Free Monthly Accounting Checklist

Streamlining financial processes is crucial for sustained business success. This Monthly Accounting Checklist ensures your financial health by covering three core areas: Bookkeeping, Financial Reporting, and Compliance and Risk Management.

Objectives:

To provide a systematic approach in managing financial tasks.

To ensure accuracy and compliance in all accounting practices.

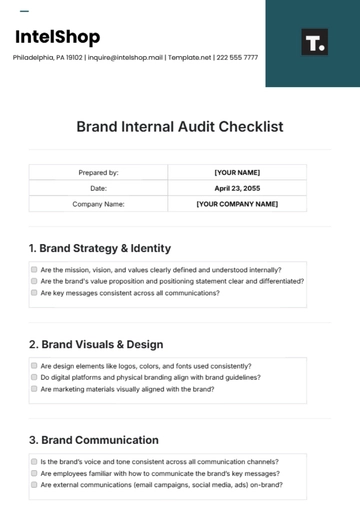

To enhance the brand identity of the company.

Bookkeeping

1. Detailed Transaction Records:

Document every financial transaction meticulously.

Log receipts, invoices, and expenses for a comprehensive financial trail.

2. Ledger Accuracy:

Regularly verify and ensure precision in ledger entries.

Address discrepancies promptly to maintain data integrity.

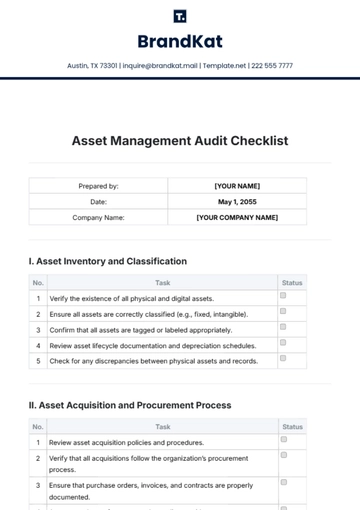

3. Internal Audits:

Conduct frequent internal audits for data validation.

Identify and rectify errors to enhance the reliability of financial information.

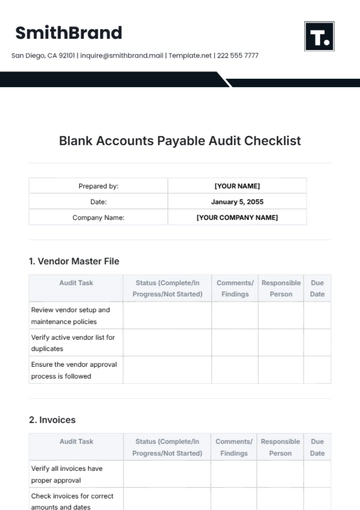

4. Invoice Monitoring:

Keep a close eye on receivables and payables.

Implement strategies to optimize cash flow and minimize payment delays.

5. Period Closure:

Summarize financial activities at the end of each period.

Facilitate smoother transitions between financial reporting periods.

Financial Reporting

1. Profit and Loss Statements:

Generate detailed monthly profit and loss statements.

Analyze trends and financial health to inform strategic decision-making.

2. Financial Forecasts:

Develop quarterly financial forecasts for proactive planning.

Anticipate potential challenges and capitalize on emerging opportunities.

3. Budget Planning:

Provide annual budget planning and reporting.

Align financial goals with overall business objectives.

4. Comprehensive Statements:

Prepare detailed financial statements for stakeholders.

Enhance transparency by presenting a clear overview of the financial position.

5. Timely Filings:

Furnish tax filings and financial disclosures promptly.

Ensure compliance with regulatory timelines.

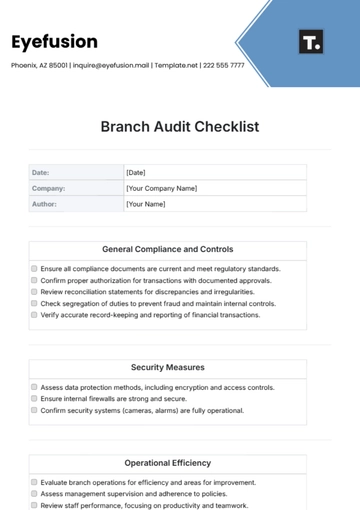

Compliance and Risk Management

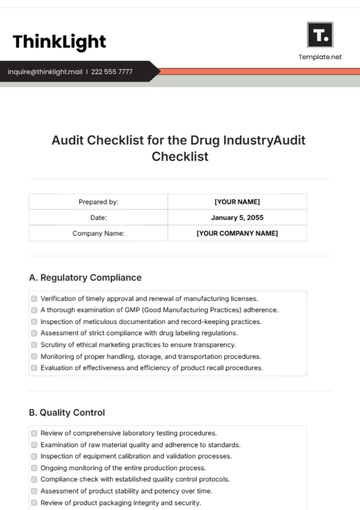

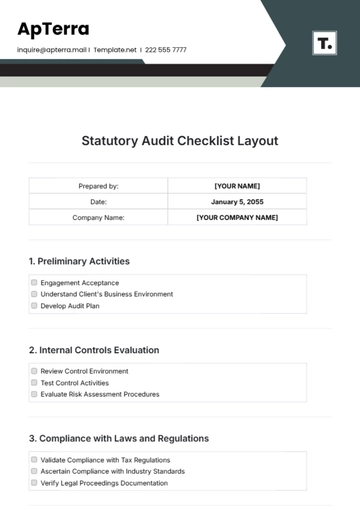

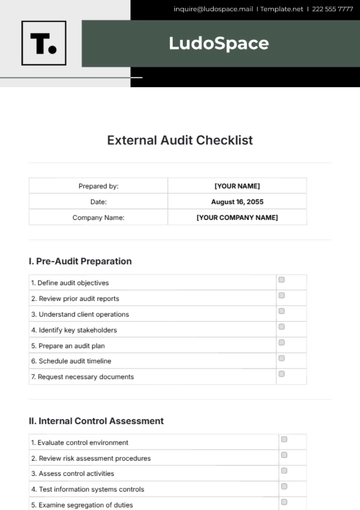

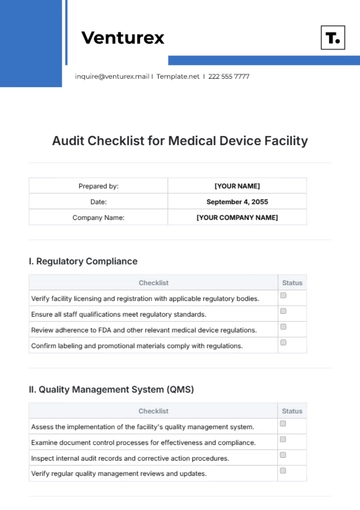

1. Regulatory Compliance:

Regularly review and update processes to meet financial regulations.

Stay informed about changes in compliance requirements.

2. Risk Management:

Develop and implement a robust risk management plan.

Identify, assess, and mitigate potential risks to financial stability.

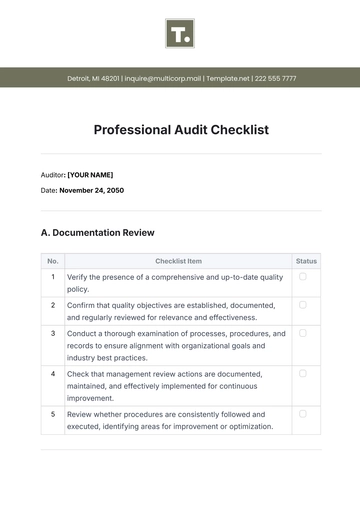

3. Audit-Based Corrective Actions:

Implement corrective actions based on internal audit findings.

Continuously refine processes to minimize risks.

4. Insurance Coverage:

Maintain up-to-date insurance coverage.

Ensure adequate protection against unforeseen financial challenges.

Conducted by: [Your Name]

Company: [Your Company Name]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Keep your finances in check with this Monthly Accounting Checklist Template, exclusively available at Template.net. Designed for meticulous financial tracking, this tool is fully customizable and editable in our Ai Editor Tool. Ensure accuracy and efficiency in your monthly accounting routines with this indispensable and editable checklist. Access it now!

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

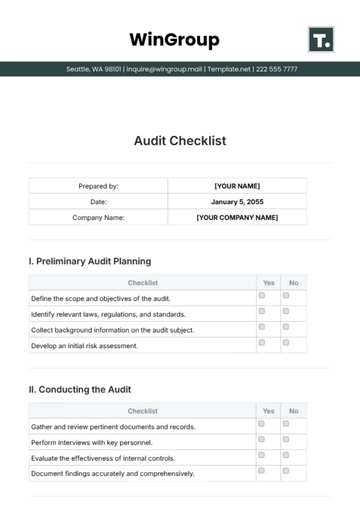

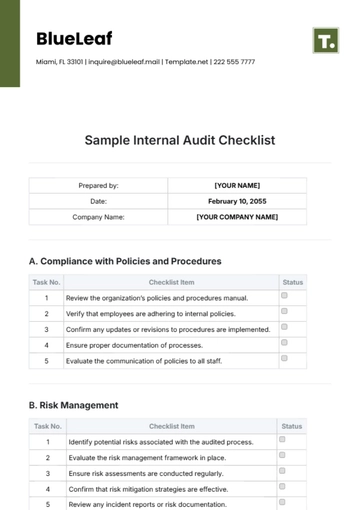

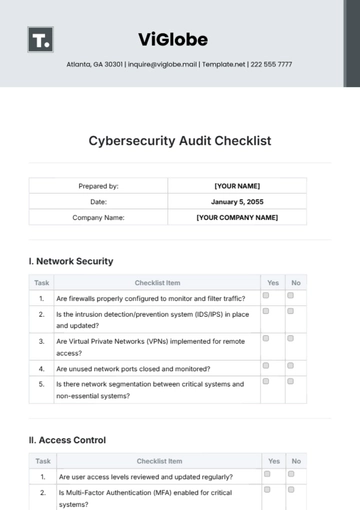

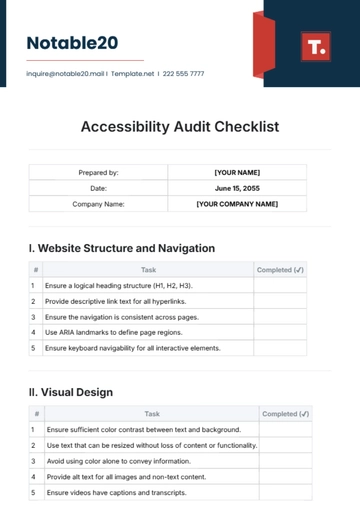

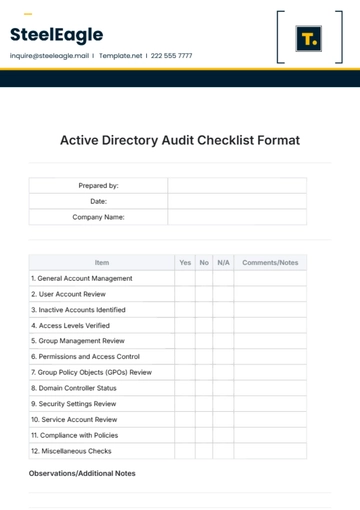

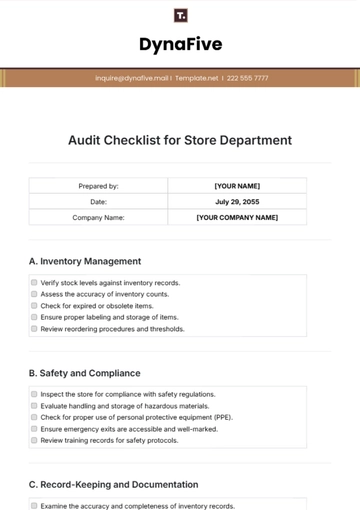

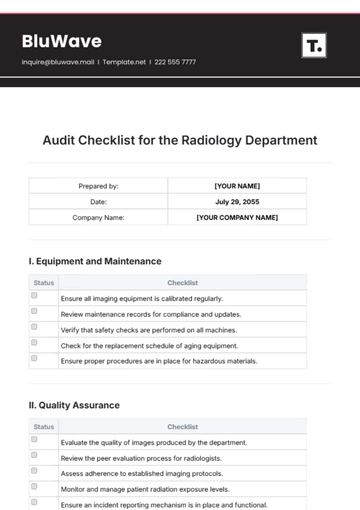

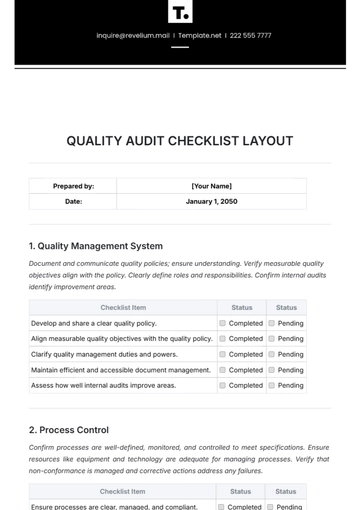

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

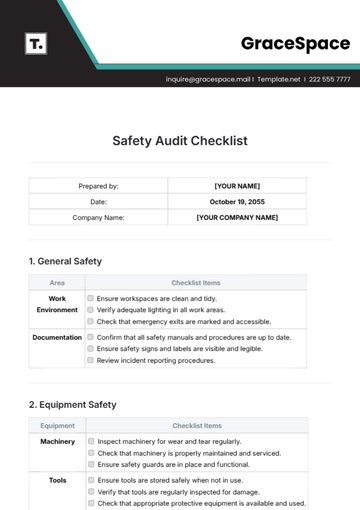

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist