Entrepreneurial success in your construction company always takes place when multiple factors work hand in hand to create a better environment. And one of those significant factors is the existence or availability of assets, or working capital, in terms of business. With that being said, allow us to help you by downloading our Construction Investment Proposal Templates that will surely secure a lifelong investment for you. Our ready-made template comes with an editable and customizable feature to add to your convenience. Download now in file formats like MS Word, Pages, and Google Docs. Don't let this great deal go away!

How to Create a Construction Investment Proposal?

A construction investment proposal is a report prepared for potential investors or creditors by a supporter of a new business project or the administration of an established company. According to smallbusiness.chron.com, the most effective construction proposal is the document that tells a prospective investor concisely and precisely what is in it for him or her if he or she wants to help finance the said project. And to ensure that your proposal incorporates these features, we have compiled a list of the most valuable pieces of information to be included in your investment proposal.

1. Start with the Format

Your proposal must begin with a cover page preceded by a page of the contents. Start the document's content with an introductory paragraph that outlines what the company is, its current, reported results and achievements. Put the estimated gross margins for several years, the size of the capital required, and the expected return for a shareholder. In your overview, don't demonstrate, validate, or support your numbers: you'll do that in the remaining portion of your proposal.

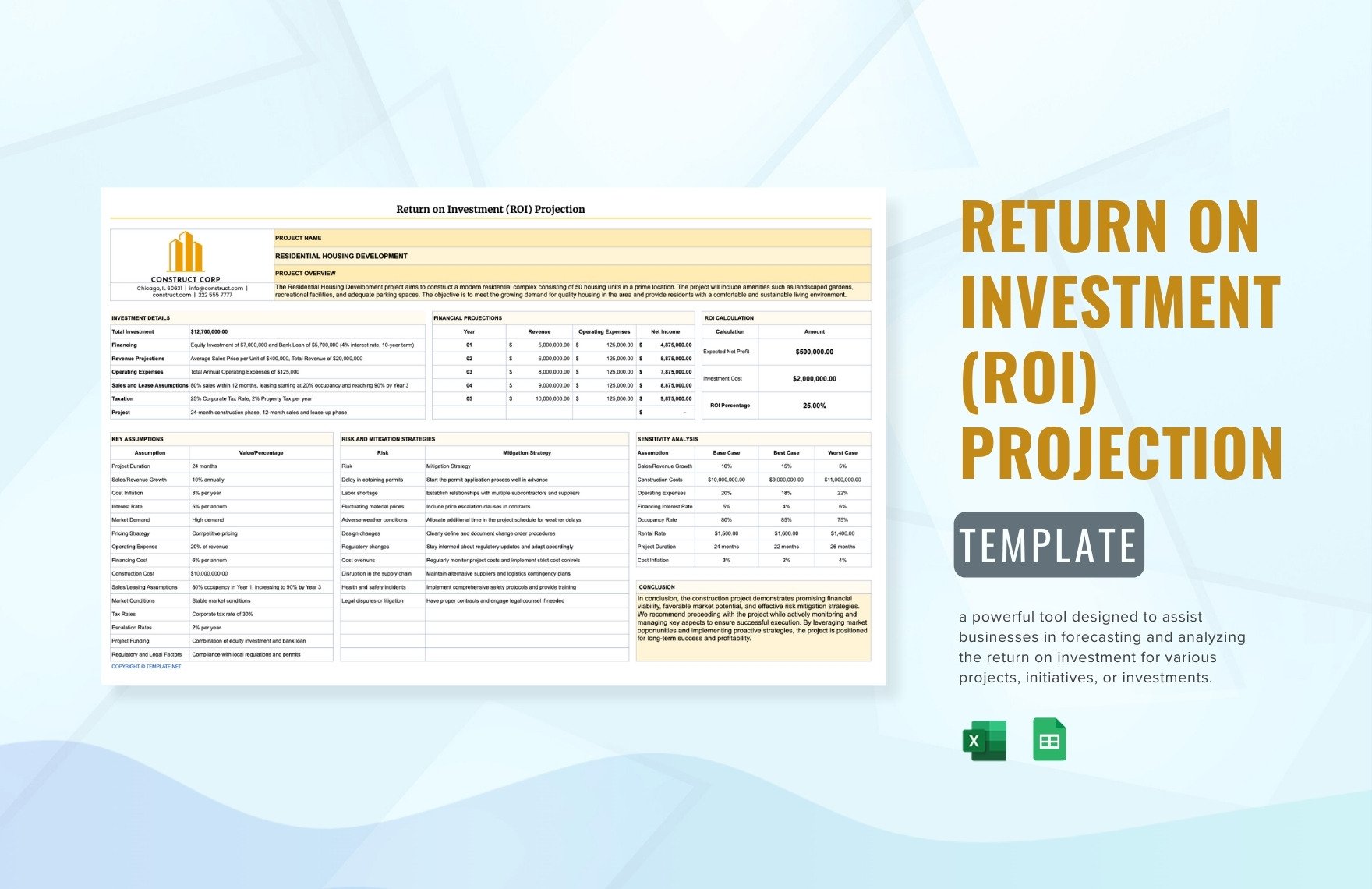

2. Collect your Numbers

The most pertinent piece of information for prospective clients might be your existing financial figures. Provide a copy of your recent payslip, operating budget, share price, and tax liability. Your balance worksheet must be a detailed description of the financial assets that you hold. Develop a chart that shows the last three years of your profits, costs, and profitability. Lastly, offer additional cash-flow declarations and aging analyses for accounts payable if these prove you are operating on a sound year-round monetary footing.

3. Present Trends

Illustrate the sales numbers according to factors, both qualitative and quantitative. Demonstrate why your sales have increased or decreased using market-specific information and any reliable data from market groups, business journals, or agencies that you can find. For instance, your revenues may have recently dipped due to a new company. Show how you're tackling this. Thus, your sales may have improved because you've introduced new platforms for marketing. To project investment returns, use your records on the latest sales and market volatility. It will tell prospective investors that you are not dragging the assumptions of sales and profits from thin air.

4. Include an Offer

Tell shareholders what you want, and what they're going to get in exchange. They're going to know how much resources they're going to prepare to put into your company, what it's going to be used for, when they'll get their initial cost back and what return they should expect afterward.