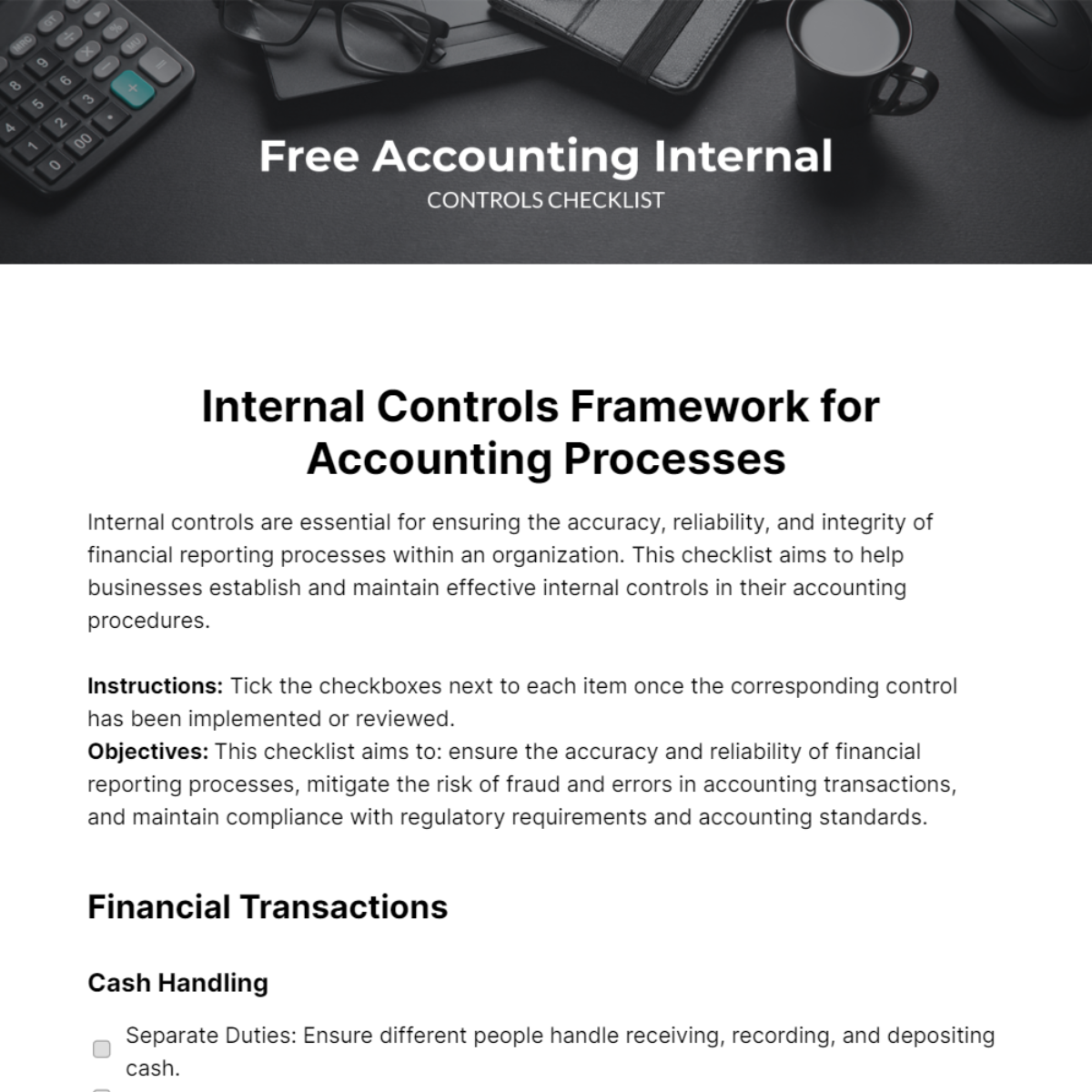

Free Accounting Internal Controls Checklist

Internal controls are essential for ensuring the accuracy, reliability, and integrity of financial reporting processes within an organization. This checklist aims to help businesses establish and maintain effective internal controls in their accounting procedures.

Instructions: Tick the checkboxes next to each item once the corresponding control has been implemented or reviewed.

Objectives: This checklist aims to: ensure the accuracy and reliability of financial reporting processes, mitigate the risk of fraud and errors in accounting transactions, and maintain compliance with regulatory requirements and accounting standards.

Financial Transactions

Cash Handling

Separate Duties: Ensure different people handle receiving, recording, and depositing cash.

Keep Records: Record all cash transactions with receipts and deposit slips.

Check Reconciliation: Match cash transactions with bank statements regularly.

Authorize Transactions: Get approval for large cash transactions.

Secure Cash: Lock cash drawers and safes when not in use.

Accounts Payable and Receivable

Verify Vendors: Make sure vendors are legitimate before paying.

Approve Invoices: Check and approve invoices before paying suppliers.

Monitor Payments: Keep track of overdue payments from customers.

Set Credit Limits: Have clear rules for extending credit and check customer creditworthiness.

Split Tasks: Separate invoicing, receiving payments, and recording transactions.

Financial Reporting

Accuracy and Completeness

Review Trial Balance: Double-check financial balances regularly.

Reconcile Accounts: Make sure all accounts match up.

Adjust Entries: Correctly record any needed adjustments.

Check Statements: Verify financial statements are accurate.

Audit Internally: Conduct internal audits to improve controls.

Compliance

Follow Rules: Adhere to accounting standards and regulations.

Keep Records: Store financial documents as required by law.

Segregate Duties: Have different people handle different tasks.

Prepare for Audits: Get ready for external audits.

Train Employees: Teach staff about accounting regulations.

Information Technology Controls

Data Security

Limit Access: Control who can see financial data.

Encrypt Data: Protect sensitive information with encryption.

Use Firewalls: Keep unauthorized users out with firewall software.

Backup Regularly: Make copies of financial data often.

Monitor Security: Keep an eye out for unusual activity.

System Reliability

Test Systems: Make sure accounting software works properly.

Update Software: Keep software up to date to fix issues.

Have Backups: Keep extra copies of data in case of emergencies.

Watch Performance: Monitor system performance for problems.

Plan for Disasters: Prepare for system failures with a recovery plan.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Safeguard your financial integrity using this Accounting Internal Controls Checklist Template. Designed to be fully customizable and editable in our Ai Editor Tool, this template ensures a comprehensive approach to maintaining and enhancing your accounting systems, providing a robust, editable framework for consistent financial oversight, available only at Template.net.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

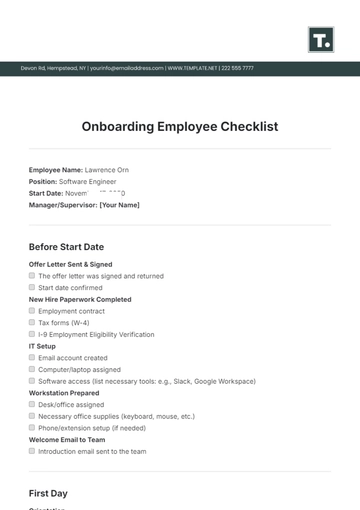

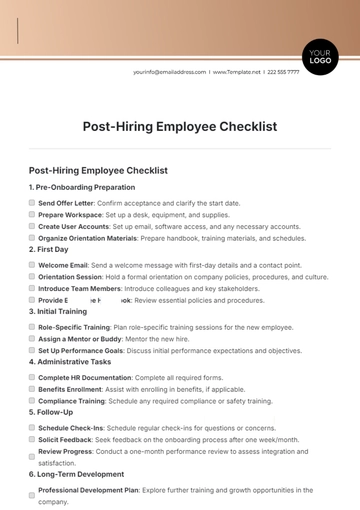

- Onboarding Checklist

- Quality Checklist

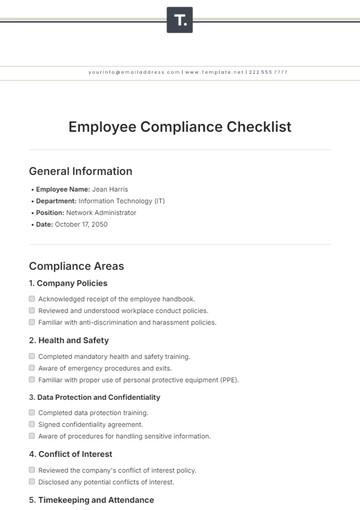

- Compliance Checklist

- Audit Checklist

- Registry Checklist

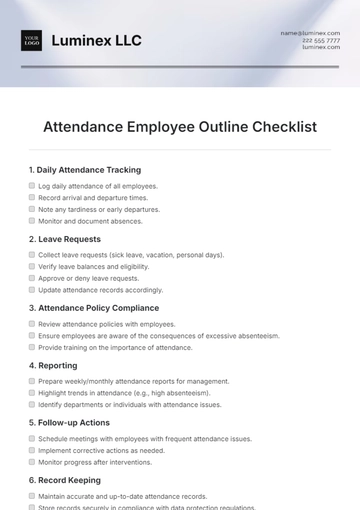

- HR Checklist

- Restaurant Checklist

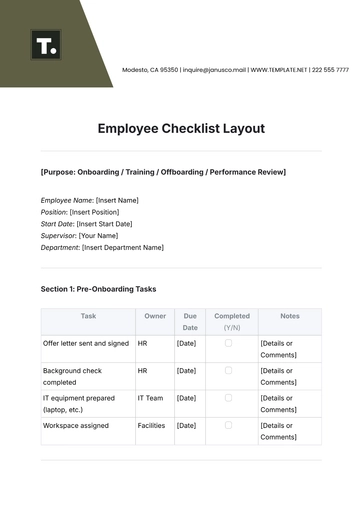

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

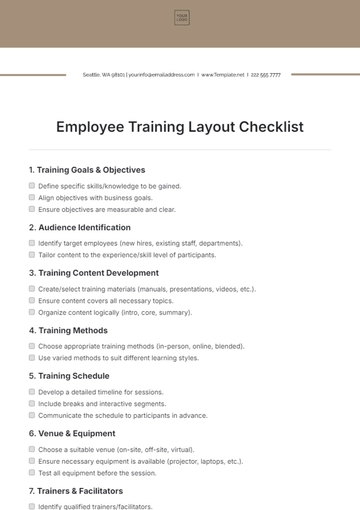

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

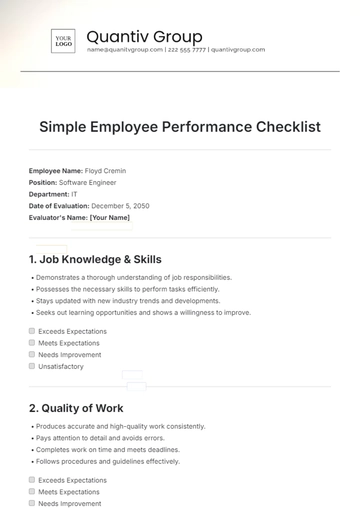

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist