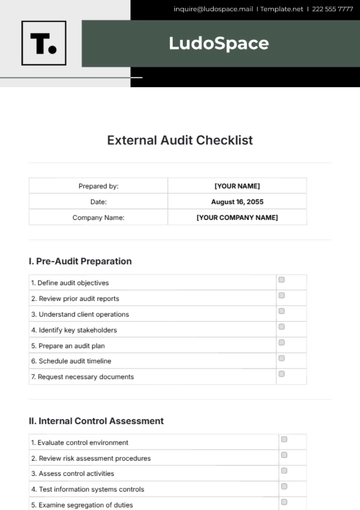

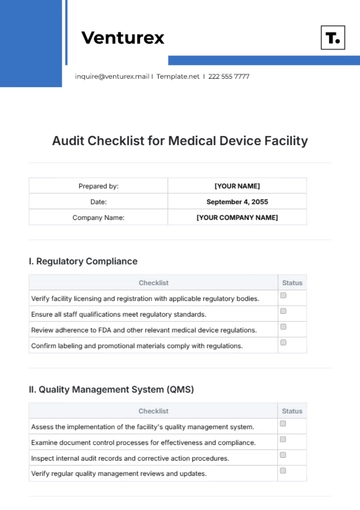

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

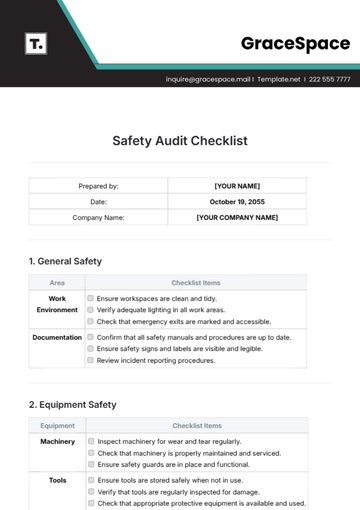

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist