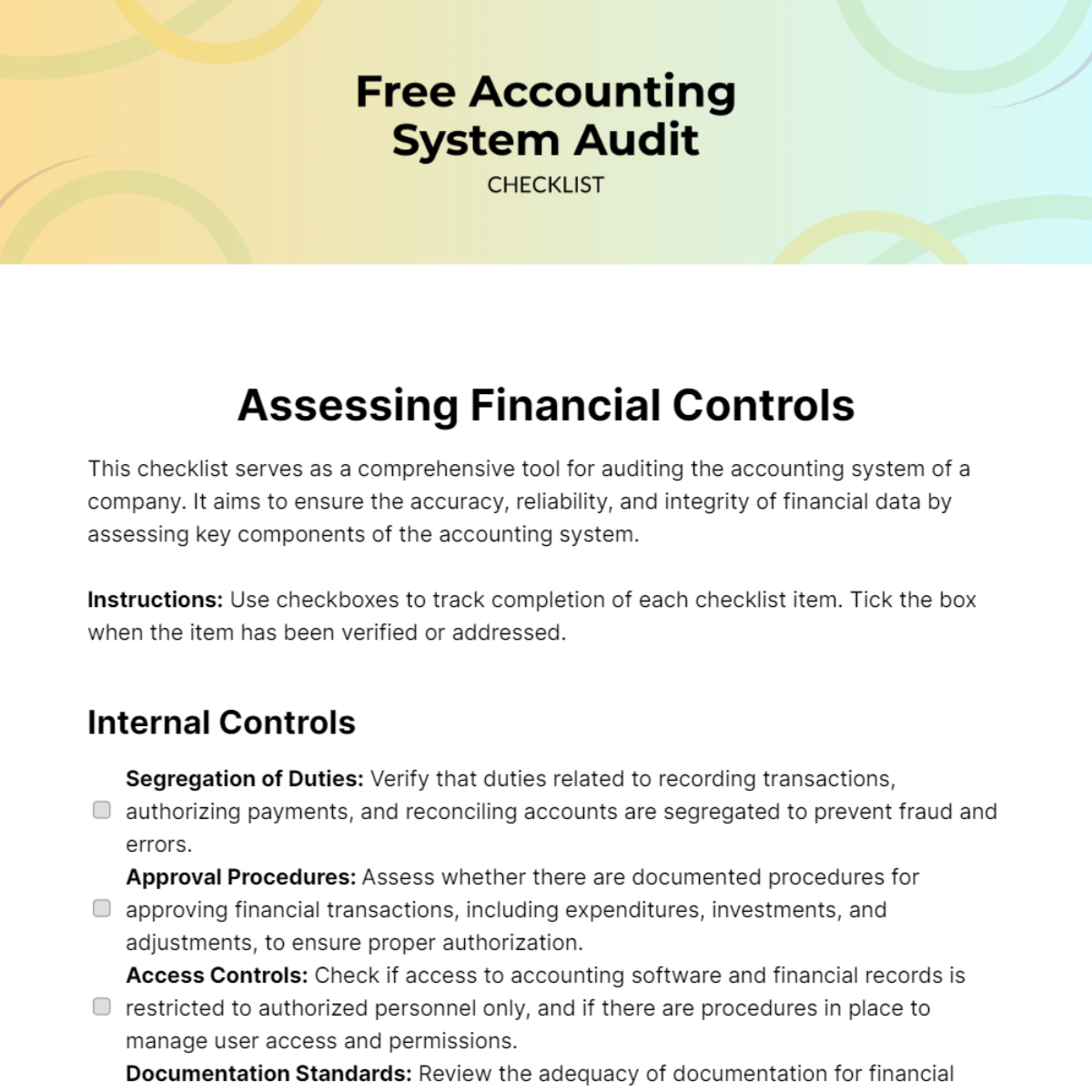

Free Accounting System Audit Checklist

This checklist serves as a comprehensive tool for auditing the accounting system of a company. It aims to ensure the accuracy, reliability, and integrity of financial data by assessing key components of the accounting system.

Instructions: Use checkboxes to track completion of each checklist item. Tick the box when the item has been verified or addressed.

Internal Controls

Segregation of Duties: Verify that duties related to recording transactions, authorizing payments, and reconciling accounts are segregated to prevent fraud and errors.

Approval Procedures: Assess whether there are documented procedures for approving financial transactions, including expenditures, investments, and adjustments, to ensure proper authorization.

Access Controls: Check if access to accounting software and financial records is restricted to authorized personnel only, and if there are procedures in place to manage user access and permissions.

Documentation Standards: Review the adequacy of documentation for financial transactions, including invoices, receipts, contracts, and agreements, to ensure completeness and accuracy.

Monitoring and Review: Evaluate the effectiveness of monitoring processes, such as regular reviews of financial reports and reconciliations, to detect and prevent errors or irregularities.

Financial Reporting

Timeliness of Reporting: Assess whether financial reports are prepared and distributed within the specified timeframes, such as monthly, quarterly, or annually, to facilitate timely decision-making.

Accuracy of Financial Statements: Verify the accuracy of financial statements, including the balance sheet, income statement, and cash flow statement, by comparing them with supporting documentation and reconciliations.

Compliance with GAAP/IFRS: Ensure that financial statements comply with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), including proper classification, measurement, and disclosure of transactions.

Consistency and Comparability: Check if accounting policies and practices are consistently applied across reporting periods and if financial information is presented in a manner that allows for meaningful comparisons over time.

Disclosure Requirements: Review the adequacy of disclosures in financial statements, such as related party transactions, contingent liabilities, and significant accounting policies, to ensure transparency and compliance with regulatory requirements.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Level up your audit process with this expertly crafted Accounting System Audit Checklist Template. Designed for thoroughness and efficiency, it is highly customizable and directly editable in our AI Editor Tool. Ensure comprehensive and accurate audits every time with this dynamic template, a must-have for any auditing professional from Template.net.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

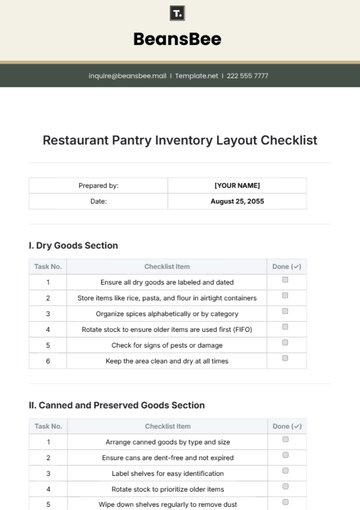

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

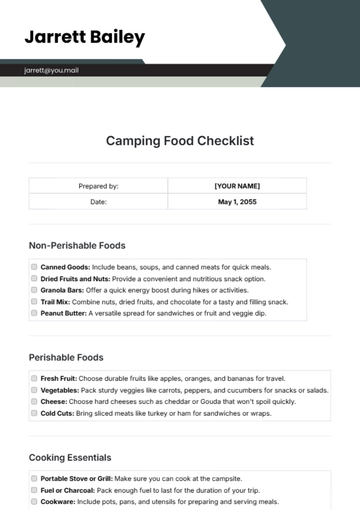

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

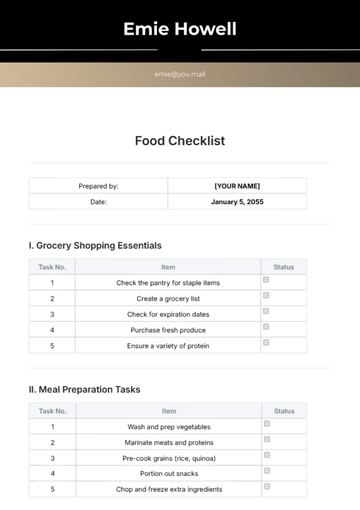

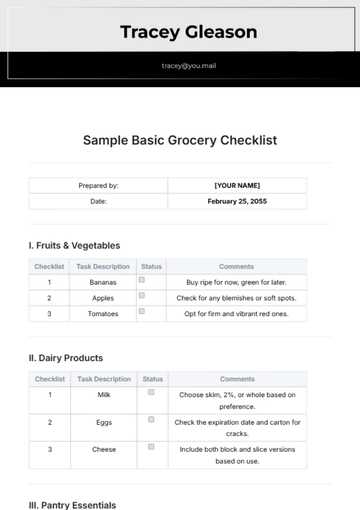

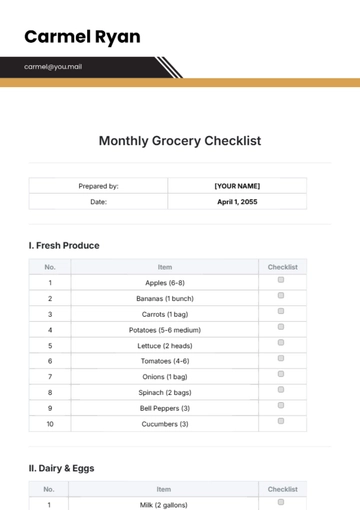

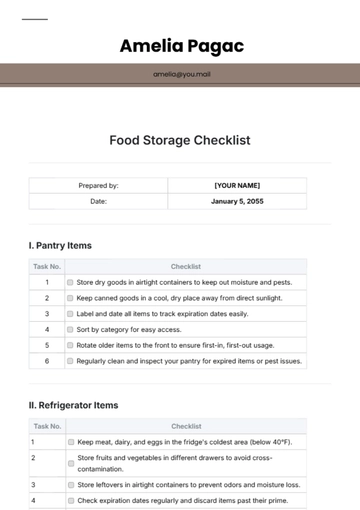

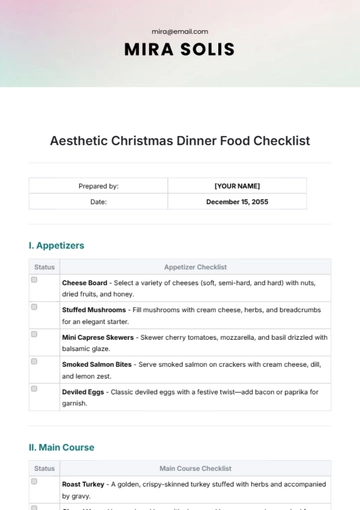

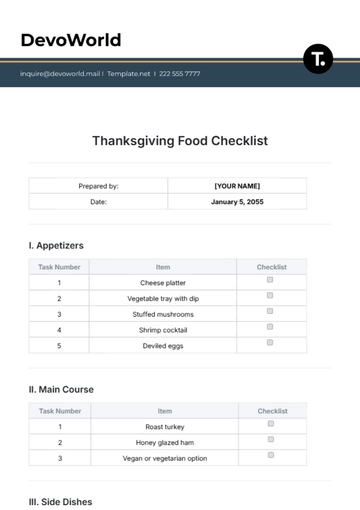

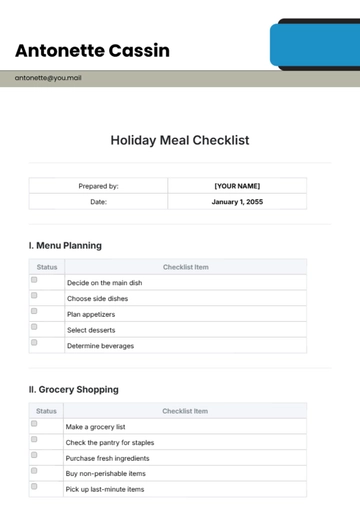

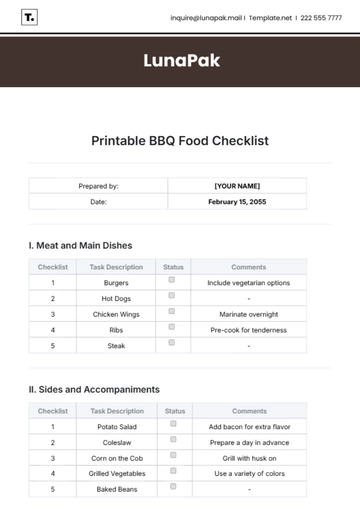

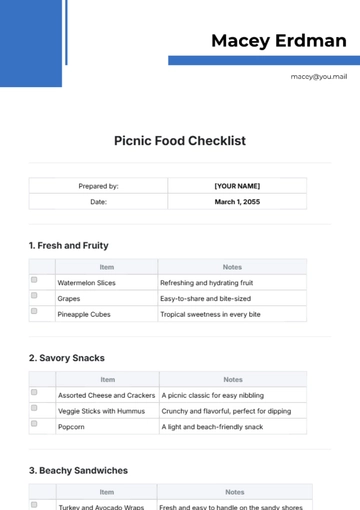

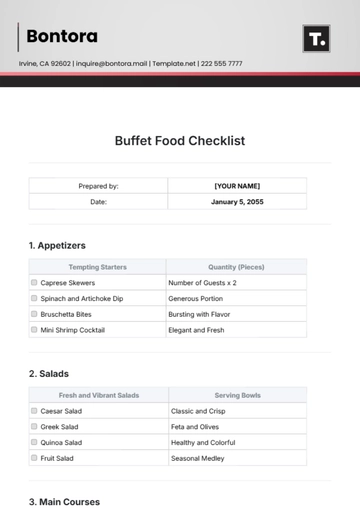

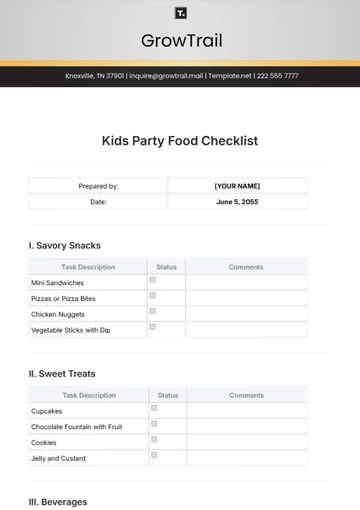

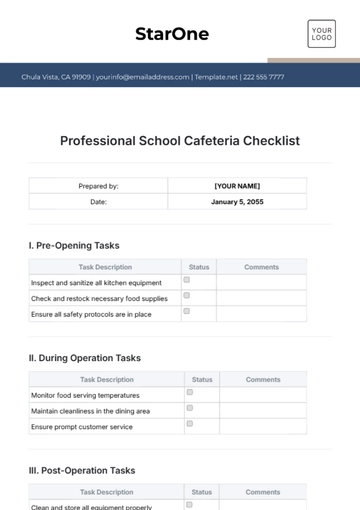

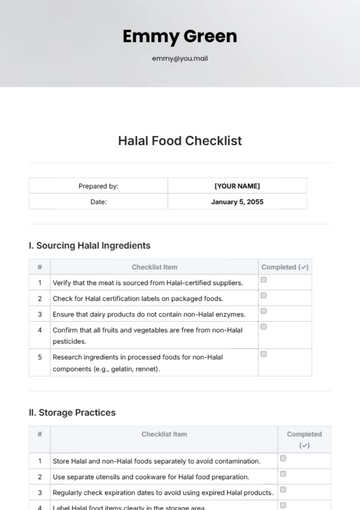

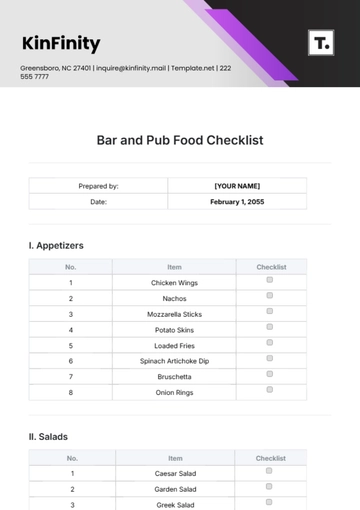

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

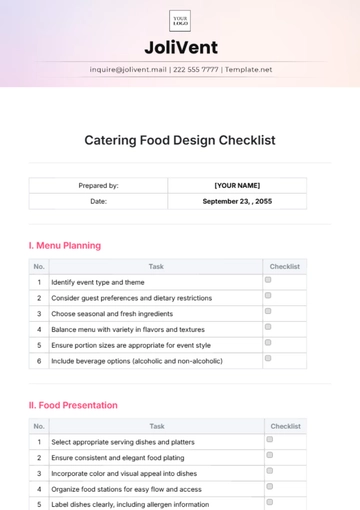

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

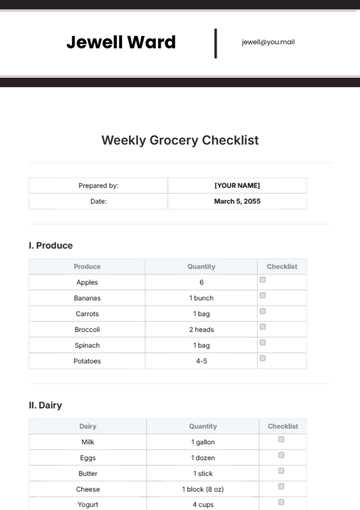

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

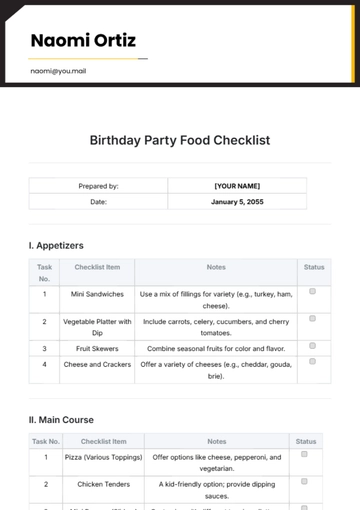

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist