Free SMART Goals for Emergency Fund

Prepared by: [YOUR NAME]

Company: [YOUR COMPANY NAME]

Objective/Goal Description:

Individuals use this SMART Goals to set specific savings goals for building an emergency fund to cover unforeseen expenses, such as medical emergencies, car repairs, or job loss.

SMART Goal

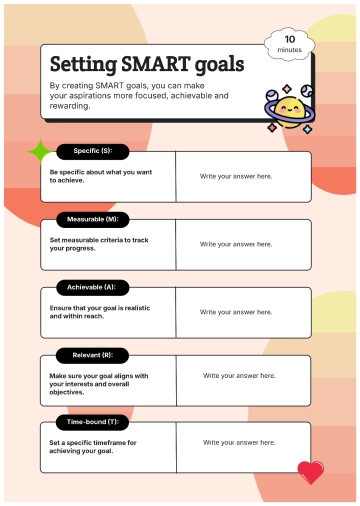

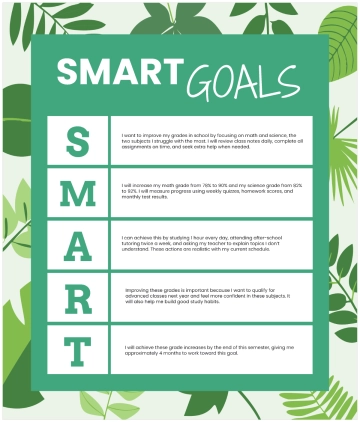

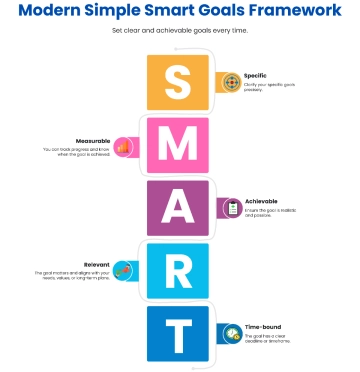

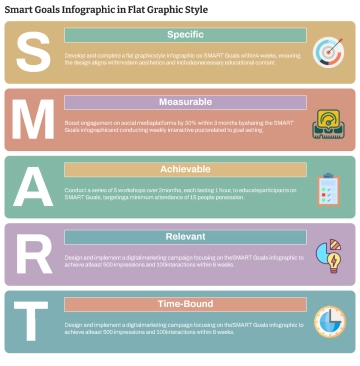

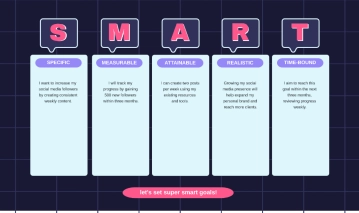

Initial | Initial Meaning | Component |

|---|---|---|

S | Specific | The goal should be clearly defined and specific. For example, "Save [SPECIFIC AMOUNT] in an emergency fund within the next [TIMEFRAME] months/years." |

M | Measurable | The goal should be quantifiable so progress can be tracked. For instance, "Track monthly contributions to the emergency fund and aim to save [SPECIFIC AMOUNT] per month." |

A | Achievable | The goal should be realistic and attainable within the individual's financial capabilities. Consider factors such as income, expenses, and other financial obligations. |

R | Relevant | The goal should align with the individual's financial priorities and provide financial security in the event of unexpected expenses or emergencies. |

T | Time-bound | The goal should have a specific deadline or timeframe for completion. Set a deadline for achieving the desired savings amount, such as within the next [TIMEFRAME] months/years. |

Action Plan

Steps to Achieve the Goal:

Assess Current Financial Situation: Review income, expenses, and existing savings to determine how much can be allocated to the emergency fund each month.

Set Monthly Savings Targets: Determine the amount of money to save each month to reach the desired emergency fund goal within the specified timeframe. [TARGET AMOUNT AND DEADLINE]

Create a Separate Savings Account: Open a dedicated savings account specifically for the emergency fund to prevent it from being used for non-emergencies. [BANK NAME AND ACCOUNT DETAILS]

Automate Savings Contributions: Set up automatic transfers from the primary checking account to the emergency fund savings account on a recurring basis. [AUTOMATION DETAILS]

Monitor Progress Regularly: Track savings progress each month and adjust contributions as needed to stay on track with the savings goal. (Placeholder: [TRACKING METHOD]

Accountability |

|

Notes |

|

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the SMART Goals Template for Emergency Fund by Template.net. Crafted with precision, this editable and customizable template empowers you to set specific, measurable, achievable, relevant, and time-bound goals effortlessly. Editable in our Ai Editor Tool, it ensures seamless adaptation to your unique financial objectives. Take charge of your emergency fund strategy today!