Free SMART Goals Retirement Planner

Prepared by: [YOUR NAME]

Company: [YOUR COMPANY NAME]

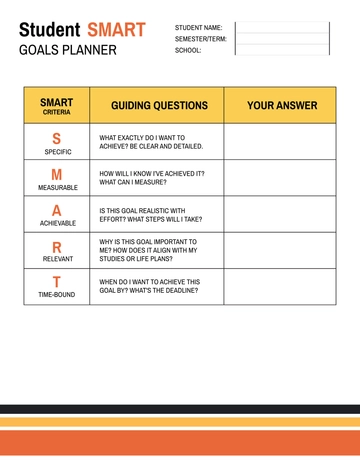

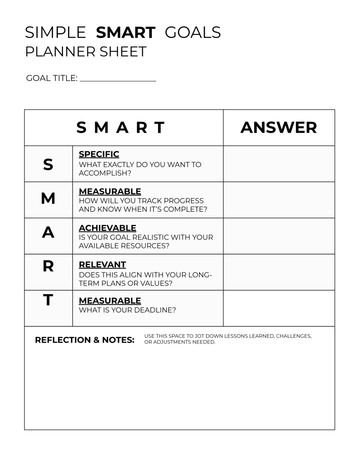

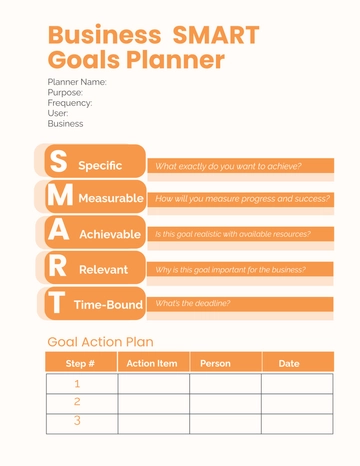

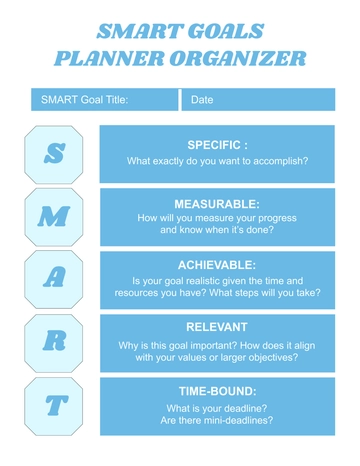

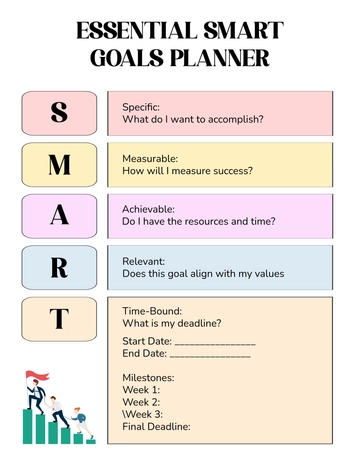

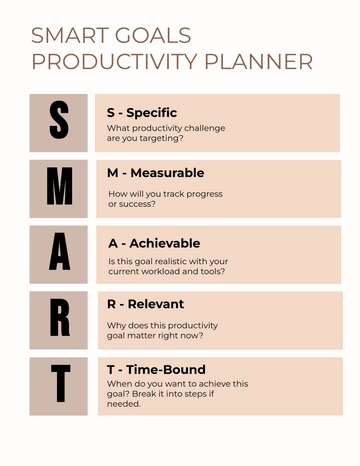

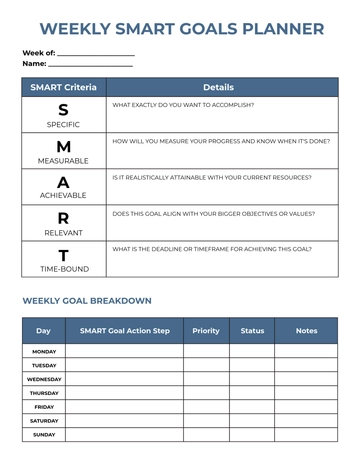

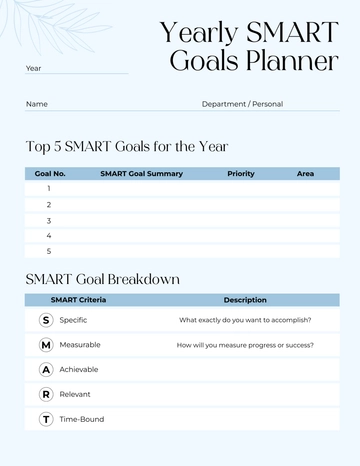

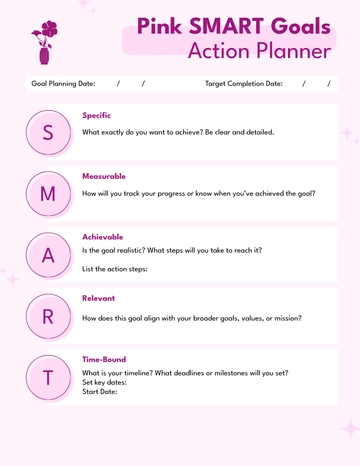

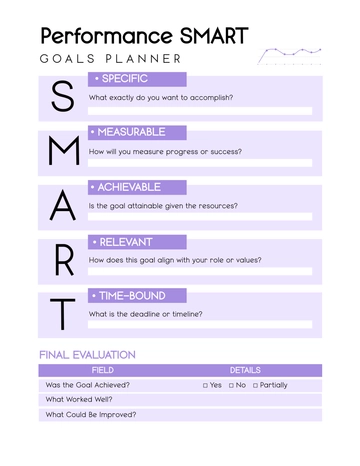

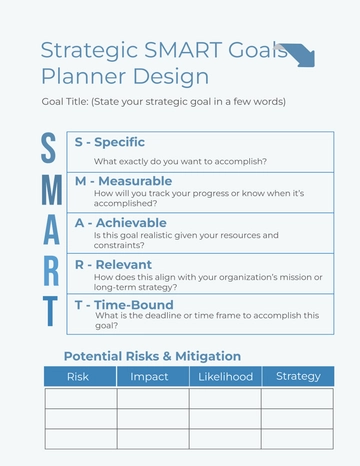

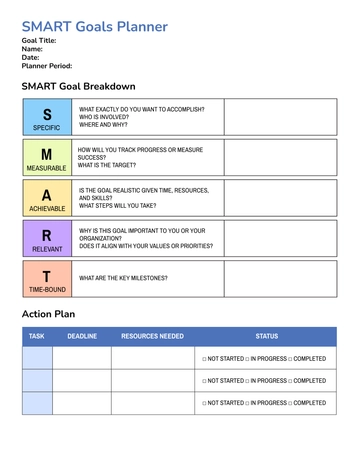

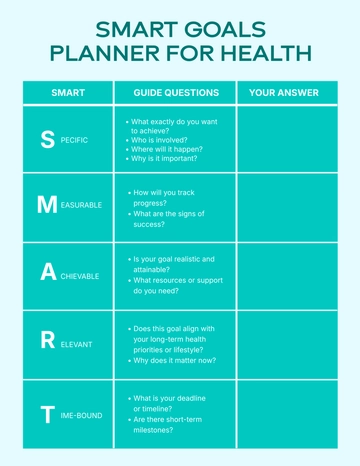

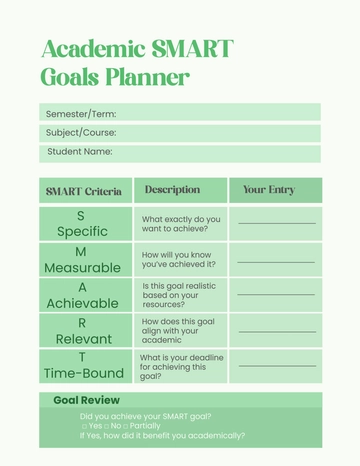

SMART Goals:

S | Specific: Define your retirement goals. What exactly do you want to achieve when you retire? Example: "I want to have $1 million saved in my retirement fund by the time I'm 65."[YOUR SPECIFIC GOAL] |

|---|---|

M | Measurable: How will you measure progress towards your goal? Example: "I will contribute $500 every month towards my retirement fund."[YOUR MEASURABLE METRIC] |

A | Achievable: Is your goal realistic with effort and commitment? have you got the resources to achieve your goal? Example: "I can afford to contribute $500 every month because I am reducing my spending and increasing my income."[YOUR ASSESSMENT] |

R | Relevant: Why is the goal important to you? Example: "I want to be financially independent when I retire and not rely on others."[YOUR REASON] |

T | Time-bound: What's your time frame for reaching your retirement goal? Example: "I plan on retiring at 65, which gives me 15 more years to save."[YOUR TIME FRAME] |

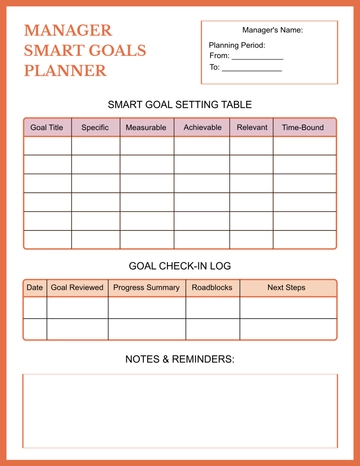

Action Plan: SMART Goals Retirement Planner

GOALS | EXPLENATIONS |

|---|---|

|

|

2.Identify Specific Retirement Goals |

|

3. SMART Goal Setting: |

|

4.CInitial Assessment |

|

5.Component Identification: |

|

ACCOUNTABILITY: |

In essence, every retirement goal needs a designated person to monitor and report on its progress. It's essential to clearly delineate the duties and responsibilities of each person or entity involved in retirement planning, ranging from [PROFESSIONAL] to [FAMILY MEMBERS]. Clearly assigning roles helps avoid confusion and facilitates a seamless planning process for retirement goals. |

NOTES: |

|

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the SMART Goals Retirement Planner Template from Template.net. This meticulously crafted tool offers an editable and customizable solution to plan your retirement effectively. With seamless integration into our Ai Editor Tool, achieving your financial goals has never been easier. Start planning your future with confidence today!

You may also like

- Aesthetic Planner

- Hourly Planner

- Daily Planner

- Weekly Planner

- Monthly Planner

- Planners Yearly

- Event Planner

- Project Planner

- Calendar Planner

- Student Planner

- School Planner

- Teacher Planner

- Kawaii Planner

- Budget Planner

- Life Planner

- Meal Planner

- Study Planner

- Business

- Workout Planner

- Work Schedule Planner

- Party Planner

- Social Media Planner

- Baby Shower Planner

- Book Planner

- Planner Cover

- Debt Planner

- Desk Planner

- Diet Planner

- Family Planner

- Fitness Planner

- Goal Planner

- Health Planner

- Medical Planner

- Holiday Planner

- Homework Planner

- Itinerary Planner

- Journal Planner

- Personal Planner

- Route Planner

- Smart Goal Planner

- Travel Planner

- Wedding Planeer