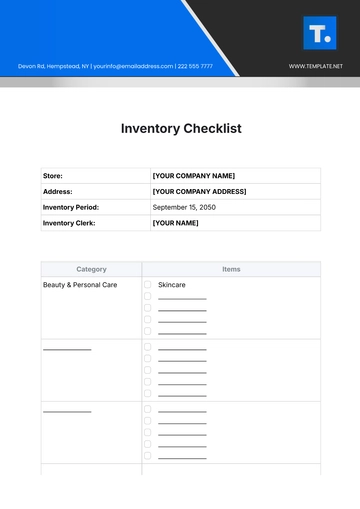

Free Restaurants Accounting Checklist

Ensuring a robust financial management system is crucial for the success of any restaurant business. This comprehensive checklist covers key aspects of restaurant accounting to help maintain financial integrity, regulatory compliance, and informed decision-making.

Instructions: Kindly check each item when accomplished. This will help you track your progress during evaluation.

Objectives

To promote efficiency and accuracy in the accounting process.

To ensure adherence to financial standards and regulations.

To facilitate regular checks and balances.

To earn trust and credibility through a brand's unique identity.

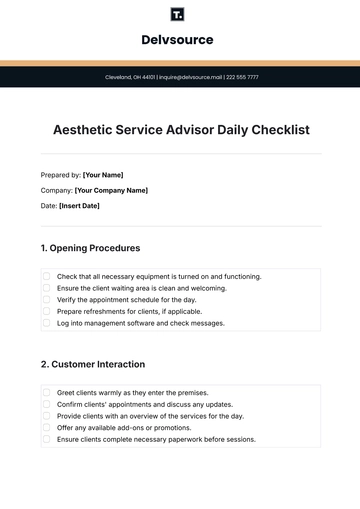

1. General Accounting:

Establish and organize a detailed chart of accounts tailored to the restaurant industry, encompassing revenue, expenses, assets, and liabilities.

Accurately record and categorize all financial transactions, including sales, purchases, and operating expenses, to maintain a clear financial trail.

Regularly reconcile bank and credit card statements to identify and rectify any discrepancies, ensuring financial accuracy.

Efficiently manage vendor payments and customer receivables to maintain healthy cash flow and build positive relationships with stakeholders.

Regularly prepare comprehensive financial statements, including income statements and balance sheets, to assess the overall financial health of the restaurant.

2. Journals and Ledgers:

Log all financial transactions in respective journals to maintain a chronological record of business activities.

Transfer journal entries to ledger books, creating a summarized and organized overview of financial transactions.

Regularly review and adjust ledger entries to reflect any necessary changes accurately.

Complete ledger entries by posting adjusting entries to ensure financial data accuracy.

Reconcile the ledger with bank statements to identify and rectify any discrepancies promptly.

3. Financial Analyses and Reporting:

Conduct monthly analyses comparing budgeted financial expectations with actual performance to identify variances.

Perform detailed analyses of financial variances to understand the reasons behind deviations from the budget.

Prepare cash flow forecasts to anticipate financial needs and plan for potential challenges.

Regularly generate income statements to assess the profitability of the restaurant's operations.

Deliver concise and informative financial reports to support strategic decision-making within the management team.

4. Regulatory Compliance:

Ensure adherence to all tax filing deadlines and maintain accurate records for tax compliance.

Stay compliant with auditable accounting standards relevant to the restaurant industry.

Implement robust internal controls to prevent and detect fraud, safeguarding the restaurant's financial integrity.

Stay updated with the latest accounting regulations to ensure ongoing compliance.

Effectively handle any compliance issues or discrepancies promptly to avoid regulatory complications.

5. Audits and Reviews:

Conduct regular internal audits to assess the effectiveness of internal controls and identify areas for improvement.

Prepare for external audits by organizing and reviewing financial records thoroughly.

Address any issues or concerns raised during audits promptly and implement corrective actions.

Implement recommendations provided by auditors to enhance financial practices and compliance.

Collaborate with the management team to review audit results, ensuring transparency and continuous improvement.

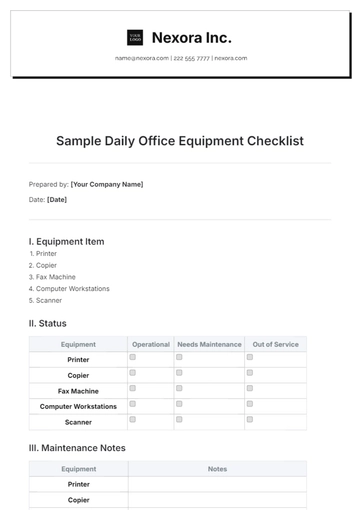

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Keep your restaurant's finances in check with this Restaurants Accounting Checklist Template. Crafted for culinary businesses, this customizable and editable tool in our Ai Editor Tool simplifies financial tracking and management. Enhance your restaurant's efficiency with this essential and adaptable checklist exclusively from Template.net. So, make it yours right away!

You may also like

- Cleaning Checklist

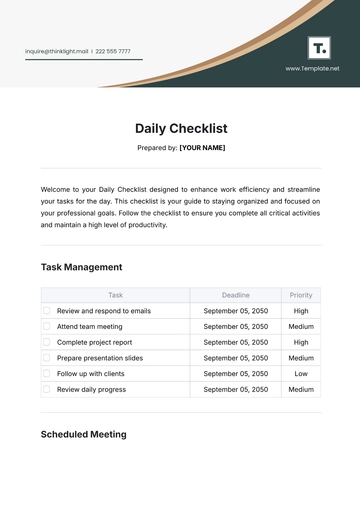

- Daily Checklist

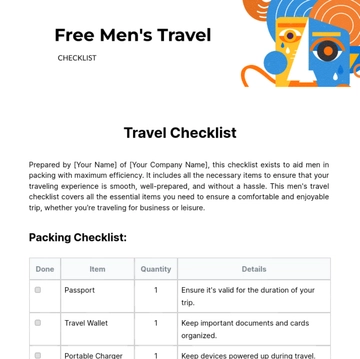

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

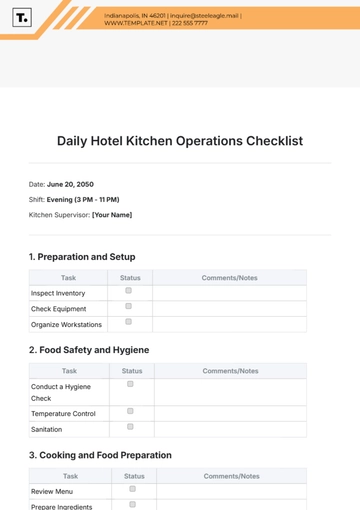

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

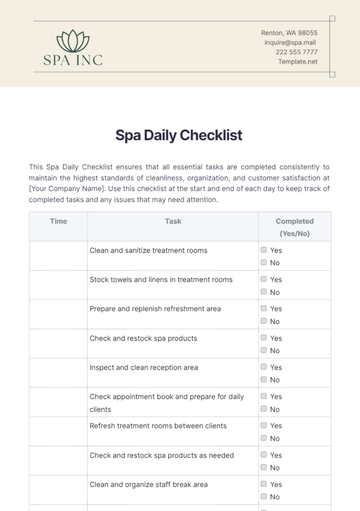

- Salon Checklist

- Baby Checklist

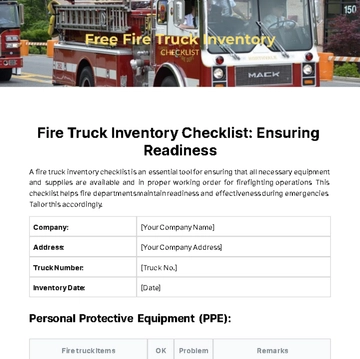

- Equipment Checklist

- Trade Show Checklist

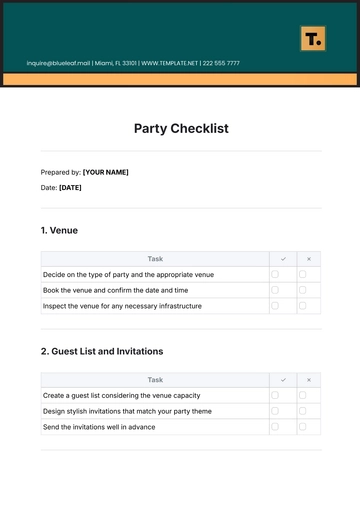

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist