Free End of Financial Year Accounting Checklist

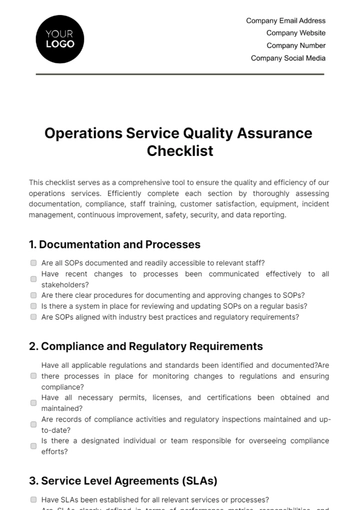

As the fiscal year concludes, a well-organized accounting process is paramount for business stability. This checklist outlines daily, weekly, monthly, and annual tasks to ensure a smooth transition and accurate financial reporting. Please tick the checkbox next to each task once completed.

Objectives:

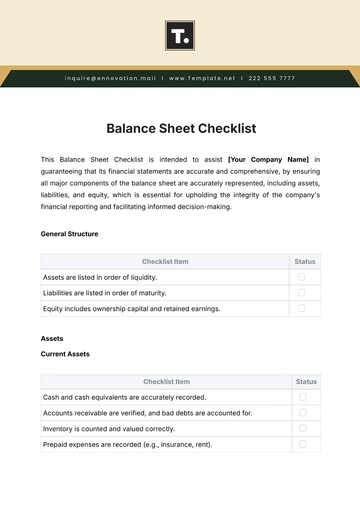

Guarantee accurate bookkeeping and financial organization.

Ensure financial transparency in all transactions and expenses.

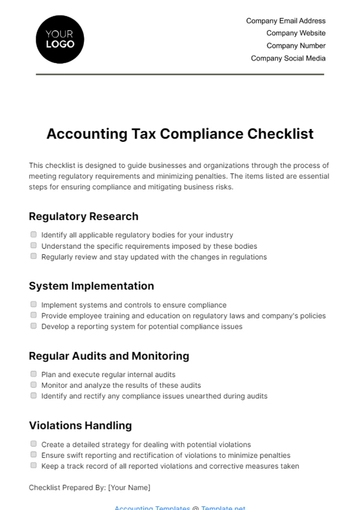

Validate regulatory compliance to avoid financial and legal penalties.

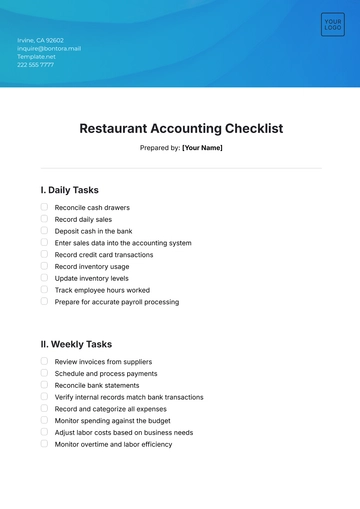

Daily Tasks:

Record and categorize all transactions for real-time financial insights.

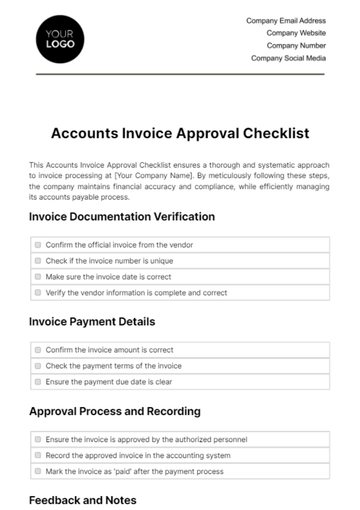

Review and input supplier invoices to maintain accurate payables.

Process and pay authorized expense reports promptly.

Regularly reconcile bank accounts for accuracy.

Timely preparation and dispatch of customer invoices for optimal cash flow.

Monitor and address credit control to ensure timely customer payments.

Update and review cash flow projections for short-term financial planning.

Weekly Tasks:

Proactively address any accounting discrepancies or irregularities.

Monitor and manage employee expense reports and travel expenses.

Manage petty cash expenses to support miscellaneous costs.

Record financial transactions with an emphasis on meeting tax obligations.

Conduct periodic audits of financial documents and contracts.

Review and optimize vendor relationships for cost-effectiveness.

Conduct internal reviews to ensure compliance with accounting policies.

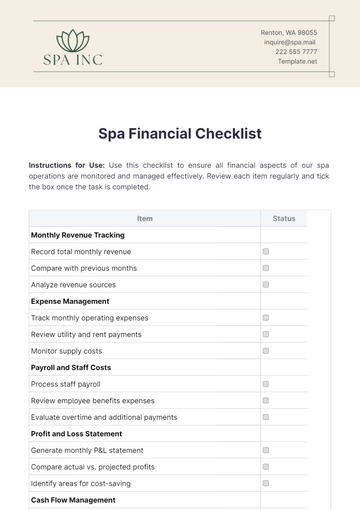

Monthly Tasks:

Compile comprehensive monthly financial statements.

Undertake basic administrative tasks, such as filing paperwork and updating records.

Thoroughly review and approve reconciliation and reports prepared by the finance staff.

Generate and analyze accounts receivable aging reports.

Reconcile revenue accounts to ensure alignment with business goals.

Evaluate and adjust inventory levels based on sales forecasts.

Review and optimize operational expenses for efficiency.

Annual Tasks:

Develop detailed annual budgets aligned with strategic goals.

Summarize year-end financial activities in comprehensive reports.

Coordinate with external auditors for a smooth annual audit.

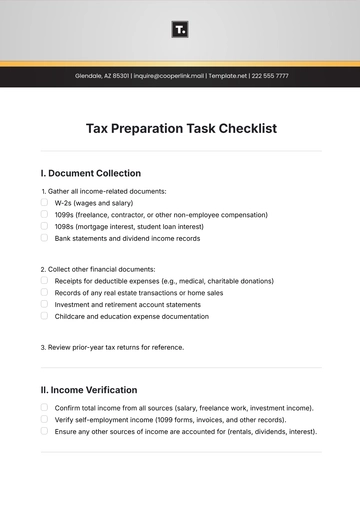

Prepare accurate tax returns and meet corporate reporting requirements.

Analyze and forecast financial needs for the upcoming year.

Assess and update long-term financial strategies.

Conduct a thorough risk assessment and update risk management plans.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Close your fiscal year with confidence using the ultimate and meticulously created End of Financial Year Accounting Checklist Template. Editable and customizable in our Ai Editor Tool, it's designed to ensure a comprehensive review of your financials. Embrace a seamless year-end process with this essential and editable checklist from Template.net.

You may also like

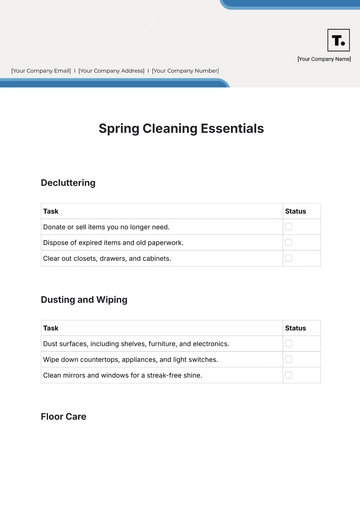

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

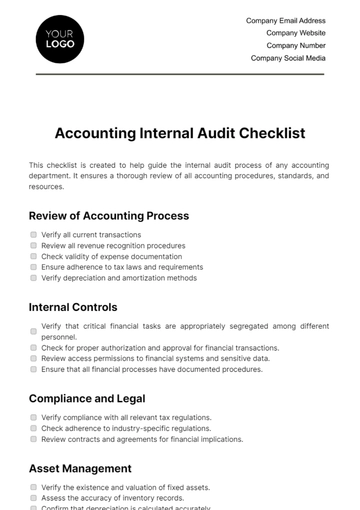

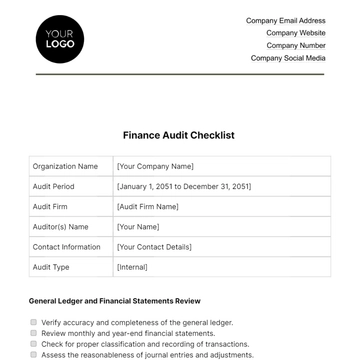

- Audit Checklist

- Registry Checklist

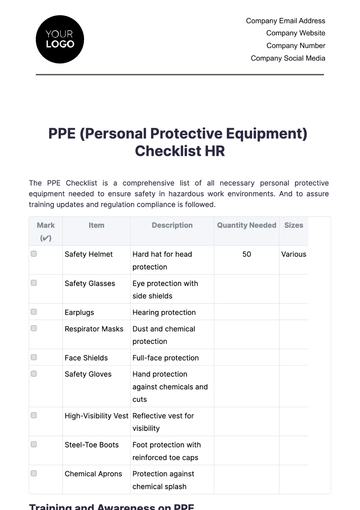

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

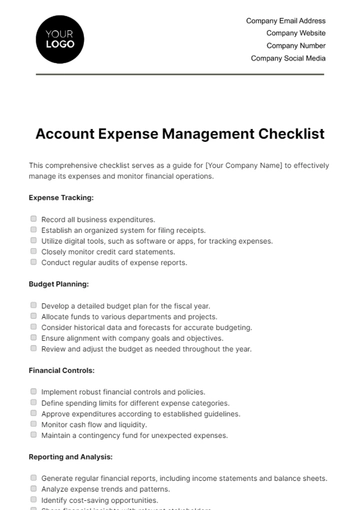

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

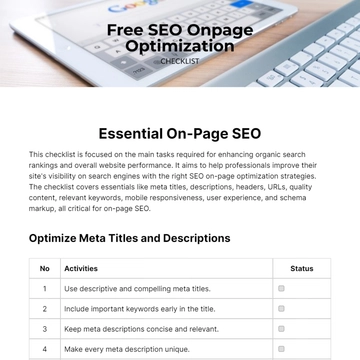

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

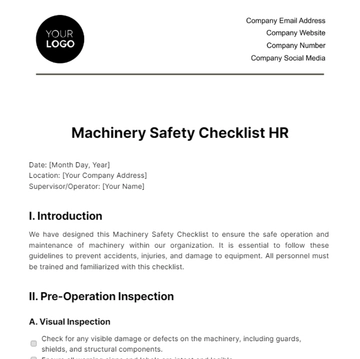

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist