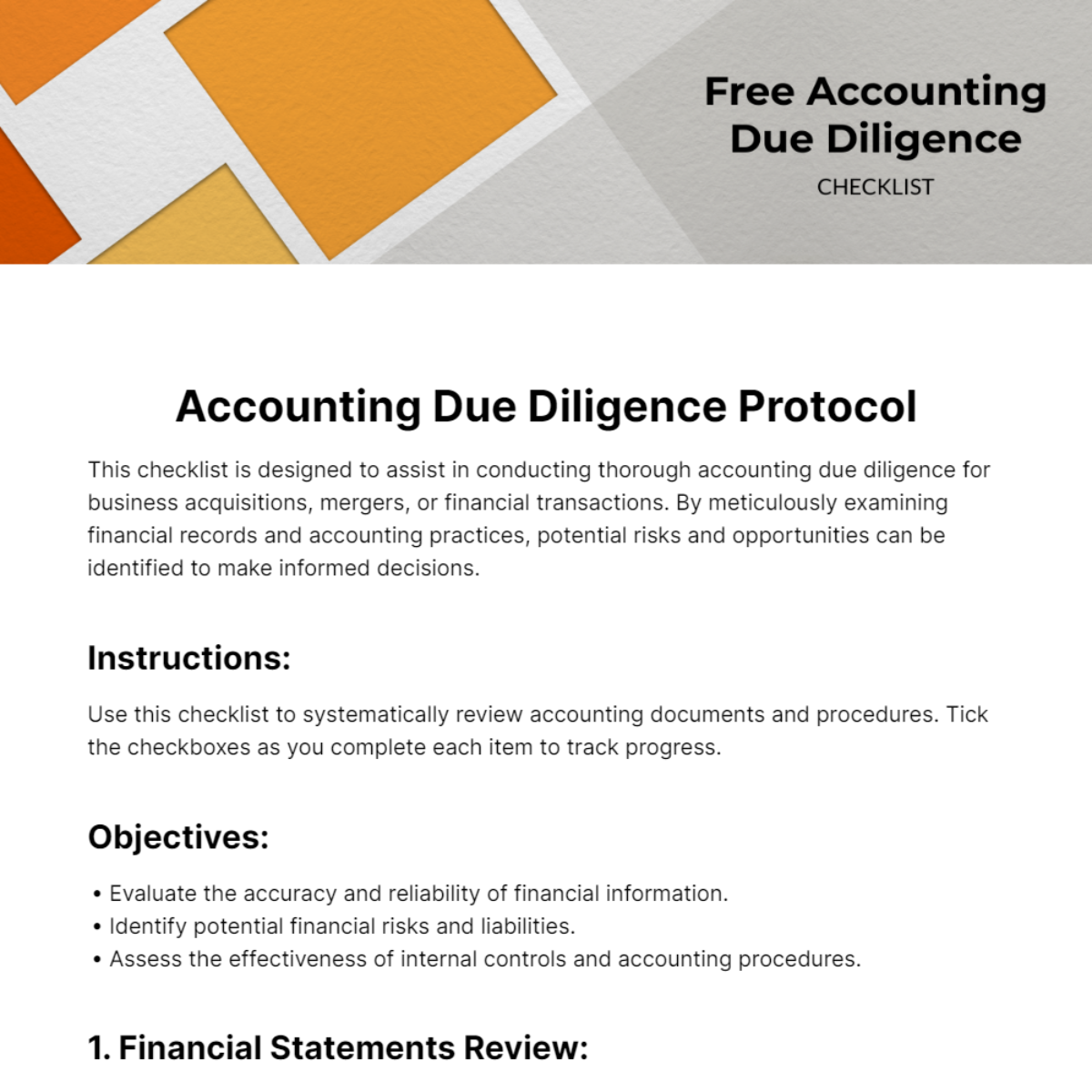

Free Accounting Due Diligence Checklist

This checklist is designed to assist in conducting thorough accounting due diligence for business acquisitions, mergers, or financial transactions. By meticulously examining financial records and accounting practices, potential risks and opportunities can be identified to make informed decisions.

Instructions:

Use this checklist to systematically review accounting documents and procedures. Tick the checkboxes as you complete each item to track progress.

Objectives:

Evaluate the accuracy and reliability of financial information.

Identify potential financial risks and liabilities.

Assess the effectiveness of internal controls and accounting procedures.

1. Financial Statements Review:

Review balance sheets, income statements, and cash flow statements for accuracy and completeness.

Analyze trends in revenue, expenses, and profitability over multiple periods.

Verify the consistency of accounting methods and adherence to GAAP or other applicable standards.

Scrutinize any unusual or significant fluctuations in financial metrics.

Confirm the reconciliation of accounts and adjustments made during the closing process.

2. Accounts Receivable and Payable:

Examine aging schedules for accounts receivable and assess the collectability of outstanding balances.

Verify the existence and accuracy of accounts payable, including accrued expenses and liabilities.

Review credit policies, bad debt reserves, and collections procedures.

Assess the adequacy of allowance for doubtful accounts and any write-off history.

Confirm the accuracy of vendor invoices and payment terms.

3. Inventory Management:

Inspect inventory records and perform physical counts to verify quantities and valuations.

Evaluate inventory turnover rates and assess the adequacy of inventory reserves.

Review inventory costing methods (e.g., FIFO, LIFO) and consistency in application.

Assess procedures for inventory control, storage, and obsolescence.

Investigate any discrepancies between recorded inventory and actual stock levels.

4. Tax Compliance and Reporting:

Review tax returns for accuracy and completeness, including federal, state, and local filings.

Assess compliance with tax laws and regulations, including income, sales, and payroll taxes.

Verify the timing and accuracy of tax payments and any outstanding tax liabilities.

Evaluate the effectiveness of tax planning strategies and potential exposure to tax risks.

Confirm the existence of any tax audits or disputes and their potential impact on the business.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your due diligence processes with Template.net's Accounting Due Diligence Checklist Template. This expertly made, editable, and customizable template ensures a thorough examination of financial records. Customize it seamlessly using our Ai Editor Tool, tailoring the checklist to your specific due diligence requirements and bolstering financial transparency. Get it now!

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

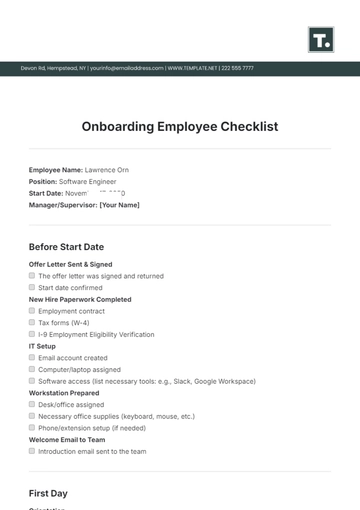

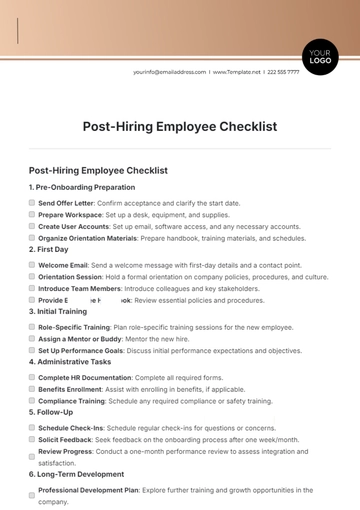

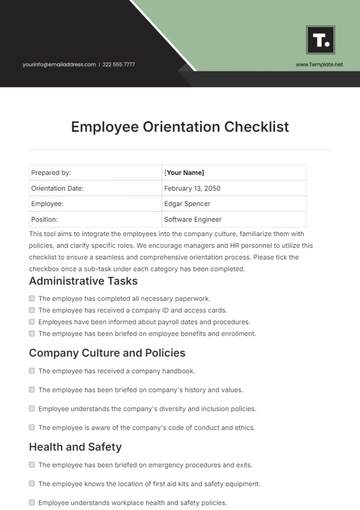

- Onboarding Checklist

- Quality Checklist

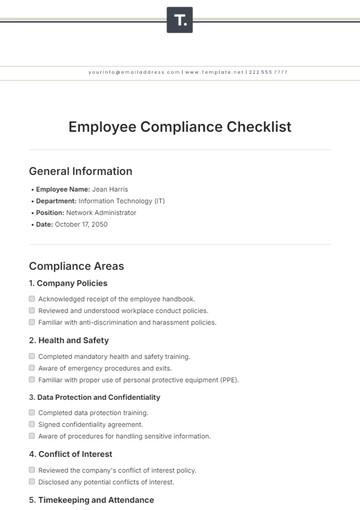

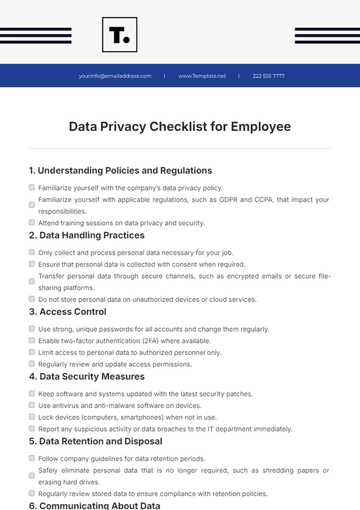

- Compliance Checklist

- Audit Checklist

- Registry Checklist

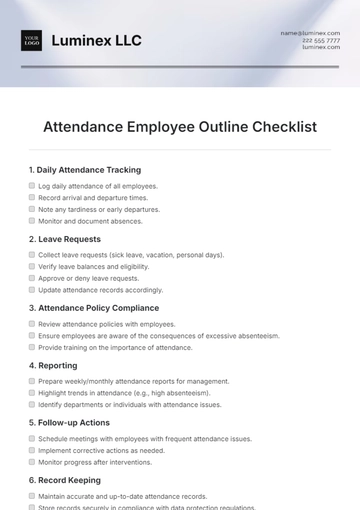

- HR Checklist

- Restaurant Checklist

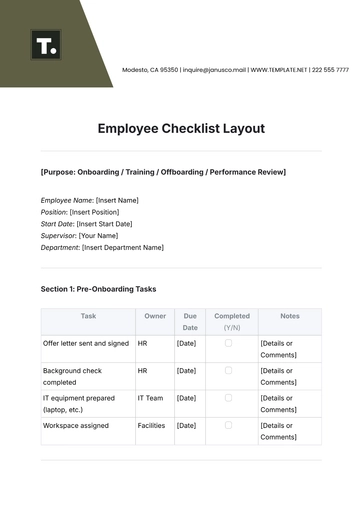

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

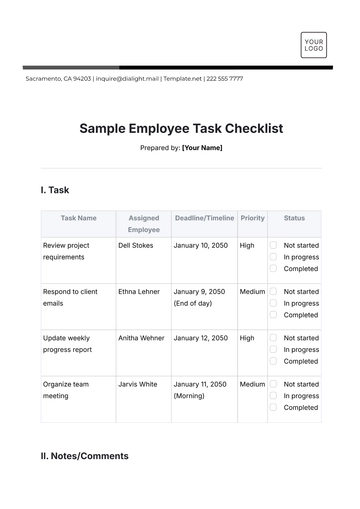

- Task Checklist

- Professional Checklist

- Hotel Checklist

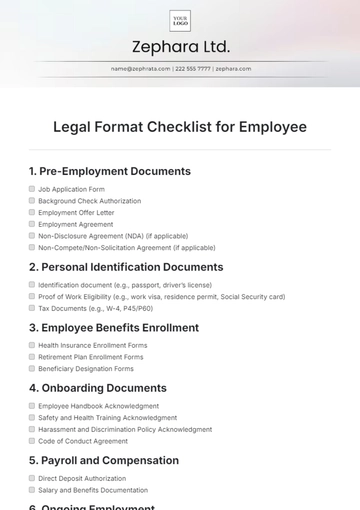

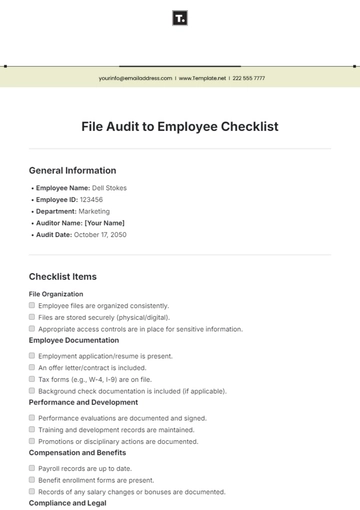

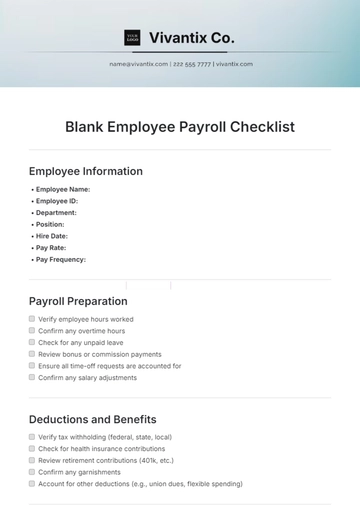

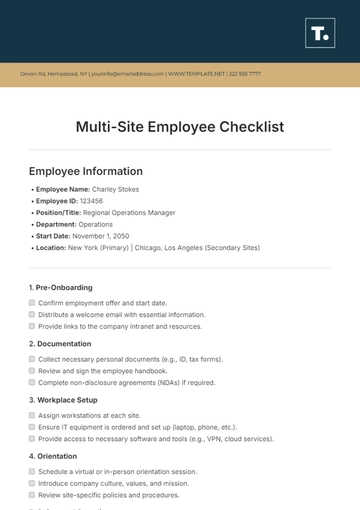

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

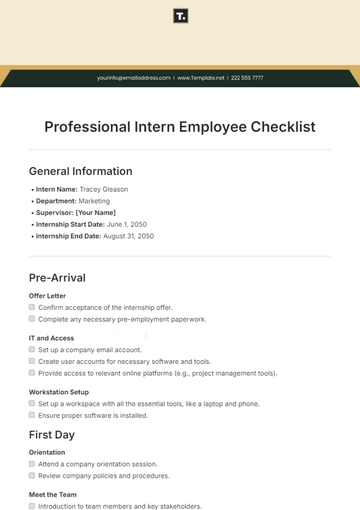

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

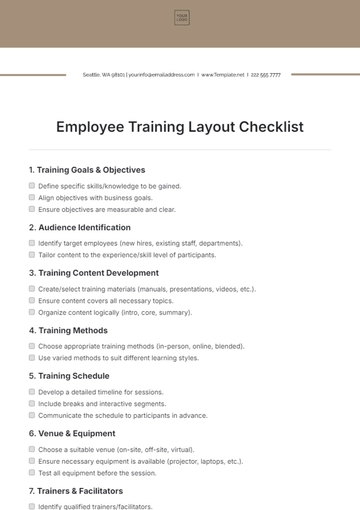

- Employee Training Checklist

- Medical Checklist

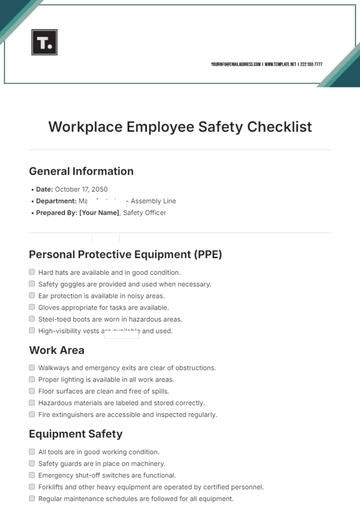

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

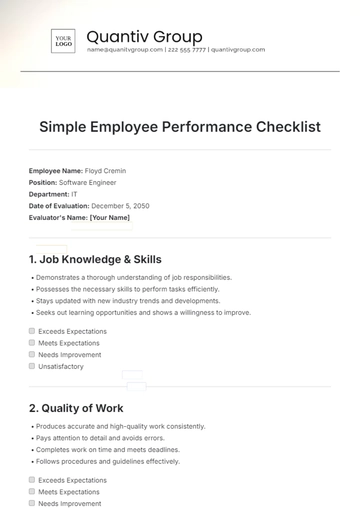

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist